by Calculated Risk on 5/31/2011 07:32:00 PM

Tuesday, May 31, 2011

Lawler: Census 2010 and the US Homeownership Rate

Earlier ...

• Case Shiller: National Home Prices Hit New Low in 2011 Q1

• Real House Prices and Price-to-Rent: Back to 1999

• The Excess Vacant Housing Supply

• Home Prices Graph Gallery

CR Note: The following is from economist Tom Lawler. He points out that the homeownership rate in April 2010 was significantly lower than previously thought. Tom also notes that the age adjusted homeownership rate was lower in April 2010 than in April 1990! Yeah, 1990.

Economist Tom Lawler writes: Census 2010 and the US Homeownership Rate: Where’s the Media?

While the data released for Census 2010 on households and housing was probably the most important “macro” housing data released by Census over the last several years, media coverage was surprisingly scant. (I am not including blogs in my definition of “media.) Many newspapers and other media that religiously report on the quarterly Housing Vacancy Survey data, especially the homeownership rate, failed to run stories highlighting that the homeownership rate last April was in fact substantially lower than previous HVS estimates had suggested, and was significantly below the homeownership rate in 2000. Indeed, a Bloomberg/Business Week story today entitled “Rising Rents Risk U.S. Inflation as Fed Restraint Questioned” noted that “the rate of homeownership has fallen to 66.4 percent, the lowest since 1998, data from the Census Bureau show,” citing HVS estimates for Q1/2011, but it failed to mention that new Census 2010 data indicated that the US homeownership rate in the middle of the first half of last year was 65.1%, far below the HVS estimate of 67%.

Here is a table from last week’s report on the various estimates of the US homeownership rate from different Census Bureau reports.

| Various Estimates, US Homeownership Rate | ||||

|---|---|---|---|---|

| HVS (Annual Avg) | ACS (Annual Avg) | Census (April 1) | CPS/ASEC (March) | |

| 1990 | 63.9% | N/A | 64.2% | 64.1% |

| 2000 | 67.5% | 65.3% | 66.2% | 67.2% |

| 2001 | 67.9% | 65.7% | 67.8% | |

| 2002 | 67.9% | 66.4% | 68.1% | |

| 2003 | 68.3% | 66.8% | 68.2% | |

| 2004 | 69.0% | 67.1% | 68.8% | |

| 2005 | 68.9% | 66.9% | 69.3% | |

| 2006 | 68.8% | 67.3% | 68.5% | |

| 2007 | 68.1% | 67.2% | 68.3% | |

| 2008 | 67.8% | 66.6% | 67.9% | |

| 2009 | 67.4% | 65.9% | 67.3% | |

| 2010 | 66.9% | N/A | 65.1% | 67.0% |

The Decennial Census numbers are far and away the most accurate. No one knows for sure why both the CPS/ASEC and the CPS/HVS estimates have been pretty far off the mark for over a decade.

Clearly, the housing and mortgage market collapse in the second half of last decade has resulted in a MUCH steeper drop in the US homeownership rate than previous CPS/HVS reports had suggested, though from what level is not crystal clear.

The decline in the US homeownership rate from 2000 to 2010 is especially striking given the fact that the age distribution of the US shifted materially to an “older” population. Older age groups typically have materially higher headship rates and homeownership rates than do younger households, and ceteris paribus a shift in the age distribution such as that seen over the last decade would have resulted in a HIGHER homeownership rate.

While Census has not yet released household and housing tenure by age groups from Census 2010, it has released the distribution of the population by age. Here is a comparison of Census 1990, Census 2000, and Census 2010 for various age groups. (These are the “official” 1990 and 2000 numbers).

| Census Population by Age | Percent of Total 15+ | |||||

|---|---|---|---|---|---|---|

| Age | 2010 | 2000 | 1990 | 2010 | 2000 | 1990 |

| 15-24 | 43,626,342 | 39,183,891 | 36,774,327 | 17.6% | 17.7% | 18.8% |

| 25-34 | 41,063,948 | 39,891,724 | 43,175,932 | 16.6% | 18.0% | 22.1% |

| 35-44 | 41,070,606 | 45,148,527 | 37,578,903 | 16.6% | 20.4% | 19.3% |

| 45-54 | 45,006,716 | 37,677,952 | 25,223,086 | 18.2% | 17.0% | 12.9% |

| 55-64 | 36,482,729 | 24,274,684 | 21,147,923 | 14.7% | 11.0% | 10.8% |

| 65-74 | 21,713,429 | 18,390,986 | 18,106,558 | 8.8% | 8.3% | 9.3% |

| 75+ | 18,554,555 | 16,600,767 | 13,135,273 | 7.5% | 7.5% | 6.7% |

| Percent greater than 45 | 49.2% | 43.8% | 39.8% | |||

| Percent less than 35 | 34.2% | 35.8% | 41.0% | |||

Here’s some history of homeownership rates and headship rates for these age groups. The “headship rate” shown is simply the number of households in each age group divided by the population in that age group.

