by Calculated Risk on 8/29/2013 10:53:00 AM

Thursday, August 29, 2013

Zillow: Negative Equity declines in Q2

Note: CoreLogic will release their Q2 negative equity report in the next couple of weeks. For Q1, CoreLogic reported there were 9.7 million properties with negative equity, and that will be down further in Q2.

From Zillow: Negative Equity Rate Falls for 5th Straight Quarter in Q2

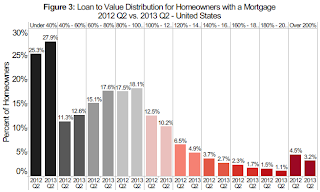

According to the second quarter Zillow Negative Equity Report, the national negative equity rate continued to fall in the second quarter, dropping to 23.8% of all homeowners with a mortgage from 25.4% in the first quarter of 2013. The negative equity rate has been continually falling for the past five quarters, with the second quarter of 2013 being down significantly from the second quarter of 2012 at 30.9% – a decrease of more than 7 percentage points. In the second quarter of 2013, more than 805,000 American homeowners were freed from negative equity. However, more than 12 million homeowners with a mortgage remain underwater ... Of all homeowners – roughly one-third of homeowners do not have a mortgage and own their homes free and clear – 16.7% are underwater.The following graph from Zillow shows negative equity by Loan-to-Value (LTV) in Q2 2013 compared to Q2 2012.

emphasis added

Click on graph for larger image.

Click on graph for larger image.From Zillow:

Figure 3 shows the loan-to-value (LTV) distribution for homeowners with a mortgage in the nation in 2013 Q2 vs. 2012 Q2. Even though many homeowners are still underwater and haven’t crossed the 100% LTV threshold to enter into positive equity, they are moving in the right direction. ... On average, a U.S. homeowner in negative equity owes $74,700 more than what their house is worth, or 42.3% more than the home’s value. While roughly a quarter of homeowners with a mortgage are underwater, 92% of these homeowners are current on their mortgages and continue to make payments.Almost half of the borrowers with negative equity have a LTV of 100% to 120% (the light red columns). Most of these borrowers are current on their mortgages - and they have probably either refinanced with HARP or the loans are well seasoned (most of these properties were purchased in the 2004 through 2006 period, so borrowers have been current for eight years or so). In a few years, these borrowers will have positive equity.

The key concern is all those borrowers with LTVs above 140% (about 8.7% of properties with a mortgage according to Zillow). It will take many years to return to positive equity ... and a large percentage of these properties will eventually be distressed sales (short sales or foreclosures).

Q2 GDP Revised up to 2.5%, Weekly Initial Unemployment Claims decline to 331,000

by Calculated Risk on 8/29/2013 08:30:00 AM

• From the BEA:

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 2.5 percent in the second quarter of 2013 (that is, from the first quarter to the second quarter), according to the "second" estimate released by the Bureau of Economic Analysis. ... In the advance estimate, the increase in real GDP was 1.7 percent.• The DOL reports:

The upward revision to the percent change in real GDP primarily reflected an upward revision to exports, a downward revision to imports, and an upward revision to private inventory investment that were partly offset by a downward revision to state and local government spending.

In the week ending August 24, the advance figure for seasonally adjusted initial claims was 331,000, a decrease of 6,000 from the previous week's revised figure of 337,000. The 4-week moving average was 331,250, an increase of 750 from the previous week's unrevised average of 330,500.The previous week was revised up from 336,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 331,250.

The 4-week average is near the lowest level since November 2007 (before the recession started). Claims were close to the 330,000 consensus forecast.

Wednesday, August 28, 2013

Thursday: Q2 GDP (second estimate), Unemployment Claims

by Calculated Risk on 8/28/2013 07:52:00 PM

An interesting article from Shaila Dewan at the NY Times: Tensions on the Cul-de-Sac

Across the country, a growing number of single-family rentals provide an option for many who lost their homes in the housing crash through foreclosure and for those who cannot obtain a mortgage under today’s tougher credit conditions. But the decline in homeownership is also changing many neighborhoods in profound ways, including reduced home values, lower voter turnout and political influence, less social stability and higher crime.Thursday:

“When there are fewer homeowners, there is less ‘self-help,’ like park and neighborhood cleanup, neighborhood watch,” said William M. Rohe, a professor at the University of North Carolina at Chapel Hill who has just completed a review of current research on homeownership’s effects.

Even conscientious landlords and tenants invest less in their property than owner-occupants, he said. “Who’s going to paint the outside of a rental house? You’d almost have to be crazy.”

• 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 330 thousand from 336 thousand last week.

