by Calculated Risk on 6/21/2011 10:00:00 AM

Tuesday, June 21, 2011

May Existing Home Sales: 4.81 million SAAR, 9.3 months of supply

The NAR reports: Existing-Home Sales Decline in May

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, fell 3.8 percent to a seasonally adjusted annual rate of 4.81 million in May from a downwardly revised 5.00 million in April, and are 15.3 percent below a 5.68 million pace in May 2010 when sales were surging to beat the deadline for the home buyer tax credit.

...

Total housing inventory at the end of May fell 1.0 percent to 3.72 million existing homes available for sale, which represents a 9.3-month supply at the current sales pace, up from a 9.0-month supply in April

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in May 2011 (4.81 million SAAR) were 3.8% lower than last month, and were 15.3% lower than in May 2010.

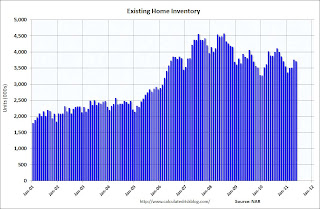

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory decreased to 3.72 million in May from 3.76 million in April.

The last graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, so it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 4.4% year-over-year in May from May 2010. This is the fourth consecutive month with a YoY decrease in inventory.

Inventory decreased 4.4% year-over-year in May from May 2010. This is the fourth consecutive month with a YoY decrease in inventory.Inventory should increase over the next couple of months months (the normal seasonal pattern), and the YoY change is something to watch closely this year.

Months of supply increased to 9.3 months in May, up from 9.0 months in April. This is much higher than normal. These sales numbers were slightly above the consensus of 4.75 million SAAR (Lawler's forecast was 4.8 million using the NAR method).

There was no mention of the coming revisions. I'll have more later.

Miami Condos: Foreign Cash Buyers

by Calculated Risk on 6/21/2011 09:05:00 AM

Existing home sales will be released soon.

Here is an article from Bloomberg: Brazilians Buy Miami Condos at Bargain Prices(ht Nanoo-Nanoo)

Surging real estate prices in Brazil and the currency’s 45 percent gain against the U.S. dollar since 2008 are sending Brazilians to South Florida in search of bargain vacation homes and property investments. That’s helping bolster Miami’s condo market ... As many as half of the downtown Miami condos that have been sold to foreigners for more than $500,000 since January were purchased by Brazilians.This doesn't help in most overbuilt areas. But it does help a little in some areas - like Miami - and they are paying all cash.

Monday, June 20, 2011

Greek Prime Minister Faces a confidence vote today

by Calculated Risk on 6/20/2011 08:13:00 PM

Or maybe a "no confidence" vote ...

From Bloomberg: Papandreou Faces Confidence Vote That May Decide Greece’s Fate

Greek Prime Minister George Papandreou faces a confidence vote in his government today that may determine whether Greece becomes the first euro-area country to default.If this is tonight (June 20), it is already after midnight in Athens.

...

The debate on the confidence motion, which began on June 19, will end around midnight.

I expect a vote of confidence ... I think everyone will try to put off a default for as long as possible.

Lawler: Closed Home Sales Down, Pending Sales Up in May

by Calculated Risk on 6/20/2011 03:45:00 PM

CR Note: Existing home sales for May will be released tomorrow and the Pending Home Sales Index on Wednesday June 29th. Hopefully the NAR will provide an update tomorrow on the timing of the benchmark revisions.

From economist Tom Lawler: Closed Home Sales Down, Pending Sales Up in May

Based on data from local realtor associations/boards/MLS, it certainly appears as if existing home sales declined on a seasonally adjusted basis in May relative to April, with sales based on the National Association of Realtors’ estimation methodology likely to come in at around a seasonally adjusted annual rate of around 4.75 - 4.80 million, down from 5.05 million in April.

The incoming data also suggest, however, that the NAR’s Pending Home Sales Index – which took a surprisingly sharply tumble in April (down 11.6% on a seasonally adjusted basis from March) – rebounded smartly in May.

