by Calculated Risk on 8/20/2013 07:12:00 PM

Tuesday, August 20, 2013

Wednesday: Existing Home Sales, FOMC Minutes

Goldman Sachs economist Kris Dawsey on the FOMC Minutes:

We will read the minutes from the July meeting with an eye toward any clues on the likelihood of near-term tapering and potential changes to the forward guidance. On the first point, within the discussion of the appropriate stance of balance sheet policy in the June minutes, "many members indicated that further improvement in the outlook for the labor market would be required before it would be appropriate to slow the pace of asset purchases." An adjustment to this language along the lines of many or most members expecting that it would soon be appropriate to reduce the pace of asset purchases would be a strong signal of near-term tapering, in our view. In terms of dovish risks, particularly extensive discussion of the risk posed by higher mortgage rates (or tighter financial conditions in general) or lower-than-target inflation could be red flags that the Fed was thinking twice about near-term tapering. ...Wednesday:

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. Refinance activity has fallen sharply over the last few months, but purchase activity is still up about 7% year-over-year.

• At 10:00 AM, Existing Home Sales for July from the National Association of Realtors (NAR). The consensus is for sales of 5.13 million on seasonally adjusted annual rate (SAAR) basis. Sales in June were at a 5.08 million SAAR. Economist Tom Lawler is estimating the NAR will report a July sales rate of 5.33 million.

• During the day, the AIA's Architecture Billings Index for July (a leading indicator for commercial real estate).

• At 2:00 PM, the FOMC Minutes for Meeting of July 30-31, 2013.

Lawler: The Washington Post (and Reuters) get it wrong again on the GSEs

by Calculated Risk on 8/20/2013 04:03:00 PM

From housing economist Tom Lawler:

In today’s “economy & business” section, the Washington Post has a short “article” with the headline “Report: Fannie, Freddie mask losses.” The first sentence begins as follows: “Fannie Mae and Freddie Mac are possibly masking billions of dollars in losses because of the level of delinquent home loans they carry, a federal watchdog said Monday…” The story is credited to Reuters.

Both the headline and the first sentence are extremely misleading (and just plain wrong!), and reflect the shockingly distorted and one-sided reporting on the GSEs by many news services, and especially by the Washington Post.

The article is referring to a letter to Acting FHFA Director DeMarco from Inspector General (of FHFA) Linick, along with an attached staff memorandum, relating to timeline for the implementation of FHFA’s “Advisory Bulletin No 2012-02” which relates to the classification of certain assets. Specifically, IG Linick questioned why the implementation of this Advisory Bulletin had been pushed back – BY FHFA – to January 1, 2015. Both Fannie and Freddie noted this Advisory Bulletin in their latest 10-K’s, and disclosed that (1) the bulletin differed from current policy, (2) that the implementation date was January 1, 2015, and (3) that the companies were evaluating the possible impact of implementation on future financial results.

E.g., here is an excerpt from Fannie’s 2012 10-K.

“On April 9, 2012, FHFA issued an Advisory Bulletin, “Framework for Adversely Classifying Loans, Other Real Estate Owned, and Other Assets and Listing Assets for Special Mention,” which was effective upon issuance and is applicable to Fannie Mae, Freddie Mac and the Federal Home Loan Banks. The Advisory Bulletin establishes guidelines for adverse classification and identification of specified single-family and multifamily assets and off-balance sheet credit exposures. The Advisory Bulletin indicates that this guidance considers and is generally consistent with the Uniform Retail Credit Classification and Account Management Policy issued by the federal banking regulators in June 2000. Among other requirements, the Advisory Bulletin requires that we classify the portion of an outstanding single-family loan balance in excess of the fair value of the underlying property, less costs to sell, as “loss” when the loan is no more than 180 days delinquent, except in certain specified circumstances (such as properly secured loans with an LTV ratio equal to or less than 60%), and charge off the portion of the loan classified as “loss.” The Advisory Bulletin also specifies that, if we subsequently receive full or partial payment of a previously charged-off loan, we may report a recovery of the amount, either through our loss reserves or as a reduction in our foreclosed property expenses.Neither the Advisory Bulletin nor the OIG staff memorandum says that current GSE accounting practices are not GAAP.

