by Calculated Risk on 11/20/2012 02:58:00 PM

Tuesday, November 20, 2012

Quarterly Housing Starts by Intent compared to New Home Sales

In addition to housing starts for October, the Census Bureau released Housing Starts by Intent for Q3. Note: Most text is a repeat from last quarter with updated graphs.

First, we can't directly compare single family housing starts to new home sales. For starts of single family structures, the Census Bureau includes owner built units and units built for rent that are not included in the new home sales report. For an explanation, see from the Census Bureau: Comparing New Home Sales and New Residential Construction

We are often asked why the numbers of new single-family housing units started and completed each month are larger than the number of new homes sold. This is because all new single-family houses are measured as part of the New Residential Construction series (starts and completions), but only those that are built for sale are included in the New Residential Sales series.However it is possible to compare "Single Family Starts, Built for Sale" to New Home sales on a quarterly basis.

The quarterly report released this morning showed there were 104,000 single family starts, built for sale, in Q3 2012, and that was above the 96,000 new homes sold for the same quarter, so inventory increased a little (Using Not Seasonally Adjusted data for both starts and sales).

This graph shows the NSA quarterly intent for four start categories since 1975: single family built for sale, owner built (includes contractor built for owner), starts built for rent, and condos built for sale.

Click on graph for larger image.

Click on graph for larger image.Single family starts built for sale were up about 33% compared to Q3 2011. This is still very low, and only back to 2008 levels.

Owner built starts were unchanged from Q3 2011. And condos built for sale are just above the record low.

The 'units built for rent' has increased significantly and is up about 33% year-over-year.

The second graph shows quarterly single family starts, built for sale and new home sales (NSA).

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.

In 2005, and most of 2006, starts were higher than sales, and inventories of new homes increased. The difference on this graph is pretty small, but the builders were starting about 30,000 more homes per quarter than they were selling (speculative building), and the inventory of new homes soared to record levels. Inventory of under construction and completed new home sales peaked at 477,000 in Q3 2006.In 2008 and 2009, the home builders started far fewer homes than they sold as they worked off the excess inventory that they had built up in 2005 and 2006.

Now it looks like builders are starting a few more homes than they are selling, and the inventory of under construction and completed new home sales increased slightly to 122,000 in Q3 (this is still near record lows).

Note: new home sales are reported when contracts are signed, so it is appropriate to compare sales to starts (as opposed to completions). This is not perfect because of the handling of cancellations, but it does suggest the builders are keeping inventories under control, and also suggests that the year-over-year increase in housing starts is directly related to an increase in demand and not renewed speculative building.

Bernanke: "The Economic Recovery and Economic Policy"

by Calculated Risk on 11/20/2012 12:15:00 PM

From Fed Chairman Ben Bernanke: The Economic Recovery and Economic Policy. A few excerpts:

A third headwind to the recovery--and one that may intensify in force in coming quarters--is U.S. fiscal policy. Although fiscal policy at the federal level was quite expansionary during the recession and early in the recovery, as the recovery proceeded, the support provided for the economy by federal fiscal actions was increasingly offset by the adverse effects of tight budget conditions for state and local governments. In response to a large and sustained decline in their tax revenues, state and local governments have cut about 600,000 jobs on net since the third quarter of 2008 while reducing real expenditures for infrastructure projects by 20 percent.Bernanke is mostly repeating what he has said before: address the budget deficit, but not too quickly: "the federal budget is on an unsustainable path" and "avoid unnecessarily adding to the headwinds that are already holding back the economic recovery". Hopefully policymakers will resolve the "fiscal slope" and not play politics again with the debt ceiling.

More recently, the situation has to some extent reversed: The drag on economic growth from state and local fiscal policy has diminished as revenues have improved, easing the pressures for further spending cuts or tax increases. In contrast, the phasing-out of earlier stimulus programs and policy actions to reduce the federal budget deficit have led federal fiscal policy to begin restraining GDP growth. Indeed, under almost any plausible scenario, next year the drag from federal fiscal policy on GDP growth will outweigh the positive effects on growth from fiscal expansion at the state and local level. However, the overall effect of federal fiscal policy on the economy, both in the near term and in the longer run, remains quite uncertain and depends on how policymakers meet two daunting fiscal challenges--one by the start of the new year and the other no later than the spring.

What are these looming challenges? First, the Congress and the Administration will need to protect the economy from the full brunt of the severe fiscal tightening at the beginning of next year that is built into current law--the so-called fiscal cliff. ...

As fiscal policymakers face these critical decisions, they should keep two objectives in mind. First, as I think is widely appreciated by now, the federal budget is on an unsustainable path. The budget deficit, which peaked at about 10 percent of GDP in 2009 and now stands at about 7 percent of GDP, is expected to narrow further in the coming years as the economy continues to recover. ...

Even as fiscal policymakers address the urgent issue of longer-run fiscal sustainability, they should not ignore a second key objective: to avoid unnecessarily adding to the headwinds that are already holding back the economic recovery. Fortunately, the two objectives are fully compatible and mutually reinforcing. Preventing a sudden and severe contraction in fiscal policy early next year will support the transition of the economy back to full employment; a stronger economy will in turn reduce the deficit and contribute to achieving long-term fiscal sustainability. At the same time, a credible plan to put the federal budget on a path that will be sustainable in the long run could help keep longer-term interest rates low and boost household and business confidence, thereby supporting economic growth today.

