by Calculated Risk on 5/21/2013 08:58:00 AM

Tuesday, May 21, 2013

Zillow: House Prices up over 5% year-over-year in March, Case-Shiller expected to show 9.8% YoY increase

From Zillow: Annual U.S. Home Value Appreciation Exceeds 5 Percent for Sixth Straight Month in April

U.S. home values continued to climb in April, increasing 0.5 percent from March to $158,300, according to the April Zillow Real Estate Market Reports. Home values were up 5.2 percent year-over-year, marking the sixth consecutive month of annual home value appreciation at or above 5 percent. The last time national home values were at this level was in June 2004.The Case-Shiller house price indexes for March will be released Tuesday, May 28th. Zillow has started forecasting the Case-Shiller a month early - and I like to check the Zillow forecasts since they have been pretty close.

A majority (55 percent) of the 365 metros covered saw home values climb in April from March. Of the 30 largest metro areas covered, Sacramento experienced the largest monthly increase, with home values rising 3.4 percent. Other large metro areas with notable monthly increases include Las Vegas (3 percent) and San Francisco (2.8 percent).

“April marks the sixth straight month of annual home value appreciation of 5 percent or above, the longest such streak since the height of the bubble in 2006. In the short term, this has been welcome news for homeowners. But in the long term, this cannot be sustained, and consumers entering the market today should not expect this kind of appreciation to last,” said Zillow Chief Economist Dr. Stan Humphries. “Overall, we expect home value appreciation to moderate as more supply comes on line over the next year, but in some areas, runaway home value appreciation, combined with expected interest rate hikes in coming years, runs a real risk of pricing out many potential buyers. Home values in these areas will have to flatten or even fall to come back in line.”

The Zillow Home Value Forecast calls for 4 percent appreciation nationally from April 2013 to April 2014.

Zillow: March Case-Shiller Composites To Show Annual Appreciation Above 9%

[W]e predict that ... Case-Shiller data (March 2013) will show that the 20-City Composite Home Price Index (non-seasonally adjusted [NSA]) increased 9.8 percent on a year-over-year basis, while the 10-City Composite Home Price Index (NSA) increased 9.3 percent on a year-over-year basis. The seasonally adjusted (SA) month-over-month change from February to March will be 0.9 percent for both the 20-City Composite and the 10-City Composite Home Price Indices (SA). All forecasts are shown in the table below. Officially, the Case-Shiller Composite Home Price Indices for March will not be released until Tuesday, May 28.The following table shows the Zillow forecast for March.

...

To forecast the Case-Shiller indices we use past data from Case-Shiller, as well as the Zillow Home Value Index (ZHVI), which is available more than a month in advance of Case-Shiller numbers, paired with foreclosure resale numbers, which we also have available more than a month prior to Case-Shiller numbers. ...

The ZHVI does not include foreclosure resales and shows home values for March 2013 up 5.1 percent from year-ago levels. ... Further details on our forecast can be found here ...

| Zillow March Forecast for Case-Shiller Index | |||||

|---|---|---|---|---|---|

| Case Shiller Composite 10 | Case Shiller Composite 20 | ||||

| NSA | SA | NSA | SA | ||

| Case Shiller (year ago) | Mar 2012 | 146.46 | 150.36 | 134.07 | 140.12 |

| Case-Shiller (last month) | Feb 2013 | 159.24 | 162.37 | 146.57 | 149.80 |

| Zillow Forecast | YoY | 9.3% | 9.3% | 9.8% | 9.8% |

| MoM | 0.5% | 0.9% | 0.5% | 0.9% | |

| Zillow Forecasts1 | 160.1 | 164.1 | 147.3 | 151.0 | |

| Current Post Bubble Low | 146.46 | 149.45 | 134.07 | 136.86 | |

| Date of Post Bubble Low | Mar-12 | Feb-12 | Mar-12 | Jan-12 | |

| Above Post Bubble Low | 9.3% | 9.8% | 9.8% | 10.3% | |

| 1Estimate based on Year-over-year and Month-over-month Zillow forecasts | |||||

Monday, May 20, 2013

Discussion on Inequality and Economic Growth

by Calculated Risk on 5/20/2013 05:47:00 PM

From 6:30 to 8:00 PM ET, the will be a live stream of professors Tony Atkinson and Paul Krugman discussing inequality and growth at CUNY. The dialogue will be moderated by Chrystia Freeland.

