by Calculated Risk on 10/30/2012 11:41:00 AM

Tuesday, October 30, 2012

House Price Comments, Real House Prices, Price-to-Rent Ratio

Case-Shiller reported the third consecutive year-over-year (YoY) gain in their house price indexes since 2010 - and the increase back in 2010 was related to the housing tax credit. Excluding the tax credit, the previous YoY increase was back in 2006. The YoY increase in August suggests that house prices probably bottomed earlier this year (the YoY change lags the turning point for prices).

The following table shows the year-over-year increase since the beginning of the year.

| Case-Shiller Composite 20 Index | |

|---|---|

| Month | YoY Change |

| Jan-12 | -3.9% |

| Feb-12 | -3.5% |

| Mar-12 | -2.5% |

| Apr-12 | -1.7% |

| May-12 | -0.5% |

| Jun-12 | 0.6% |

| Jul-12 | 1.1% |

| Aug-12 | 2.0% |

| Sep-12 | |

| Oct-12 | |

| Nov-12 | |

| Dec-12 | |

| Jan-13 | |

On a not seasonally adjusted basis (NSA), house prices will probably start to decline month-to-month in October. But I think prices will remain above the post-bubble lows set earlier this year.

Here is another update to a few graphs: Case-Shiller, CoreLogic and others report nominal house prices, and it is also useful to look at house prices in real terms (adjusted for inflation) and as a price-to-rent ratio. Real prices, and the price-to-rent ratio, are back to late 1999 to 2000 levels depending on the index.

Nominal House Prices

Click on graph for larger image.

Click on graph for larger image.The first graph shows the quarterly Case-Shiller National Index SA (through Q2 2012), and the monthly Case-Shiller Composite 20 SA and CoreLogic House Price Indexes (through August) in nominal terms as reported.

In nominal terms, the Case-Shiller National index (SA) is back to Q1 2003 levels (and also back up to Q4 2010), and the Case-Shiller Composite 20 Index (SA) is back to August 2003 levels, and the CoreLogic index (NSA) is back to December 2003.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.In real terms, the National index is back to mid-1999 levels, the Composite 20 index is back to June 2000, and the CoreLogic index back to February 2001.

In real terms, most of the appreciation early in the last decade is gone.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.

Here is a similar graph using the Case-Shiller National, Composite 20 and CoreLogic House Price Indexes.This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to Q3 1999 levels, the Composite 20 index is back to June 2000 levels, and the CoreLogic index is back to February 2001.

In real terms - and as a price-to-rent ratio - prices are mostly back to 1999 or early 2000 levels.

Case-Shiller: House Prices increased 2.0% year-over-year in August

by Calculated Risk on 10/30/2012 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for July (a 3 month average of June, July and August).

This release includes prices for 20 individual cities, and two composite indices (for 10 cities and 20 cities).

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: Home Prices Continued to Rise in August 2012 According to the S&P/Case-Shiller Home Price Indices

Data through August 2012, released today by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices, the leading measure of U.S. home prices, showed average home prices increased by 0.9% for both the 10- and 20-City Composites in August versus July 2012. Nineteen of the 20 cities and both Composites posted positive monthly gains in August; Seattle was the only exception where prices declined 0.1% over the month.

The 10- and 20-City Composites recorded annual returns of +1.3% and +2.0% in August 2012 – an improvement over the +0.6% and +1.2% respective annual rates posted for July 2012. Eighteen of the 20 cities and both Composites posted better annual returns in August compared to July 2012. Annual returns for Dallas remained unchanged at +3.6% and Chicago saw its annual return worsen from -1.0% in July to 1.6% in August 2012.

...

“Home prices continued climbing across the country in August,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices. “Nineteen of the 20 cities and both Composites showed monthly gains in August. Seventeen cities and both Composites posted positive annual returns in August 2012. In 18 cities and both Composites annual rates improved in August versus July. Dallas’ rate remained unchanged at +3.6% and Chicago worsened slightly from a -1.0% annual rate in July to a -1.6% annual rate in August.

“Phoenix continues to lead the home price recovery. It recorded its fourth consecutive month of double-digit positive annual returns with a +18.8% rate for August. Atlanta posted a -6.1% annual rate, however this is significantly better than the nine consecutive months of double-digit declines it posted from October 2011 through June 2012. Las Vegas’ annual rate finally moved to positive territory with a +0.9% annual rate of change in August 2012, its first since January 2007.

