by Calculated Risk on 11/21/2012 11:49:00 AM

Wednesday, November 21, 2012

AIA: Architecture Billings Index increases in October, Highest in Two Years

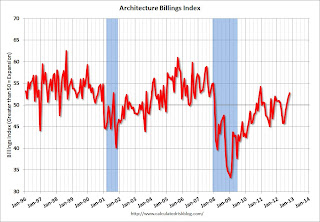

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From AIA: Architecture Billings Index Positive for Third Straight Month

Billings at architecture firms accelerated to their strongest pace of growth since December 2010. As a leading economic indicator of construction activity, the Architecture Billings Index (ABI) reflects the approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the October ABI score was 52.8, up from the mark of 51.6 in September. This score reflects an increase in demand for design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 59.4, compared to a mark of 57.3 the previous month.

“With three straight monthly gains – and the past two being quite strong – it’s beginning to look like demand for design services has turned the corner,” said AIA Chief Economist, Kermit Baker, PhD, Hon. AIA. “With 2012 winding down on an upnote, and with the national elections finally behind us, there is a general sense of optimism. However, this is balanced by a tremendous amount of anxiety and uncertainty in the marketplace, which likely means that we’ll have a few more bumps before we enter a full-blown expansion.”

• Regional averages: South (52.8), Northeast (52.6), West (51.8), Midwest (50.8)

• Sector index breakdown: multi-family residential (59.6), mixed practice (52.4), institutional (51.4), commercial / industrial (48.0)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 52.8 in October, up from 51.6 in September. Anything above 50 indicates expansion in demand for architects' services.

This increase is mostly being driven by demand for design of multi-family residential buildings - and this suggests there are more apartments coming (there are already quite a few apartments under construction). New project inquiries are also increasing. Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests some increase in CRE investment next year (it will be some time before investment in offices and malls increases significantly).

Final November Consumer Sentiment at 82.7, MarkIt Flash PMI shows Improvement in Manufacturing

by Calculated Risk on 11/21/2012 09:58:00 AM

Click on graph for larger image.

The final Reuters / University of Michigan consumer sentiment index for November declined to 82.7 from the preliminary reading of 84.9, and was up from the October reading of 82.6.

This was below the consensus forecast of 84.0. Overall, consumer sentiment has been improving; the recent decline in sentiment might be related to the stock market decline (the consumer sentiment index is impacted by employment, gasoline prices, the stock market and more).

From MarkIt: Manufacturing growth strengthens to five-month high in November

The Markit Flash U.S. Manufacturing Purchasing Managers’ Index™ (PMI™)1 signalled the strongest improvement in U.S. manufacturing business conditions for five months in November. The preliminary ‘flash’ PMI reading, which is based on around 85% of usual monthly replies, rose to 52.4 from 51.0 in October to indicate a moderate manufacturing expansion overall.

Weekly Initial Unemployment Claims decline to 410,000

by Calculated Risk on 11/21/2012 08:30:00 AM

The DOL reports:

In the week ending November 17, the advance figure for seasonally adjusted initial claims was 410,000, a decrease of 41,000 from the previous week's revised figure of 451,000. The 4-week moving average was 396,250, an increase of 9,500 from the previous week's revised average of 386,750.The previous week was revised up from 439,000.

[New York] +43,956 Increase in initial claims due to Hurricane Sandy. These separations were primarily in the construction, food service, and transportation industries.

[New Jersey] +31,094 Increase in initial claims due to Hurricane Sandy. These separation were primarily in the accommodation and food services, manufacturing, transportation and warehousing, administrative service, healthcare and social assistance,construction, retail, professional, trade, educational service, and public administration industries.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 396,250.

This sharp increase in the 4 week average is due to Hurricane Sandy as claims increased significantly in the impacted areas. Note the spike in 2005 related to hurricane Katrina - we are seeing a similar impact, although on a smaller scale.

Weekly claims were about at the consensus forecast.

And here is a long term graph of weekly claims:

Mostly moving sideways this year until the recent spike due to Hurricane Sandy. Weekly claims should continue to decline over the next few weeks.

MBA: Purchase Mortgage Applications increase, Refinance Applications decrease

by Calculated Risk on 11/21/2012 07:01:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

The Refinance Index decreased 3 percent from the previous week. The seasonally adjusted Purchase Index increased 3 percent from one week earlier.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) increased to 3.54 percent from 3.52 percent, with points decreasing to 0.40 from 0.41 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. The effective rate increased from last week.

Click on graph for larger image.

Click on graph for larger image.This graph shows the MBA mortgage purchase index.

The purchase index has been mostly moving sideways over the last two years, however the purchase index has increased 7 of the last 9 weeks and is now near the high for the year - but this index still isn't showing an increase like other housing reports.

