by Calculated Risk on 10/20/2013 10:41:00 AM

Sunday, October 20, 2013

EIA Forecast: Gasoline Prices down sharply Year-over-year, Expected to Decline Further in 2014

Gasoline prices are down about 46 cents year-over-year at $3.43 per gallon nationally compared to $3.89 on October 15, 2012. This is a positive for the overall economy.

Prices are expected to decline further in Q4 and in 2014 according to the current EIA forecast:

Brent crude oil spot prices fell from a recent peak of $117 per barrel in early September to $108 per barrel at the end of the month as some crude oil production restarted in Libya and concerns over the conflict in Syria moderated. EIA expects the Brent crude oil price to continue to weaken, averaging $107 per barrel during the fourth quarter of 2013 and $102 per barrel in 2014. Projected West Texas Intermediate (WTI) crude oil prices average $101 per barrel during the fourth quarter of 2013 and $96 per barrel during 2014.WTI oil prices have declined recently, with WTI at $100.81 per barrel. Brent is at $109.94 per barrel. A year ago, WTI was around $90s, and Brent was around $112 per barrel.

...

The weekly U.S. average regular gasoline retail price fell by 18 cents per gallon during September, ending the month at $3.43 per gallon. EIA’s forecast for the regular gasoline retail price averages $3.34 per gallon in the fourth quarter of 2013. The annual average regular gasoline retail price, which was $3.63 per gallon in 2012, is expected to be $3.52 per gallon in 2013 and $3.40 per gallon in 2014.

emphasis added

Some of the year-over-year gasoline price decline is related to slightly lower Brent oil prices, but most of decline is because there were refinery and pipeline issues last year. In California, prices spiked last September and were still very high in October (put Los Angeles into the graph below to see the huge spike last year).

The following graph is from Gasbuddy.com. Note: If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Saturday, October 19, 2013

Schedule for Week of October 20th

by Calculated Risk on 10/19/2013 01:02:00 PM

Special Note: With the government shutdown, some economic data was delayed. Some of the delayed data has been rescheduled to be released this week, and it is possible additional data will be released later this week (not yet scheduled).

The key report this week is the delayed September employment report on Tuesday.

Other key reports this week are September Existing Home Sales on Monday, and New Home sales on Thursday (not confirmed release).

For manufacturing, the Richmond and Kansas City regional manufacturing surveys for October will be released this week.

8:30 AM ET: Chicago Fed National Activity Index for September. This is a composite index of other data and will probably be delayed.

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR).

10:00 AM: Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for sales of 5.30 million on seasonally adjusted annual rate (SAAR) basis. Sales in August were at a 5.48 million SAAR. Economist Tom Lawler is estimating the NAR will report sales of 5.26 million SAAR for September.

A key will be inventory and months-of-supply.

8:30 AM: Employment Report for September. The consensus is for an increase of 178,000 non-farm payroll jobs in September; the economy added 169,000 non-farm payroll jobs in August.

The consensus is for the unemployment rate to be unchanged at 7.3% in September.

The following graph shows the percentage of payroll jobs lost during post WWII recessions through July.

The economy has added 7.5 million private sector jobs since employment bottomed in February 2010 (6.8 million total jobs added including all the public sector layoffs).

The economy has added 7.5 million private sector jobs since employment bottomed in February 2010 (6.8 million total jobs added including all the public sector layoffs).There are still 1.4 million fewer private sector jobs now than when the recession started in 2007.

9:00 AM: Chemical Activity Barometer (CAB) for October from the American Chemistry Council. This appears to be a leading economic indicator.

10:00 AM: Richmond Fed Survey of Manufacturing Activity for October.

7:00 AM: The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

9:00 AM: FHFA House Price Index for August 2013. This was original a GSE only repeat sales, however there is also an expanded index that deserves more attention. The consensus is for a 0.8% increase.

During the day: The AIA's Architecture Billings Index for September (a leading indicator for commercial real estate).

8:30 AM: The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 335 thousand from 358 thousand last week.

9:00 AM: The Markit US PMI Manufacturing Index Flash for October. The consensus is for a decrease to 52.7 from 52.8 in September.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS.

10:00 AM: Job Openings and Labor Turnover Survey for August from the BLS. This graph shows job openings (yellow line), hires (purple), Layoff, Discharges and other (red column), and Quits (light blue column) from the JOLTS.

Jobs openings decreased in July to 3.689 million, down from 3.869 million in June. number of job openings (yellow) is up 5.4% year-over-year compared to July 2012.

Quits were up in July, and quits are up about 8% year-over-year. These are voluntary separations. (see light blue columns at bottom of graph for trend for "quits").

