by Calculated Risk on 9/29/2011 01:45:00 PM

Thursday, September 29, 2011

Employment: Comment on preliminary annual benchmark revision

This morning the BLS released the preliminary annual benchmark revision of +192,000 payroll jobs. The final revision will be published next February when the January 2012 employment report is released February 3, 2012. Usually the preliminary estimate is pretty close to the final benchmark estimate.

The annual revision is benchmarked to state tax records. From the BLS:

Establishment survey benchmarking is done on an annual basis to a population derived primarily from the administrative file of employees covered by unemployment insurance (UI). The time required to complete the revision process—from the full collection of the UI population data to publication of the revised industry estimates—is about 10 months. The benchmark adjustment procedure replaces the March sample-based employment estimates with UI-based population counts for March. The benchmark therefore determines the final employment levels ...Using the preliminary benchmark estimate, this means that payroll employment in March 2011 was 192,000 higher than originally estimated. In February 2012, the payroll numbers will be revised up to reflect this estimate. The number is then "wedged back" to the previous revision (March 2010).

Click on graph for larger image.

Click on graph for larger image.This graph shows the impact of the preliminary benchmark revision on job losses in percentage terms from the start of the employment recession.

The red line on the graph is the current estimate, and the dotted line shows the impact of estimated coming benchmark revision. This puts the current payroll employment about 6.7 million jobs below the pre-recession peak in December 2007. Still very ugly.

For details on the benchmark revision process, see from the BLS: Benchmark Article and annual benchmark revision for the new preliminary estimate.

The following table shows the benchmark revisions since 1979.

| Year | Percent benchmark revision | Benchmark revision (in thousands) |

|---|---|---|

| 1979 | 0.5 | 447 |

| 1980 | -0.1 | -63 |

| 1981 | -0.4 | -349 |

| 1982 | -0.1 | -113 |

| 1983 | * | 36 |

| 1984 | 0.4 | 353 |

| 1985 | * | -3 |

| 1986 | -0.5 | -467 |

| 1987 | * | -35 |

| 1988 | -0.3 | -326 |

| 1989 | * | 47 |

| 1990 | -0.2 | -229 |

| 1991 | -0.6 | -640 |

| 1992 | -0.1 | -59 |

| 1993 | 0.2 | 263 |

| 1994 | 0.7 | 747 |

| 1995 | 0.5 | 542 |

| 1996 | * | 57 |

| 1997 | 0.4 | 431 |

| 1998 | * | 44 |

| 1999 | 0.2 | 258 |

| 2000 | 0.4 | 468 |

| 2001 | -0.1 | -123 |

| 2002 | -0.2 | -313 |

| 2003 | -0.2 | -122 |

| 2004 | 0.2 | 203 |

| 2005 | -0.1 | -158 |

| 2006 | 0.6 | 752 |

| 2007 | -0.2 | -293 |

| 2008 | -0.1 | -89 |

| 2009 | -0.7 | -902 |

| 2010 | -0.3 | -378 |

| 2011 | 0.1 | 192 (estimate) |

| * less than 0.05% | ||

Kansas City Manufacturing Survey: Manufacturing activity expands "modestly" in September

by Calculated Risk on 9/29/2011 11:00:00 AM

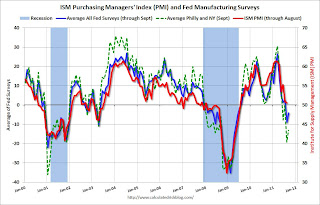

This is the last of the regional Fed surveys for September. The regional surveys provide a hint about the ISM manufacturing index - and the regional surveys were weak in September, but not as weak as in August.

From the Kansas City Fed: Growth in Manufacturing Activity Edged Higher

Growth in Tenth District manufacturing activity edged higher in September. Expectations moderated slightly, but producers on net still anticipated increased activity over the next six months. Price indexes moved up modestly, with slightly more producers planning to raise selling prices.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

The month-over-month composite index was 6 in September, up from 3 in August and 3 in July ... The employment index increased for the second straight month, but the new orders for exports index fell slightly after rising last month.

“Factory activity in our region continues to grow modestly, and firms generally expect this trend to continue,” said Wilkerson. “Price indexes also edged higher this month after generally decelerating earlier in the summer.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The New York and Philly Fed surveys are averaged together (dashed green, through September), and five Fed surveys are averaged (blue, through September) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through August (right axis).

The ISM index for September will be released Monday, Oct 3rd and this suggests another weak reading in September.

