by Calculated Risk on 7/04/2013 10:34:00 AM

Thursday, July 04, 2013

ECB's Draghi: "ECB interest rates to remain at present or lower levels for an extended period of time"

From David Keohane at FT Alphaville: Forward guidance is contagious and the ECB has caught it

From a very dovish Mario Draghi’s press conference following the European Central Bank’s decision to keep its key rates on hold ...And from the WSJ: ECB Chief Gives Rate Forecast

Looking ahead, our monetary policy stance will remain accommodative for as long as necessary. The Governing Council expects the key ECB interest rates ... to remain at present or lower levels for an extended period of time. This expectation is based on the overall subdued outlook for inflation extending into the medium term, given the broad-based weakness in the real economy and subdued monetary dynamics. In the period ahead, we will monitor all incoming information on economic and monetary developments and assess any impact on the outlook for price stability ...This feels really rather significant.

It is a radical departure from the policy the ECB has followed ever since it started operations in 1999, under which it never pre-committed to any level of rates in advance.

...

Earlier in the day, the Bank of England had also broken with its usual practice, issuing a forward-looking statement that, likewise, appeared aimed at damping expectations of future interest rate increases. Mr. Draghi said it was a "coincidence" that the two things had happened on the same day.

Mr. Draghi drew attention to the fact that the council had been unanimous on giving its new guidance, implying that even hawkish members such as Germany's Jens Weidmann had consented to what was a powerfully dovish signal.

Wednesday, July 03, 2013

Trulia: Asking Home Prices increased in June

by Calculated Risk on 7/03/2013 09:19:00 PM

This was released earlier today: Trulia Reports Asking Home Prices Up 10.7 Percent Year-over-year Nationally as Mortgage Rates Rise

Nationally, asking home prices rose 10.7 percent year-over-year (Y-o-Y) in June. Even excluding foreclosures, prices jumped 11.4 percent Y-o-Y, signaling that the current rise in prices is not primarily driven by the shift away from foreclosure to non-distressed homes for sale. However, asking prices will eventually slow down as mortgage rates rise, inventory expands, and investor demand falls.Note: These asking prices are SA (Seasonally Adjusted) - and adjusted for the mix of homes - and this suggests further house price increases over the next few months on a seasonally adjusted basis.

Nationally, asking home prices bottomed in February 2012 – but the turnaround has been uneven. Prices first rebounded two years ago in San Jose, Phoenix, Denver, Miami, and a few other housing markets where job growth or bargain buying started boosting prices earlier. Meanwhile, prices continued to fall in several East Coast and Midwest markets until three to six months ago. Now with the housing recovery in full swing, asking prices rose in 99 of the 100 largest metros.

Marking its biggest Y-o-Y increase since January, rents rose 2.8 percent Y-o-Y nationally in June. Rents climbed most in Houston, Miami, and Tampa-St. Petersburg, but fell where asking prices are up more than 30 percent: Las Vegas, Oakland, and Sacramento. In fact, home prices outpaced rents in 22 of the 25 largest rental markets. Only in Houston, New York, and Philadelphia did rents rise faster than home prices.

“Rising home prices have swept the country,” said Jed Kolko, Trulia’s Chief Economist. “Local markets that suffered most during the housing crisis are seeing the biggest price rebounds today. Now even markets that escaped the worst of the bust, like Chicago and Baltimore, are seeing prices climb. However, these runaway price gains won’t last: both rising mortgage rates and slowly growing inventories should start tapping the brakes on home prices, preventing them from rising back into bubble territory.”

emphasis added

More from Kolko: Asking Home Prices Not Cooling Off – Yet

Employment Situation Preview

by Calculated Risk on 7/03/2013 04:22:00 PM

On Friday, at 8:30 AM ET, the BLS will release the employment report for June. The consensus is for an increase of 161,000 non-farm payroll jobs in June, and for the unemployment rate to decline to 7.5% from 7.6% in May.

Here is a summary of recent data:

• The ADP employment report showed an increase of 188,000 private sector payroll jobs in June. This was above expectations of 165,000 private sector payroll jobs added. The ADP report hasn't been very useful in predicting the BLS report for any one month. But in general, this suggests employment growth somewhat above expectations.