• Also at 8:30 AM, Q2 GDP (second estimate). This is the second estimate of Q2 GDP from the BEA. The consensus is that real GDP increased 2.2% annualized in Q2, revised up from the advance estimate of 1.7% in Q2

• Note: The FDIC Q2 Quarterly Banking Profile could be released tomorrow or Friday.

Freddie Mac: Mortgage Serious Delinquency rate declined in July, Lowest since April 2009

by Calculated Risk on 8/28/2013 04:35:00 PM

Freddie Mac reported that the Single-Family serious delinquency rate declined in July to 2.70% from 2.79% in June. Freddie's rate is down from 3.42% in July 2012, and this is the lowest level since April 2009. Freddie's serious delinquency rate peaked in February 2010 at 4.20%.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

Very few seriously delinquent loans cure with the owner making up back payments - most of the reduction in the serious delinquency rate is from foreclosures, short sales, and modifications.

I'm frequently asked when the distressed sales will be back to normal levels, and that will happen when the percent of seriously delinquent loans (and in foreclosure) is back to normal.

Note: Fannie Mae will report their Single-Family Serious Delinquency rate for July next week.

Click on graph for larger image

Click on graph for larger image

Although this indicates some progress, the "normal" serious delinquency rate is under 1%.

At the recent rate of improvement, the serious delinquency rate will not be under 1% until 2016 or so. Therefore I expect a fairly high level of distressed sales for 2 to 3 more years (mostly in judicial states).

Dean Baker: "Rising Mortgage Rates Did Not Affect June Case-Shiller Data"

by Calculated Risk on 8/28/2013 02:22:00 PM

Dean Baker beat me to this: Rising Mortgage Rates Did Not Affect June Case-Shiller Data

The Washington Post ... article today on the Case-Shiller June price index attributed the slower price growth in part to higher interest rates. This makes no sense.One addition: we will not see any impact of higher mortgage rates until at least the "August" Case-Shiller report is released (see earlier post), and - as Baker notes - the impact will not be fully apparent in the Case-Shiller index until the "October" report is released because of the 3 month average. However other prices indexes - like Zillow and LPS - will pick up any impact sooner.

The Case-Shiller index is an average of three months data. The June release is based on the price of houses that were closed in April, May, and June. Since there is typically 6-8 weeks between when a contract is signed and when a sale is completed these houses would have come under contract in the period from February to May. This is a period before there was any real rise in interest rates.

... We will first begin to see a limited impact of higher interest rates in the Case Shilller index in the July data and the impact of the rise will not be fully apparent until the October index is released.

Zillow: Case-Shiller House Price Index expected to show 12.5% year-over-year increase in July

by Calculated Risk on 8/28/2013 11:41:00 AM

The Case-Shiller house price indexes for June were released yesterday. Zillow has started forecasting Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close. Note: Zillow makes a strong argument that the Case-Shiller index is currently overstating national house price appreciation.

Another 12% Hike Predicted for July Case-Shiller Indices

The Case-Shiller data for June (2013 Q2) came out [yesterday] and, based on this information and the July 2013 Zillow Home Value Index (released last week), we predict that next month’s Case-Shiller data (July 2013) will show that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]), as well as the 10-City Composite Home Price Index (NSA) increased 12.5 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from June to July will be 1.0 percent for the 20-City Composite and 1.2 percent for the 10-City Composite Home Price Indices (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for June will not be released until Tuesday, September 24.The following table shows the Zillow forecast for the July Case-Shiller index.

...

As home value appreciation is beginning to moderate, the Case-Shiller indices will continue to show an inflated sense of national home value appreciation. First signs of a slowdown in monthly appreciation are present, although these slowdowns are fairly timid. The Case-Shiller indices are biased toward the large, coastal metros currently seeing enormous home value gains, and they include foreclosure resales. The inclusion of foreclosure resales disproportionately boosts the index when these properties sell again for much higher prices — not just because of market improvements, but also because the sales are no longer distressed. In contrast, the ZHVI does not include foreclosure resales and shows home values for July 2013 up 6 percent from year-ago levels. We expect home value appreciation to continue to moderate through the end of 2013 and into 2014, rising 4.8 percent between July 2013 and July 2014. The main drivers of this moderation include rising mortgage rates, less investor participation – decreasing demand – and increasing for-sale inventory supply. Further details on our forecast of home values can be found here, and more on Zillow’s full July 2013 report can be found here.

...