| Homeownership Rate | Headship Rate | |||||

|---|---|---|---|---|---|---|

| 2010 | 2000 | 1990 | 2010 | 2000 | 1990 | |

| 15-24 | 17.9% | 17.1% | 14.1% | 13.7% | ||

| 25-34 | 45.6% | 45.3% | 45.9% | 46.0% | ||

| 35-44 | 66.2% | 66.2% | 53.1% | 54.3% | ||

| 45-54 | 74.9% | 75.3% | 56.5% | 56.7% | ||

| 55-64 | 79.8% | 79.7% | 58.7% | 58.5% | ||

| 65-74 | 81.3% | 78.8% | 62.6% | 63.6% | ||

| 75+ | 74.7% | 70.4% | 64.1% | 64.4% | ||

| US Total | 65.1% | 66.2% | 64.2% | |||

If 2010 headship rates and homeownership rates for each age group had been the same as in 1990, the US homeownership rate would have been 66.7% instead of 65.1%. If 2010 headship rates and homeownership rates had been the same as in 2000, the US homeownership rate would have been 67.3%!

In fact, the aggregate data suggest that in 2010 the homeownership for most age groups was probably below 1990 rates!!!

Last week’s report, then, was clearly the BIGGEST STORY ON US HOMEOWNERSHIP in many, many years. So ... why the lack of media coverage?

I can’t easily say, but there may be several reasons. First, of course, Census 2010 took a snapshot of the US over a year ago, and as such some reporters may have viewed the data as “stale,” and would rather report on more current data from the CPS/HVS even though that report has now been discredited. Second, trying to write a story on WHY the CPS/HVS data substantially overstated the US homeownership rate for at least a decade, with the “miss” clearly growing, in a fashion that readers could understand is not an easy task, requiring thought, analysis, and an ability to write about complex issues in an understandable way.

But ... it’s a pretty sad statement about journalists covering the US housing market!! Ditto, by the way, on vacancies, but that’s another piece!

CR Note: This indicates that the age adjusted homeownership rate has fallen below the 1990 homeownership rate. All my previous analysis was based on the HVS data, and now that Census 2010 data has been released, the previous analysis is unfortunately incorrect (I need to think about the implications).

Here is a spreadsheet of Lawler's tables, plus a calculation of the age adjusted homeownership rates using the 1990 and 2000 data. Most of the increase in the homeownership rate in the from 1990 to 2000 was simply due to the aging of the population (older people generally have a higher homeownership rate).

As Lawler mentions, this means that when the Census 2010 age group homeownership rate data is released, the homeownership rates for most age groups will probably below both the 1990 and 2000 rates.

Renters and the Mini-Boom in Miami

by Calculated Risk on 5/31/2011 03:43:00 PM

From Arian Campo-Flores at the WSJ: Miami Renters Fuel a Boomlet

When the real estate market collapsed five years ago, this city's downtown soon became an emblem of the worst excesses of the building boom. Glittering new towers sat mostly vacant.This is an example of excess inventory being absorbed. Many of these condos were bought by international buyers and / or investors, and many are now occupied by renters. These are not "accidental landlords" (homeowners who rented their homes because they couldn't sell) - these are cash flow investors. Yes, some investors will sell if prices start to increase, keeping prices from rising quickly, but they can also be patient since many paid cash - so I wouldn't count this as shadow inventory.

Those towers are filling up much sooner than some analysts predicted. The new arrivals, mostly renters, are spurring the establishment of restaurants, bars and shops.

...

Condo sales here began surging after property owners slashed prices about two years ago, sometimes by 50% or more. ... Fewer than 4,000 out of the 22,000 new units built since 2003 remain unsold, according to Condo Vultures.

Note: The Case-Shiller index indicated prices in Miami are off 50.4% from the peak - and many of these condos sold for more than half off.

Earlier ...

• Case Shiller: National Home Prices Hit New Low in 2011 Q1

• Real House Prices and Price-to-Rent: Back to 1999

• The Excess Vacant Housing Supply

• Home Prices Graph Gallery

Real House Prices and Price-to-Rent: Back to 1999

by Calculated Risk on 5/31/2011 12:35:00 PM

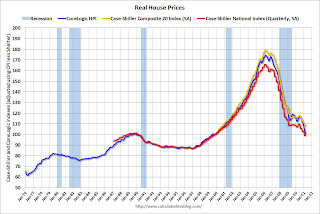

Case-Shiller, CoreLogic and others report nominal house prices. However it is also useful to look at house prices in real terms (adjusted for inflation), as a price-to-rent ratio, and also price-to-income (not shown here).

Below are three graphs showing nominal prices (as reported), real prices and a price-to-rent ratio. Real prices are back to 1999/2000 levels, and the price-to-rent ratio is also back to 1999/2000 levels.

Nominal House Prices

The first graph shows the quarterly Case-Shiller National Index SA (through Q1 2011), and the monthly Case-Shiller Composite 20 SA (through March) and CoreLogic House Price Indexes (through March) in nominal terms (as reported).