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.5% from the peak, and up 0.4% in August (SA). The Composite 10 is up 4.0% from the post bubble low set in March (SA).

The Composite 20 index is off 30.92% from the peak, and up 0.5% (SA) in August. The Composite 20 is up 4.4% from the post-bubble low set in March (SA).

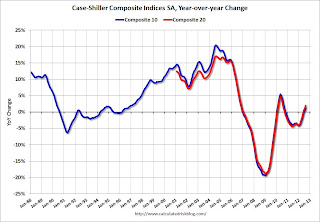

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is up 1.3% compared to August 2011.

The Composite 20 SA is up 2.0% compared to August 2011. This was the third consecutive month with a year-over-year gain since 2010 (when the tax credit boosted prices temporarily).

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 19 of the 20 Case-Shiller cities in August seasonally adjusted (also 19 of 20 cities increased NSA). Prices in Las Vegas are off 59.5% from the peak, and prices in Dallas only off 5.8% from the peak. Note that the red column (cumulative decline through August 2012) is above previous declines for all cities.

Prices increased (SA) in 19 of the 20 Case-Shiller cities in August seasonally adjusted (also 19 of 20 cities increased NSA). Prices in Las Vegas are off 59.5% from the peak, and prices in Dallas only off 5.8% from the peak. Note that the red column (cumulative decline through August 2012) is above previous declines for all cities.This was about at the consensus forecast and the recent change to a year-over-year increase is a significant story. I'll have more on prices later.

Monday, October 29, 2012

Tuesday: Case-Shiller House Prices

by Calculated Risk on 10/29/2012 07:10:00 PM

NOTE: US Markets will remain closed on Tuesday due to severe weather in the New York area. Stay safe!

Here is the preliminary tide level data for The Battery, NY (raw data not checked yet) . Apparently the record level is 11.2 feet. This gauge is currently showing 11.07 feet, and high tide is in about 2 hours. Ouch.

Tuesday:

• At 9:00 AM ET, S&P/Case-Shiller House Price Index for August is expected to be released. Although this is the August report, it is really a 3 month average of June, July and August. The consensus is for a 1.9% year-over-year increase in the Composite 20 prices (NSA) for August.

• At 10:00 AM, the Conference Board's consumer confidence index for October is expected to be released. The consensus is for an increase to 74.0 from 70.3 last month.

• Also at 10:00, Q3 Housing Vacancies and Homeownership report from the Census Bureau. This report is frequently mentioned by analysts and the media to track the homeownership rate, and the homeowner and rental vacancy rates. However, based on the initial evaluation, it appears the vacancy rates are too high. The Census Bureau is looking into the differences between the HVS, the ACS, and the decennial Census, and until the issues are resolved, this survey probably shouldn't be used to estimate the excess vacant housing supply.

Another question for the October economic prediction contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Wells Fargo raises Housing Forecasts for 2013 and 2014

by Calculated Risk on 10/29/2012 04:26:00 PM

Near the end of the year, I collect housing forecasts from a number of analysts. From Mark Vitner and Anika Khan at Wells Fargo:

We have raised our forecast for new home sales and housing starts in 2013 and 2014 due to recent reports from homebuilders, strong gains in building permits and starts, record low new home inventories, and the Fed’s stated intentions to purchase large quantities of mortgage-backed securities on an ongoing basis. ...Wells Fargo is now forecasting total starts of 990 thousand in 2013, and 1.17 million in 2014 (from around 770 thousand in 2012).

[G]iven the strong gain in permits, which are running slightly ahead of starts, the gain in the Wells Fargo/NAHB Homebuilders’ Index and robust orders data from several large homebuilders, we raised our expectations for 2013 and 2014 to 990,000 and 1.17 million homes, respectively.

They are forecasting single family starts of 680 thousand in 2013, and 820 thousand in 2014 (around 530 thousand this year).

Their forecast for new home sales is 465 thousand in 2013, and 530 thousand in 2014 (from 370 thousand this year).

That is an increase of around 25%+ next year, and an additional 15% to 20% in 2014.