• The ISM manufacturing employment index decreased in June to 48.7% from 50.1% in April. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS reported payroll jobs for manufacturing decreased by close to 25,000 in June. The ADP report indicated a 1,000 increase for manufacturing jobs in June.

The ISM non-manufacturing (service) employment index increased in June to 54.7% from 50.1% in May. A historical correlation between the ISM service employment index and the BLS employment report for non-manufacturing, suggests that private sector BLS reported payroll jobs for non-manufacturing increased by about 185,000 in June.

Taken together, these surveys suggest only around 160,000 jobs added in June - in line with the consensus forecast.

• Initial weekly unemployment claims averaged about 345,000 in June. This was down slightly from 348,000 in May, and near the low for the year.

For the BLS reference week (includes the 12th of the month), initial claims were at 355,000; up from 344,000 in May.

• The final June Reuters / University of Michigan consumer sentiment index decreased to 84.1 from the May reading of 84.5. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors.

• The small business index from Intuit showed 25,000 payroll jobs added in June, Down from 35,000 in May.

• And on the unemployment rate from Gallup: Unadjusted Unemployment Rate Static in June

Gallup's unadjusted unemployment rate for the U.S. workforce was 7.8% in June, statistically similar to the 7.9% in May, and the 8.0% in June 2012.Note: So far the Gallup numbers haven't been very useful in predicting the BLS unemployment rate.

Gallup's seasonally adjusted U.S. unemployment rate for June, however, was 7.6%, down from 8.2% in May.

• Conclusion: The employment related data was slightly better in June than in May. The ADP and ISM manufacturing reports suggest an increase in hiring. However weekly claims for the reference week were slightly higher in June than in May, and consumer sentiment decreased slightly.

There is always some randomness to the employment report, but my guess is the BLS will report close to the consensus of 161,000 jobs added in June. A key will the unemployment rate to see if that is tracking the Fed's forecast for QE3 tapering.

Reis: Regional Mall Vacancy Rates unchanged in Q2

by Calculated Risk on 7/03/2013 01:38:00 PM

Reis reported that the vacancy rate for regional malls was unchanged in Q2 at 8.3%, the same is in Q1. This is down from a cycle peak of 9.4% in Q3 2011.

For Neighborhood and Community malls (strip malls), the vacancy rate declined slightly to 10.5% in Q2, down from 10.6% in Q1. For strip malls, the vacancy rate peaked at 11.1% in Q3 2011.

Comments from Reis Senior Economist Ryan Severino:

[Strip Malls] During the second quarter vacancy declined by yet another 10 bps. This is the sixth time in the last seven quarters that vacancy fell by 10 bps. The market is proving to be consistent if not spectacular in its recovery. On a year‐over‐year basis, the vacancy rate declined by 30 bps. The amount of space absorbed continues to slightly exceed the amount of space completed. Since only 914,000 square feet were delivered, the modest improvement in vacancy remains a function of slack demand for space.

...

[New construction] With demand for space so meager, there exists no real catalyst for new construction in the market. Consequently, new construction continues to hover near record‐low levels. 914,000 square feet were delivered during the second quarter, versus 1.124 million square feet during the first quarter. This is a slight slowdown compared to the 1.171 million square feet of retail space that were delivered during the second quarter of 2012. In fact, 914,000 square feet is the fourth‐lowest figure on record since Reis began tracking quarterly data in 1999. Although construction this quarter came primarily from new centers and not expansion of existing centers, roughly 60% of the new space that came online during the quarter was in only three projects.

...

[Regional] The improvement in the malls subsector took a bit of a breather during the second quarter. The national vacancy rate was unchanged during the quarter, this first time this segment of the market did not register a decline in vacancy since the third quarter of 2011 when mall vacancies reached their all time high of 9.4%. Asking rent growth was also unchanged versus last quarter, growing by another 0.4%. This was the ninth consecutive quarter of asking rent increases and on a year‐over‐year basis, rent growth slightly accelerated.

Click on graph for larger image.