As we endure the slow, uneven recovery from the “Great Recession,” there is no more critical or timely question than that of the relationship between economic growth and inequality. Join two preeminent economists as they assess the connection between prosperity for some and poverty for others. Paul Krugman is professor of economics at Princeton University, a Nobel laureate, and a New York Times columnist. He is the author of numerous books, including the recently published End This Depression Now! Sir Tony Atkinson, professor of economics at Oxford's Nuffield College, is one of the world’s foremost scholars of inequality and author or editor of more than thirty books on inequality and related topics. He recently coedited Top Incomes: A Global Perspective, a volume that analyses high-end income inequality around the world.Chrystia Freeland will be taking questions at #GCinequality

This is a very interesting topic. Intuitively it seems higher inequality should lead to slower growth (I think it would at the extreme!), but I'm not sure the relationship between inequality and growth is clear.

UPDATE: Here is a replay video (starts around 55 minutes into video):

Existing Home Inventory is up 17.7% year-to-date on May 20th

by Calculated Risk on 5/20/2013 03:37:00 PM

Weekly Update: One of key questions for 2013 is Will Housing inventory bottom this year?. Since this is a very important question, I'm tracking inventory weekly in 2013.

There is a clear seasonal pattern for inventory, with the low point for inventory in late December or early January, and then peaking in mid-to-late summer.

The Realtor (NAR) data is monthly and released with a lag (the most recent data was for March). However Ben at Housing Tracker (Department of Numbers) has provided me some weekly inventory data for the last several years. This is displayed on the graph below as a percentage change from the first week of the year (to normalize the data).

In 2010 (blue), inventory increased more than the normal seasonal pattern, and finished the year up 7%. However in 2011 and 2012, there was only a small increase in inventory early in the year, followed by a sharp decline for the rest of the year.

Click on graph for larger image.

Click on graph for larger image.

Note: the data is a little weird for early 2011 (spikes down briefly).

So far in 2013, inventory is up 17.7%. This is well above the peak percentage increases for 2011 and 2012 and suggests to me that inventory is near the bottom. It now seems likely - at least by this measure - that inventory bottomed early this year (it could still happen early next year).

It is important to remember that inventory is still very low, and is down 15.1% from the same week last year according to Housing Tracker. Once inventory starts to increase (more than seasonal), buyer urgency will wane, and I expect price increases to slow.

Lumber Prices decline Sharply over last month

by Calculated Risk on 5/20/2013 01:12:00 PM

Just over a month ago I mentioned that lumber prices were nearing the housing bubble highs. Since then prices have declined sharply, with prices off about 20% from the recent highs.

Some of the decline could be related to additional supply coming on the market, and some due to less buying from China (several sources are reporting that China has pulled back significantly on buying North American lumber).

On additional supply, two months ago the WSJ had an article about some producers increasing supply:

Georgia-Pacific, the largest U.S. producer of plywood ... plans to invest about $400 million over the next three years to boost softwood plywood and lumber capacity by 20%.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows two measures of lumber prices (not plywood): 1) Framing Lumber from Random Lengths through last week (via NAHB), and 2) CME framing futures.

Lumber prices are now 20% off the recent highs.

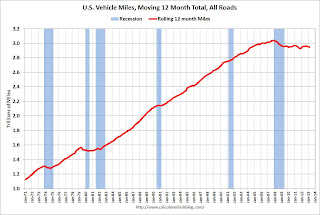

DOT: Vehicle Miles Driven decreased 1.5% in March

by Calculated Risk on 5/20/2013 10:37:00 AM

The Department of Transportation (DOT) reported:

Travel on all roads and streets changed by -1.5% (-3.7 billion vehicle miles) for March 2013 as compared with March 2012. Travel for the month is estimated to be 248.8 billion vehicle miles.

The following graph shows the rolling 12 month total vehicle miles driven.

The rolling 12 month total is still mostly moving sideways.

Click on graph for larger image.

Click on graph for larger image.In the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months.

Currently miles driven has been below the previous peak for 64 months - over 5 years - and still counting.

The second graph shows the year-over-year change from the same month in the previous year.