For 2012, Wells Fargo forecast 350 thousand new home sales, 457 single family starts, and 690 total starts. All too low.

Update: Employment Report expected on Friday

by Calculated Risk on 10/29/2012 02:51:00 PM

From the WSJ: UPDATE: Labor Department ‘Working Hard’ to Ensure Jobs Report Released on Time

The U.S. Labor Department on Monday said it is “working hard to ensure the timely release” of the October jobs report, saying it intends to released the report on schedule Friday despite Hurricane Sandy.From the NY Times: Still at Sea, Storm Drenches East Coast

“It is our intention that Friday will be business as usual,” said Carl Fillichio, a senior press advisor at Labor. Mr. Fillichio’s statement provided clarity to an earlier Labor statement that said the agency would assess how to handle data releases this week after the “weather emergency” is over.

Hurricane Sandy churned relentlessly through the Atlantic Ocean on Monday on the way to carving what forecasters agreed would be a devastating path on land that is expected to paralyze life for millions of people in more than a half-dozen states, with extensive evacuations, once-in-a-generation flooding, widespread power failures and mass transit disruptions.Oh my. Please stay safe.

The huge storm, which picked up speed over the water on Monday morning, was producing sustained winds of 90 miles per hour by 11 a.m., up from 75 m.p.h. on Sunday night. The center of Hurricane Sandy made its expected turn toward the New Jersey coast early on Monday. ...

According to forecasters, the storm is on a scale that weather historians say has little precedent along the East Coast. Landfall is predicted on Monday night somewhere between central New Jersey and southern Delaware. But most of the eastern United States will feel Hurricane Sandy’s effects, making the exact landfall spot less important than the overall trajectory.

emphasis added

No Decision yet on delaying October Jobs Report

by Calculated Risk on 10/29/2012 12:20:00 PM

From the WSJ: Labor Department May Delay Jobs Report

The U.S. Labor Department on Monday said it hasn’t made a decision yet on whether to delay Friday’s October jobs report ... The U.S. Census Bureau also said it hasn’t made a decision on whether to delay economic reports it plans to release this week, including construction spending on Thursday and factory orders on Friday.This is minor compared to other storm related issues, but I'll check up on this. They will probably know any schedule changes by Wednesday. Stay safe.

Update: For anyone interested, the WSJ online is free today.

Dallas Fed: Regional Manufacturing Activity expands slowly in October

by Calculated Risk on 10/29/2012 10:30:00 AM

From the Dallas Fed: Texas Manufacturing Activity Expands but at a Slower Pace

Texas factory activity increased in October, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, dipped from 10 to 7.9, indicating slightly slower growth.This was at expectations of a reading of 2 for the general business activity index. Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Most other measures of current manufacturing activity also suggested growth in October, although new orders declined. The capacity utilization index edged up from 9.3 to 11.4, with more than one-quarter of manufacturers noting an increase. The shipments index held steady at 4.7, suggesting shipments rose at about the same pace as in September. The new orders index fell from 5.3 to –4.5, reaching its lowest level this year and indicating a decrease in demand.

Perceptions of general business conditions improved slightly in October. The general business activity index rose to 1.8, registering its first positive reading since June. The company outlook index was positive for the sixth month in a row and remained unchanged at 2.4.

Labor market indicators reflected slow but steady labor demand growth and shrinking workweeks. The employment index was 5.2 in October, largely unchanged from last month but well below the higher levels seen earlier in the year. About 15 percent of firms reported hiring new workers, while 10 percent reported layoffs. The hours worked index fell back into negative territory with a reading of –5.9, down from 2.8 in September.

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (dashed green, through October), and five Fed surveys are averaged (blue, through October) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through September (right axis).

The ISM index for October will be released Thursday, Nov 1st, and these surveys suggest another weak reading close to 50.

Personal Income increased 0.4% in September, Spending increased 0.8%

by Calculated Risk on 10/29/2012 08:30:00 AM

The BEA released the Personal Income and Outlays report for September:

Personal income increased $48.1 billion, or 0.4 percent ... in September, according to the Bureau of Economic Analysis. Personal consumption expenditures (PCE) increased $87.9 billion, or 0.8 percent.The following graph shows real Personal Consumption Expenditures (PCE) through September (2005 dollars). Note that the y-axis doesn't start at zero to better show the change.