10:00 AM: New Home Sales for September from the Census Bureau.

10:00 AM: New Home Sales for September from the Census Bureau. This graph shows New Home Sales since 1963. The dashed line is the July sales rate.

The consensus is for a decrease in sales to 420 thousand Seasonally Adjusted Annual Rate (SAAR) in September from 420 thousand in August.

11:00 AM: Kansas City Fed Survey of Manufacturing Activity for August. The consensus is for a reading of 9 for this survey, up from 8 in August (Above zero is expansion).

8:30 AM: Durable Goods Orders for September from the Census Bureau. The consensus is for a 2.5% increase in durable goods orders.

9:55 AM: Reuter's/University of Michigan's Consumer sentiment index (final for October). The consensus is for a reading of 74.8, down from the preliminary reading of 75.2, and down from the September reading of 77.5.

Unofficial Problem Bank list declines to 677 Institutions

by Calculated Risk on 10/19/2013 09:15:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for October 18, 2013.

Changes and comments from surferdude808:

The OCC released its enforcement action activity through mid-September 2013 this week. The release led to many changes to the Unofficial Problem Bank List. In all, there were seven removals and one addition that leave the list holding 677 institutions with assets of $236.8 billion. A year ago, the list held 865 institutions with assets of $333.2 billion.

The OCC terminated actions against Golden Bank, National Association, Houston, TX ($566 million); First National Banking Company, Ash Flat, AR ($374 million); Valley National Bank, Tulsa, OK ($211 million); United Fidelity Bank, fsb, Evansville, IN ($170 million); Mutual Federal Savings Bank, A FSB, Sidney, OH ($112 million); Heritage First Bank, Rome, GA ($99 million); and Mutual Federal Bank, Chicago, IL ($75 million).

Added this week was The First National Bank of Sullivan, Sullivan, IL ($65 million).

Capitol Bancorp, Ltd. was in the news this week for agreeing to sell four of its banking subsidiaries to Talmer Bancorp, Troy, MI ($3.8 billion), which controls an Ohio-based thrift and a Michigan-based commercial bank. The units being sold are Michigan Commerce Bank , Ann Arbor, MI ($612 million); Bank of Las Vegas, Henderson, NV ($235 million); Indiana Community Bank, Goshen, IN ($97 million); and Sunrise Bank Of Albuquerque, Albuquerque, NM ($47 million). Talmer Bancorp is backed by Wilbur Ross and the deal is contingent upon the FDIC granting cross-guarantee waivers for each bank.

Friday, October 18, 2013

Data Schedule Update: CBO Will Release Budgetary Results for Fiscal Year 2013 in Early November

by Calculated Risk on 10/18/2013 04:33:00 PM

A few items:

• From CBO: CBO's Next Monthly Budget Review Will Be Published Early in November

Because CBO largely shut down its operations during the recent lapse in appropriated funds, the agency will not issue its Monthly Budget Review in October. The next issue of that report will come out early in November and will discuss the budgetary results for fiscal year 2013.No schedule on Fiscal 2013 results from Treasury yet.

• From the BEA: 2013 Release Schedule Revision

BEA is currently assessing the impact of the government shutdown on our release schedule and will post revisions to the release schedule as soon as possible.• From the BLS yesterday: Updated Schedule of BLS News Releases. Here is a partial table of rescheduled BLS releases:

| Release | Reference Period | Previously Scheduled Release Date | Revised Release Date |

|---|---|---|---|

| Metropolitan Area Employment and Unemployment | Aug-13 | Wednesday, October 02, 2013 | Monday, October 21, 2013 |

| Employment Situation | Sep-13 | Friday, October 04, 2013 | Tuesday, October 22, 2013 |

| U.S. Import and Export Price Indexes | Sep-13 | Thursday, October 10, 2013 | Wednesday, October 23, 2013 |

| Job Openings and Labor Turnover Survey | Aug-13 | Tuesday, October 08, 2013 | Thursday, October 24, 2013 |

| Producer Price Index | Sep-13 | Friday, October 11, 2013 | Tuesday, October 29, 2013 |

| Consumer Price Index | Sep-13 | Wednesday, October 16, 2013 | Wednesday, October 30, 2013 |

| Real Earnings | Sep-13 | Wednesday, October 16, 2013 | Wednesday, October 30, 2013 |

| Employment Situation | Oct-13 | Friday, November 01, 2013 | Friday, November 08, 2013 |

• No update yet from the Census Bureau (Housing Starts, New Home sales, etc)

CoStar: Commercial Real Estate prices mostly flat in August, Up 9% Year-over-year

by Calculated Risk on 10/18/2013 01:22:00 PM

Here is a price index for commercial real estate that I follow.