Gasoline prices were down in March compared to March 2012. In March 2013, gasoline averaged of $3.78 per gallon according to the EIA. In 2012, prices in March averaged $3.91 per gallon. But even with the year-over-year decline in gasoline prices, miles driven decreased.

Gasoline prices were down in March compared to March 2012. In March 2013, gasoline averaged of $3.78 per gallon according to the EIA. In 2012, prices in March averaged $3.91 per gallon. But even with the year-over-year decline in gasoline prices, miles driven decreased.This is because gasoline prices are just part of the story. The lack of growth in miles driven over the last 5 years is probably also due to the lingering effects of the great recession (high unemployment rate and lack of wage growth), the aging of the overall population (over 55 drivers drive fewer miles) and changing driving habits of young drivers.

With all these factors, it might take several more years before we see a new peak in miles driven.

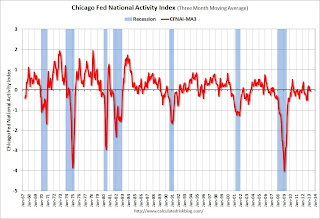

Chicago Fed: "Economic Activity Slower in April"

by Calculated Risk on 5/20/2013 08:36:00 AM

The Chicago Fed released the national activity index (a composite index of other indicators): Economic Activity Slower in April

Led by declines in production-related indicators, the Chicago Fed National Activity Index (CFNAI) decreased to –0.53 in April from –0.23 in March. Three of the four broad categories of indicators that make up the index decreased from March, and none of the categories made a positive contribution to the index in April.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967.

The index’s three-month moving average, CFNAI-MA3, ticked up to –0.04 in April from –0.05 in March. April’s CFNAI-MA3 suggests that growth in national economic activity was very near its historical trend. The economic growth reflected in this level of the CFNAI-MA3 suggests subdued inflationary pressure from economic activity over the coming year.

emphasis added

Click on graph for larger image.

Click on graph for larger image.This suggests economic activity slowed in April, and growth was near the historical trend (using the three-month average).

According to the Chicago Fed:

What is the National Activity Index? The index is a weighted average of 85 indicators of national economic activity drawn from four broad categories of data: 1) production and income; 2) employment, unemployment, and hours; 3) personal consumption and housing; and 4) sales, orders, and inventories.

A zero value for the index indicates that the national economy is expanding at its historical trend rate of growth; negative values indicate below-average growth; and positive values indicate above-average growth.

Sunday, May 19, 2013

Sunday Night Futures

by Calculated Risk on 5/19/2013 10:15:00 PM

Monday:

• At 8:30 AM ET, the Chicago Fed National Activity Index for April will be released. This is a composite index of other data.

Weekend:

• Schedule for Week of May 19th

The Asian markets are green tonight with the Nikkei up 1.0%, and Shanghai Composite up 0.2%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down slightly and DOW futures are down 6 (fair value).

Oil prices have moved sideways recently with WTI futures at $95.99 per barrel and Brent at $104.62 per barrel.

Below is a graph from Gasbuddy.com for nationwide gasoline prices. Nationally prices are up 17 cents per gallon over the last two weeks to $3.67 per gallon. Based on Brent prices and the calculator at Econbrowser, I expect gasoline prices to fall soon.

If you click on "show crude oil prices", the graph displays oil prices for WTI, not Brent; gasoline prices in most of the U.S. are impacted more by Brent prices.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Report: Wells Fargo, JPMorgan Chase and Citigroup "nearly halt foreclosure sales"

by Calculated Risk on 5/19/2013 08:00:00 PM

From Scott Reckard at the LA Times: 3 big banks nearly halt foreclosure sales after U.S. tweaks orders

Sales of homes in foreclosure by Wells Fargo & Co., JPMorgan Chase & Co. and Citigroup Inc. ground nearly to a halt after regulators revised their orders on treatment of troubled borrowers during the 60 days before they lose their homes.This will probably be a temporary delay. Here is the new Operating standards for scheduled foreclosure sales, but I'm not sure what was changed.

The banks said they paused the sales on May 6 to make sure that their late-stage foreclosure procedures were in accordance with the guidelines.

...

"We are in the process of complying and following the directive set forth in the OCC guidance," Citigroup said.

Wells, saying the latest OCC bulletin had "slight changes from the previous," declared that it "wanted to be absolutely sure that our interpretation of the language was the same as our regulators."

