by Calculated Risk on 9/06/2012 12:42:00 PM

Thursday, September 06, 2012

Employment Situation Preview

In July, the BLS reported there were 163,000 payroll jobs added. This followed three weak months: 68,000 payroll jobs were added in April, 87,000 in May, and 64,000 in June. Some of the spring weakness might have been "payback" for the mild weather earlier in the year, so it might help to look at the average per month. So far this year, the economy has added 151,000 payroll jobs per month (161,000 private sector per month).

Also, there is a strong possibility that the seasonal factors are a little distorted by the deep recession and financial crisis - this is the third year in a row we've some late spring weakness. In 2010, payrolls picked up in October following a weak period (looking at the data ex-Census), in 2011, payrolls picked up in September. If there is a seasonal distortion, the next four months will probably see some increase too.

Bloomberg is showing the consensus is for an increase of 125,000 payroll jobs in August, and for the unemployment rate to remain unchanged at 8.3%.

Here is a summary of recent data:

• The ADP employment report showed an increase of 201,000 private sector payroll jobs in August. This is the strongest ADP report since March, and this would seem to suggest that the consensus for the increase in total payroll employment is too low. However the ADP report hasn't been very useful in predicting the BLS report for any one month.

• The ISM manufacturing employment index decreased in August to 51.6%, down from 52.0% in July. A historical correlation between the ISM manufacturing employment index and the BLS employment report for manufacturing, suggests that private sector BLS reported payroll jobs for manufacturing decreased about 12,000 in August.

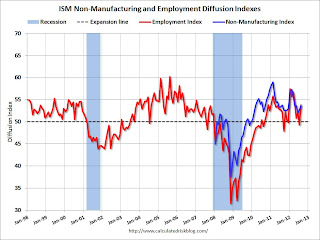

The ISM non-manufacturing (service) employment index increased in August to 53.8%, up from 49.3% in July. A historical correlation between the ISM non-manufacturing employment index and the BLS employment report for services, suggests that private sector BLS reported payroll jobs for services increased about 160,000 in August.

Added together, the ISM reports suggests about 148,000 jobs added in August.

• Initial weekly unemployment claims averaged about 371,000 in August, up from the 366,000 average for July - but below the 382,000 average for April, May and June. This was about the same level as in the January, February and March period when the BLS reported an average of 226,000 payroll jobs added per month.

For the BLS reference week (includes the 12th of the month), initial claims were at 374,000; down from 388,000 during the reference week in July.

• The final July Reuters / University of Michigan consumer sentiment index increased to 74.3, up from the July reading of 72.3. This is frequently coincident with changes in the labor market, but also strongly related to gasoline prices and other factors. This level still suggests a weak labor market.

• The small business index from Intuit showed 30,000 payroll jobs added, down from 45,000 in July.

• And on the unemployment rate from Gallup: U.S. Unadjusted Unemployment Rate at 8.1% in August

U.S. unemployment, as measured by Gallup without seasonal adjustment, is 8.1% for the month of August, down slightly from 8.3% measured in mid-August and 8.2% for the month of July. Gallup's seasonally adjusted unemployment rate for August is also 8.1%, a slight uptick from 8.0% at the end of July.Note: Gallup only recently has been providing a seasonally adjusted estimate for the unemployment rate, so use with caution (Gallup provides some caveats). Note: So far the Gallup numbers haven't been useful in predicting the BLS unemployment rate.

• Conclusion: The overall feeling is that economic activity picked up a little in August, and that would seem to suggest a stronger than consensus employment report. Also it is possible that there have been some seasonal factor distortions.

The ISM manufacturing reports suggest a gain of around 148,000 payroll jobs, and the ADP report (private only), also suggests the consensus is too low. Initial weekly unemployment claims were near the low for the year during August.

A negative is the weak small business numbers from Intuit.

Overall it seems like the August report will be somewhat stronger than expected.

ISM Non-Manufacturing Index increases in August

by Calculated Risk on 9/06/2012 10:00:00 AM

The August ISM Non-manufacturing index was at 53.7%, up from 52.6% in July. The employment index increased in August to 53.8%, up from 49.3% in July. Note: Above 50 indicates expansion, below 50 contraction.