To forecast the Case-Shiller indices, we use the June Case-Shiller index level, as well as the July Zillow Home Value Index (ZHVI), which is available more than a month in advance of the Case-Shiller index, paired with July foreclosure resale numbers, which Zillow also publishes more than a month prior to the release of the Case-Shiller index. Together, these data points enable us to reliably forecast the Case-Shiller 10-City and 20-City Composite indices.

| Zillow July Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | July 2012 | 157.21 | 154.35 | 144.58 | 141.81 |

| Case-Shiller (last month) | June 2013 | 173.37 | 172.25 | 159.54 | 158.32 |

| Zillow Forecast | YoY | 12.5% | 12.5% | 12.5% | 12.5% |

| MoM | 2.0% | 1.2% | 1.9% | 1.2% | |

| Zillow Forecasts1 | 176.8 | 174.0 | 162.6 | 159.9 | |

| Current Post Bubble Low | 146.46 | 149.62 | 134.07 | 136.88 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 20.7% | 16.3% | 21.3% | 16.8% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

NAR: Pending Home Sales index declined 1.3% in July

by Calculated Risk on 8/28/2013 10:00:00 AM

From the NAR: July Pending Home Sales Slip

The Pending Home Sales Index, a forward-looking indicator based on contract signings, declined 1.3 percent to 109.5 in July from 110.9 in June, but is 6.7 percent above July 2012 when it was 102.6; the data reflect contracts but not closings. Pending sales have stayed above year-ago levels for the past 27 months.Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in August and September.

...

The PHSI in the Northeast fell 6.5 percent to 81.5 in July but is 3.3 percent higher than a year ago. In the Midwest the index slipped 1.0 percent to 113.2 in July but is 14.5 percent above July 2012. Pending home sales in the South rose 2.6 percent to an index of 121.5 in July and are 7.7 percent higher than a year ago. The index in the West fell 4.9 percent in July to 108.6, and is 0.4 percent below July 2012.

Note: It appears some buyers pushed to close in July because of rising mortgage rates (People who signed contracts in May probably locked in mortgage rates, and they wanted to close before the lock expired). So I expect closed sales in August to decline more than the pending home sales index would indicate.

MBA: Mortgage Refinance Applications down, Purchase Applications Up in Recent Survey

by Calculated Risk on 8/28/2013 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.5 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 23, 2013. ...

The Refinance Index decreased 5 percent from the previous week. The Refinance Index has fallen 64.2 percent from its recent peak the week of May 3, 2013. The seasonally adjusted Purchase Index increased 2 percent from one week earlier.

...

The refinance share of mortgage activity decreased to 60 percent of total applications from 61 percent the previous week, which is the lowest share observed since April 2011. ...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,000 or less) increased to 4.80 percent, the highest rate since April 2011, from 4.68 percent, with points decreasing to 0.41 from 0.42 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

Refinance activity has fallen sharply, decreasing in 14 of the last 16 weeks.

This index is down 64.2% over the last 16 weeks. The last time the index declined this far was in late 2010 and early 2011 when mortgage increased sharply with the Ten Year Treasury rising from 2.5% to 3.5%. We've seen a similar increase over the last few months with the Ten Year Treasury yield up from 1.6% to over 2.7% today.

The second graph shows the MBA mortgage purchase index. The purchase index has increased for the last two weeks, and three of the last four.

The second graph shows the MBA mortgage purchase index. The purchase index has increased for the last two weeks, and three of the last four.The 4-week average of the purchase index has generally been trending up over the last year (but down over the couple of months), and the 4-week average of the purchase index is up about 6.7% from a year ago.

Tuesday, August 27, 2013

Wednesday: Mortgage Applications, Pending Home Sales Index

by Calculated Risk on 8/27/2013 08:45:00 PM

Just an update ... during the recession, I wrote about the troubles in Las Vegas and included a chart of visitor and convention attendance: Lost Vegas.

Since then Las Vegas visitor traffic recovered to a new record high in 2012.

However convention attendance in 2012 was still about 21% below the peak level in 2006. Here is the data from the Las Vegas Convention and Visitors Authority.

Click on graph for larger image.

Click on graph for larger image.

The blue bars are annual visitor traffic (left scale), and the red line is convention attendance (right scale). The numbers for 2013 are a projection based on data through June.

So far this year - through June - there were 19.9 million visitors to Las Vegas - slightly less than for the first six months of 2012.

Convention attendance was at 2.9 million during the first half of 2013, for a pace over 5 million for the first time since 2008 - but still well below the record of 6.3 million in 2006.

Wednesday:

• 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. With higher mortgage rates, the refinance index has fallen sharply over the last few months. The key will be to watch the purchase application index.

• At 10:00 AM, the NAR will release the Pending Home Sales Index for July. The consensus is for a 1.0% decrease in the index.

