by Calculated Risk on 2/27/2012 03:26:00 PM

Monday, February 27, 2012

FHFA announces Pilot REO Bulk Sales Offer

From the FHFA: FHFA Announces Pilot REO Property Sales in Hardest-Hit Areas

The Federal Housing Finance Agency (FHFA) today announced the first pilot transaction under the Real Estate-Owned (REO) Initiative, targeted to hardest-hit metropolitan areas — Atlanta, Chicago, Las Vegas, Los Angeles, Phoenix and parts of Florida.Here is an over view of the properties being offered. The offer is for 2,490 Fannie Mae properties with a total of 2,854 units (some properties are 2, 3 and 4-units).

With this next step, prequalified investors will be able to submit applications to demonstrate their financial capacity, experience and specific plans for purchasing pools of Fannie Mae foreclosed properties with the requirement to rent the purchased properties for a specified number of years.

Click on graph for larger image.

Click on graph for larger image.What is surprising is that most of these units are already rented (85% of the units are rented) and almost 60% of the units on term leases (the rest are month-to-month).

The original idea behind the REO-to-rental program was to sell vacant REO to investors and only in certain areas. These investors would agree to rent the properties for a certain period, and that would reduce the number of vacant units on the market (or coming on the market). This offer doesn't seem to match that goal.

Fannie already has a program to keep tenants in place if they foreclose on a rented property - and this sounds like Fannie is selling some of these tenant-in-place properties.

Germany's Bundestag votes for Greek Bailout

by Calculated Risk on 2/27/2012 02:03:00 PM

Yesterday I listed some key events in Europe this week and over the next couple of months (list repeated below). The German Bundestag voted overwhelmingly today for the Greek Bailout.

From the WSJ: German Lawmakers Endorse Greek Bailout

Of 591 valid votes cast in the Bundestag, or lower house of Parliament, 496 lawmakers were in favor of the bailout, while 90 were against. Five lawmakers abstained.Feb 27th: Germany's Bundestag votes on Greek Bailout deal (done).

Chancellor Angela Merkel now has a mandate from Parliament to give her approval of the €130 billion ($174.8 bililon) aid package at a meeting of European Union leaders in Brussels this week.

Feb 29th: ECB three year Long Term Refinancing Operation (LTRO)

Feb 29th: Finland lawmakers vote on Greek Bailout deal.

March 1st and 2nd: EU leaders meet in Brussels.

March 8th: €200bn private sector bond swap is scheduled. From the Financial Times Alphaville: A special invitation from the Hellenic Republic ... "The invitation will expire at 9:00 P.M. (C.E.T.) on 8 March 2012, unless extended, re-opened, amended or terminated ..."

March 8th: ECB holds rate meeting

March 12th: Euro-area finance ministers meet in Brussels

March 20th: €14.4bn of Greek bonds scheduled to mature.

March 30th: Euro-area finance ministers meet in Copenhagen.

Late April: Proposed date for Greek general election.

April 22nd: France election.

NY Fed: Delinquent Debt Shrinks while Real Estate Debt Continues to Fall

by Calculated Risk on 2/27/2012 11:30:00 AM

From the NY Fed: Delinquent Debt Shrinks while Real Estate Debt Continues to Fall

Aggregate consumer debt fell $126 billion to $11.53 trillion in the fourth quarter of 2011 according to the Federal Reserve Bank of New York’s latest Quarterly Report on Household Debt and Credit, a 1.1 percent decrease from the $11.66 trillion reported in the prior quarter’s findings.Here is the Q4 report: Quarterly Report on Household Debt and Credit. Here are two graphs:

...

Mortgage and home equity lines of credit (HELOC) balances fell a combined $146 billion, a sign that consumers continue to reduce housing related debt.

After a mild uptick in the third quarter, total household delinquency rates resumed their downward trend in the fourth quarter. The report finds that $1.12 trillion of consumer debt (or 9.8 percent of outstanding debt) is currently delinquent, with $824 billion seriously delinquent (at least 90 days late). Meanwhile about 2.2 percent of mortgage balances transitioned into delinquency during the fourth quarter, resuming the recent trend of reductions in this measure. However, delinquency rates remain elevated compared to historical figures.

"While we continue to see improvements in the delinquent balances and delinquency transition rates this quarter, there has been a noticeable decrease in the rate of improvement compared to 2009-2010," said Andrew Haughwout, vice president and economist at the New York Fed. "Overall it appears that delinquency rates are stabilizing at levels that remain significantly higher than pre-crisis levels."

Click on graph for larger image.