Research Notes: Fiscal Drag and Upward Revisions to Q2 GDP

by Calculated Risk on 5/19/2013 11:02:00 AM

Some brief excerpts from two research notes released this week. The fiscal drag is hitting hard right now and is expected to fade towards the end of the year. Right now it looks like Q2 is tracking close to 2% GDP growth.

From economist Alec Phillips at Goldman Sachs:

Earlier this year, we expected fiscal policy to weigh on growth most heavily in Q2 and Q3, when sequestration, other federal spending reductions, and the recent tax increases looked likely to have their greatest combined effect. It now looks like the fiscal drag will be somewhat more spread out than we anticipated.From Ethan Harris at Merrill Lynch:

The main reason is the 15% (annualized) drop in federal spending in Q4, followed by the 8% drop in Q1. This reduces the amount of fiscal drag from federal spending cuts we think is still in the pipeline, though it doesn't eliminate it. The chart below shows the drag on growth ...

Click on graph for larger image.

The upshot is that the amount of fiscal drag we expect is fairly similar in Q1, Q2, and Q3. This is consistent with our current growth forecast: we expect Q1 GDP to come in slightly lower than the 2.5% advance reading, at 2.3%, while we see Q2 tracking at 2.1% and we forecast growth in Q3 of 2.0%. In Q4, when we expect the drag from fiscal policy to fade somewhat, we expect real GDP growth to pick up to 2.5% at an annual rate.

Despite significant fiscal tightening, the US economy continues to grow at a trendlike pace. Last fall we had expected growth to be weak in both 1Q and 2Q. As the better data came in, we assumed the shock was hitting with longer lags and we moved the “soft patch” to 2Q and 3Q. We argued that investors should look at two indicators for signs of weakness: soft retail sales and rising jobless claims. Instead, the “control” measure of retail sales continues to grow at about a 4% annualized pace and claims have fallen.

This week we are “marking to market” our 2Q forecast: we now see growth of 1.8%, up from 1.3% and roughly in line with the consensus. We have not changed our forecast for coming quarters. The economy has shown a lot more resilience than we had thought, but the full impact of the fiscal shock has not arrived yet and some kind of soft patch still appears likely.

Saturday, May 18, 2013

Unofficial Problem Bank list declines to 770 Institutions

by Calculated Risk on 5/18/2013 03:51:00 PM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for May 17, 2013.

Changes and comments from surferdude808:

As anticipated, the OCC released its enforcement action activity through mid-April 2013 this Friday. What we did not anticipate was an early week failed-bank closure of another Capitol Bancorp's banking subsidiaries after two were closed last Friday. Along with the failure, there were two other removals and two additions to the Unofficial Problem List this week. After changes, the list has 770 institutions with assets of $284.1 billion. A year ago, the list held 928 institutions with assets of $361.9 billion.

The OCC terminated actions against Liberty Savings Bank, F.S.B., Wilmington, OH ($552 million) and First Federal Community Bank, Paris, TX ($344 million); and issued actions against Mid-Southern Savings Bank, FSB, Salem, IN ($218 million) and Midwest Federal Savings and Loan Association of St Joseph, Saint Joseph, MO ($35 million Ticker: SJBA).

In a rare Tuesday closing, the Arizona Department of Financial Institutions shuttered Central Arizona Bank, Scottsdale, AZ ($33 million Ticker: CBCRQ). The state banking department was prevented from closing the bank last Friday because of a legal challenge by Capitol Bancorp. By Tuesday, the state banking department was able to prevail, in part, because the bank's Tier 1 leverage ratio had apparently fallen much lower than the 2.13 percent reported in the bank's March 2013 Call Report. Meanwhile in Nevada, the Nevada Department of Business and Industry's Financial Institutions Division was prevented from closing 1st Commerce Bank, North Las Vegas ($24 million) through another legal action by Capitol Bancorp. Reportedly, a preliminary hearing on the injunction stopping the closing will be held next Thursday. SNL Securities is reporting that Capitol Bancorp, in a bankruptcy filing, sold its remaining interest in Capitol National Bank, Lansing, MI ($145 million) in April 2013 with the proceeds being held in escrow until the FDIC issues a cross-guaranty liability waiver.