by Calculated Risk on 3/23/2012 12:16:00 PM

Friday, March 23, 2012

Home Sales: Distressing Gap

Here is an update to the "distressing gap" graph that shows existing home sales (left axis) and new home sales (right axis) through February. This graph starts in 1994, but the relationship has been fairly steady back to the '60s.

Following the housing bubble and bust, the "distressing gap" appeared mostly because of distressed sales. The flood of distressed sales has kept existing home sales elevated, and depressed new home sales since builders can't compete with the low prices of all the foreclosed properties.

Click on graph for larger image.

Click on graph for larger image.

I expect this gap to eventually close once the number of distressed sales starts to decline.

Note: Existing home sales are counted when transactions are closed, and new home sales are counted when contracts are signed. So the timing of sales is different.

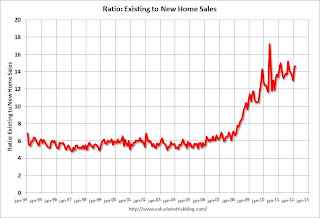

The second graph shows the same information but as a ratio of existing sales to new home sales.

The ratio was fairly stable for years until the market was flooded with distressed sales.

The ratio was fairly stable for years until the market was flooded with distressed sales.

So far there has been little progress towards a more "normal" market.

On February New Home Sales:

• New Home Sales decline in February to 313,000 Annual Rate

• New Home Sales graphs

Earlier this week on Existing Home sales:

• Existing Home Sales in February: 4.59 million SAAR, 6.4 months of supply

• Existing Home Sales: Inventory and NSA Sales Graph

• Existing Home Sales graphs

New Home Sales decline in February to 313,000 Annual Rate

by Calculated Risk on 3/23/2012 10:00:00 AM

The Census Bureau reports New Home Sales in February were at a seasonally adjusted annual rate (SAAR) of 313 thousand. This was down from a revised 318 thousand in January (revised down from 321 thousand). November and December of last year were revised up.

The first graph shows New Home Sales vs. recessions since 1963. The dashed line is the current sales rate.

Sales of new single-family houses in February 2012 were at a seasonally adjusted annual rate of 313,000 ... This is 1.6 percent (±23.9%)* below the revised January rate of 318,000, but is 11.4 percent (±17.8%)* above the February 2011 estimate of 281,000.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The second graph shows New Home Months of Supply.

Months of supply increased to 5.8 in February from 5.7 in January.

The all time record was 12.1 months of supply in January 2009.

This is now close to normal (less than 6 months supply is normal).

This is now close to normal (less than 6 months supply is normal).The seasonally adjusted estimate of new houses for sale at the end of February was 150,000. This represents a supply of 5.8 months at the current sales rate.On inventory, according to the Census Bureau:

"A house is considered for sale when a permit to build has been issued in permit-issuing places or work has begun on the footings or foundation in nonpermit areas and a sales contract has not been signed nor a deposit accepted."Starting in 1973 the Census Bureau broke this down into three categories: Not Started, Under Construction, and Completed.

This graph shows the three categories of inventory starting in 1973.

This graph shows the three categories of inventory starting in 1973.The inventory of completed homes for sale was at 54,000 units in February. The combined total of completed and under construction is at the lowest level since this series started.

The last graph shows sales NSA (monthly sales, not seasonally adjusted annual rate).

In February 2012 (red column), 25 thousand new homes were sold (NSA). Last year only 22 thousand homes were sold in February (although 2012 is a leap year). This was the second weakest February since this data has been tracked - the third weakest was February 2010 with 27 thousand homes sold. The high for February was 109 thousand in 2005.

This was below the consensus forecast of 325 thousand.

This was below the consensus forecast of 325 thousand.New home sales have averaged only 303 thousand SAAR over the 22 months since the expiration of the tax credit ... mostly moving sideways, although sales have been increasing a little lately (averaging 322 thousand rate over the last four months).