From CoStar: Commercial Real Estate Pricing Growth Levels Off in August Amid Uncertainty over Fed Tapering and Rising Interest Rates

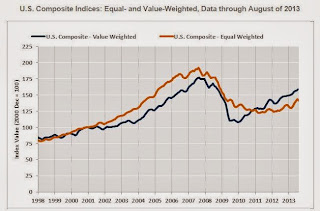

PRICING GROWTH FOR COMMERCIAL PROPERTY SLOWED IN AUGUST AMID ANXIETY OVER FED’S TAPERING OF BOND PURCHASES AND RISE IN INTEREST RATES: The two broadest measures of aggregate pricing for commercial properties within the CCRSI—the value-weighted and the equal-weighted versions of the U.S. Composite Index—saw mixed movements for the month. The equal-weighted index, which reflects the pricing impact of more numerous smaller transactions, edged downward by 1.1% in August, while the value-weighted index, which is influenced by larger transactions, expanded by 1.6% during the same time period. On an annual basis, both indices advanced by nearly 10%. Despite investor reassurance following the Fed’s decision in September to delay the tapering of its quantitative easing policies, further economic uncertainty, largely stemming from the U.S. government shutdown and debt ceiling debate, may lead to further volatility in pricing in the near term.

POSITIVE ABSORPTION IN BOTH INVESTMENT GRADE AND GENERAL COMMERCIAL SEGMENTS SUPPORTS BROAD PRICING RECOVERY: Net absorption of available space across the three major commercial property types – office, retail and warehouse – continues to improve. For the first three quarters of 2013 net absorption among these three property types totaled more than 240 million square feet, the highest level for the first three quarters of a year since 2008. ...

TRANSACTION VOLUME REMAINS STEADY: The number of repeat sale transactions through August 2013 increased 15% from the same period one year ago, while the value of those transactions increased 17%. The percentage of commercial property selling at distressed prices remains near a four-and-a-half year low.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph from CoStar shows the Value-Weighted and Equal-Weighted indexes. CoStar reported that the Value-Weighted index is up 47.5% from the bottom (showing the earlier and stronger demand for higher end properties) and up 9.0% year-over-year. However the Equal-Weighted index is only up 15.7% from the bottom, and up 10.0% year-over-year.

Note: These are repeat sales indexes - like Case-Shiller for residential - but this is based on far fewer pairs.

Lawler: Updated Table of Distressed Sales and Cash buyers for Selected Cities in September

by Calculated Risk on 10/18/2013 10:03:00 AM

Economist Tom Lawler sent me the updated table below of short sales, foreclosures and cash buyers for several selected cities in September.

Comments from CR: Tom Lawler has been sending me this table every month for a couple of years (or longer). I think it is very useful for looking at the trend for distressed sales and cash buyers in these areas. I sincerely appreciate Tom sharing this data with us.

Look at the first two columns in the table for Short Sales Share. Short sales are down sharply from a year ago, and will probably really decline in early 2014. It appears that the Mortgage Debt Relief Act of 2007 will not be extended again next year. Usually cancelled debt is considered income, but a provision of the 2007 Debt Relief Act allowed borrowers "to exclude certain cancelled debt on [a] principal residence from income. Debt reduced through mortgage restructuring, as well as mortgage debt forgiven in connection with a foreclosure, qualifies for the relief." (excerpt from IRS). This relief expires on Dec 31, 2013. As I've written before, plan to complete all short sales by the end of this year!

Total "Distressed" Share. In most areas the share of distressed sales is down year-over-year (Hampton Roads is an exception). Also there has been a decline in foreclosure sales in all of these cities except Springfield, Ill.

The All Cash Share is declining in some cities (Phoenix, Las Vegas, Sacramento, Orlando), but steady in other areas. When investors pull back in markets like Phoenix (already declining), the share of all cash buyers will probably decline.