Zillow: House Prices increased 4.7% Year-over-year in October

by Calculated Risk on 11/21/2012 12:22:00 AM

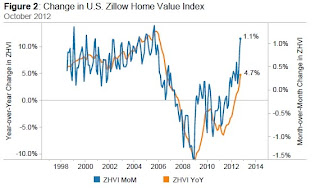

From Zillow: October Marks 12th Consecutive Month of National Home Value Increases

Zillow’s October Real Estate Market Reports, released today, show that national home values rose 1.1% from September to October to $155,400. This is the largest monthly increase since August 2005 when home values rose 1.2% month-over-month. October 2012 marks the 12th consecutive month of home value appreciation, further evidence of a durable housing market recovery. On a year-over-year basis, home values were up by 4.7% in October 2012 – a rate of annual appreciation we haven’t seen since September of 2006 ...

In October, 276 (75%) of the 366 markets showed monthly home value appreciation, and 228 (62%) of the 366 markets saw annual home value appreciation. Among the top 30 metros, 29 experienced monthly home value appreciation and 26 saw annual increases.

Click on graph for larger image.

Click on graph for larger image. The graph from Zillow shows both the year-over-year and month-over-month change for the Zillow HPI.

This is a very strong month-over-month increase, and the largest year-over-year increase since 2006.

Tuesday, November 20, 2012

Wednesday: Unemployment claims, Consumer sentiment

by Calculated Risk on 11/20/2012 09:04:00 PM

There is an EU summit meeting on Thursday, so there might be some news over the holiday.

From Reuters: Euro zone mulls Greek debt buy-back up to 40 billion euros

Euro zone finance ministers are considering allowing Athens to buy back up to 40 billion euros of its own bonds at a discount as one of a number of measures to cut Greek debt to 120 percent of GDP within the next eight years.Wednesday:

...

Under a proposal discussed by ministers, Greece would offer private-sector bondholders around 30 cents for every euro of Greek debt they hold ... The ministers, who failed to reach agreement last week, have also discussed granting Greece a 10-year moratorium on paying interest on about 130 billion euros of loans from the euro zone's emergency fund ...There is also the possibility of reducing the interest rate on loans made by euro zone countries directly to Greece in 2010, from 1.5 percent to just 0.25 percent ...

• At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the mortgage purchase applications index.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 415 thousand from 439 thousand. Note: Claims increased sharply last week due to Hurricane Sandy.

• At 9:00 AM, The Markit US PMI Manufacturing Index Flash will be released. This is a new release and might provide hints about the ISM PMI for November. The consensus is for a decline to 51.0 in November, from 51.5 in October.

• At 9:55 AM, the finale Reuters/University of Michigan's Consumer sentiment index for November will be released). The consensus is for a decline to 84.0 from the preliminary reading of 84.9. Goldman Sachs is forecasting a decline in confidence to 81.0, and Merrill Lynch is forecasting a decline to 83.

• At 10:00 AM, the Conference Board Leading Indicators for October. The consensus is for a 0.2% decrease in this index.

• During the day: The AIA's Architecture Billings Index for October will be released (a leading indicator for commercial real estate).

Earlier on Housing Starts:

• Housing Starts increased to 894 thousand SAAR in October

• Starts and Completions: Multi-family and Single Family

• Quarterly Housing Starts by Intent compared to New Home Sales

• All Housing Investment and Construction Graphs

WaPo: Price-to-rent ratio for Certain Cities

by Calculated Risk on 11/20/2012 05:46:00 PM

Neil Irwin at the WaPo looks at the price-to-rent ratio for several cities using Case-Shiller prices and Owner's equivalent rent (OER) from the BLS. This is the same approach I use with the national data very month.

From Neil Irwin at the WaPo: Why Atlanta, New York, and Chicago are poised to drive a housing recovery

A good way to look at which housing markets are potentially overvalued and which are undervalued—and where the market seems to be begging for new home construction and where there is still a surplus of unneeded houses—is to look at the relationship between rents and home prices. Over long periods of time, the price to rent a given house should rise at about the same rate as the price to buy one.Irwin only looked at Case-Shiller cities with monthly OER data. However the BLS has semi-annual OER data for several more Case-Shiller cities.

But over shorter periods of time, the two can diverge. And when they do, it is usually a sign that something curious is up in that market. For example, from 2000 to 2005, prices in the Miami metro area rose by 136 percentage points more than did rents, a sure sign that it was one of the nation’s most bubbly housing markets.

...

The best news out of this analysis, though, may be this: Most of the largest U.S. cities have housing markets that have been in pretty good balance over the last year, with prices rising at about the same rate as rents. That’s true of the Washington metro area ( where prices are up 4.3 percent, rents up 2.4 percent), and also of San Francisco, Los Angeles, Boston, Dallas, Seattle, and Cleveland.

And that may be the best sign for the housing market of all. After all these years of bubbles and busts, ups and downs, there finally is a measure of stability.

Click on graph for larger image.

Click on graph for larger image.This graph shows the price-to-rent ratio of Case-Shiller and OER for Denver, Portland and San Diego (cities Irwin didn't include).

The BLS only provides first and second half OER data for these cities, so I averaged six months of the Case-Shiller indexes to calculate the price-to-rent ratio. I set the ratio to 1.0 for the period 1997 through 2000.

It appears San Diego is back to normal, and prices in Denver and Portland might be a little high by this measure.