KB Home: Deliveries Up, Net Orders down year-over-year

by Calculated Risk on 3/23/2012 08:46:00 AM

While we wait for the new home sales report, from KB Home via MarketWatch: KB Home Reports First Quarter 2012 Results. A few excerpts:

Homes delivered increased 21% to 1,150, up from 949 homes delivered in the year-earlier quarter ... The average selling price rose 6% to $219,000 from $205,700 for the year-earlier quarter ...Gross orders were only up 3% year-over-year (not much of an increase), and net orders were down due to an increase in cancellations. Hopefully they will address the increase in cancellations on the conference call - and which local markets are "showing greater strength".

Net orders totaled 1,197 in the first quarter of 2012, down 8% from 1,302 net orders in the year-earlier quarter ... gross orders were up 3%, an increase in the cancellation rate to 36% from 29% in the year-earlier quarter led to the year-over-year decrease in net orders.

The Company had a backlog of 2,203 homes, representing potential future housing revenues of $460.0 million, as of February 29, 2012, compared to a backlog of 1,689 homes, representing potential future housing revenues of $353.6 million, as of February 28, 2011.

...

“Reflecting the improving trends in the economy, including recent job growth and higher consumer confidence, we are seeing signs that the overall housing market is stabilizing and beginning to recover,” said Jeffrey Mezger, president and chief executive officer. “The pace of the recovery is uneven, however, with certain local markets showing greater strength and more normalized activity than other areas where a rebound will take longer to manifest. We expect that the housing market in general will gradually strengthen as the economy continues to advance.”

Thursday, March 22, 2012

WSJ: BofA to try Deed-in-lieu to Rental Program

by Calculated Risk on 3/22/2012 11:30:00 PM

From Nick Timiraos at the WSJ: Alternative to Foreclosure Tested

Bank of America Corp. BAC -2.24% is launching a pilot program that will allow homeowners at risk of foreclosure to hand over deeds to their houses and sign leases that will let them rent the houses back from the bank at a market rate.Dean Baker proposed something like this a few years ago.

... the "Mortgage to Lease" program is small—the bank began sending letters Thursday offering leases to 1,000 homeowners in Arizona, Nevada and New York

...Borrowers would agree to a what is known as a "deed-in-lieu" of foreclosure, where they essentially sign over ownership of the property to the lender. ... In exchange, former owners would be offered one-year leases with options to renew the leases in each of the following two years at rents that the bank determines are at or below the current market price.

Also - and Timiraos didn't mention this - in the recent white paper on housing, the Fed proposed to relax the rules on how banks can manage rented REOs. From the Fed white paper:

In light of the current unusually difficult circumstances in many housing markets across the nation, the Federal Reserve is contemplating issuing guidance to banking organizations and examiners to clarify supervisory expectations regarding rental of residential REO properties by such organizations while such circumstances continue (and within relevant federal and statutory and regulatory limits). If finalized and adopted, such guidance would explain how rental of a residential REO property within applicable holding-period time limits could meet the supervisory expectation for ongoing good faith efforts to sell that property. Relatedly, if a successful model is developed for the GSEs to transition REO properties to the rental market, banks may wish to participate in such a program or adopt some of its features.

Bernanke: "The Federal Reserve and the Financial Crisis" Part 2

by Calculated Risk on 3/22/2012 07:08:00 PM

This is part 2 of 4 of a lecture series on the Federal Reserve. The first lecture (about 1 hour) discussed monetary policy history, the tools and goals of the reserve - and he spent some time on the gold standard.

The second lecture focuses on the Fed from after World War II up to the financial crisis. Here are the slides Lecture 2: The Federal Reserve after World War II. Link to lecture series (Part 3 is next Tuesday).

Video here.

Other House Price Indexes: FNC and RadarLogic

by Calculated Risk on 3/22/2012 04:35:00 PM

In a post yesterday I mentioned some bearish comments from Professor Kenneth Rosen back in 2006. That reminded me of some comments I made back in 2005 and 2006 when I argued the sequence for housing would be:

1) A surge in inventories as sellers try to get out at today's [2006] high prices.Sure enough inventory started rising in the second half of 2005, and then activity started to decline - and then prices eventually started to fall - and finally fell off a cliff.