Click on graph for larger image.This graph shows the strip mall vacancy rate starting in 1980 (prior to 2000 the data is annual). The regional mall data starts in 2000. Back in the '80s, there was overbuilding in the mall sector even as the vacancy rate was rising. This was due to the very loose commercial lending that led to the S&L crisis.

In the mid-'00s, mall investment picked up as mall builders followed the "roof tops" of the residential boom (more loose lending). This led to the vacancy rate moving higher even before the recession started. Then there was a sharp increase in the vacancy rate during the recession and financial crisis.

The yellow line shows mall investment as a percent of GDP through Q1 2013. This has increased from the bottom because this includes renovations and improvements. New mall investment has essentially stopped.

The good news is, as Severino noted, new square footage is near a record low, and with very little new supply, the vacancy rate will probably continue to decline slowly.

Mall vacancy data courtesy of Reis.

Trade Deficit increased in May to $45.0 Billion

by Calculated Risk on 7/03/2013 11:13:00 AM

Catching up ... the Department of Commerce reported this morning:

[T]otal May exports of $187.1 billion and imports of $232.1 billion resulted in a goods and services deficit of $45.0 billion, up from $40.1 billion in April, revised. May exports were $0.5 billion less than April exports of $187.6 billion. May imports were $4.4 billion more than April imports of $227.7 billion.The trade deficit was higher than the consensus forecast of $40.8 billion.

The first graph shows the monthly U.S. exports and imports in dollars through May 2013.

Click on graph for larger image.

Click on graph for larger image.Imports increased in May, and exports decreased slightly.

Exports are 13% above the pre-recession peak and up 2% compared to May 2012; imports are at the pre-recession peak, and up 1% compared to May 2012 (mostly moving sideways).

The second graph shows the U.S. trade deficit, with and without petroleum, through May.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. Most of the recent improvement in the trade deficit is related to petroleum.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products. Most of the recent improvement in the trade deficit is related to petroleum.Oil averaged $96.84 in May, down slightly from $97.82 in April, and down from $108.06 in May 2012.

The trade deficit with the euro area was $8.9 billion in May, up from $8.7 billion in May 2012.

The trade deficit with China increased to $27.9 billion in May, up from $26.0 billion in May 2012. Most of the trade deficit is related to oil and China.

ISM Non-Manufacturing Index indicates slower expansion in June

by Calculated Risk on 7/03/2013 10:00:00 AM

The June ISM Non-manufacturing index was at 52.2%, down from 53.7% in May. The employment index increased in June to 54.7%, up from 50.1% in May. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: June 2013 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in June for the 42nd consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 52.2 percent in June, 1.5 percentage points lower than the 53.7 percent registered in May. This indicates continued growth at a slightly slower rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 51.7 percent, which is 4.8 percentage points lower than the 56.5 percent reported in May, reflecting growth for the 47th consecutive month. The New Orders Index decreased by 5.2 percentage points to 50.8 percent, and the Employment Index increased 4.6 percentage points to 54.7 percent, indicating growth in employment for the 11th consecutive month. The Prices Index increased 1.4 percentage points to 52.5 percent, indicating prices increased at a faster rate in June when compared to May. According to the NMI™, 14 non-manufacturing industries reported growth in June. Respondents' comments are mixed about business conditions depending upon the industry and company. The majority indicate that growth has been slow and incremental; however, it is still better year over year."

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was below the consensus forecast of 54.5% and indicates slightly slower expansion in June than in May.

Weekly Initial Unemployment Claims decline to 343,000

by Calculated Risk on 7/03/2013 08:35:00 AM

The DOL reports:

In the week ending June 29, the advance figure for seasonally adjusted initial claims was 343,000, a decrease of 5,000 from the previous week's revised figure of 348,000. The 4-week moving average was 345,500, a decrease of 750 from the previous week's revised average of 346,250.The previous week was revised up from 346,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 345,500.

The 4-week average has mostly moved sideways over the last few months. Claims were close to the 345,000 consensus forecast.