State Unemployment Rates decreased in 37 States in October

by Calculated Risk on 11/20/2012 11:05:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in October. Thirty-seven states and the District of Columbia recorded unemployment rate decreases, seven states posted rate increases, and six states had no change, the U.S. Bureau of Labor Statistics reported today.

...

Nevada continued to record the highest unemployment rate among the states, 11.5 percent in October. Rhode Island and California posted the next highest rates, 10.4 and 10.1 percent, respectively. North Dakota again registered the lowest jobless rate, 3.1 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). All states are below the maximum unemployment rate for the recession.

The size of the blue bar indicates the amount of improvement - Michigan and Ohio have seen the most improvement - New Jersey, Connecticut and New York are the laggards.

The states are ranked by the highest current unemployment rate. Only three states still have double digit unemployment rates: Nevada, Rhode Island, and California. In early 2010, 18 states and D.C. had double digit unemployment rates.

I expect the unemployment rate in California to fall below 10% very soon, although New Jersey might hit double digits because of Hurricane Sandy.

Earlier on Housing Starts:

• Housing Starts increased to 894 thousand SAAR in October

• Starts and Completions: Multi-family and Single Family

• All Housing Investment and Construction Graphs

Starts and Completions: Multi-family and Single Family

by Calculated Risk on 11/20/2012 09:56:00 AM

Ten months of the way through 2012, single family starts are on pace for about 530 thousand this year, and total starts are on pace for about 770 thousand. That is an increase of over 20% from 2011.

The following table shows annual starts (total and single family) since 2005 and an estimate for 2012.

| Housing Starts (000s) | ||||

|---|---|---|---|---|

| Total | Change | Single Family | Change | |

| 2005 | 2,068.3 | --- | 1,715.8 | --- |

| 2006 | 1,800.9 | -12.9% | 1,465.4 | -14.6% |

| 2007 | 1,355.0 | -24.8% | 1,046.0 | -28.6% |

| 2008 | 905.5 | -33.2% | 622.0 | -40.5% |

| 2009 | 554.0 | -38.8% | 445.1 | -28.4% |

| 2010 | 586.9 | 5.9% | 471.2 | 5.9% |

| 2011 | 608.8 | 3.7% | 430.6 | -8.6% |

| 20121 | 770.0 | 26% | 530.0 | 23% |

| 12012 estimated | ||||

And the growth in housing starts should continue over the next few years. Even with the significant increase this year, starts in 2012 will still be the 4th lowest year since the Census Bureau started tracking starts in 1959 (the three lowest years were 2009 through 2011).

My estimate is the US will probably add around 12 million households this decade, and if there was no excess supply, total housing starts would be 1.2 million per year, plus demolitions, plus 2nd home purchases. So housing starts could come close to doubling the 2012 level over the next several years - and that is one of the key reasons I think the US economy will continue to grow.

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) is lagging behind - but completions will follow starts up (completions lag starts by about 12 months).

This means there will be an increase in multi-family deliveries next year, but still well below the 1997 through 2007 level of multi-family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.Starts are moving up, but the increase in completions has just started. Usually single family starts bounce back quickly after a recession, but not this time because of the large overhang of existing housing units. The "wide bottom" was what I was forecasting several years ago, and now I expect several years of increasing single family starts and completions.

Housing Starts increased to 894 thousand SAAR in October

by Calculated Risk on 11/20/2012 08:30:00 AM

From the Census Bureau: Permits, Starts and Completions

Housing Starts:

Privately-owned housing starts in October were at a seasonally adjusted annual rate of 894,000. This is 3.6 percent above the revised September estimate of 863,000 and is 41.9 percent above the October 2011 rate of 630,000.

Single-family housing starts in October were at a rate of 594,000; this is 0.2 percent below the revised September figure of 595,000. The October rate for units in buildings with five units or more was 285,000.

Building Permits:

Privately-owned housing units authorized by building permits in October were at a seasonally adjusted annual rate of 866,000. This is 2.7 percent below the revised September rate of 890,000, but is 29.8 percent above the October 2011 estimate of 667,000.

Single-family authorizations in October were at a rate of 562,000; this is 2.2 percent above the revised September figure of 550,000. Authorizations of units in buildings with five units or more were at a rate of 280,000 in October.

Click on graph for larger image.

Click on graph for larger image.The first graph shows single and multi-family housing starts for the last several years.

Total housing starts were at 894 thousand (SAAR) in October, up 3.6% from the revised September rate of 863 thousand (SAAR). Note that September was revised down from 872 thousand.

Single-family starts decreased slightly to 594 thousand in October.

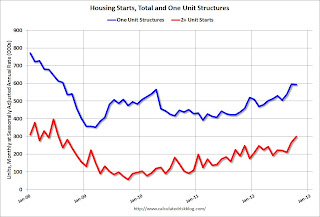

The second graph shows total and single unit starts since 1968.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years.

This shows the huge collapse following the housing bubble, and that total housing starts have been increasing lately after moving sideways for about two years and a half years. Total starts are up about 87% from the bottom start rate, and single family starts are up about 70% from the low.

This was above expectations of 840 thousand starts in October. This was mostly because of the volatile multi-family sector that increased sharply in October. However single family starts have increased recently too. Right now starts are on pace to be up about 25% from 2011. I'll have more soon ...