Earlier:

• Weekly Initial Unemployment Claims decline sharply to 391,000

• Misc: GDP revised up, Employment to be revised up, Germany approves EFSF changes, Pending Home sales decline

Misc: GDP revised up, Employment to be revised up, Germany approves EFSF changes, Pending Home sales decline

by Calculated Risk on 9/29/2011 10:00:00 AM

• From the BLS: Current Employment Statistics Preliminary Benchmark Announcement

In accordance with usual practice, the Bureau of Labor Statistics (BLS) is announcing the preliminary estimate of the upcoming annual benchmark revision to the establishment survey employment series. The final benchmark revision will be issued on February 3, 2012, with the publication of the January 2012 Employment Situation news release.Usually the final benchmark revision is pretty close to the preliminary revision.

Each year, the Current Employment Statistics (CES) survey employment estimates are benchmarked to comprehensive counts of employment for the month of March. These counts are derived from state unemployment insurance (UI) tax records that nearly all employers are required to file. ... The preliminary estimate of the benchmark revision indicates an upward adjustment to March 2011 total nonfarm employment of 192,000 (0.1 percent).

• The BEA reported that GDP increased at a 1.3% real annual rate in Q2 (third estimate), revised up from the previously reported 1.0% increase. It was still a weak quarter, but the internals were positive: the contributions from consumption and trade were revised up, and the contribution from "change in private inventories" was revised down.

• From the NAR: Pending Home Sales Decline in August

The Pending Home Sales Index,* a forward-looking indicator based on contract signings, declined 1.2 percent to 88.6 in August from 89.7 in July but is 7.7 percent above August 2010 when it stood at 82.3. The data reflects contracts but not closings.• From Bloomberg: German Parliament Backs Euro Rescue Fund

The lower house of parliament passed the measure with 523 votes in favor and 85 against, granting the fund powers to buy bonds in secondary markets, enable bank recapitalizations and offer precautionary credit lines.A key point: German Chancellor Merkel's ruling coalition party backed the bill.

Weekly Initial Unemployment Claims decline sharply to 391,000

by Calculated Risk on 9/29/2011 08:30:00 AM

The DOL reports:

In the week ending September 24, the advance figure for seasonally adjusted initial claims was 391,000, a decrease of 37,000 from the previous week's revised figure of 428,000. The 4-week moving average was 417,000, a decrease of 5,250 from the previous week's revised average of 422,250.The following graph shows the 4-week moving average of weekly claims since January 2000 (there is a longer term graph in graph gallery).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims declined this week to 417,000.

This is the lowest level for weekly claims since early April, although the 4-week average is still elevated.

Wednesday, September 28, 2011

Treasury: Mortgage loan fraud suspicious activity reports increased in Q2, Most occurred during bubble

by Calculated Risk on 9/28/2011 09:31:00 PM

From Treasury: Second Quarter Mortgage Loan Fraud Suspicious Activity Persists

The Financial Crimes Enforcement Network (FinCEN) today reported in its Second Quarter 2011 Analysis of mortgage loan fraud suspicious activity reports (MLF SARs) that financial institutions filed 29,558 MLF SARs in the second quarter of 2011 up from 15,727 MLF SARs reported in the same quarter of 2010.The most common mortgage loan fraud suspicious activity was the misrepresentation of income, occupancy, debts, or assets (about 30%). Some of the more current frauds are related to debt elimination and short sale fraud (unfortunately attempted short sale fraud is very common).

A large majority of the MLF SARs examined in the second quarter involved mortgages closed during the height of the real estate bubble. The upward spike in second quarter MLF SAR numbers is directly attributable to mortgage repurchase demands and special filings generated by several institutions. For instance, FinCEN noted that 81 percent of the MLF SARs filed during the quarter involved suspicious activities that occurred before 2008; 63 percent involved suspicious activities that occurred four or more years ago.

"We're continuing to see a large number of SARs filed on activity that occurred more than two years ago, an indication that financial institutions are uncovering fraud as they sift through defaulted mortgages," said FinCEN Director James H. Freis, Jr.

FinCEN has some Mortgage Fraud SAR Datasets breaking down the data by state, MSA and county. California was #1 in Q2 (Nevada or Florida have usually been #1). San Jose-Sunnyvale-Santa Clara, CA was the #1 MSA.

And in a related story from the AP: Santa Rosa Hells Angels leaders indicted on loan fraud. This involved a mortgage broker and false statement of income and assets to buy marijuana "grow houses". Oh my ...

