by Calculated Risk on 11/21/2012 11:49:00 AM

Wednesday, November 21, 2012

AIA: Architecture Billings Index increases in October, Highest in Two Years

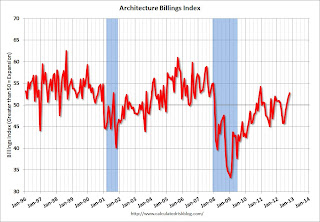

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Positive for Third Straight Month

Billings at architecture firms accelerated to their strongest pace of growth since December 2010. As a leading economic indicator of construction activity, the Architecture Billings Index (ABI) reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the October ABI score was 52.8, up from the mark of 51.6 in September. This score reflects an increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 59.4, compared to a mark of 57.3 the previous month.

“With three straight monthly gains – and the past two being quite strong – it’s beginning to look like demand for design services has turned the corner,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “With 2012 winding down on an upnote, and with the national elections finally behind us, there is a general sense of optimism. However, this is balanced by a tremendous amount of anxiety and uncertainty in the marketplace, which likely means that we’ll have a few more bumps before we enter a full-blown expansion.”

• Regional averages: South (52.8), Northeast (52.6), West (51.8), Midwest (50.8)

• Sector index breakdown: multi-family residential (59.6), mixed practice (52.4), institutional (51.4), commercial / industrial (48.0)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.8 in October, up from 51.6 in September. Anything above 50 indicates expansion in demand for architects' services.

This increase is mostly being driven by demand for design of multi-family residential buildings - and this suggests there are more apartments coming (there are already quite a few apartments under construction). New project inquiries are also increasing. Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests some increase in CRE investment next year (it will be some time before investment in offices and malls increases significantly).

Final November Consumer Sentiment at 82.7, MarkIt Flash PMI shows Improvement in Manufacturing

by Calculated Risk on 11/21/2012 09:58:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for November declined to 82.7 from the preliminary reading of 84.9, and was up from the October reading of 82.6.

This was below the consensus forecast of 84.0. Overall, consumer sentiment has been improving; the recent decline in sentiment might be related to the stock market decline (the consumer sentiment index is impacted by employment, gasoline prices, the stock market and more).

From MarkIt: Manufacturing growth strengthens to five-month high in November

The Markit Flash U.S. Manufacturing Purchasing Managers’ Index™ (PMI™)1 signalled the strongest improvement in U.S. manufacturing business conditions for five months in November. The preliminary ‘flash’ PMI reading, which is based on around 85% of usual monthly replies, rose to 52.4 from 51.0 in October to indicate a moderate manufacturing expansion overall.

Weekly Initial Unemployment Claims decline to 410,000

by Calculated Risk on 11/21/2012 08:30:00 AM

The DOL reports:

In the week ending November 17, the advance figure for seasonally adjusted initial claims was 410,000, a decrease of 41,000 from the previous week's revised figure of 451,000. The 4-week moving average was 396,250, an increase of 9,500 from the previous week's revised average of 386,750.The previous week was revised up from 439,000.

[New York] +43,956 Increase in initial claims due to Hurricane Sandy. These separations were primarily in the construction, food service, and transportation industries.

[New Jersey] +31,094 Increase in initial claims due to Hurricane Sandy. These separation were primarily in the accommodation and food services, manufacturing, transportation and warehousing, administrative service, healthcare and social assistance,construction, retail, professional, trade, educational service, and public administration industries.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 396,250.

This sharp increase in the 4 week average is due to Hurricane Sandy as claims increased significantly in the impacted areas. Note the spike in 2005 related to hurricane Katrina - we are seeing a similar impact, although on a smaller scale.

Weekly claims were about at the consensus forecast.

And here is a long term graph of weekly claims:

Mostly moving sideways this year until the recent spike due to Hurricane Sandy. Weekly claims should continue to decline over the next few weeks.

MBA: Purchase Mortgage Applications increase, Refinance Applications decrease

by Calculated Risk on 11/21/2012 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.54 percent from 3.52 percent, with points decreasing to 0.40 from 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index.

The purchase index has been mostly moving sideways over the last two years, however the purchase index has increased 7 of the last 9 weeks and is now near the high for the year - but this index still isn't showing an increase like other housing reports.

Zillow: House Prices increased 4.7% Year-over-year in October

by Calculated Risk on 11/21/2012 12:22:00 AM

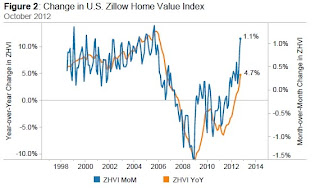

From Zillow: October Marks 12th Consecutive Month of National Home Value Increases

Zillow’s October Real Estate Market Reports, released today, show that national home values rose 1.1% from September to October to $155,400. This is the largest monthly increase since August 2005 when home values rose 1.2% month-over-month. October 2012 marks the 12th consecutive month of home value appreciation, further evidence of a durable housing market recovery. On a year-over-year basis, home values were up by 4.7% in October 2012 – a rate of annual appreciation we haven’t seen since September of 2006 ...

In October, 276 (75%) of the 366 markets showed monthly home value appreciation, and 228 (62%) of the 366 markets saw annual home value appreciation. Among the top 30 metros, 29 experienced monthly home value appreciation and 26 saw annual increases.

Click on graph for larger image.

Click on graph for larger image. The graph from Zillow shows both the year-over-year and month-over-month change for the Zillow HPI.

This is a very strong month-over-month increase, and the largest year-over-year increase since 2006.