by Calculated Risk on 7/22/2011 06:10:00 PM

Friday, July 22, 2011

Bank Failures #56 & 57 in 2011: Two banks in Florida

Momentum reversed collapse

Sisyphean task

by Soylent Green is People

From the FDIC: American Momentum Bank, Tampa, Florida, Acquires All the Deposits of Two Florida Banks: Southshore Community Bank, Apollo Beach and LandMark Bank of Florida, Sarasota

As of March 31, 2011, Southshore Community Bank had approximately $46.3 million in total assets and $45.3 million in total deposits; and LandMark Bank of Florida had total assets of $275.0 million and total deposits of $246.7 million. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) for Southshore Community Bank will be $8.3 million and for LandMark Bank of Florida, $34.4 million. ... The closings are the 56th and 57th FDIC-insured institutions to fail in the nation so far this year and the eighth and ninth in Florida.Friday is here!

Goldman Sachs Lowers estimate of Excess Vacant Housing Supply

by Calculated Risk on 7/22/2011 04:27:00 PM

The current number of excess vacant housing units is a key piece of data for the housing market. Unfortunately available data is inconsistent.

Economist Tom Lawler has been arguing that many analysts are overestimating the vacant supply by using the HVS - and Lawler has been using the 2010 Census data to make his case. See: The “Excess Supply of Housing” War and Census 2010 Demographic Profile: Highlights, Excess Housing Supply Estimate, and Comparison to HVS

Lawler has also pointed out the most commonly used data for the homeownership rate appears incorrect. The Census Bureau agrees: Census Bureau on Homeownership Rate: We've got “Some 'Splainin' to Do”

Today Goldman Sachs lowered their estimate of the excess supply.

While the decennial census data are from the largest sample, we do not believe it is appropriate to ignore the other sources. ...A range of 2.2 years to 5.1 years to clear the excess inventory? We need better data!

With the 2010 Census results in hand, we would now say that excess vacancies in the housing market are 1.5 to 3.5 million units—a wide range, reflecting discrepancies in the available data.

Clearly though, the census results suggest the risks to our previous estimate of 3.5 million units are to the downside. ... [A]t the current rate of housing production and with household growth of one million per year, it would take 5.1 years to clear 3.5 million units of excess inventory, but only 2.2 years to clear 1.5 million units of excess inventory.

Lawler thinks the excess supply is closer to the low end of that range.

Note: The Census Bureau is looking at the various data sources now, and is expected to provide analysis on the differences soon.

Mortgage Rates and Refinance Activity

by Calculated Risk on 7/22/2011 02:29:00 PM

Freddie Mac reported this week: 30-Year Fixed-Rate Mortgage Ticks Up To 4.52 Percent

Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®), which shows mortgage rates changing little over the previous week following mixed economic and housing data. The 30-year fixed average 4.52 percent and the 15-year fixed averaged 3.66 percent.To put this into perspective, here is a long term graph of 30 year mortgage rate in the Freddie Mac survey:

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The Freddie Mac survey started in 1971. Mortgage rates are currently near the low for the last 40 years (mortgage rates close to this range in the '50s).

The monthly low was 4.23% in October 2010.

The second graphs shows refinance activity and mortgage rates:

This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®.

This graph shows the MBA's refinance index (monthly average) and the the 30 year fixed rate mortgage interest rate from the Freddie Mac Primary Mortgage Market Survey®. It takes lower and lower rates to get people to refi (at least lower than recent purchase rates).

With 30 year mortgage rates still about 0.3 percentage points above the lows of last October, mortgage refinance activity has only picked up a little recently.

State Unemployment Rates "little changed" in June

by Calculated Risk on 7/22/2011 10:00:00 AM

From the BLS: Regional and State Employment and Unemployment Summary

Regional and state unemployment rates were little changed in June. Twenty-eight states and the District of Columbia registered unemployment rate increases, 8 states recorded rate decreases, and 14 states had no rate change, the U.S. Bureau of Labor Statistics reported today.The following graph shows the current unemployment rate for each state (red), and the max during the recession (blue). If there is no blue (only Louisiana in May), the state is currently at the maximum during the recession.

...

Nevada continued to register the highest unemployment rate among the states, 12.4 percent in June. California had the next highest rate, 11.8 percent. North Dakota reported the lowest jobless rate, 3.2 percent, followed by Nebraska, 4.1 percent ...

Nevada recorded the largest jobless rate decrease from June 2010 (-2.5 percentage points). Two other states had rate decreases of at least 2.0 percentage points--Michigan (-2.1 points) and Indiana (-2.0 points). Eleven additional states had smaller but also statistically significant decreases over the year. The remaining 36 states and the District of Columbia registered unemployment rates that were not appreciably different from those of a year earlier.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The states are ranked by the highest current unemployment rate.