The accounting methods outlined in FHFA’s Advisory Bulletin are different from our current methods of accounting for single-family loans that are 180 days or more delinquent. As described in “Risk Factors,” we believe that implementation of these changes in our accounting methods present significant operational challenges for us. We have agreed with FHFA that (1) effective January 1, 2014, we will implement the Advisory Bulletin’s requirements related to classification, and (2) effective January 1, 2015, we will implement an updated accounting policy related to charging-off delinquent loans. We are currently assessing the impact of implementing these accounting changes on our future financial results.”

The real issue with the IG/OIG has on this issue is with the FHFA, and why it had “agreed” to a delayed implementation of the Advisory Bulletin. Here is an excerpt from the OIG staff memorandum.

Here is an excerpt from FHFA’s response.

And here was another part of FHFA’s response.

Now let’s go back to the Post’s headline: “Report: Fannie, Freddie mask losses.”

Neither the IG letter nor the OIG staff memorandum says anything of the sort.

On a separate note, some articles on this issue have assumed that when this advisory bulletin is implemented, Fannie’s and Freddie’s GAAP earnings will be reduced. While that is possible, it isn’t necessarily correct. From what I can gather, implementation of the directive will probably (I can’t rightly be certain) increase “realized” losses/charge-offs; it isn’t even remotely clear, however, than implementation will result either in a higher loss PROVISION or a higher allowance for losses – the latter of which at both companies currently assumes that there will be a high level of “realized” losses for quite a while.

Last year, after eight years of litigation, a judged dismissed Fannie’s former CEO, CFO, and Controller from a class-action “securities fraud” lawsuit, with the judge ruling that there was no evidence that any had “committed fraud” or knowingly misled shareholders. While not “front page news,” this story was covered by most “national” newspapers and national news services. Yet even though Fannie is a major employer in the Washington Post’s home market, the Post did not report on a story exonerating these former Fannie officials after eight years of hell. Why? The Washington Post editorial staff “doesn’t like” Fannie and Freddie. That is not journalism.

ATA Trucking Index declined in July, Up 4.7% Year-over-year

by Calculated Risk on 8/20/2013 12:41:00 PM

Here is a minor indicator that I follow, from ATA: ATA Truck Tonnage Index Fell 0.4% in July

The American Trucking Associations’ advanced seasonally adjusted (SA) For-Hire Truck Tonnage Index slipped 0.4% in July after edging 0.1% higher in June. ... The latest drop was the first since April. In July, the SA index equaled 125.4 (2000=100) versus 125.9 in June. June 2013 is the highest level on record. Compared with July 2012, the SA index increased 4.7%, which is robust, although the smallest year-over-year gain since April.

“After gaining a total of 2.2% in May and June, it isn’t surprising that tonnage slipped a little in July,” ATA Chief Economist Bob Costello said. “The decrease corresponds with the small decline in manufacturing output during July reported by the Federal Reserve last week.”

“Despite the small reprieve in July, we expect solid tonnage numbers during the second half of the year as sectors that generate heavy freight, like oil and gas and autos, continue with robust growth,” Costello said. “Home construction generates a significant amount of tonnage, but as mortgage rates and home prices rise, growth in housing starts will decelerate slightly in the second half of the year, but still be a positive for truck freight volumes. Tonnage gains in the second half of the year are likely to overstate the strength in the economy as these heavy freight sectors continue to outperform the economy overall.”

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here is a long term graph that shows ATA's For-Hire Truck Tonnage index.

The dashed line is the current level of the index.

The index is just off the record high set in June and up solidly year-over-year.

Zillow: House Prices up 6% year-over-year in July, Case-Shiller expected to show 12.1% YoY increase for June

by Calculated Risk on 8/20/2013 11:13:00 AM

From Zillow: Housing Conversation Turns to the Future as Market Turns in Another Strong Month in July

The national housing market recovery proved it is on firm ground in July, as home values rose 6 percent year-over-year to a Zillow Home Value Index of $161,600, the first time home values have appreciated at an annual pace of 6 percent or higher since August 2006.The Zillow data is for July.

July marked the 14th straight month of annual home value appreciation, according to the July Zillow Real Estate Market Reports. Home values were up 0.4 percent in July compared with June. ...