Lawler: Best Guess for August Pending Home Sales

by Calculated Risk on 9/28/2011 05:31:00 PM

From economist Tom Lawler:

It is difficult to “work up” an estimate of the NAR’s Pending Home Sales Index from local Realtor associations/boards/MLS, for several reasons. First, many of these A/B/M’s don’t release “new” pending sales data (that is, data on contracts signed in a month). Indeed, many don’t track such data at all, and as a result the NAR’s PHSI is based on a sample size about half as large as that used to estimate closed existing home sales. And second, some publicly-released A/B/M reports are run early in the month, and have preliminary pending sales that are often revised by a lot in subsequent months.

As such, my estimate of the NAR’s PHSI is subject to far more uncertainty than are my estimates for closed existing home sales.

Based on the data I do have, however, I estimate that the NAR’s August Pending Home Sales Index will probably come in about 3.5% higher than the July PHSI on a seasonally adjusted basis. While, as always, reported YOY gains vary massively across various A/B/M’s, almost all showed YOY gains and many – including but not limited to several in the Midwest – showed hefty YOY increases. Of course, July’s PHSI on a seasonally adjusted basis was 9% higher than last August’s, and this August had one more business day than last August. As such, a national YOY gain in unadjusted pending sales for August of close to 12% would produce a flat seasonally adjusted reading versus July.

In looking at various regional reports, only a handful showed YOY declines (including a few but not even close to all Florida markets), several showed modest single-digit gains (including several in the Northeast), but quite a few showed YOY gains of 20% or more (and a few by a LOT more).

A 3.5% gain would be well above the “consensus” forecast of a moderate decline.

CR Note: The NAR is scheduled to release Pending Home sales for August tomorrow (Thursday) at 10 AM ET. The consensus is for a 2% decrease in the index.

Europe Update

by Calculated Risk on 9/28/2011 03:54:00 PM

From the WSJ: Euro-Zone Bailout Plan Progresses

The euro zone is on track to expand its bailout fund ... But the debate ... has already moved on to two thornier issues: a more radical increase in the scope of bailouts, and possible debt restructuring for Greece.And a roundup of events from the Financial Times: Rolling blog: the eurozone crisis

Greece's failure to close its budget shortfall is prompting some European governments, led by Germany, to push for a re-examination of the international bailout program for Athens ... In return, Germany is under pressure to agree to "leverage" the euro-zone bailout fund ...

• José Manual Barroso, president of the European Commission, gave his annual State of the Union address ... in which he insisted Greece would remain a member of the euro, and formally approved proposals for a tax on financial transactions ...The Greek 2 year yield is at 70%. The Greek 1 year yield is at 131%.

• The European Commission confirmed that the troika would return to Athens on Thursday ... and said an additional ‘eurogroup meeting’ (where European finance ministers meet up) would be held in October to “consider the disbursement of the next tranche” of bailout money

• Finland voted to approve expanding the powers of the [EFSF]

• German inflation hit a 3-year high

• French president Nicolas Sarkozy pledged to [reduce the French] budget deficit to 3 per cent of gross domestic product in 2013

The Portuguese 2 year yield is up to 18% and the Irish 2 year yield was down sharply to 7.6%. Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Fed's Rosengren: Housing and Economic Recovery

by Calculated Risk on 9/28/2011 01:43:00 PM

From Boston Fed President Eric Rosengren: Housing and Economic Recovery

A few excepts and couple of graphs that highlight two topics we've discussed for years:

[E]even though residential investment is a small share of GDP (today only 2.2 percent), it is quite interest-sensitive – it can decline quite dramatically as interest rates rise, and expand quickly when interest rates are relatively low. So it has been a disproportionally important part of the monetary policy transmission mechanism.

In the current situation, however, U.S. mortgage rates are quite low but residential investment has not been the engine of growth that it normally is in economic recoveries. As shown in Figure 4, exports have been a source of strength in the first two years of the U.S. recovery, and business fixed investment has grown at approximately the same rate in this recovery as in the previous three. Yet the household sector has been particularly weak. Consumption, which accounts for approximately 70 percent of U.S. GDP, has grown only about half as much in the first two years of the recovery as it did in the previous three recoveries. And the shortfall for residential investment is even more striking. In the previous three recoveries, residential investment grew over 30 percent on average in the first years of the recovery – but has actually decreased in the first two years of this recovery. ...

CR Note: Residential investment (RI) is usually an engine of recovery, but with the huge overhang of existing vacant housing units, RI didn't contribute during the first two years this time. This is exactly what we've expected.

