by Calculated Risk on 3/15/2012 10:00:00 AM

Thursday, March 15, 2012

Philly Fed and Empire State Manufacturing Surveys indicate slightly stronger expansion in March

From the Philly Fed: March 2012 Business Outlook Survey

The survey's broadest measure of manufacturing conditions, the diffusion index of current activity, edged slightly higher, from a reading of 10.2 in February to 12.5, its highest reading since April of last year ... The new orders index decreased 8 points, to 3.3, while the shipments index declined 12 points, to 3.5.From the NY Fed: Empire State Manufacturing Survey

...

Firms' responses suggest a slight pickup in levels of employment this month. The current employment index, which has been positive for seven consecutive months, increased 6 points ... and the current workweek index decreased 7 points.

The general business conditions index was little changed in March and, at 20.2, indicated a continued moderate pace of growth in business activity for New York State manufacturers.

...

The new orders index inched down three points to 6.8, indicating a modest growth in orders. The shipments index fell five points to 18.2, revealing a continued increase in shipments, though at a slower pace than in February.

...

The number of employees index rose two points to 13.6, and the average workweek index climbed 11 points to 18.5.

...

Indexes for the six-month outlook were generally somewhat lower than they were last month, but held at levels that conveyed a high degree of optimism.

Click on graph for larger image.

Click on graph for larger image.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through March. The ISM and total Fed surveys are through February.

The average of the Empire State and Philly Fed surveys increased slightly again in March, and is at the highest level since April 2011.

Both surveys indicated expansion in March, at a slightly faster pace than in February, and both were slightly above the consensus forecast.

Weekly Initial Unemployment Claims decline to 351,000

by Calculated Risk on 3/15/2012 08:38:00 AM

The DOL reports:

In the week ending March 10, the advance figure for seasonally adjusted initial claims was 351,000, a decrease of 14,000 from the previous week's revised figure of 365,000. The 4-week moving average was 355,750, unchanged from the previous week's revised average of 355,750.The previous week was revised up to 365,000 from 362,000.

The following graph shows the 4-week moving average of weekly claims since January 2000.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims was unchanged at 355,750.

The 4-week moving average is near the lowest level since early 2008.

And here is a long term graph of weekly claims:

Wednesday, March 14, 2012

LA area Port Traffic declines in February

by Calculated Risk on 3/14/2012 08:30:00 PM

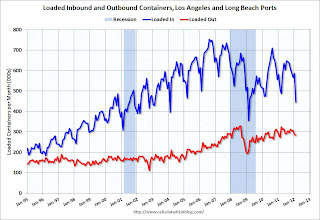

The following graphs are for inbound and outbound traffic at the ports of Los Angeles and Long Beach in TEUs (TEUs: 20-foot equivalent units or 20-foot-long cargo container).

Container traffic gives us an idea about the volume of goods being exported and imported - and possibly some hints about the trade report for February. LA area ports handle about 40% of the nation's container port traffic.

To remove the strong seasonal component for inbound traffic, the first graph shows the rolling 12 month average.

Click on graph for larger image.

Click on graph for larger image.

On a rolling 12 month basis, inbound traffic is down 0.9% from January, and outbound traffic is up 0.3%.

On a rolling 12 month basis, outbound traffic is moving up slowly, and inbound traffic is declining slightly.

The 2nd graph is the monthly data (with a strong seasonal pattern for imports).

For the month of February, loaded outbound traffic was up 4.6% compared to February 2011, and loaded inbound traffic was down 12.5% compared to February 2011. (typo corrected, reversed inbound and outbound).

For the month of February, loaded outbound traffic was up 4.6% compared to February 2011, and loaded inbound traffic was down 12.5% compared to February 2011. (typo corrected, reversed inbound and outbound).

Note: Every year imports decline in February mostly because of the Chinese New Year.

Lawler: Updated “Distressed Sales” Shares Table, Select Areas

by Calculated Risk on 3/14/2012 04:16:00 PM

Economist Tom Lawler sent me the updated table below for several distressed areas. He added Orlando and Southern California today.

Lawler noted that the Reno data is NOT directly from the realtor association/MLS. Also "SoCal shares are not MLS based, but are Dataquick estimates based on property records".

CR Note: This could be very useful data over the next several months (and years) as we try to track the impact of the mortgage servicer settlement and to see if the markets are improving. Obviously fewer distressed sales would indicate a less unhealthy market (except it might be due to process delays right now).

For most of the areas (with the exception of Reno), the distressed share of sales is down from February 2011, the share of short sales has increased and the share of foreclosure sales are down - and down significantly in some areas.

Look at Orlando: Short sales have increased from 23.7% to 33.3%, and foreclosures have declined from almost half of sales (49.9%) to 28.9%.

Note: The table is a percentage of total sales.

| Short Sales Share | Foreclosure Sales Share | Total "Distressed" Share | ||||

|---|---|---|---|---|---|---|

| 12-Feb | 11-Feb | 12-Feb | 11-Feb | 12-Feb | 11-Feb | |

| Las Vegas | 29.3% | 26.6% | 42.0% | 51.6% | 71.3% | 78.2% |

| Reno | 28.0% | 30.0% | 42.0% | 36.0% | 70.0% | 66.0% |

| Phoenix | 28.1% | 21.1% | 23.3% | 49.6% | 51.4% | 70.7% |

| Sacramento | 31.9% | 22.1% | 33.9% | 49.2% | 65.8% | 71.3% |

| Minneapolis | 15.0% | 13.6% | 42.3% | 47.9% | 57.3% | 61.5% |

| Mid-Atlantic (MRIS) | 16.4% | 14.5% | 17.5% | 27.2% | 33.9% | 41.7% |

| Orlando | 33.3% | 23.7% | 28.9% | 49.9% | 62.2% | 73.6% |

| Southern California | 20.5% | 19.7% | 32.5% | 37.0% | 53.0% | 56.7% |

DataQuick: Socal Home Sales increased in February

by Calculated Risk on 3/14/2012 01:43:00 PM

Another key distressed market ... from DataQuick: Southland Home Sales Jump in February, Prices Still Down Yr/Yr

The Southland housing market posted the highest number of February home sales in five years as record levels of investor and cash buyers helped spur robust activity under $300,000. ...And on distressed sales:

A total of 15,573 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month. That was up 7.2 percent from 14,523 in January, and up 8.4 percent from 14,369 in February 2011, according to San Diego-based DataQuick.

The increase in sales between January and February was larger than usual. On average, sales have risen 1.1 percent between those two months since 1988, when DataQuick’s statistics begin.

...

“February sales got a big boost from investors and others paying cash for relatively affordable homes, as well as from an extra day’s worth of sales thanks to the leap year. Without the latter, sales might have been up a bit, but not to a five-year high. It’s just one more reason for us to remind everyone that January and February usually aren’t good months to use for forecasting purposes. The big picture remains one where the bottom of the housing market continues to see much of the action, while move-up activity remains sluggish. Financing is still difficult for many and lots of potential move-up buyers and sellers are stuck because they owe more than their homes are worth,” said John Walsh, DataQuick president.

Foreclosure resales – properties foreclosed on in the prior 12 months – accounted for 32.5 percent of the resale market last month, down from a revised 32.6 percent in January and down from 37.0 percent a year earlier. Foreclosure resales hit a high for the current cycle of 56.7 percent in February 2009 and a low of 31.6 percent last November.Distressed sales are very high at about 53% of the market, but the percentage is down from 56.7% a year ago.

Short sales ... made up an estimated 20.5 percent of Southland resales last month. That compares with 21.1 percent in January, which was a high point for the current real estate cycle, and 19.7 percent in February 2011.

...

Cash purchasers accounted for a record 32.8 percent of February home sales, up from 32.2 percent in January and up from 32.3 percent a year earlier.

The NAR will report February existing home sales next week on Wednesday March 21st.