Nevada saw the most improvement year-over-year in June, but still has the highest state unemployment rate.

Two states and D.C. are still at the recession maximum (no improvement): Arkansas and Montana. The fact that 36 states and the District of Columbia have seen little or no improvement over the last year is a reminder that the unemployment crisis is ongoing.

Greece: Fitch warns of ‘selective default’

by Calculated Risk on 7/22/2011 08:49:00 AM

Here it is - no surprise. From Bloomberg: Fitch Ratings Says Greece Faces ’Restricted Default’ After New Debt Pact

Yields have fallen sharply this morning ...

The Greek 2 year yield is down to 25.7% (was above 39%).

The Portuguese 2 year yield is down to 14.9% (was above 20%)

The Irish 2 year yield is down to 14.7% (was above 23%).

The Italian 2 year yield is down to 3.6%. And the Spanish 2 year yield is down to 3.7%.

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Thursday, July 21, 2011

Greek Default and more

by Calculated Risk on 7/21/2011 10:23:00 PM

Earlier today:

• Philly Fed Survey: "Regional manufacturing remained weak in July"

This is a day to remember - Greece will now default - so this is probably worth one more post (I haven't seen a rating agency downgrade them yet). For details: STATEMENT BY THE HEADS OF STATE OR GOVERNMENT OF THE EURO AREA

AND EU INSTITUTIONS.

Note: The history of the European bailouts is deny first, then act later. So naturally the following denial of additional defaults just raises the question of "when" for many observers:

"As far as our general approach to private sector involvement in the euro area is concerned, we would like to make it clear that Greece requires an exceptional and unique solution.And here is a look at European bond spreads from the Atlanta Fed weekly Financial Highlights released today (graph as of July 20th). The spreads have declined sharply since the Euro Zone announcement.

...

All other euro countries solemnly reaffirm their inflexible determination to honour fully their own individual sovereign signature and all their commitments to sustainable fiscal conditions and structural reforms."

From the Atlanta Fed:

In recent days, Italy has become the next euro-area member to come under financial market pressure. Along with Greece, Portugal, Spain, and Ireland, Italian bond spreads (over German bonds) have continued to widen.Note: I added arrows pointing to the various bailouts starting with the first bailout for Greece, followed by Ireland, Portugal and then Greece again.

• Early last week, amid political uncertainty over intra-euro zone negotiations, Italian bond spreads spiked higher. Since the June FOMC meeting, the 10-year Italian-to-German bond spread has widened by nearly 108 bps through July 19. The spreads for Ireland and Portugal have soared higher by 276 bps and 262 bps, respectively, over the same period.

• Greek bond spreads remain extremely elevated, 140 bps higher since the June FOMC meeting, at 16.3 percent over German bonds. Spain’s spread also rose 80 bps

Other House Price Indexes

by Calculated Risk on 7/21/2011 05:45:00 PM

In addition to Case-Shiller and CoreLogic, I follow the following house price indexes: : RadarLogic (based on a house price per square foot method), FNC Residential Price Index (a hedonic price index), Clear Capital, Altos Research and Zillow.

CoreLogic already reported that the CoreLogic HPI increased 0.8% in May.

• FNC reported:

Based on the latest data on non-distressed home sales (existing and new homes), FNC’s Residential Price Index™ (RPI) indicates that single-family home prices were up again in May at a seasonally unadjusted rate of 0.8%.You can see the FNC composite indexes, and prices for 30 cities here.

...

Minneapolis, Boston, Charlotte, Portland, Chicago, and Washington D.C. show the strongest price momentum – rising month-over-month since March by a cumulative total of 9.2%, 7.1%, 5.7%, 5.5%, 5.3% and 3.5% respectively. Orlando and Phoenix, on the other hand, lead the nation in home price declines during 2011–having lost close to 5.0% over the last five months, followed by Las Vegas, New York, and Miami at about 3.0%.

• The FHFA (GSEs only): FHFA House Price Index Rises 0.4 Percent in May; Second Consecutive Monthly Increase

U.S. house prices rose 0.4 percent on a seasonally adjusted basis from April to May, according to the Federal Housing Finance Agency’s monthly House Price Index. The previously reported 0.8 percent increase in April was revised to a 0.2 percent increase. For the 12 months ending in May, U.S. prices fell 6.3 percent.• From RadarLogic Weak Fundamentals Undermine Seasonal Strength in Home Prices:

While the RPX Composite increased somewhat during April and gained 1.2 percent month-over-month in May, these gains have barely offset declines inAnd RadarLogic's prediction for Case-Shiller Not Seasonally Adjusted:

January. In contrast to this year’s performance to date, the RPX Composite Price increased significantly over the same period during seven of the past ten years.

Home prices usually increase in the spring due to seasonal factors, and the bulk of the gains typically occur by May. The lackluster performance of the RPX Composite Price to date means that we are almost assured to see new post-bust lows in the fall, when seasonal strength comes to an end and softening demand pulls housing prices downward.