In general it appears the housing market is slowly moving back to normal.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | All Cash Share | |||||

|---|---|---|---|---|---|---|---|---|

| Sep-13 | Sep-12 | Sep-13 | Sep-12 | Sep-13 | Sep-12 | Sep-13 | Sep-12 | |

| Las Vegas | 23.0% | 44.8% | 7.4% | 13.6% | 30.4% | 58.4% | 47.2% | 54.8% |

| Reno | 20.0% | 41.0% | 5.0% | 12.0% | 25.0% | 53.0% | ||

| Phoenix | 8.8% | 27.0% | 8.0% | 12.9% | 16.8% | 39.9% | 33.4% | 44.0% |

| Sacramento | 12.1% | 35.4% | 3.9% | 15.4% | 16.0% | 50.8% | 23.6% | 35.9% |

| Minneapolis | 6.0% | 9.9% | 15.9% | 25.0% | 21.9% | 34.9% | ||

| Mid-Atlantic | 7.7% | 12.4% | 8.2% | 9.4% | 15.9% | 21.8% | 18.4% | 18.8% |

| Orlando | 17.6% | 28.4% | 18.2% | 23.7% | 35.8% | 52.1% | 43.4% | 53.0% |

| Bay Area CA* | 8.6% | 27.5% | 3.6% | 14.1% | 12.2% | 41.6% | 24.0% | 28.4% |

| So. California* | 13.1% | 28.0% | 6.3% | 16.6% | 19.4% | 44.6% | 27.6% | 32.2% |

| Hampton Roads | 26.1% | 25.4% | ||||||

| Northeast Florida | 34.9% | 44.1% | ||||||

| Chicago | 31.0% | 41.0% | ||||||

| Hampton Roads | 26.1% | 25.4% | ||||||

| Toledo | 38.1% | 35.9% | ||||||

| Tucson | 29.8% | 29.7% | ||||||

| Omaha | 19.1% | 15.8% | ||||||

| Pensacola | 27.3% | 34.4% | ||||||

| Des Moines | 19.2% | 19.9% | ||||||

| Houston | 7.4% | 16.1% | ||||||

| Memphis* | 18.4% | 26.6% | ||||||

| Birmingham AL | 20.9% | 26.6% | ||||||

| Springfield IL | 14.2% | 13.5% | ||||||

| *share of existing home sales, based on property records | ||||||||

Zillow: Home Value Appreciation slows in Q3

by Calculated Risk on 10/18/2013 08:44:00 AM

From Zillow: Housing Market Shows Welcome Signs of Cooling in Q3

The pace of home value appreciation nationwide is slowing, and has even turned negative in some areas. But rather than being a bad sign for housing, this slowdown was expected and is, in fact, welcome in a handful of markets, according to the third quarter Zillow Real Estate Market Reports.With a little more inventory, and somewhat higher mortgage rates, a slowdown in house price appreciation makes sense.

The U.S. Zillow Home Value Index stood at $163,000 as of the end of the third quarter, up 6.4 percent year-over-year and 1.2 percent from the end of the second quarter. But national home values in September remained the same as in August, and the pace of monthly home value growth has fallen in each of the past three months. Among the top 30 largest metro areas covered by Zillow, half showed negative monthly appreciation at the end of the third quarter. As recently as July, all of the top 30 metro areas showed positive monthly appreciation, with none exhibiting a monthly pace slower than 1 percent month-over-month.

...

"Far from being a negative sign, we’re relieved to see more noticeable signs of cooling in the market. If home values continued to rise as they have, relatively unchecked, we would almost certainly be headed into another bubble cycle, and nobody wants that,” said Zillow Chief Economist Dr. Stan Humphries. “This is more proof that the market recovery is entering a new phase, transitioning away from the bounce off the bottom we’ve been experiencing and finding a more sustainable level. This moderation should help consumers feel more at ease in their decisions to buy and sell, and will help keep the market balanced.”

The Zillow Home Value Forecast calls for annual appreciation rates to slow markedly over the next 12 months as moderation spreads, to an annual pace of 3.8 percent nationwide by September 2014.

emphasis added

Thursday, October 17, 2013

WSJ: "Shutdown Upends Timing" of Taper

by Calculated Risk on 10/17/2013 08:36:00 PM

From Jon Hilsenrath at the WSJ: Fed Unlikely to Trim Bond Buying in October

The Fed is unlikely to start curtailing its bond buying at its next policy meeting Oct. 29-30. Fed officials have said the decision depends on how the economic data evolve, but the data won't be very illuminating into November because the partial government shutdown closed the agencies that collect them.We've been flying blind, and it will take some until all "instruments" are working again. Plus the shutdown probably slowed growth in Q4 - and the Fed will want to understand the economic impact of the shutdown before changing course.

"For those who really look at the data, it is going to basically delay thought of changing course," Richard Fisher, president of the Federal Reserve Bank of Dallas, said Thursday in an interview.

...

Fed officials could act at one of the following two meetings—Dec. 17-18 or Jan. 28-29. Their decision will turn on the strength of an economy that would still be a bit harder to read ...