...

Real PCE -- PCE adjusted to remove price changes -- increased 0.4 percent in September, compared with an increase of 0.1 percent in August. ... The price index for PCE increased 0.4 percent in September, the same increase as in August. The PCE price index, excluding food and energy, increased 0.1 percent in September, the same increase as in August.

...

Personal saving -- DPI less personal outlays -- was $395.0 billion in September, compared with $445.1 billion in August. The personal saving rate -- personal saving as a percentage of disposable personal income -- was 3.3 percent in September, compared with 3.7 percent in August.

Click on graph for larger image.

Click on graph for larger image.This graph shows real PCE by month for the last few years. The dashed red lines are the quarterly levels for real PCE. The September pickup in PCE is clear.

A key point is the PCE price index has only increased 1.7% over the last year, and core PCE is up only 1.7%. In August, core PCE increased at a 1.4% annualized rate.

Sunday, October 28, 2012

Monday: Personal Income and Spending, Senior Loan Officer Survey

by Calculated Risk on 10/28/2012 09:50:00 PM

UPDATE: US Markets closed on Monday. From NBC abd Reuters: NYSE and Nasdaq to close on Monday due to Hurricane Sandy

U.S. stock trading will be closed on Monday and possibly Tuesday in response to Hurricane Sandy, NYSE Euronext said late on Sunday.To all in the path of Sandy: Stay safe and dry!

NYSE Euronext, which runs the New York Stock Exchange, had previously said that electronic trading would remain open and that only the exchange's trading floor would close.

In a statement, the company said that "the dangerous conditions developing as a result of Hurricane Sandy will make it extremely difficult to ensure the safety of our people and communities, and safety must be our first priority."

Nasdaq said it would also close all U.S. equity and derivatives exchanges, as well as the Nasdaq/FINRA TRF on Monday, CNBC reported late Sunday night. It is likley the markets will also be closed on Tuesday, according to the statement from the exchange.

Monday:

• At 8:30 AM ET, the Personal Income and Outlays report for September is expected to be released. The consensus is for a 0.4% increase in personal income in September, and for 0.6% increase in personal spending. And for the Core PCE price index to increase 1.7% year-over-year.

• At 10:30 AM, the Dallas Fed Manufacturing Survey for October. The consensus is for a reading of 2, up from -0.9 last month. This is the last of the regional survey for October.

• At 2:00 PM, The Federal Reserve is expect to release the October 2012 Senior Loan Officer Opinion Survey on Bank Lending Practices.

• Expected: the National Multi Housing Council (NMHC) Quarterly Apartment Survey. This is a key survey for apartment vacancy rates and rents.

The Asian markets are mixed tonight, with the Nikkei up 0.3%.

From CNBC: Pre-Market Data and Bloomberg futures: the S&P futures are down 2 and DOW futures are down 10.

Oil prices are down recently with WTI futures at $86.28 per barrel and Brent down to $110.12 per barrel.

Weekend:

• Summary for Week Ending Oct 26th

• Schedule for Week of Oct 28th

Three more questions this week for the October economic prediction contest and four question for the November contest (Note: You can now use Facebook, Twitter, or OpenID to log in).

Sandy: D.C. Government Offices closed to Public, NYSE Trading Floor Closed

by Calculated Risk on 10/28/2012 06:15:00 PM

Stay safe! Here is the National Hurricane Center website.

From the U.S. Office of Personnel Management: Monday, October 29, 2012, FEDERAL OFFICES in the Washington, DC, area are CLOSED TO THE PUBLIC.

From the NY Times: N.Y.S.E. Plans to Close Its Trading Floor

The New York Stock Exchange plans to close its trading floor on Monday as Hurricane Sandy approaches, in its first weather-related closure in 27 years. Trading operations will be conducted through its electronic market instead.I think the economic releases scheduled for Monday will still be released (Personal Income and Spending, Senior Loan Officer Survey), but there could be delays.

...

Clients should not notice any differences in the way their orders are executed, Duncan L. Niederauer, the chief executive of NYSE Euronext, said by telephone on Sunday.

Yesterday:

• Summary for Week Ending Oct 26th

• Schedule for Week of Oct 28th