by Calculated Risk on 7/19/2012 08:37:00 AM

Thursday, July 19, 2012

Weekly Initial Unemployment Claims increase to 386,000

The DOL reports:

In the week ending July 14, the advance figure for seasonally adjusted initial claims was 386,000, an increase of 34,000 from the previous week's revised figure of 352,000. The 4-week moving average was 375,500, a decrease of 1,500 from the previous week's revised average of 377,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined to 375,500.

The sharp decline last week due to onetime factors, and some increase was expected.

And here is a long term graph of weekly claims:

This was well above the consensus forecast of 365,000 and suggests ongoing weakness in the labor market.

This was well above the consensus forecast of 365,000 and suggests ongoing weakness in the labor market.Wednesday, July 18, 2012

Thursday: Existing Home Sales, Philly Fed, Unemployment Claims

by Calculated Risk on 7/18/2012 09:31:00 PM

Existing home sales for June is the key release on Thursday. Most of the focus will be on sales, but the key numbers are inventory and months-of-supply.

• At 8:30 AM ET, the initial weekly unemployment claims report will be released. The consensus is for claims to increase to 365 thousand.

• At 10:00 AM, Existing Home Sales for June from the National Association of Realtors (NAR). The consensus is for sales of 4.65 million on seasonally adjusted annual rate (SAAR) basis, up from 4.55 million in May.

• Also at 10:00 AM, Philly Fed Survey for July will be released. This survey really surprised to the downside in June, and the consensus is for a reading of -8.0, up from -16.6 last month (below zero indicates contraction).

• Also at 10:00 AM, the Conference Board Leading Indicators for June will be released. The consensus is for a 0.1% decrease in this index.

Earlier:

• Housing Starts increased to 760 thousand in June, Highest since October 2008

• Starts and Completions: Multi-family and Single Family

• August 1st QE3 Departure Date?

Starts and Completions: Multi-family and Single Family

by Calculated Risk on 7/18/2012 05:12:00 PM

Halfway through 2012, single family starts are on pace for over 500 thousand this year, and total starts are on pace for about 730 thousand. That is above the forecasts for most analysts (however Lawler and the NAHB were close).

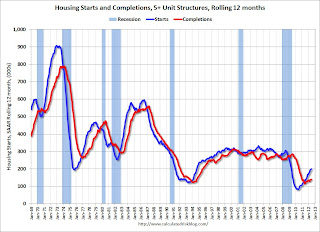

Here is an update to the graph comparing multi-family starts and completions. Since it usually takes over a year on average to complete a multi-family project, there is a lag between multi-family starts and completions. Completions are important because that is new supply added to the market, and starts are important because that is future new supply (units under construction is also important for employment).

These graphs use a 12 month rolling total for NSA starts and completions.

Click on graph for larger image.

Click on graph for larger image.

The blue line is for multifamily starts and the red line is for multifamily completions.

The rolling 12 month total for starts (blue line) has been increasing steadily, and completions (red line) is lagging behind - but completions will follow starts up over the course of the year (completions lag starts by about 12 months).

This means there will be an increase in multi-family deliveries next year.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

The second graph shows single family starts and completions. It usually only takes about 6 months between starting a single family home and completion - so the lines are much closer. The blue line is for single family starts and the red line is for single family completions.

For the fifth consecutive month, the rolling 12 month total for starts has been above completions - that usually only happens after housing has bottomed.

Earlier on housing starts:

• Housing Starts increased to 760 thousand in June, Highest since October 2008

Fed's Beige Book: Economic activity increased at "modest to moderate" pace, Residential real estate "largely positive"

by Calculated Risk on 7/18/2012 02:00:00 PM

Reports from most of the twelve Federal Reserve Districts indicated that overall economic activity continued to expand at a modest to moderate pace in June and early July.This is a downgrade from the previous beige book that reported "moderate" growth.

And on real estate:

Reports on residential housing markets remained largely positive. Sales were characterized as improving in Philadelphia, New York, Richmond, Chicago, St. Louis, and Minneapolis, while home sales increased in Boston, Cleveland, Atlanta, St. Louis, Minneapolis, Kansas City, Dallas, and San Francisco."Prepared at the Federal Reserve Bank of Atlanta and based on information collected before July 9, 2012."

...

Most Districts reported declines in home inventories. Homes prices have begun to stabilize in some markets and price increases were noted in select markets. Boston and Atlanta noted that appraisals were coming in below market prices.

...

Rental markets continued to strengthen by most accounts.

...

Recent activity in commercial real estate markets has been mixed. Modest improvements were noted in Boston, Atlanta, and St. Louis and demand strengthened in the San Francisco District. Softer conditions were reported in the New York and Richmond Districts, while demand held steady in the Philadelphia and Dallas Districts. Nonresidential construction activity varied as well.

More sluggish growth, but still "modest to moderate". And a few positive comments on residential real estate ...

August 1st QE3 Departure Date?

by Calculated Risk on 7/18/2012 11:47:00 AM

There is quite a bit of discussion on when (not if) the Fed will embark on QE3. As an example, from Goldman Sachs yesterday:

While we think that a modest easing step is a strong possibility at the August or September meeting, we suspect that a large move is more likely to come after the election or in early 2013, barring rapid further deterioration in the already-cautious near term Fed economic outlook.And from Merrill Lynch this morning:

We expect that, as the data continue to soften, the Fed will undershoot its own forecasts and thus respond with further easing. We expect the Fed to push out its forward guidance until at least mid-2015, perhaps at the August 1 FOMC meeting, and to launch a $500bn QE3 asset purchase plan by the September 13 meeting.Although the date is uncertain, I think there is a strong possibility that the Fed will launch QE3 on August 1st.

First, I think Bernanke paved the way for QE3 at the press conference on June 20th. Before embarking on previous rounds of QE, Bernanke always outlined the reasons - and I thought he made it clear that if the economy didn't improve, more accommodation was coming. And, if anything, the data has been worse since the last meeting. However there has only been a limited amount of data (Q2 GDP will be released next week), and some participants might argue they need additional data before supporting QE3.

Second, two of the key undecided voting members of the FOMC are clearly moving closer to supporting QE3. Last week Atlanta Fed President Dennis Lockhart came close to advocating QE3. Although Lockhart weighed both sides of each issue in his speech, he concluded: 1) the risks of QE3 are "manageable", 2) QE3 will be modestly effective, and 3) his earlier forecast is becoming "untenable" and that means he will support more accommodation if the recent weak data continues.

And yesterday, Cleveland Fed President Sandra Pianalto said more easing could be warranted.

My outlook calls for the pace of growth to pick up over the course of this year and into 2013 as the headwinds holding back the recovery gradually abate. I also expect inflation to remain close to 2 percent. If the expansion were to continue to lose momentum, and inflation threatened to run persistently below 2 percent, additional policy action could be warranted.I expect Pianalto will revise down her outlook over the next couple of weeks.

Third, it appears some key members of the FOMC (Yellen, Dudley, Williams) are all pushing harder for QE now. San Francisco Fed President John Williams is definitely being more aggressive, from July 9th:

We are falling short on both our employment and price stability mandates, and I expect that we will make only very limited progress toward these goals over the next year. ... If further action is called for, the most effective tool would be additional purchases of longer-maturity securities, including agency mortgage-backed securities. ... At the Fed, we take our dual mandate with the utmost seriousness. ... We stand ready to do what is necessary to attain our goals of maximum employment and price stability.By my count, if Bernanke decides that QE3 is appropriate, he will have 10 or 11 votes on August 1st. Maybe the FOMC will wait for more data, but I think QE3 is likely very soon.