Lawler: Early Look at Existing Home Sales in September

by Calculated Risk on 10/17/2013 05:27:00 PM

From housing economist Tom Lawler:

Based on local realtor association/board/MLS reports I’ve seen so far, I estimate that existing home sales as measured by the National Association of Realtors ran at a seasonally adjusted annual rate of about 5.26 million in September, down 4% from

August’s seasonally-adjusted pace. While unadjusted sales this September showed faster YOY growth than was the case in August, business-day related seasonal factor differences, combined with a lower year-ago “comp” for September relative to August, are the reasons why the faster YOY growth translates into a lower monthly SA sales pace.

[CR Note: on adjustments, see table below]

On the inventory front, data from various local listings trackers, combined with local realtor association/board/MLS reports, would suggest that the number of existing homes for sale at the end of September was down only slightly from August. However, NAR inventory estimates typically show larger monthly declines in September than listings data and publicly-available realtor reports would suggest, for reasons that aren’t clear. For example, NAR estimates suggest that the number of existing homes for sale fell by 9.6% from the end of last August to the end of last September, a drop that vastly exceeded both what available listings data and local realtor reports would have suggested. If the NAR’s inventory estimate for this September were down 3.56% from August’s estimate, then this September’s inventory estimate would be unchanged from last September’s. Such a result is quite possible.

Finally, local realtor/MLS/board reports suggest that the NAR’s median home sales estimate will show significantly slower YOY growth for September than for August My best estimate is that the NAR’s estimate for the median existing SF home sales price in September will be around $198,800, up 11.1% from last September.

CR Note: The NAR is scheduled to report September existing home sales on Monday, October 21st.

As Lawler noted, there is a chance that the NAR will report inventory flat year-over-year for September (although it will probably be down slightly).

| YOY Growth, Existing Home Sales, 2013 vs. 2012 | ||||

|---|---|---|---|---|

| Unadjusted | Seasonally Adjusted | Difference | % Difference, Business Days | |

| Jan-13 | 11.9% | 9.5% | 2.4% | 5.0% |

| Feb-13 | 5.9% | 9.5% | -3.6% | -5.0% |

| Mar-13 | 7.5% | 10.8% | -3.3% | -4.5% |

| Apr-13 | 13.5% | 9.7% | 3.8% | 4.8% |

| May-13 | 14.7% | 12.0% | 2.7% | 0.0% |

| Jun-13 | 8.0% | 14.7% | -6.7% | -4.8% |

| Jul-13 | 20.7% | 17.2% | 3.5% | 4.8% |

| Aug-13 | 10.5% | 13.2% | -2.7% | -4.3% |

| Sep-13proj | 14.0% | 10.0% | 3.9% | 5.3% |

BLS: September Employment Report to be released Tuesday, October 22nd

by Calculated Risk on 10/17/2013 04:38:00 PM

From the BLS: Updated Schedule of BLS News Releases

See the table below for some of the updated dates.

There will be concerns about the data for some time (this is the October employment report reference week). As an example, from the Cleveland Fed: Implications of the Government Shutdown on Inflation Estimates

Each month, the Bureau of Labor Statistics (BLS) releases estimates of the Consumer Price Index (CPI) and the Producer Price Index (PPI). The government shutdown, which ended late on October 16, caused a delay in the release of these statistics and many of the statistics and data products that rely on them. But the shutdown will also affect the accuracy of these statistics for months to come. This article outlines the impact of the shutdown, particularly on the accuracy of the CPI.Here are a few of the schedule changes:

The repercussions on CPI estimates will continue for at least seven months. Some of these repercussions will occur later this month, but the majority of the influence will occur the next month, in November, when the monthly overall inflation estimates derived from the CPI will be subject to significant error.

emphasis added

| Release | Reference Period | Previously Scheduled Release Date | Revised Release Date |

|---|---|---|---|

| Metropolitan Area Employment and Unemployment | Aug-13 | Wednesday, October 02, 2013 | Monday, October 21, 2013 |

| Employment Situation | Sep-13 | Friday, October 04, 2013 | Tuesday, October 22, 2013 |

| U.S. Import and Export Price Indexes | Sep-13 | Thursday, October 10, 2013 | Wednesday, October 23, 2013 |

| Job Openings and Labor Turnover Survey | Aug-13 | Tuesday, October 08, 2013 | Thursday, October 24, 2013 |

| Producer Price Index | Sep-13 | Friday, October 11, 2013 | Tuesday, October 29, 2013 |

| Consumer Price Index | Sep-13 | Wednesday, October 16, 2013 | Wednesday, October 30, 2013 |

| Real Earnings | Sep-13 | Wednesday, October 16, 2013 | Wednesday, October 30, 2013 |

| Employment Situation | Oct-13 | Friday, November 01, 2013 | Friday, November 08, 2013 |