ADP: Private Employment increased 188,000 in June

by Calculated Risk on 7/03/2013 08:19:00 AM

Private sector employment increased by 188,000 jobs from May to June, according to the June ADP National Employment Report®. ... May’s job gains were revised downward to 134,000 from 135,000.This was above the consensus forecast for 165,000 private sector jobs added in the ADP report. Note: The BLS reports on Friday, and the consensus is for an increase of 175,000 payroll jobs in June, on a seasonally adjusted (SA) basis.

...

Mark Zandi, chief economist of Moody’s Analytics, said, "The job market continues to gracefully navigate through the strongly blowing fiscal headwinds. Health Care Reform does not appear to be significantly hampering job growth, at least not so far. Job gains are broad based across industries and businesses of all sizes."

Note: ADP hasn't been very useful in predicting the BLS report.

MBA: Mortgage Refinance Applications Decline as Mortgage Rates Increase in Latest Weekly Survey

by Calculated Risk on 7/03/2013 07:01:00 AM

From the MBA: Mortgage Applications Decrease as Rates Reach Two-year High in Latest MBA Weekly Survey

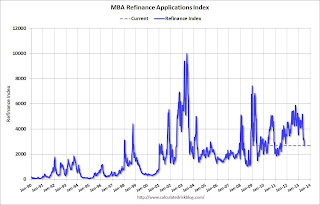

The Refinance Index decreased 16 percent from the previous week and is at its lowest level since July 2011. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier.

...

“Mortgage rates reached their highest point in two years last week. At these rates, many fewer homeowners have an incentive to refinance, and refinance application volume declined more than 15 percent. With this decline in volume, the refinance share dropped to its lowest level in more than two years. Purchase application volume also declined, but not nearly to the same extent, as affordability remains strong,” said Mike Fratantoni, MBA’s Vice President of Research and Economics

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less)increased to 4.58 percent, the highest rate since July 2011, from 4.46 percent, with points increasing to 0.43 from 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index.

With 30 year mortgage rates above 4.5%, refinance activity has fallen sharply, decreasing in 7 of the last 8 weeks.

This index is down 48% over the last eight weeks.

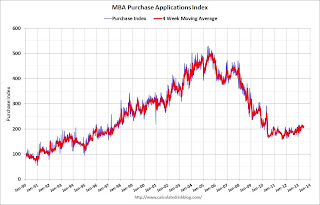

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is up almost 10% from a year ago.

The second graph shows the MBA mortgage purchase index. The 4-week average of the purchase index has generally been trending up over the last year, and the 4-week average of the purchase index is up almost 10% from a year ago.

Tuesday, July 02, 2013

Wednesday: Trade Deficit, ADP Employment, ISM Service, Q2 Mall Vacancy Rates

by Calculated Risk on 7/02/2013 08:10:00 PM

The Egyptian "deadline" is tomorrow, from CNN: Showdown? Egypt's Morsy defies military 'ultimatum'

Egyptian President Mohamed Morsy refused Tuesday to bow to a military ultimatum that he find a solution to the unrest sweeping the country or be pushed aside, setting the stage for a possible showdown.Hoping for the best for the people of Egypt.

Morsy declared he was elected president in balloting that was free and representative of the will of the people.

...

It was unclear what steps the military would take given Morsy's refusal to meet its Wednesday evening deadline. The military has previously stopped short of saying that it was suggesting a coup.

Wednesday:

• Early: the Reis Q2 2013 Mall Survey of rents and vacancy rates.

• At 7:00 AM ET, the Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index.

• At 8:15 AM, the ADP Employment Report for June will be released. This report is for private payrolls only (no government). The consensus is for 165,000 payroll jobs added in June.

• At 8:30 AM, the Trade Balance report for May from the Census Bureau. The consensus is for the U.S. trade deficit to increase to $40.8 billion in May from $40.3 billion in April.

• Also at 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for a decrease to 345 thousand from 346 thousand last week.

• At 10:00 AM, the ISM non-Manufacturing Index for June will be released. The consensus is for a reading of 54.5, up from 53.7 in May. Note: Above 50 indicates expansion, below 50 contraction.

• Also at 10:00 AM, the Trulia Price Rent Monitors for June. This is the index from Trulia that uses asking house prices adjusted both for the mix of homes listed for sale and for seasonal factors.