“After three straight months of annual home value appreciation above 5 percent, the U.S. housing market recovery has proven it is on very sound footing. We have entered a new phase in the recovery when we can begin to turn away from ugly recent history and turn toward what the housing market of the future will look like and how it will act. ...” said Zillow Chief Economist Dr. Stan Humphries. ...

For the 12-month period from July 2013 to July 2014, U.S. home values are expected to rise another 4.8 percent to approximately $169,308, according to the Zillow Home Value Forecast.

The Case-Shiller house price indexes for June will be released Tuesday, August 27th. Zillow has argued that the Case-Shiller numbers overstate the recent price increases: "The Case-Shiller indices are giving an inflated sense of national home value appreciation because they are biased toward the large, coastal metros currently seeing such enormous home value gains, and because they include foreclosure resales."

Also Zillow has started forecasting the Case-Shiller a month early, and I like to check the Zillow forecasts since they have been pretty close. NOTE: Here is a repeat of the table I posted a few weeks ago:

Zillow Predicts Another 12% Annual Increase in Case-Shiller Indices for June. The following table shows the Zillow forecast for the June Case-Shiller index.

| Zillow June Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | June 2012 | 154.94 | 154.07 | 142.37 | 141.37 |

| Case-Shiller (last month) | May 2013 | 169.69 | 170.62 | 156.14 | 157.01 |

| Zillow Forecast | YoY | 12.0% | 12.0% | 12.1% | 12.1% |

| MoM | 2.2% | 1.2% | 2.3% | 1.1% | |

| Zillow Forecasts1 | 173.5 | 172.6 | 159.7 | 158.6 | |

| Current Post Bubble Low | 146.46 | 149.61 | 134.07 | 136.85 | |

| Date of Post Bubble Low | Mar-12 | Jan-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 18.4% | 15.4% | 19.1% | 15.9% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Chicago Fed: "Index shows economic growth in July again below average"

by Calculated Risk on 8/20/2013 08:46:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Index shows economic growth in July again below average

The Chicago Fed National Activity Index (CFNAI) edged up to –0.15 in July from –0.23 in June.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, increased to –0.15 in July from –0.24 in June, marking its fifth consecutive reading below zero. July’s CFNAI-MA3 suggests that growth in national economic activity was below its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity was below the historical trend in July (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Monday, August 19, 2013

Inventory, Inventory, Inventory

by Calculated Risk on 8/19/2013 08:45:00 PM

The NAR is scheduled to report July existing home sales on Wednesday. The consensus is for sales of 5.13 million on seasonally adjusted annual rate (SAAR) basis. However economist Tom Lawler is estimating the NAR will report a July sales rate of 5.33 million. So it is likely that the NAR will report above consensus sales.

However I wouldn't read too much into an above consensus report. I suspect some people pushed to close in July before their mortgage rate "lock" expired, and my very early guess is existing home sales will decline in August.

Of course what really matters in the NAR report is inventory and months-of-supply. It is mostly visible inventory that impacts prices, and it appears inventory bottomed earlier this year.

Watching inventory during the bubble helped me call the top of the housing market. And watching inventory decline helped me call the bottom for prices (see Feb 2012: The Housing Bottom is Here), and now inventory is suggesting price increases will slow. Below is a table of the year-over-year change in inventory since January 2012. Notice that the year-over-year change will probably turn positive soon. Inventory is still very low, but this will be a key change to watch.

| Year-over-year Change in Inventory | |

|---|---|

| YoY % Change | |

| Jan-12 | -19.9% |

| Feb-12 | -20.3% |

| Mar-12 | -23.4% |

| Apr-12 | -21.9% |

| May-12 | -21.1% |

| Jun-12 | -25.0% |

| Jul-12 | -23.8% |

| Aug-12 | -20.5% |

| Sep-12 | -25.2% |

| Oct-12 | -23.0% |

| Nov-12 | -24.0% |

| Dec-12 | -21.1% |

| Jan-13 | -24.0% |

| Feb-13 | -20.8% |

| Mar-13 | -16.8% |

| Apr-13 | -14.0% |

| May-13 | -13.0% |

| Jun-13 | -7.6% |

| Jul-13 | |

Tuesday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for July will be released. This is a composite index of other data.