Click on graph for larger image.The first graph shows aggregate consumer debt decreased slightly in Q4. From the NY Fed:

Aggregate consumer debt fell slightly in the fourth quarter. As of December 31, 2011, total consumer indebtedness was $11.53 trillion, a reduction of $126 billion (1.1%) from its September 30, 2011 level. Mortgage balances shown on consumer credit reports fell again ($134 billion or 1.6%) during the quarter; home equity lines of credit (HELOC) balances fell by $12 billion (1.9%). Household mortgage and HELOC indebtedness are now 11.0% and 11.7%, respectively, below their peaks. Consumer indebtedness excluding mortgage and HELOC balances again rose slightly ($20 billion or about 0.8%) in the quarter. Consumers’ non-real estate indebtedness now stands at $2.635 trillion. Student loan indebtedness rose slightly, to $867 billion.

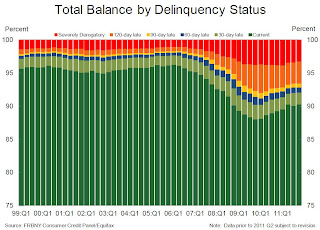

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). The percent of seriously delinquent loans will probably decline quicker now that the mortgage servicer settlement has been reached.

The second graph shows the percent of debt in delinquency. In general, the percent of delinquent debt is declining, but what really stands out is the percent of debt 90+ days delinquent (Yellow, orange and red). The percent of seriously delinquent loans will probably decline quicker now that the mortgage servicer settlement has been reached. From the NY Fed:

As of December 31, 9.8% of outstanding debt was in some stage of delinquency, compared to 10.0% on September 30. About $1.12 trillion of consumer debt is currently delinquent, with $824 billion seriously delinquent (at least 90 days late or “severely derogatory”).There are a number of credit graphs at the NY Fed site.

...

About 2.2% of current mortgage balances transitioned into delinquency during 2011Q4, reinstating the recent trend of reductions in this measure which had been temporarily reversed in 2011Q3. The rate of transition from early (30-60 days) into serious (90 days or more) delinquency also fell slightly, to 28.8%. This reduction in delinquency transitions was accompanied by an improved cure rate: 27.2% of mortgage balances in early delinquency became “current” during the fourth quarter.

NAR: Pending home sales increase in January

by Calculated Risk on 2/27/2012 10:07:00 AM

From the NAR: January Pending Home Sales Rise, Market on Uptrend

The Pending Home Sales Index, a forward-looking indicator based on contract signings, rose 2.0 percent to 97.0 in January from a downwardly revised 95.1 in December and is 8.0 percent higher than January 2011 when it was 89.8. The data reflects contracts but not closings.December was revised down from 96.6, so most of the 2% increase was due to the downward revision. Without the downward revision, this was below the consensus of a 1.5% increase.

The January index is the highest since April 2010 when it reached 111.3 as buyers were rushing to take advantage of the home buyer tax credit.

Contract signings usually lead sales by about 45 to 60 days, so this is for sales in February and March.

Consensus Housing Forecast for 2012: 700,000 starts

by Calculated Risk on 2/27/2012 08:55:00 AM

I guess we can call this the "consensus" forecast for housing starts, from the NABE: NABE Outlook February 2012

Housing starts are expected to increase 19 percent in 2012. The economists surveyed expect housing starts to reach 700,000 units in 2012, up from 610,000 in 2011 and an upward revision from the November forecast. The forecast for 2013 shows continued improvement, with housing starts reaching 850,000 units. Correspondingly, real residential investment is forecast to increase 6.6 percent in 2012, slightly higher than the 4.3 percent predicted in November, and then strengthen further, rising 10 percent in 2013. The projection for home prices in 2012 was lowered slightly from a projected increase in the FHFA index of 0.9 percent (Q4/Q4) in the November survey to home prices remaining unchanged in the February survey. In 2013 home prices are expected to increase slightly more than 2 percent.Here was housing economist Tom Lawler's forecast for 2012.

The following table shows several forecasts for 2012:

| Some Housing Forecasts for 2012 (000s) | |||

|---|---|---|---|

| New Home Sales | Single Family Starts | Total Starts | |

| Consensus (NABE) | 700 | ||

| Merrill Lynch | 330 | 713 | |

| Fannie Mae | 336 | 473 | 704 |

| Wells Fargo | 350 | 457 | 690 |

| John Burns | 359 | 717 | |

| NAHB | 360 | 501 | 709 |

| Tom Lawler | 365 | 515 | 740 |

| Moody's | 530 | 687 | |

| 2011 Actual | 304 | 431 | 609 |

Sunday, February 26, 2012

Question Contest, iPad Update, RSS and Twitter

by Calculated Risk on 2/26/2012 09:23:00 PM

• For fun I've added a monthly question contest on the right sidebar. It takes a Facebook login right now. The contest has two parts: 1) every day, before 9:30 AM ET, you can enter whether you think the S&P 500 will be up or down that day, and 2) I'll ask some economic predictions (for March 1st, I'm asking: Will light vehicle sales increase in February compared to January?)