Quarterly Housing Starts by Intent compared to New Home Sales

by Calculated Risk on 11/20/2012 02:58:00 PM

In addition to housing starts for October, the Census Bureau released Housing Starts by Intent for Q3. Note: Most text is a repeat from last quarter with updated graphs.

First, we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released this morning showed there were 104,000 single family starts, built for sale, in Q3 2012, and that was above the 96,000 new homes sold for the same quarter, so inventory increased a little (Using Not Seasonally Adjusted data for both starts and sales).

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Click on graph for larger image.

Click on graph for larger image.Single family starts built for sale were up about 33% compared to Q3 2011. This is still very low, and only back to 2008 levels.

Owner built starts were unchanged from Q3 2011. And condos built for sale are just above the record low.

The 'units built for rent' has increased significantly and is up about 33% year-over-year.

The second graph shows quarterly single family starts, built for sale and new home sales (NSA).

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory that they had built up in 2005 and 2006.

Now it looks like builders are starting a few more homes than they are selling, and the inventory of under construction and completed new home sales increased slightly to 122,000 in Q3 (this is still near record lows).

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations, but it does suggest the builders are keeping inventories under control, and also suggests that the year-over-year increase in housing starts is directly related to an increase in demand and not renewed speculative building.

Bernanke: "The Economic Recovery and Economic Policy"

by Calculated Risk on 11/20/2012 12:15:00 PM

From Fed Chairman Ben Bernanke: The Economic Recovery and Economic Policy. A few excerpts:

A third headwind to the recovery--and one that may intensify in force in coming quarters--is U.S. fiscal policy. Although fiscal policy at the federal level was quite expansionary during the recession and early in the recovery, as the recovery proceeded, the support provided for the economy by federal fiscal actions was increasingly offset by the adverse effects of tight budget conditions for state and local governments. In response to a large and sustained decline in their tax revenues, state and local governments have cut about 600,000 jobs on net since the third quarter of 2008 while reducing real expenditures for infrastructure projects by 20 percent.Bernanke is mostly repeating what he has said before: address the budget deficit, but not too quickly: "the federal budget is on an unsustainable path" and "avoid unnecessarily adding to the headwinds that are already holding back the economic recovery". Hopefully policymakers will resolve the "fiscal slope" and not play politics again with the debt ceiling.

More recently, the situation has to some extent reversed: The drag on economic growth from state and local fiscal policy has diminished as revenues have improved, easing the pressures for further spending cuts or tax increases. In contrast, the phasing-out of earlier stimulus programs and policy actions to reduce the federal budget deficit have led federal fiscal policy to begin restraining GDP growth. Indeed, under almost any plausible scenario, next year the drag from federal fiscal policy on GDP growth will outweigh the positive effects on growth from fiscal expansion at the state and local level. However, the overall effect of federal fiscal policy on the economy, both in the near term and in the longer run, remains quite uncertain and depends on how policymakers meet two daunting fiscal challenges--one by the start of the new year and the other no later than the spring.

What are these looming challenges? First, the Congress and the Administration will need to protect the economy from the full brunt of the severe fiscal tightening at the beginning of next year that is built into current law--the so-called fiscal cliff. ...

As fiscal policymakers face these critical decisions, they should keep two objectives in mind. First, as I think is widely appreciated by now, the federal budget is on an unsustainable path. The budget deficit, which peaked at about 10 percent of GDP in 2009 and now stands at about 7 percent of GDP, is expected to narrow further in the coming years as the economy continues to recover. ...

Even as fiscal policymakers address the urgent issue of longer-run fiscal sustainability, they should not ignore a second key objective: to avoid unnecessarily adding to the headwinds that are already holding back the economic recovery. Fortunately, the two objectives are fully compatible and mutually reinforcing. Preventing a sudden and severe contraction in fiscal policy early next year will support the transition of the economy back to full employment; a stronger economy will in turn reduce the deficit and contribute to achieving long-term fiscal sustainability. At the same time, a credible plan to put the federal budget on a path that will be sustainable in the long run could help keep longer-term interest rates low and boost household and business confidence, thereby supporting economic growth today.

State Unemployment Rates decreased in 37 States in October

by Calculated Risk on 11/20/2012 11:05:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in October. Thirty-seven states and the District of Columbia recorded unemployment rate decreases, seven states posted rate increases, and six states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada continued to record the highest unemployment rate among the states, 11.5 percent in October. Rhode Island and California posted the next highest rates, 10.4 and 10.1 percent, respectively. North Dakota again registered the lowest jobless rate, 3.1 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan and Ohio have seen the most improvement - New Jersey, Connecticut and New York are the laggards.

The states are ranked by the highest current unemployment rate. Only three states still have double digit unemployment rates: Nevada, Rhode Island, and California. In early 2010, 18 states and D.C. had double digit unemployment rates.

I expect the unemployment rate in California to fall below 10% very soon, although New Jersey might hit double digits because of Hurricane Sandy.

Earlier on Housing Starts:

• Housing Starts increased to 894 thousand SAAR in October

• Starts and Completions: Multi-family and Single Family

• All Housing Investment and Construction Graphs