Trying to “build up” a pending home sales index estimate from local data is challenging, as not all associations/boards/MLS report “new” pending sales – i.e., contracts signed in a month – to the public. Indeed, not all associations/boards/MLS even TRACK new pending sales, including many in the NAR’s existing home sales sample – and thus, of course, do not report new pending sales to the NAR. According to the NAR, the sample size for its pending home sales index is about half as large as the sample size used to estimate closed existing home sales. The NAR’s PHSI data also only goes back to 2001, making seasonal factors somewhat “imprecise.”

In looking at associations/boards/MLS/etc that DO report on new pending sales/contracts signed, however, it appears as if there was a substantial rebound in pending sales on a seasonally adjusted basis.

Below is a table showing the YOY % change in the NOT seasonally adjusted NAR PHSI compared to the YOY % change in new pending sales/contracts written reported by various associations/etc1 that together comprised over 52,000 pending sales last month. It is NOT a sample representative of the country as a whole, though it does have data from all broad regions.

| YOY % Change, New Pending Sales, 2011 v 2010 | NAR PHSI (NSA) | NAR PHSI (SA) | ||||

|---|---|---|---|---|---|---|

| NAR PHSI | Select MLS | 2010 | 2011 | 2010 | 2011 | |

| Jan | -4.4% | 1.1% | 74.3 | 71.0 | 90.3 | 88.9 |

| Feb | -10.5% | -3.9% | 88.3 | 79.0 | 98.9 | 89.5 |

| Mar | -12.9% | -9.0% | 119.7 | 104.3 | 106.2 | 92.6 |

| Apr | -26.8% | -24.3% | 133.4 | 97.6 | 111.5 | 81.9 |

| May | 27.9% | 89.0 | 78.3 | |||

The table suggests that pending sales in the sample I’m looking at did not decline as much from a year ago as did pending sales in the NAR’s sample, though the YOY declines certainly follow a similar pattern.

Last year, pending sales plunged in most of the country from April to May following the expiration of the federal home buyer tax credit. From last May’s depressed level, however, the vast bulk of associations/etc. have reported sizable gains in pending sales – sufficient to suggest a strong rebound in the pending home sales index from April.

Of course, this May had one more business day than last May, suggesting that this year’s seasonal factor will be higher than last year’s -- meaning that the YOY % change in the seasonally adjusted number will be below that of the not seasonally adjusted numbers.

Still, after allowing for changing seasonal factors the incoming data suggest that the May pending home sales index on a seasonally adjusted basis is likely to show a double-digit gain from April’s level.

DOT: Vehicle Miles Driven decreased -2.4% in April compared to April 2010

by Calculated Risk on 6/20/2011 11:30:00 AM

This data is for April and gasoline prices were at the highest level of the year at end of April and in early May - so the YoY decline might be less in June.

Note: WTI future oil prices are down to $92.53 per barrel (down from $113.39 on April 29th), and Brent Crude is at $112.04 per barrel (down from $126.64). Gasoline prices are off over 30 cents per gallon from the recent peak.

The Department of Transportation (DOT) reported that vehicle miles driven in April were down 2.4% compared to April 2010:

Travel on all roads and streets changed by -2.4% (-6.1 billion vehicle miles) for April 2011 as compared with April 2010. Travel for the month is estimated to be 250.5 billion vehicle miles.

Cumulative Travel for 2011 changed by -0.8% (-7.1 billion vehicle miles). The Cumulative estimate for the year is 939.2 billion vehicle miles of travel.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the rolling 12 month total vehicle miles driven.

Note: in the early '80s, miles driven (rolling 12 months) stayed below the previous peak for 39 months. Currently miles driven has been below the previous peak for 41 months - so this is a new record for longest period below the previous peak - and still counting!

The second graph shows the year-over-year change from the same month in the previous year. So far the current decline is not as a severe as in 2008.

The second graph shows the year-over-year change from the same month in the previous year. So far the current decline is not as a severe as in 2008.With the decline in oil and gasoline prices, the YoY decline in miles driven will probably not be as large in June.