Contestants receive 1 point for each correct answer (either stocks or economic predictions). At the end of the month, starting in March, I'll list the leaders in a post on the blog. For February, I'm the leader (just a few friends entered). Hey, play along and beat CR!

• iPad layout. Based on feedback, I've switched the iPad layout back to the standard blog layout. For those who liked the touch layout, use this URL touch.calculatedriskblog.com

• RSS Feed: For those interested, here is the RSS feed for Calculatedrisk.

• on Twitter @calculatedrisk (My family friend Sasha Cohen, Olympic skater, economics student at Columbia and future hedge fund manager is on twitter @SashaCohenNYC)

Join the contest - beat CR!

Yesterday:

• Summary for Week ending February 24th

• Schedule for Week of February 26th

Europe: A few key dates

by Calculated Risk on 2/26/2012 07:17:00 PM

This will be another busy week in Europe. Germany and Finland will vote on the new Greek bailout, the ECB will conduct the second LTRO, and EU leaders will meet in Brussels at the end of the week.

Feb 27th: Germany's Bundestag votes on Greek Bailout deal.

Feb 29th: ECB three year Long Term Refinancing Operation (LTRO)

Feb 29th: Finland lawmakers vote on Greek Bailout deal.

March 1st and 2nd: EU leaders meet in Brussels.

March 8th: €200bn private sector bond swap is scheduled. From the Financial Times Alphaville: A special invitation from the Hellenic Republic ... "The invitation will expire at 9:00 P.M. (C.E.T.) on 8 March 2012, unless extended, re-opened, amended or terminated ..."

March 8th: ECB holds rate meeting

March 12th: Euro-area finance ministers meet in Brussels

March 20th: €14.4bn of Greek bonds scheduled to mature.

March 30th: Euro-area finance ministers meet in Copenhagen.

Late April: Proposed date for Greek general election.

April 22nd: France election.

Yesterday:

• Summary for Week ending February 24th

• Schedule for Week of February 26th

2011: Record Low Placements of Manufactured Homes, and Record low Total Completions

by Calculated Risk on 2/26/2012 02:03:00 PM

Last week the Census Bureau released the placements of manufactured homes in December and for all of 2011. Placements were at 3.4 thousand in December, and at a record low of 46.0 thousand for all of 2011.

Although the manufactured home data only goes back to 1980, it is pretty clear that total housing completions (single and multi-family) and manufactured home placements were at record low levels since at least the early '60s. Here is a table of the worst years on record:

| Worst Years for Housing Completions and Placements | |

|---|---|

| Year | Total Completions (000s) |

| 2011 | 631.2 |

| 2010 | 701.6 |

| 2009 | 848.9 |

| 2008 | 1,200.2 |

| 1982 | 1,239.4 |

| 1991 | 1,265.3 |

Unfortunately there is no timely count of household formation, so it is hard to tell how quickly the excess supply of housing is being absorbed.

Note: Household formation is a function of changes in population, and also of changes in household size. During the '70s, the baby boomers started moving out of their parents' homes, and there was a dramatic decrease in the number of persons per household and that led to a huge demand for apartments. We can't directly compare the level of total completions in the '00s to the '70s or '80s - we need to know the number of households being formed.

Click on graph for larger image.

Click on graph for larger image.This graph shows total housing completions and placements since 1980. The net additional to the housing stock is less because of demolitions and destruction of housing units.

Although we don't know the exact number, it is pretty clear that there are more households being formed than housing units completed last year - and the excess supply is being absorbed.

Yesterday:

• Summary for Week ending February 24th

• Schedule for Week of February 26th

Unofficial Problem Bank list increases to 960 Institutions

by Calculated Risk on 2/26/2012 09:18:00 AM

This is an unofficial list of Problem Banks compiled only from public sources.

Here is the unofficial problem bank list for Feb 24, 2012. (table is sortable by assets, state, etc.)

Changes and comments from surferdude808:

As anticipated, the FDIC released its enforcement actions for January 2012 this Friday. Moreover, after playing footsie with community bankers last week as part of an effort to stem proposed Congressional action to broaden the examination appeal process, the FDIC got back to closing a couple this week. The release of these actions and closings contributed to many changes in the Unofficial Problem Bank List. In all, this week there were four removals and eight additions, which leave the list at 960 institutions with assets of $389.7 billion. A year ago, the list held also held 960 institutions but assets were higher at $413.8 billion.