2) followed by a drop in orders as buyers become leery of buying at the top. Historically house prices tend to be sticky as sellers want prices close to those of recent sales in their neighborhood. And buyers want a discount from recent sales. The result is a drop in orders.

3) Then prices start falling as some sellers (speculators and homeowners in distress) need to get out.

Now inventory is declining, activity is picking up gradually, and I think it is time to look for prices to stop falling. (I don't expect prices to rise quickly, but if prices just stopped falling, then people would become more confident in the real estate market). Note: by fundamental measures (real prices, price-to-income), prices are probably close to a bottom, so I think it is OK to start looking for a bottom.

As I noted yesterday one of indicators I'm looking at is the year-over-year change in house prices. If we are at the house price bottom on a national basis, then year-over-year price changes should start to get smaller soon - and eventually turn positive in early 2013.

In addition to Case-Shiller, CoreLogic, and LPS, I'm also watching the FNC and RadarLogic indexes.

Click on graph for larger image.

Click on graph for larger image.The first graph is based on the FNC index (four composites) through January 2012. The FNC indexes are hedonic price indexes using a blend of sold homes and real-time appraisals.

The indexes are generally showing less of a year-over-year decline in January (I think prices will fall seasonally through the March report).

Also RadarLogic released their January report today.

According to the January 2012 RPX Monthly Housing Market Report released today by Radar Logic Incorporated, the RPX Composite price, which tracks home prices in 25 major US metropolitan areas, declined 5.42 percent during the year ending January 19 to $169.75 per square foot. The last time the RPX Composite was this low was in July 2002.

The year-over-year rate of decline in the RPX Composite price slowed in December and January after reaching its fastest pace since 2009 in early December, 2011. While the slowing rate of decline is encouraging, it is still too early to tell whether it will lead to lasting stability in home prices any time soon.

"Frankly, I don't think we've reached the bottom in housing prices." said Quinn Eddins, Director of Research at Radar Logic Incorporated. "The fact is there is still too much supply in the housing market for the current level of demand, particularly if you consider homes in the foreclosure process and those under water. At very least the excess supply will delay the recovery in housing prices, and could well push prices lower."

This graph shows the year-over-year decline for the RadarLogic composite index.

This graph shows the year-over-year decline for the RadarLogic composite index. From RadarLogic:

While the slowing rate of price decline is promising, it is too early to say yet whether housing prices will find a bottom soon. After all, we saw price declines slow in 2009, only to see them start accelerating again in 2010.The third graph shows the RPX futures for house prices.

From RadarLogic:

From RadarLogic: Exhibit 8 shows historical RPX Composite prices plotted with RPX futures prices. The historical RPX prices are plotted according to their publication date (Radar Logic publishes its daily prices 63 days after the last day in the transaction period) and RPX futures prices are plotted according to their settlement date. The term structure of RPX futures prices indicates that home prices are expected to increasing at an accelerating rate from 2012 through 2015.Investors think prices will bottom soon, but any increase will be sluggish.

Manufactured Home Shipments up 33% year-over-year in January

by Calculated Risk on 3/22/2012 01:34:00 PM

This is something I rarely mention, since manufactured homes is a very small category of residential investment (the largest categories are new single family homes, home improvement, brokers' commissions, and new multifamily).

However it appears activity for manufactured homes is coming off the bottom too. The Census Bureau reported that shipments in January were at a 60 thousand Seasonally Adjusted Annual Rate (SAAR), up 33% from 45 thousand (SAAR) in January 2011.

Click on graph for larger image.

This graph shows shipments of manufactured homes. The spike in 2005 was related to Hurricane Katrina.

There were a record low number of manufactured home placements in 2011 (46 thousand) and it appears that this category will increase in 2012. Of course this is a very small part of the economy.

