by Calculated Risk on 11/29/2012 09:04:00 PM

Thursday, November 29, 2012

Friday: October Personal Income and Outlays, Chicago PMI

A couple of articles on the fiscal slope negotiations:

Suzy Khimm at the WaPo has the initial White House proposal: The White House’s fiscal cliff proposal

Jonathan Weisman at the NY Times writes: G.O.P. Balks at White House Plan on Fiscal Crisis

Treasury Secretary Timothy F. Geithner presented the House speaker, John A. Boehner, a detailed proposal on Thursday to avert the year-end fiscal crisis with $1.6 trillion in tax increases over 10 years, $50 billion in immediate stimulus spending, home mortgage refinancing and a permanent end to Congressional control over statutory borrowing limits.For the economy this proposal would resolve the "fiscal cliff" uncertainty, significant reduce the fiscal drag, and also reduce the deficit. Of course there are other agendas too - this proposal is a starting point - but hopefully eliminating the debt ceiling nonsense is part of the final agreement.

My guess is an agreement will be reached, perhaps in early January after the tax cuts expire, so politicians can claim to be cutting taxes.

Friday:

• At 8:30 AM, the Personal Income and Outlays report for October will be released. The consensus is for a 0.3% increase in personal income in October, and for 0.1% increase in personal spending. And for the Core PCE price index to increase 0.2%.

• At 9:45 AM, Chicago Purchasing Managers Index for November. The consensus is for an increase to 50.3, up from 49.9 in October.

The last question for the November economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Freddie Mac: Mortgage Rates Near Record Lows

by Calculated Risk on 11/29/2012 05:05:00 PM

From Freddie Mac today: Mortgage Rates Virtually Unchanged

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), showing fixed mortgage rates virtually unchanged and remaining near their record lows ...

30-year fixed-rate mortgage (FRM) averaged 3.32 percent with an average 0.8 point for the week ending November 29, 2012, up from last week when it averaged 3.31 percent. Last year at this time, the 30-year FRM averaged 4.00 percent.

15-year FRM this week averaged 2.64 percent with an average 0.6 point, up from last week when it averaged 2.63 percent. A year ago at this time, the 15-year FRM averaged 3.30 percent.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

The Freddie Mac survey started in 1971 and mortgage rates are currently near the record low for the last 40 years.

It usually takes around a 50 bps decline from the previous mortgage rate low to get a significant refinance boom, and refinance activity has picked up.

There has also been an increase in refinance activity due to HARP.

Here is an update to an old graph - by request - that shows the relationship between the 10 year Treasury Yield and 30 year mortgage rates.

Here is an update to an old graph - by request - that shows the relationship between the 10 year Treasury Yield and 30 year mortgage rates.The y-intercept is around 2.6%, so if the 10 year Treasury yield falls to zero, 30 year mortgage rates would still be around 2.6% (using this fit).

Currently the 10 year Treasury yield is 1.62% and 30 year mortgage rates are at 3.32%.

The third graph shows the 15 and 30 year fixed rates from the Freddie Mac survey since the Primary Mortgage Market Survey® started in 1971 (15 year in 1991).

The third graph shows the 15 and 30 year fixed rates from the Freddie Mac survey since the Primary Mortgage Market Survey® started in 1971 (15 year in 1991).Note: Mortgage rates were at or below 5% back in the 1950s.

A few comments on GDP Revision and Unemployment Claims

by Calculated Risk on 11/29/2012 02:21:00 PM

• GDP Revision: Although Q3 real GDP growth was revised up from 2.0% annualized to 2.7%, the underlying details were disappointing. There were three main sources for the revision: 1) Personal consumption expenditures (PCE) increased at a 1.4% annualized rate, revised down from 2.0%. This means PCE contributed 0.99 percentage points to real growth in Q3 (revised down from a 1.42 percentage point contribution in the advance release), and 2) the change in private inventories added 0.77 percentage point contribution to growth (revised up from -0.12), and 3) exports were revised up to a 0.16 percentage point contribution (revised up from -0.23).

This suggests weaker final demand in the US than originally estimated.

Also Justin Wolfers at Bloomberg discusses the weak Gross Domestic Income (GDI) data: The Bad News in Today's Happy Growth Report. Sluggish growth continues.

• Unemployment Claims: A reader sent me some "analysis" on the initial weekly unemployment claims report released this morning that was incorrect. The writer wrote that the 1) the 4-week moving average was at the highest level this year, 2) that there were 30,603 fewer layoffs in New York "last week", so 3) the recent increase in the 4-week average can't be blamed on Hurricane Sandy.

The first point is correct. The 4-week average is at the highest level since October 2011, but the conclusion about not blaming Sandy is incorrect.