Lawler: Measuring Changes in Home Prices is Difficult!

by Calculated Risk on 8/27/2013 04:25:00 PM

From housing economist Tom Lawler:

Below is a table showing the latest YOY % changes in various entities’ home price indexes for the metro areas covered in today’s Case Shiller home price report, as well as “national” HPIs. The YOY changes are for the period ended in June, with Case-Shiller, FHFA expanded, and Zillow effectively being quarterly averages; CoreLogic a weighted 3-month moving average; and LPS and FNC being “June.” Zillow does not include foreclosure resales in constructing its HVI, while LPS’ HPI “reflects” non-distressed sales, as it “takes into account” price discounts for REO and short sales. FNC’s RPI is a “hedonic” price index, as is (pretty much) Zillow’s HVI. CoreLogic produces HPIs for all of the metro areas below, but only releases to the public the ones shown below. Note that in some cases (e.g., NY), Case-Shiller’s “metro area” definition differs from the other entities (it is broader).

The biggest “outliers” are the “hedonic” home price indexes, which attempt to take into account the characteristics of homes sold. FNC’s RPI for many metro areas seem “most strange” – the RPIs for DC and Portland showed virtually no change from a year ago, which just doesn’t seem right. And FNC’s “national” (100 metro area) RPI gain of 3.7% over the last year seems way too low.

Even if all of the metro/regional/state HPIs from these entities “matched up,” the various entities’ “national” HPIs would show different growth rates. Case-Shiller constructs a “national” HPI from Census division HPIs with weights based on each division’s share of the market value of the housing stock from Census 2000. FHFA constructs a “national” HPI using weights based on state shares of the housing stock in units using the latest available ACS data. CoreLogic does not “build up” a national HPI from regional HPIs, but instead aggregates all transactions across the county. Zillow’s HVI is a “median” home-value measure, I believe using all homes for which it has a “Zestimate.” I’m not rightly sure how LPS or FNC construct their “national” HPIs.

The method used to construct a “national” HPI from state/regional HPIs can have a material impact. As I noted last week, if CoreLogic used Census 2000 market value weight applied to its state HPIs, its “national” HPI for June would have been up 9.4% YOY, compared to the reported 11.9%. And if the FHFA had applied Census 2000 market value weights to its state HPIs, its “national” HPI for June would have bee up 8.1%, instead of the reported 7.6%. The Case Shiller “national” HPI for “June” (Q2) was up 10.1% YOY. Case-Shiller doesn’t produce state HPIs and doesn’t release its Census division HPIs to the public.

| YOY % Change, Various Home Price Indexes ("June"/Q2 2013) | ||||||

|---|---|---|---|---|---|---|

| Case-Shiller | FHFA Expanded | CoreLogic | LPS | FNC | Zillow | |

| AZ-Phoenix | 19.8% | 21.2% | 17.1% | 16.6% | 27.5% | 22.0% |

| CA-Los Angeles | 19.9% | 18.3% | 20.7% | 18.8% | 7.8% | 19.7% |

| CA-San Diego | 19.3% | 17.5% | 19.9% | 18.0% | 9.1% | 21.8% |

| CA-San Francisco | 24.5% | 19.7% | 23.9% | 10.2% | 26.3% | |

| CO-Denver | 9.4% | 10.3% | 10.5% | 9.8% | 8.8% | 12.7% |

| DC-Washington | 5.7% | 9.9% | 9.4% | 7.7% | 0.8% | 7.0% |

| FL-Miami | 14.8% | 13.4% | 13.4% | 14.3% | 5.8% | 12.5% |

| FL-Tampa | 11.1% | 11.7% | 9.4% | 11.0% | 5.9% | 10.6% |

| GA-Atlanta | 19.0% | 18.6% | 16.1% | 13.0% | 2.7% | 6.5% |

| IL-Chicago | 7.3% | 6.7% | 4.6% | 6.8% | -1.0% | 1.1% |

| MA-Boston | 6.7% | 7.5% | 6.4% | 3.0% | 6.7% | |

| MI-Detroit | 16.4% | 15.2% | 11.3% | 6.3% | 15.1% | |

| MN-Minneapolis | 11.5% | 10.2% | 9.1% | 8.4% | 4.4% | 11.7% |

| NC-Charlotte | 7.8% | 8.5% | 6.3% | 5.3% | 1.9% | |

| NV-Las Vegas | 24.9% | 24.5% | 27.0% | 18.6% | 29.5% | |

| NY-New York | 3.3% | 2.6% | 7.2% | 4.2% | 0.2% | 1.8% |

| OH-Cleveland | 3.5% | 3.1% | 3.5% | 0.9% | 3.2% | |

| OR-Portland | 11.8% | 13.8% | 14.6% | 10.3% | 0.9% | 13.3% |

| TX-Dallas | 8.0% | 9.0% | 9.9% | 6.5% | 7.4% | 6.0% |

| WA-Seattle | 11.8% | 14.9% | 15.1% | 11.9% | 2.9% | 13.0% |

| “National” | 10.1% | 7.6% | 11.9% | 8.4% | 3.7% | 5.6% |