The weak housing sector also has an impact on employment. Figure 9 shows that far fewer jobs have been created in the first two years of this recovery (the left bar in each pair) than in previous recoveries (the right bar in the pair). In fact, construction jobs have continued to decline during the first two years of this recovery – we have lost over a half a million construction jobs since the recovery began. While construction employment is typically volatile during a recovery, on average the sector adds roughly 150,000 jobs.

Indeed, ... employment in construction has declined by 9 percent in the first two years of this recovery compared to growth over 4 percent during the previous three recoveries. And weak construction employment and activity also reduces the demand for labor in sectors that support construction.

CR Note: Employment is been especially weak in this recovery, and construction employment was especially hard hit. In addition to the excess housing inventory, there is excess capacity in most industries - and households have too much debt and are deleveraging.

The little bit of good news is that Residential Investment will make a positive contribution to growth this year (mostly from multi-family and home improvement), and construction employment will probably increase this year (not much).

Existing Home Inventory continues to decline year-over-year in September

by Calculated Risk on 9/28/2011 10:24:00 AM

In June, Tom Lawler posted on how the NAR estimates existing home inventory. The NAR does NOT aggregate data from the local boards (see Tom's post for how the NAR estimates inventory).

In a few months the NAR will revise down their estimates fpr inventory and sales of existing homes for the last few years. Also the NAR methodology for estimating sales and inventory will be changed.

I think the HousingTracker / DeptofNumbers data that Tom mentioned provides a timely estimate of changes in inventory. Ben at deptofnumbers.com is tracking the aggregate monthly inventory for 54 metro areas.

![]() Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

This graph shows the NAR estimate of existing home inventory through August (left axis) and the HousingTracker data for the 54 metro areas through September. The HousingTracker data shows a steeper decline in inventory over the last few years (as mentioned above, the NAR will probably revise down their inventory estimates this fall).

![]() The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

The second graph shows the year-over-year change in inventory for both the NAR and HousingTracker.

HousingTracker reported that the September listings - for the 54 metro areas - declined 16.7% from last year.

Of course there is a large percentage of distressed inventory, and various categories of "shadow inventory" too. But the decline in listed or "visible" inventory is a key story in 2011 - and listed inventory for September is probably down to the lowest level since September 2005.

Note: inventory surged in the late 2005 and early 2006 - a key sign that the housing bubble was bursting.

MBA: Mortgage Purchase Application Index increases

by Calculated Risk on 9/28/2011 07:22:00 AM

Note: The graph below includes the enhanced sample discussed last week. "The survey captures more than 75% of all U.S. retail and consumer direct mortgage applications, compared to 50% previously." For a discussion of the changes, see: Presentation to Discuss Enhancements to MBA’s Weekly Applications Survey.

There is also additional data. The weekly survey now includes mortgage rates for both conforming and jumbo loans. There is also a new Monthly Profile report (see sample here: Monthly Profile of State and National Mortgage Activity). This report breaks down the monthly application data by product type, size of loans, and state data. This appears very useful for short-term prepay modeling given the differences across states. This report is only available to subscribers.

The MBA reports: Mortgage Applications Increase in Latest MBA Weekly Survey

The Refinance Index increased 11.2 percent from the previous week. The seasonally adjusted Purchase Index increased 2.6 percent from one week earlier.The following graph shows the MBA Purchase Index and four week moving average since 1990.

...

"Mortgage rates declined last week, at least partially in response to the Fed's announcement that they would shift their portfolio towards longer-term Treasury securities, and that they would resume buying mortgage-backed securities," said Mike Fratantoni, MBA's Vice President of Research and Economics. "With lower rates, refinance application volume increased to its highest level since August 19, 2011. Purchase application volume also increased. However, the increase was in conventional purchase applications, which were up by 4.9 percent. Purchase applications for government loans fell by 0.6 percent over the week, likely influenced by the pending decline in FHA loan limits."

...

The average loan size of all loans for home purchase in the US was $212,700 in August 2011, up from $211,200 in July 2011. The average loan size for a refinance was $241,300, up from $209,200 in July.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($417,500 or less) decreased to 4.25 percent from 4.29 percent, with points decreasing to 0.35 from 0.41 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $417,500) decreased to 4.51 percent from 4.55 percent, with points decreasing to 0.38 from 0.46 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.August was an especially weak month for this index. This increase was pretty small, and although this doesn't include the large number of cash buyers, this suggests fairly weak home sales in September and October.