Misc: Merrill House prices"bottoming now", FHFA House price index unchanged in January

by Calculated Risk on 3/22/2012 10:12:00 AM

• Merill Lynch put out a research note this morning: Home price forecast update

We have ... updated our home price model and believe that prices are bottoming now. However, we continue to believe the recovery will not begin in earnest until 2014. ... we expect roughly flat home prices this year and next with modest growth in 2014.Merrill had expected a further decline, but now they expect prices to be mostly flat for the next two years.

• From the FHFA: FHFA House Price Index Unchanged in January

U.S. house prices were unchanged on a seasonally adjusted basis from December to January, according to the Federal Housing Finance Agency’s monthly House Price Index. The previously reported 0.7 percent increase in December was revised downward to reflect a 0.1 percent increase. For the 12 months ending in January, U.S. prices fell 0.8 percent.Note: the FHFA index is no longer closely followed.

• From MarketWatch: Leading economic indicators rise 0.7% in February

[T]he Conference Board ... reported that its index of leading economic indicators grew 0.7% in February, led by improving jobless claims. "Continued broad-based gains in the LEI for the United States confirm a more positive outlook for general economic activity in the first half of 2012," said Ataman Ozyildirim, a Conference Board economist.

Weekly Initial Unemployment Claims decline to 348,000

by Calculated Risk on 3/22/2012 08:30:00 AM

The DOL reports:

In the week ending March 17, the advance figure for seasonally adjusted initial claims was 348,000, a decrease of 5,000 from the previous week's revised figure of 353,000. The 4-week moving average was 355,000, a decrease of 1,250 from the previous week's revised average of 356,250.The previous week was revised up to 353,000 from 351,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims was declined to 355,000.

The 4-week moving average is near the lowest level since early 2008.

And here is a long term graph of weekly claims:

The ongoing decline in initial weekly claims is good news. Even in "good times" weekly claims are usually just above 300 thousand, and claims are getting there.

Wednesday, March 21, 2012

Housing: "Signs of Life"

by Calculated Risk on 3/21/2012 09:35:00 PM

A couple of excerpts from an article by Neil Shah and Nick Timiraos at the WSJ: Housing Shows Signs of Life

For the first time since 2005, investment in residential real-estate, including home building and renovation, has contributed to U.S. economic output for the past three quarters.A few comments:

...

"Housing bottoming is going to surprise a lot of people," said Kenneth Rosen, a housing economist at the University of California, Berkeley. "Housing was pulling us down consistently, quarter after quarter, for years. That was really over in 2011."

...

Home-purchase contracts in January and February are up about 20% from a year earlier for HomeServices, a subsidiary of Berkshire Hathaway Inc., and Mr. [Ronald Peltier, chief executive of HomeServices of America Inc.] said the firm now expects sales growth of around 10% this year, upgrading its forecast last fall for flat sales levels in 2012.

• There are two bottoms for housing: 1) for residential investment, new home sales and housing starts, and 2) for house prices. (see my post on February on Housing: The Two Bottoms). With residential investment adding to GDP and employment growth over the last several quarters, it appears the first bottom has already happened.

• On prices (the 2nd bottom), I'll be looking closely at year-over-year changes in various price indexes. If we are at the housing price bottom on a national basis, then year-over-year price changes should start to get smaller soon - and eventually turn positive in early 2013.

• Professor Rosen was a "housing bear" back at the peak. See these comments from Rosen in February 2006: Barron's: Is It Crunch Time for Housing?

Rosen calls himself a real-estate bear who endorses the doom-and-gloom scenario of Yale University professor Robert Shiller ... We've already passed stage one, characterized by "a falloff in new sales and orders," says Rosen, and are just entering stage two, in which unsold inventories build up.Earlier:

That may be where the crunch begins.

...

The final phase is when we see massive defaults or delinquencies on mortgage loans. That's several years away, he says, and this time the damage could be worse because of the large number of exotic loans giddy lenders extended to desperate home buyers.

• Existing Home Sales in February: 4.59 million SAAR, 6.4 months of supply

• Existing Home Sales: Inventory and NSA Sales Graph

• Existing Home Sales graphs