From the Institute for Supply Management: August 2012 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in August for the 32nd consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee. "The NMI™ registered 53.7 percent in August, 1.1 percentage points higher than the 52.6 percent registered in July. This indicates continued growth this month at a slighter faster rate in the non-manufacturing sector. The Non-Manufacturing Business Activity Index registered 55.6 percent, which is 1.6 percentage points lower than the 57.2 percent reported in July, reflecting growth for the 37th consecutive month. The New Orders Index decreased by 0.6 percentage point to 53.7 percent. The Employment Index increased by 4.5 percentage points to 53.8 percent, indicating growth in employment after one month of contraction. The Prices Index increased 9.4 percentage points to 64.3 percent, indicating substantially higher month-over-month prices when compared to July. According to the NMI™, 10 non-manufacturing industries reported growth in August. Respondents' comments continue to be mixed, and for the most part reflect uncertainty about business conditions and the economy."

Click on graph for larger image.

Click on graph for larger image.This graph shows the ISM non-manufacturing index (started in January 2008) and the ISM non-manufacturing employment diffusion index.

This was above the consensus forecast of 53.0% and indicates faster expansion in August than in July. The internals were mixed with the employment index up sharply, but new order down slightly.

Weekly Initial Unemployment Claims decline to 365,000

by Calculated Risk on 9/06/2012 08:30:00 AM

The DOL reports:

In the week ending September 1, the advance figure for seasonally adjusted initial claims was 365,000, a decrease of 12,000 from the previous week's revised figure of 377,000. The 4-week moving average was 371,250, an increase of 250 from the previous week's revised average of 371,000.The previous week was revised up from 374,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased to 371,250.

This was below the consensus forecast of 370,000.

And here is a long term graph of weekly claims:

ADP: Private Employment increased 201,000 in August

by Calculated Risk on 9/06/2012 08:15:00 AM

ADP reports:

Employment in the U.S. nonfarm private business sector increased by 201,000 from July to August, on a seasonally adjusted basis. The estimated gain from June to July was revised up from the initial estimate of 163,000 to 173,000.This was above the consensus forecast of an increase of 149,000 private sector jobs in August. The BLS reports on Friday, and the consensus is for an increase of 125,000 payroll jobs in August, on a seasonally adjusted (SA) basis.

Employment in the private, service-providing sector expanded 185,000 in August, up from 156,000 in July. Employment in the private, goods-producing sector added 16,000 jobs in August. Manufacturing employment rose 3,000, following an increase of 6,000 in July.

ADP hasn't been very useful in predicting the BLS report, but this suggests a stronger than consensus report.

Wednesday, September 05, 2012

Thursday: Draghi, Unemployment Claims, ADP, ISM Services

by Calculated Risk on 9/05/2012 07:18:00 PM

Usually during the first week of the month, all of the discussion would be about the employment report. This month focus is on the ECB ...

ECB Governing Council meeting times:

• 7:45 AM ET (1.45 PM CET) Monetary Policy Decision. The expectation is rates will be cut 25 bps.

• 8:30 AM ET (2.30 PM CET) ECB President Mario Draghi Press conference. The expectation is Draghi will announce some sort of short term bond buying program.

Note: I'll post the US data in the morning. For updates on the ECB, I recommend Alphaville. Here is the ECB website and press conference page.

From Cardiff Garcia at Alphaville: More questions pre-Draghi

There are some obvious questions going into Draghi’s meeting on Thursday after a few of the early details were reported today — What will be the terms of conditionality? Where on the curve will the buying be concentrated? — and we’ve got a few more.From the WSJ: ECB Said to Ready Measures as Euro Zone Slide Deepens

The euro zone's economic downturn accelerated during the summer, economic reports Wednesday suggest, raising concerns that even aggressive anticrisis measures from the European Central Bank won't be enough to keep the euro bloc from sliding into a deep recession.On Thursday:

...

The reports raise a vexing problem for ECB policy makers. Even if they announce detailed plans to buy government bonds as a means to lower borrowing costs for crisis-hit countries, the measures' effectiveness may be limited by high unemployment, weak consumer confidence and stagnant growth prospects.

"In the next three to six months, there is nothing the ECB can do to prevent a further slowdown from materializing," said Carsten Brzeski, economist at ING Bank.

• At 8:15 AM ET, the ADP Employment Report for August will be released. This report is for private payrolls only (no government). The consensus is for 149,000 payroll jobs added in August, down from the 163,000 reported last month.

• At 8:30 AM, the initial weekly unemployment claims report will be released. The consensus is for claims to decrease to 370 thousand from 374 thousand.

• At 10:00 AM, the ISM non-Manufacturing Index (Services) for August will be released. The consensus is for an increase to 53.0 from 52.6 in July.

Another question for the September economic contest: