by Calculated Risk on 2/28/2012 09:00:00 AM

Tuesday, February 28, 2012

Case Shiller: House Prices fall to new post-bubble lows in December

S&P/Case-Shiller released the monthly Home Price Indices for December (a 3 month average of October, November and December).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the quarterly national index.

Note: Case-Shiller reports NSA, I use the SA data.

From S&P: All Three Home Price Composites End 2011 at New Lows According to the S&P/Case-Shiller Home Price Indices

Data through December 2011, released today by S&P Indices for its S&P/Case-Shiller Home Price Indices, the leading measure of U.S. home prices, showed that all three headline composites ended 2011 at new index lows. The national composite fell by 3.8% during the fourth quarter of 2011 and was down 4.0% versus the fourth quarter of 2010. Both the 10- and 20-City Composites fell by 1.1`% in December over November, and posted annual returns of -3.9% and -4.0% versus December 2010, respectively. These are worse than the -3.8% respective annual rates both reported for November. With these latest data, all three composites are at their lowest levels since the housing crisis began in mid-2006.

In addition to both Composites, 18 of the 20 MSAs saw monthly declines in December over November. Miami and Phoenix were up 0.2% and 0.8%, respectively. ...

“In terms of prices, the housing market ended 2011 on a very disappointing note,” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “With this month’s report we saw all three composite hit new record lows."

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 34.0% from the peak, and down 0.5% in December (SA). The Composite 10 is at a new post bubble low (both Seasonally adjusted and Not Seasonally Adjusted).

The Composite 20 index is off 33.9% from the peak, and down 0.5% in December (SA). The Composite 20 is also at a new post-bubble low.

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 3.9% compared to December 2010.

The Composite 20 SA is down 4.0% compared to December 2010. This was a slightly larger year-over-year decline for both indexes than in November.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in December seasonally adjusted (only 2 city increased NSA). Prices in Las Vegas are off 61.6% from the peak, and prices in Dallas only off 9.0% from the peak.

Prices increased (SA) in 8 of the 20 Case-Shiller cities in December seasonally adjusted (only 2 city increased NSA). Prices in Las Vegas are off 61.6% from the peak, and prices in Dallas only off 9.0% from the peak.Both the SA and NSA are at new post-bubble lows - and the NSA indexes will continue to decline for the next few months (this report was for the three months ending in December). I'll have more on house prices later this morning.

Durable Goods orders decline 4% in January

by Calculated Risk on 2/28/2012 08:39:00 AM

Durable goods is always very volatile. Durable goods orders were expected to decline due to lower aircraft orders (Nondefense aircraft and parts declined 19%) and the expiration of a tax credit that allowed for faster depreciation of equipment purchases.

From the Census Bureau: Advance Report on Durable Goods Manufacturers’ Shipments, Inventories and Orders

January 2012

New orders for manufactured durable goods in January decreased $8.6 billion or 4.0 percent to $206.1 billion,the U.S. Census Bureau announced today. This decrease, down following three consecutive monthly increases, followed a 3.2 percent December increase. Excluding transportation, new orders decreased 3.2 percent. Excluding defense, new orders decreased 4.5 percent.

Transportation equipment, down following two consecutive monthly increases, had the largest decrease, $3.6 billion or 6.1 percent to $55.2 billion. This was due to nondefense aircraft and parts, which decreased $3.8 billion.

Monday, February 27, 2012

Dallas Fed: Texas Manufacturing Expansion Strengthens in February

by Calculated Risk on 2/27/2012 09:19:00 PM

This was released earlier today. These high frequency surveys are useful because they provide a glimpse of what was happening just a week or two ago - as opposed to other data that is released with a long lag.

From the Dallas Fed: Texas Manufacturing Expansion Strengthens

Texas factory activity continued to increase in February, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 5.8 to 11.2, suggesting a pickup in the pace of growth.All of the regional surveys were stronger in February than in January; the last regional survey, from the Richmond Fed, will be released tomorrow.

Other measures of current manufacturing conditions also indicated expansion in February. The new orders index was positive for a second month in a row but fell from 9.5 to 5.8. Similarly, the shipments index moved down from 6.1 to 4.2. Capacity utilization increased further in February; the index edged up from 8.5 to 10.

...

The general business activity index rose to 17.8, its highest reading since November 2010.

...

Labor market indicators reflected a sharp increase in hiring and longer workweeks. The employment index jumped to 25.2, its highest level since the beginning of 2006.

...

Prices and wages increased in February. The raw materials price index was 25.2, little changed from January. The finished goods price index climbed from 9 to 16.2, suggesting selling prices rose at a faster pace.

FHFA: "Tremendous" interest in new HARP Refinance Program

by Calculated Risk on 2/27/2012 05:02:00 PM

From Bloomberg: U.S. Refinancing Program Garners ‘Tremendous Borrower Interest,’ FHFA Says

A program designed to help homeowners who have lost equity in their properties has generated “tremendous borrower interest,” said Edward J. DeMarco, acting director of the Federal Housing Finance Agency.The key to the new HARP program is the elimination of the representations and warranties on the original loan for the lenders. If the lenders can get borrowers to refinance (only loans owned or guaranteed by Fannie and Freddie), the lenders will no longer be responsible if the original loan defaults. This is important for the banks (these are well seasoned loans, so it makes sense for Fannie and Freddie too).

DeMarco made his comments in written testimony prepared for delivery tomorrow to the Senate Banking Committee.

The elimination of Reps and warrants for the original loans applies to Desktop Underwriter® (DU) and that will not be updated until sometime in March. The lenders and servicers know which loans are 1) owned or guaranteed by Fannie and Freddie, and 2) qualify for HARP. The lenders are very motivated to get borrowers to refinance ... and the borrowers will be very motivated to get much lower mortgage rates. So it should be no surprise that there is "tremendous borrower interest"!

FHFA announces Pilot REO Bulk Sales Offer

by Calculated Risk on 2/27/2012 03:26:00 PM

From the FHFA: FHFA Announces Pilot REO Property Sales in Hardest-Hit Areas

The Federal Housing Finance Agency (FHFA) today announced the first pilot transaction under the Real Estate-Owned (REO) Initiative, targeted to hardest-hit metropolitan areas — Atlanta, Chicago, Las Vegas, Los Angeles, Phoenix and parts of Florida.Here is an over view of the properties being offered. The offer is for 2,490 Fannie Mae properties with a total of 2,854 units (some properties are 2, 3 and 4-units).

With this next step, prequalified investors will be able to submit applications to demonstrate their financial capacity, experience and specific plans for purchasing pools of Fannie Mae foreclosed properties with the requirement to rent the purchased properties for a specified number of years.

Click on graph for larger image.

Click on graph for larger image.What is surprising is that most of these units are already rented (85% of the units are rented) and almost 60% of the units on term leases (the rest are month-to-month).

The original idea behind the REO-to-rental program was to sell vacant REO to investors and only in certain areas. These investors would agree to rent the properties for a certain period, and that would reduce the number of vacant units on the market (or coming on the market). This offer doesn't seem to match that goal.

Fannie already has a program to keep tenants in place if they foreclose on a rented property - and this sounds like Fannie is selling some of these tenant-in-place properties.

Germany's Bundestag votes for Greek Bailout

by Calculated Risk on 2/27/2012 02:03:00 PM

Yesterday I listed some key events in Europe this week and over the next couple of months (list repeated below). The German Bundestag voted overwhelmingly today for the Greek Bailout.

From the WSJ: German Lawmakers Endorse Greek Bailout

Of 591 valid votes cast in the Bundestag, or lower house of Parliament, 496 lawmakers were in favor of the bailout, while 90 were against. Five lawmakers abstained.Feb 27th: Germany's Bundestag votes on Greek Bailout deal (done).

Chancellor Angela Merkel now has a mandate from Parliament to give her approval of the €130 billion ($174.8 bililon) aid package at a meeting of European Union leaders in Brussels this week.

Feb 29th: ECB three year Long Term Refinancing Operation (LTRO)

Feb 29th: Finland lawmakers vote on Greek Bailout deal.

March 1st and 2nd: EU leaders meet in Brussels.

March 8th: €200bn private sector bond swap is scheduled. From the Financial Times Alphaville: A special invitation from the Hellenic Republic ... "The invitation will expire at 9:00 P.M. (C.E.T.) on 8 March 2012, unless extended, re-opened, amended or terminated ..."

March 8th: ECB holds rate meeting

March 12th: Euro-area finance ministers meet in Brussels

March 20th: €14.4bn of Greek bonds scheduled to mature.

March 30th: Euro-area finance ministers meet in Copenhagen.

Late April: Proposed date for Greek general election.

April 22nd: France election.

NY Fed: Delinquent Debt Shrinks while Real Estate Debt Continues to Fall

by Calculated Risk on 2/27/2012 11:30:00 AM

From the NY Fed: Delinquent Debt Shrinks while Real Estate Debt Continues to Fall

Aggregate consumer debt fell $126 billion to $11.53 trillion in the fourth quarter of 2011 according to the Federal Reserve Bank of New York’s latest Quarterly Report on Household Debt and Credit, a 1.1 percent decrease from the $11.66 trillion reported in the prior quarter’s findings.Here is the Q4 report: Quarterly Report on Household Debt and Credit. Here are two graphs:

...

Mortgage and home equity lines of credit (HELOC) balances fell a combined $146 billion, a sign that consumers continue to reduce housing related debt.

After a mild uptick in the third quarter, total household delinquency rates resumed their downward trend in the fourth quarter. The report finds that $1.12 trillion of consumer debt (or 9.8 percent of outstanding debt) is currently delinquent, with $824 billion seriously delinquent (at least 90 days late). Meanwhile about 2.2 percent of mortgage balances transitioned into delinquency during the fourth quarter, resuming the recent trend of reductions in this measure. However, delinquency rates remain elevated compared to historical figures.

"While we continue to see improvements in the delinquent balances and delinquency transition rates this quarter, there has been a noticeable decrease in the rate of improvement compared to 2009-2010," said Andrew Haughwout, vice president and economist at the New York Fed. "Overall it appears that delinquency rates are stabilizing at levels that remain significantly higher than pre-crisis levels."

Click on graph for larger image.

Click on graph for larger image.The first graph shows aggregate consumer debt decreased slightly in Q4. From the NY Fed:

Aggregate consumer debt fell slightly in the fourth quarter. As of December 31, 2011, total consumer indebtedness was $11.53 trillion, a reduction of $126 billion (1.1%) from its September 30, 2011 level. Mortgage balances shown on consumer credit reports fell again ($134 billion or 1.6%) during the quarter; home equity lines of credit (HELOC) balances fell by $12 billion (1.9%). Household mortgage and HELOC indebtedness are now 11.0% and 11.7%, respectively, below their peaks. Consumer indebtedness excluding mortgage and HELOC balances again rose slightly ($20 billion or about 0.8%) in the quarter. Consumers’ non-real estate indebtedness now stands at $2.635 trillion. Student loan indebtedness rose slightly, to $867 billion.

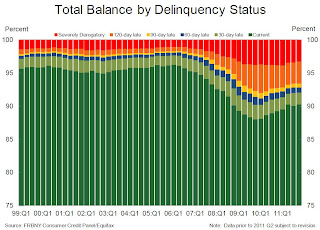

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). The percent of seriously delinquent loans will probably decline quicker now that the mortgage servicer settlement has been reached.

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). The percent of seriously delinquent loans will probably decline quicker now that the mortgage servicer settlement has been reached. From the NY Fed:

As of December 31, 9.8% of outstanding debt was in some stage of delinquency, compared to 10.0% on September 30. About $1.12 trillion of consumer debt is currently delinquent, with $824 billion seriously delinquent (at least 90 days late or “severely derogatory”).There are a number of credit graphs at the NY Fed site.

...

About 2.2% of current mortgage balances transitioned into delinquency during 2011Q4, reinstating the recent trend of reductions in this measure which had been temporarily reversed in 2011Q3. The rate of transition from early (30-60 days) into serious (90 days or more) delinquency also fell slightly, to 28.8%. This reduction in delinquency transitions was accompanied by an improved cure rate: 27.2% of mortgage balances in early delinquency became “current” during the fourth quarter.

NAR: Pending home sales increase in January

by Calculated Risk on 2/27/2012 10:07:00 AM

From the NAR: January Pending Home Sales Rise, Market on Uptrend

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 2.0 percent to 97.0 in January from a downwardly revised 95.1 in December and is 8.0 percent higher than January 2011 when it was 89.8. The data reflects contracts but not closings.December was revised down from 96.6, so most of the 2% increase was due to the downward revision. Without the downward revision, this was below the consensus of a 1.5% increase.

The January index is the highest since April 2010 when it reached 111.3 as buyers were rushing to take advantage of the home buyer tax credit.

Contract signings usually lead sales by about 45 to 60 days, so this is for sales in February and March.

Consensus Housing Forecast for 2012: 700,000 starts

by Calculated Risk on 2/27/2012 08:55:00 AM

I guess we can call this the "consensus" forecast for housing starts, from the NABE: NABE Outlook February 2012

Housing starts are expected to increase 19 percent in 2012. The economists surveyed expect housing starts to reach 700,000 units in 2012, up from 610,000 in 2011 and an upward revision from the November forecast. The forecast for 2013 shows continued improvement, with housing starts reaching 850,000 units. Correspondingly, real residential investment is forecast to increase 6.6 percent in 2012, slightly higher than the 4.3 percent predicted in November, and then strengthen further, rising 10 percent in 2013. The projection for home prices in 2012 was lowered slightly from a projected increase in the FHFA index of 0.9 percent (Q4/Q4) in the November survey to home prices remaining unchanged in the February survey. In 2013 home prices are expected to increase slightly more than 2 percent.Here was housing economist Tom Lawler's forecast for 2012.

The following table shows several forecasts for 2012:

| Some Housing Forecasts for 2012 (000s) | |||

|---|---|---|---|

| New Home Sales | Single Family Starts | Total Starts | |

| Consensus (NABE) | 700 | ||

| Merrill Lynch | 330 | 713 | |

| Fannie Mae | 336 | 473 | 704 |

| Wells Fargo | 350 | 457 | 690 |

| John Burns | 359 | 717 | |

| NAHB | 360 | 501 | 709 |

| Tom Lawler | 365 | 515 | 740 |

| Moody's | 530 | 687 | |

| 2011 Actual | 304 | 431 | 609 |

Sunday, February 26, 2012

Question Contest, iPad Update, RSS and Twitter

by Calculated Risk on 2/26/2012 09:23:00 PM

• For fun I've added a monthly question contest on the right sidebar. It takes a Facebook login right now. The contest has two parts: 1) every day, before 9:30 AM ET, you can enter whether you think the S&P 500 will be up or down that day, and 2) I'll ask some economic predictions (for March 1st, I'm asking: Will light vehicle sales increase in February compared to January?)

Contestants receive 1 point for each correct answer (either stocks or economic predictions). At the end of the month, starting in March, I'll list the leaders in a post on the blog. For February, I'm the leader (just a few friends entered). Hey, play along and beat CR!

• iPad layout. Based on feedback, I've switched the iPad layout back to the standard blog layout. For those who liked the touch layout, use this URL touch.calculatedriskblog.com

• RSS Feed: For those interested, here is the RSS feed for Calculatedrisk.

• on Twitter @calculatedrisk (My family friend Sasha Cohen, Olympic skater, economics student at Columbia and future hedge fund manager is on twitter @SashaCohenNYC)

Join the contest - beat CR!

Yesterday:

• Summary for Week ending February 24th

• Schedule for Week of February 26th