With this being the last Friday of the month, it is time to review changes for the month. After experiencing declines in the number of institutions each month since July 2011, the list count increased by four institutions during February 2012. While the increase in assets of $649 million during the month was small, it was the first increase in total assets since October 2011. Other interesting factoids include the absence of any unassisted mergers during the month, which has not happened since November 2010; and the monthly additions of 16 are the highest since 18 institutions were added in October 2011.

Removals this week include two rehabilitations -- Ridgestone Bank, Brookfield, WI ($423 million) and Fireside Bank, Pleasanton, CA ($278 million Ticker: KMPR); and two failures -- Home Savings of America, Little Falls, MN ($440 million) and Central Bank of Georgia, Ellaville, GA ($276 million).

Among the eight additions are Britton & Koontz Bank, N.A., Natchez, MS ($371 million Ticker: BKBK); Crown Bank, Edina, MN ($258 million); Rabun County Bank, Clayton, GA ($248 million); and Farmers & Merchants Bank, Statesboro, GA ($231 million). After 76 failures, inclusive of the one tonight, many might think there are not any banks left in Georgia to turn bad.

Other changes to the list include the FDIC issuing Prompt Corrective Action orders against 1st Commerce Bank, North Las Vegas, NV ($32 million); First Carolina State Bank, Rocky Mount, NC ($90 million); Pisgah Community Bank, Asheville, NC ($30 million); Sunrise Bank, Valdosta, GA ($86 million); and Sunrise Bank of Albuquerque, Albuquerque, NM ($61 million). All five banks are controlled by Capitol Bancorp, Ltd., which has divested or merged 45 institutions that were under its control during the crisis. Capitol has pending sale agreements for two of the banks just issued PCA orders. Should any bank controlled by Capitol fail, the other 18 banks controlled by Capitol could be liable for the resolution cost should the FDIC decide to apply cross guaranty. The FDIC did not apply cross guaranty to Capitol back in November 2009, when Commerce Bank of Southwest Florida failed, which cost the FDIC insurance fund approximately $31 million.

Next week, the FDIC will likely release its quarterly financial performance report for the fourth quarter of 2010, which will include an update on the Official Problem Bank List figures.

Click on graph for larger image.

Click on graph for larger image.This graph shows the cumulative bank failures for each year starting in 2008. There have been 425 bank failures since the beginning of 2008, and so far, closings this year are running at about half the rate of 2010.

Yesterday:

• Summary for Week ending February 24th

• Schedule for Week of February 26th

Saturday, February 25, 2012

Buffett's Views on Housing

by Calculated Risk on 2/25/2012 06:44:00 PM

In Feb 2010, Warren Buffett wrote:

[W]ithin a year or so residential housing problems should largely be behind us, the exceptions being only high-value houses and those in certain localities where overbuilding was particularly egregious.Of course I disagreed with his timing.

Then in Feb 2011, Buffett wrote:

A housing recovery will probably begin within a year or so. In any event, it is certain to occur at some point.As I noted last year, the key word was "begin" and sure enough - based on housing starts and new home sales - it appears a modest recovery has begun.

Today Buffett wrote:

Last year, I told you that “a housing recovery will probably begin within a year or so.” I was dead wrong.Really? And I was going to give him a little credit this time. Oh well.

More from Buffett:

Housing will come back – you can be sure of that. Over time, the number of housing units necessarily matches the number of households (after allowing for a normal level of vacancies). For a period of years prior to 2008, however, America added more housing units than households. Inevitably, we ended up with far too many units and the bubble popped with a violence that shook the entire economy. That created still another problem for housing: Early in a recession, household formations slow, and in 2009 the decrease was dramatic.Buffett makes several key points:

That devastating supply/demand equation is now reversed: Every day we are creating more households than housing units. People may postpone hitching up during uncertain times, but eventually hormones take over. And while “doubling-up” may be the initial reaction of some during a recession, living with in-laws can quickly lose its allure.

At our current annual pace of 600,000 housing starts – considerably less than the number of new households being formed – buyers and renters are sopping up what’s left of the old oversupply. (This process will run its course at different rates around the country; the supply-demand situation varies widely by locale.) While this healing takes place, however, our housing-related companies sputter, employing only 43,315 people compared to 58,769 in 2006. This hugely important sector of the economy, which includes not only construction but everything that feeds off of it, remains in a depression of its own. I believe this is the major reason a recovery in employment has so severely lagged the steady and substantial comeback we have seen in almost all other sectors of our economy.

1) Housing completions have been at record lows.

2) There are currently more households being formed than new housing units completed, and this is decreasing the excess supply.

3) The excess supply will be "sopped up" at different rates across the country.

4) Housing is a key reason for the sluggish economy (not the only reason).

Earlier:

• Summary for Week ending February 24th

• Schedule for Week of February 26th