Weekly Update: Existing Home Inventory is up 21.7% year-to-date on Aug 19th

by Calculated Risk on 8/19/2013 05:20:00 PM

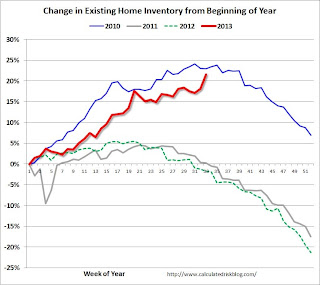

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for June). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 21.7%, and there might be some further increases over the next few weeks. It is important to remember that inventory is still very low, and is down 5.7% from the same week last year according to Housing Tracker.

This strongly suggests inventory bottomed early this year. I expect inventory to be up year-over-year very soon (maybe in September), and I also expect the seasonal decline to be less than usual at the end of the year. This increase in inventory also means price increases will slow.

Research: Drop in Jobless Claims suggests pickup in Wage Growth

by Calculated Risk on 8/19/2013 01:10:00 PM

Fast FT has an excerpt from a Deutsche Bank research note: US jobless claims hold signs for the second half

So far, rises in wages and salaries have barely been able to outpace the combined effect of inflation and the higher payroll tax introduced at the start of the year.The following graph is from the research note. This shows that the year-over-year change in weekly unemployment claims (inverted) typically leads wage growth. However, I think wage growth will remain sluggish with the high unemployment rate.

Deutsche expects that could change:

If the recent four-week average (332,000) on claims is sustained over the entirety of the third quarter, this should be consistent with an acceleration in wages and salary income toward 5.7% by yearend—which would significantly outpace the drag from inflation and the payroll taxexcerpt with permission

BLS: State unemployment rates were "little changed" in July

by Calculated Risk on 8/19/2013 10:16:00 AM

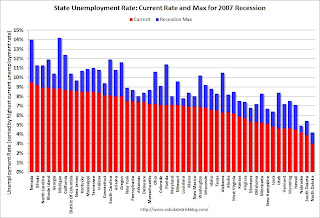

From the BLS: Jobless rates up in 28 states, down in 8 in July; payroll jobs up in 32 states, down in 17

Regional and state unemployment rates were little changed in July. Twenty-eight states and the District of Columbia had unemployment rate increases, 8 states had decreases, and 14 states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada had the highest unemployment rate among the states in July, 9.5 percent. The next highest rate was in Illinois, 9.2 percent. North Dakota continued to have the lowest jobless rate, 3.0 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan and Nevada have seen the largest declines and many other states have seen significant declines (California, Florida and more).

The states are ranked by the highest current unemployment rate. No state has double digit unemployment and the unemployment rate is at or above 9% in only two states: Nevada and Illinois, and Mississippi. This is the fewest states with 9% unemployment since 2008.

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).

The second graph shows the number of states with unemployment rates above certain levels since January 2006. At the worst of the employment recession, there were 9 states with an unemployment rate above 11% (red).Currently only two states have an unemployment rate above 9% (purple), seventeen states above 8% (light blue), and 28 states above 7% (blue).

Sunday, August 18, 2013

San Francisco: Apartments converting back to condos

by Calculated Risk on 8/18/2013 07:57:00 PM

From Carolyn Said at the San Francisco Chronicle: Bay Area rental pendulum swings to condos

Some condominium complexes opened at the worst possible time - in the depths of the real estate downturn when home buyers were few and far between. They coped by becoming for-rent apartment buildings instead. But now, as the housing recovery accelerates, several East Bay and South Bay developments are switching back to for-sale condos.The conversion of these condo projects to apartments was an interesting story during the housing bust (and a way to take excess "for sale" inventory off the market) - and now they are converting back to condos (taking advantage of the lack of "for sale" inventory). This is similar to a story by Cale Ottens at the LA Times last week: Condo conversions inch up in Los Angeles.

...

For instance, the 125-unit Broadway Grand in Oakland, developed by Signature Properties, first opened as a condo complex, sold 17 units, and then switched to rentals as the market tanked ... Last year it went condo again, and now has sold all but 11 of its units.

Similarly, the Skyline in San Jose with 121 units is now switching to condos after opening as rentals during the downturn. In Emeryville, the 424-unit Bridgewater is switching from rentals to condos. The current phase II, which started in June with 174 homes ranging from $185,000 to $450,000, is finding a receptive audience, said Alan Mark, president of the Mark Co., which is marketing the complex.