First, the initial claims data is very noisy, so most analysts use the 4-week average to smooth out the noise. When an event happens - like Hurricanes Katrina in 2005 or Sandy this year - the 4-week average lags the event. Here is the unemployment claims data for the last 10 weeks:

| Week Ending | Initial Claims (SA) | 4-Week Average |

|---|---|---|

| 9/22/2012 | 363,000 | 375,000 |

| 9/29/2012 | 369,000 | 375,500 |

| 10/6/2012 | 342,000 | 364,750 |

| 10/13/2012 | 392,000 | 366,500 |

| 10/20/2012 | 372,000 | 368,750 |

| 10/27/2012 | 363,000 | 367,250 |

| 11/3/2012 | 361,000 | 372,000 |

| 11/10/2012 | 451,000 | 386,750 |

| 11/17/2012 | 416,000 | 397,750 |

| 11/24/2012 | 393,000 | 405,250 |

It is no surprise that the 4-week average increased this week. The 363,000 claims for the week ending Oct 27th were dropped out of the average and replaced with the 393,000 initial claims this week - so the 4-week average increased even though initial unemployment claims are declining.

The 4-week average will probably increase again next week as the 361,000 claims for the week ending Nov 3rd will be replaced with the claims for this week. Note: There are some large seasonal adjustment this time of year - especially the week after Thanksgiving - so it is hard to predict the level of claims. But the math is simple.

The good news is in two weeks the 451,000 claims for the week of Nov 10th will be dropped out of the 4-week average.

Key point: the 4-week average is intended to smooth out noise, but it lags events.

The writer's conclusion about 30,603 fewer layoffs in New York "last week" so the increase in the 4-week average can't be blamed on hurricane Sandy are incorrect. As part of the weekly release, the DOL notes the UNADJUSTED state data for the PREVIOUS week. The headline number was for the week ending Nov 24th, but the unadjusted state data was for Nov 17th.

The state data for New York showed a large decline, but the week before the New York data showed an even large increase. Since this data is unadjusted, we can't tell if claims are still elevated in New York, but since the increase for the week ending Nov 10th was much larger than the decrease for the week ending Nov 17th, my guess would be that claims are still above normal.

The bottom line is the recent increase in unemployment claims is most likely due to Hurricane Sandy, and there is nothing in the data that would suggest otherwise. And using simple arithmetic, we'd expect the 4-week average to lag the event. The state data supports this view, and I expect the 4-week average to increase again next week, and then start declining the following week (although there can be large seasonal effects this time of year, so we could be off a week or two).

Kansas City Fed: Regional Manufacturing Activity "Eased Further" in November

by Calculated Risk on 11/29/2012 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Eased Further

The Federal Reserve Bank of Kansas City released the November Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity eased further in November, while producers’ expectations were unchanged from last month at modestly positive levels.Most of the regional manufacturing surveys were weak in November (Richmond was the exception).

“We saw a decline in regional factory activity for the second straight month, and firms have put hiring plans on hold for the next six months” said Wilkerson. “However, overall production and capital spending are expected to rise moderately in coming months.”

...

Several contacts noted uncertainties about the upcoming fiscal cliff, and a few producers cited delayed deliveries and reduced orders from the East Coast as a result of the Hurricane Sandy. Price indexes moderated slightly.

The month-over-month composite index was -6 in November, down from -4 in October and 2 in September. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. This marked the first time the composite index has been negative for two straight months since mid-2009. Manufacturing slowed at durable goods-producing plants, while nondurable factories reported a slight uptick in activity, particularly for food and plastics products. Other month-over-month indexes were mixed in November. The production index was unchanged at -6, while the new orders and order backlog indexes declined for the third straight month to their lowest levels in three years. In contrast, the employment index increased from -6 to 0, and the shipments and new orders for exports indexes were less negative.

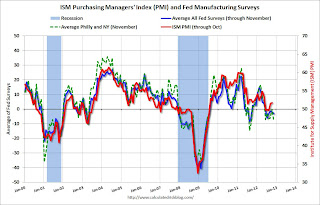

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through November), and five Fed surveys are averaged (blue, through November) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through October (right axis).

The ISM index for November will be released Monday, Dec 3rd, and these surveys suggest another weak reading.

NAR: Pending Home Sales Index increases in October

by Calculated Risk on 11/29/2012 10:16:00 AM

From the NAR: Pending Home Sales Rise in October to Highest Level in Over Five Years

The Pending Home Sales Index, a forward-looking indicator based on contract signings, increased 5.2 percent to 104.8 in October from an upwardly revised 99.6 in September and is 13.2 percent above October 2011 when it was 92.6. The data reflect contracts but not closings.Contract signings usually lead sales by about 45 to 60 days, so this would usually be for closed sales in November and December. However, because of the increase in short sales that take longer to close, some of these contract signings are probably for next year.

...

Outside of a few spikes during the tax credit period, pending home sales are at the highest level since March 2007 when the index also reached 104.8. On a year-over-year basis, pending home sales have risen for 18 consecutive months.