Last month, we predicted that the S&P/Case-Shiller 10-City composite for April 2011 would be about 153 and the 20-City composite would be roughly 140. In fact, the 10-City composite was 152.51 and the 20-City composite was 138.84.This suggests a slight increase for the Case-Shiller index on a seasonally adjusted basis.

This month, we expect the May 2011 10-City composite index to be about 154 and the 20-City index to be roughly 141.

Overall this suggests most of the recent increase in prices is seasonal, and we'd expect to see declines again late this year. The Case-Shiller index for May will be released Tuesday, July 26th at 9 AM ET.

European Summit Statement Approved

by Calculated Risk on 7/21/2011 03:03:00 PM

UPDATE2: STATEMENT BY THE HEADS OF STATE OR GOVERNMENT OF THE EURO AREA

AND EU INSTITUTIONS

Update: Herman Van Rompuy said "Private sector involvement is for Greece and Greece only" (paraphrase). The lower interest rates are for Greece, Portugal and Ireland.

From Herman Van Rompuy, President of the European Council "Statement by the heads of state or government of the Euro area & EU institutions is approved. More details at the press conference."

Just a few resources ...

• The Guardian is providing live updates.

• The Telegraph is also providing live updates.

• There will be European Council press conference later today. The time is still uncertain. Here is the video feed Meeting of Heads of State or Government of the Euro area - press conference (time TBD).

• European Commission - Audiovisual services

• The press release should be available here.

• Any statement from the ECB will probably be here.

Europe Update: Some Details, More Later

by Calculated Risk on 7/21/2011 12:15:00 PM

The details are sketchy - it appears the EFSF will have new powers, terms will be extended for Greece, Portugal and Ireland at lower rates - and "selective default" for Greece will be allowed.

The announcement will be later today.

From the NY Times: Greek Rescue Plan May Allow for Default on Some Debt

According to the draft declaration, euro zone leaders gathered in Brussels are set to agree on a series of measures to lighten the burden on Greece, Ireland and Portugal ... the euro zone leaders were also being asked to give wide-ranging new powers to the region’s bailout fund, the European Financial Stability Facility, by allowing it to buy government bonds on the secondary market and to help recapitalize banks where necessary.From the WSJ: Euro Zone Moves Toward Greek Deal

...

According to the draft, the maturity of European loans to Greece would be extended from the current 7.5 years to a minimum of 15 years and at interest rates of around 3.5 percent.

Similar help through reduced borrowing costs would be extended to Portugal and Ireland.

Some of the options to ease Greece's debt to bondholders would probably cause losses to banks and others, and trigger a temporary assessment of default against Greece by credit-rating agencies.The Greek 2 year yield is down to 33.8% (was above 39%).

Finance Minister Jan Kees de Jager said Thursday that euro-zone governments seem to have accepted that Greece will be put into "selective default" when the country gets a new financial-aid package.

The Portuguese 2 year yield is down to 17.1% (was above 20%)

The Irish 2 year yield is down to 19.1% (was above 23%).

The Italian 2 year yield is down to 3.6%. And the Spanish 2 year yield is down to 3.8%.

Here are the links for bond yields for several countries (source: Bloomberg):

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Philly Fed Survey: "Regional manufacturing remained weak in July"

by Calculated Risk on 7/21/2011 10:00:00 AM

From the Philly Fed: July 2011 Business Outlook Survey

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, increased to 3.2 from -7.7 [any reading above zero is expansion]. The demand for manufactured goods, as measured by the current new orders index, improved from last month but suggests flat demand: The index rose 8 points to a reading of zero ...This indicates a little expansion in July. This was about at the consensus of 5.0.

Firms’ responses suggest a slight improvement in the labor market compared to June. The current employment index increased 5 points and remained positive for the 11th consecutive month. ...

Diffusion indexes for prices paid and prices received were lower this month and suggest a continued trend of moderating price pressures. The prices paid index declined 2 points, following a sharp drop of 22 points last month.

...

The broadest indicator of future activity improved markedly this month, rebounding from its lowest reading in 31 months in June.

Click on graph for larger image in graph gallery.

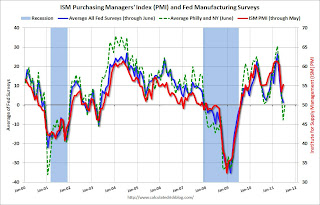

Click on graph for larger image in graph gallery.Here is a graph comparing the regional Fed surveys and the ISM manufacturing index. The dashed green line is an average of the NY Fed (Empire State) and Philly Fed surveys through July. The ISM and total Fed surveys are through June.

The averaged Empire State and Philly Fed surveys are back close to zero combined. July was a little better than June for both surveys.