by Calculated Risk on 4/20/2012 10:30:00 AM

Friday, April 20, 2012

State Unemployment Rates decline in 30 states in March

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in March. Thirty states recorded unemployment rate decreases, 8 states posted rate increases, and 12 states and the District of Columbia had no change, the U.S. Bureau of Labor Statistics reported today. Forty-nine states and the District of Columbia registered unemployment rate decreases from a year earlier, while New York experienced an increase.

...

Nevada continued to record the highest unemployment rate among the states, 12.0 percent in March. Rhode Island and California posted the next highest rates, 11.1 and 11.0 percent, respectively. North Dakota again registered the lowest jobless rate, 3.0 percent, followed by Nebraska, 4.0 percent.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the current unemployment rate for each state (red), and the max during the recession (blue). Every state has some blue - indicating no state is currently at the maximum during the recession.

The states are ranked by the highest current unemployment rate. Only three states still have double digit unemployment rates: Nevada, Rhode Island, and California. This is the fewest since January 2009. In early 2010, 18 states and D.C. had double digit unemployment rates.

Spanish 10 year bond yields near 6%

by Calculated Risk on 4/20/2012 08:53:00 AM

From Dow Jones: Italian, Spanish Bonds Suffer As Crisis Fears Mount

Italian and Spanish government bond prices continued to fall early Friday after Thursday's Spanish bond auction failed to inspire renewed confidence in peripheral markets, while French bonds also suffered ahead of Sunday's presidential election. ... Italian 10-year bond yields climbed 10 basis points to 5.68%, while Spanish yields were up 10 basis points at 5.97%, according to Tradeweb. German 10-year bund yields were at 1.61%, having briefly hit a record low of just below 1.6%, while French 10-year yields climbed four basis points to 3.11%.Here are the Spanish and Italian 10-year yields from Bloomberg. Both are still well below the highs of last November. Both the election in France, and the election in Greece scheduled for May 6th, are making investors uneasy. Sarkozy will probably lose in a runoff, and the smaller parties in Greece will probably do very well. At some point current policies will not survive at the ballot box.

Thursday, April 19, 2012

State and Local Government Payroll Employment Stabilizing?

by Calculated Risk on 4/19/2012 08:50:00 PM

A few months ago I wrote:

It is looking like there will be less drag from state and local governments in 2012, and that most of the drag will be over by the end of Q2 (end of FY 2012). This doesn't mean state and local government will add to GDP in the 2nd half of 2012, just that the drag on GDP and employment will probably end. Just getting rid of the drag will help.It is time for an update - it is early in the year, but it is possible the employment drag from state and local governments has already ended. In fact, state and local government have added 14 thousand jobs since December.

Click on graph for larger image.

Click on graph for larger image.This graph shows total state and government payroll employment since January 2007. Note: Some of the stimulus spending from the American Recovery and Reinvestment Act probably kept state and local employment from declining faster in 2009.

Of course the Federal government is still losing workers (53,000 over the last year), but it looks like state and local government employment is stabilizing.

Homeowner Financial Obligation Ratio near normal, Mortgage obligations still high

by Calculated Risk on 4/19/2012 05:16:00 PM

From Floyd Norris at the NY Times: Debt Burden Lifting, Consumers Open Wallets a Crack

One measure of the financial health of householders is the level of financial obligations, like required mortgage and credit card payments, to disposable income. By the fall of 2007, those obligations took up 14 percent of disposable income, more than at any time since the Federal Reserve began calculating the statistic in 1980.Norris is referring to the Debt Service Ratio (DSR) from the Federal Reserve.

But now the situation has turned around. The latest figures, for the final quarter of 2011, show that required debt service payments now make up just 10.9 percent of disposable income, the lowest proportion since 1994. A broader measure — which adds in such obligations as property tax and insurance premiums for homeowners, and rent for those who do not own their homes — has fallen to the lowest level since 1984.

There is little mystery in how that happened. First, debt levels have fallen. ... Second, low interest rates mean that servicing that debt costs less. ...

Getting those debt levels down was not a simple matter of making payments, of course. The McKinsey Global Institute estimates that about two-thirds of the reduction came from the cancellation of debt, through write-offs and foreclosures.

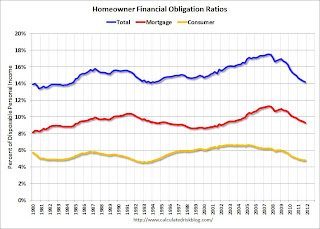

I also like to look at the Financial Obligation Ratio (FOR) for homeowners.

Note: This series is useful to look for changes over time, but there are limitations. From the Fed:

The limitations of current sources of data make the calculation of the ratio especially difficult. The ideal data set for such a calculation would have the required payments on every loan held by every household in the United States. Such a data set is not available, and thus the calculated series is only a rough approximation of the current debt service ratio faced by households. Nonetheless, this rough approximation may be useful if, by using the same method and data series over time, it generates a time series that captures the important changes in household debt service payments.

Click on graph for larger image.

Click on graph for larger image.This graph shows the Total, Mortgage and Consumer financial obligation ratios for homeowners.

With some decline in debt, and much lower interest rates, the total homeowner financial obligations ratio is back to normal levels. However the mortgage ratio - even with record low mortgage rates - is still somewhat high.

Back in the early '90s, following the previous surge in mortgage obligations, the mortgage ratio declined for about 9 years. For the mortgage ratio to decline further, it would take a combination of more debt reduction and - hopefully - more disposable income.

Philly Fed: "Regional manufacturing activity expanded modestly" in April Survey

by Calculated Risk on 4/19/2012 01:48:00 PM

Earlier from the Philly Fed: April 2012 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, edged down from a reading of 12.5 in March to 8.5. Indexes for new orders and shipments remained positive but were slightly weaker than their March readings. The indexes for new orders and shipments, which decreased about 1 point, remain at relatively low readings.

...

Firms’ responses suggested a notable pickup in levels of employment this

month. The current employment index, which has been positive for eight consecutive months, increased 11 points, to its highest reading in 11 months. ... The average workweek was near steady this month, with 75 percent of the firms surveyed reporting no change in average hours.

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through April. The ISM and total Fed surveys are through March.

The average of the Empire State and Philly Fed surveys declined in April, and is at the lowest level this year.

Both the NY and Philly Fed surveys indicated expansion in April, at a slower pace than in March, and both were below the consensus forecast. However both surveys showed a strong increase in employment.