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

In nominal terms, the Case-Shiller National index is back to Q3 2002 levels, the Case-Shiller Composite 20 Index (SA) is slightly above the May 2009 lows (and close to June 2003 levels), and the CoreLogic index is back to January 2003.

Note: The not seasonally adjusted Case-Shiller Composite 20 Index (NSA) is back to April 2003 levels.

Real House Prices

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

The second graph shows the same three indexes in real terms (adjusted for inflation using CPI less Shelter). Note: some people use other inflation measures to adjust for real prices.

In real terms, the National index is back to Q4 1999 levels, the Composite 20 index is back to October 2000, and the CoreLogic index back to November 1999.

A few key points:

• In real terms, all appreciation in the last decade is gone.

• Real prices are still too high, but they are much closer to the eventual bottom than the top in 2005. This isn't like in 2005 when prices were way out of the normal range. In many areas - with an increasing population and land constraints - there is an upward slope to real prices (see: The upward slope of Real House Prices)

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index (through March).

Here is a similar graph using the Case-Shiller Composite 20 and CoreLogic House Price Index (through March).

This graph shows the price to rent ratio (January 1998 = 1.0).

Note: the measure of Owners' Equivalent Rent (OER) was mostly flat for two years - so the price-to-rent ratio mostly followed changes in nominal house prices. In recent months, OER has been increasing - lowering the price-to-rent ratio.

On a price-to-rent basis, the Composite 20 index is back to October 2000 levels, and the CoreLogic index is back to December 1999.

Earlier ...

• Case Shiller: National Home Prices Hit New Low in 2011 Q1

• The Excess Vacant Housing Supply

Chicago PMI shows sharply slower growth, Manufacturing Activity Expands in Texas

by Calculated Risk on 5/31/2011 10:58:00 AM

• From the Chicago Business Barometer™ Dropped: The overall index decreased to 56.6 from 67.6 in April. This was below consensus expectations of 62.3. Note: any number above 50 shows expansion.

"Breadth of EMPLOYMENT expansion softened but remained strong." The employment index decreased to a still strong 60.8 from 63.7. The new orders index decreased to 53.5 from 66.3.

• From the Dallas Fed: Texas Manufacturing Activity Expands

Texas factory activity increased in May, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, rose from 8 to 13 with 27 percent of respondents noting output increased from April.This is the last of the regional Fed surveys for May. The regional surveys provide a hint about the ISM manufacturing index - and most of the regional surveys were weak this month as the following graph shows.

Other measures of current manufacturing conditions also indicated growing activity, although the pace of new orders slowed. ... Labor market indicators reflected more hiring and longer workweeks. The employment index came in at 12, with the share of manufacturers adding workers reaching its highest level this year. The hours worked index jumped up from -1 in April to 13 in May.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.The New York and Philly Fed surveys are averaged together (dashed green, through May), and averaged five Fed surveys (blue, through May) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through April (right axis).

The regional surveys suggest the ISM manufacturing index will fall to the mid-50s or so. The ISM index for May will be released tomorrow, June 1st, and expectations are for a decrease to 57.5 from 60.4 in April (I think the consensus is too high).

Earlier ...

• Case Shiller: National Home Prices Hit New Low in 2011 Q1

Case Shiller: National Home Prices Hit New Low in 2011 Q1

by Calculated Risk on 5/31/2011 09:00:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for March (actually a 3 month average of January, February and March).

This includes prices for 20 individual cities and and two composite indices (for 10 cities and 20 cities), plus the Q1 2011 quarterly national house price index.

Note: Case-Shiller reports NSA, I use the SA data.

From S&P:National Home Prices Hit New Low in 2011 Q1

Data through March 2011 ... show that the U.S. National Home Price Index declined by 4.2% in the first quarter of 2011, after having fallen 3.6% in the fourth quarter of 2010. The National Index hit a new recession low with the first quarter’s data and posted an annual decline of 5.1% versus the first quarter of 2010. Nationally, home prices are back to their mid-2002 levels.

...

As of March 2011, 19 of the 20 MSAs covered by S&P/Case-Shiller Home Price Indices and both monthly composites were down compared to March 2010. Twelve of the 20 MSAs and the 20-City Composite also posted new index lows in March. With an index value of 138.16, the 20-City Composite fell below its earlier reported April 2009 low of 139.26. Minneapolis posted a double-digit 10.0% annual decline, the first market to be back in this territory since March 2010 when Las Vegas was down 12.0% on an annual basis. In the midst of all these falling prices and record lows, Washington DC was the only city where home prices increased on both a monthly (+1.1%) and annual (+4.3%) basis.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 31.8% from the peak, and down 0.1% in March (SA). The Composite 10 is still 1.6% above the May 2009 post-bubble bottom (Seasonally adjusted).

The Composite 20 index is off 31.6% from the peak, and down 0.2% in March (SA). The Composite 20 is only 0.1% above the May 2009 post-bubble bottom seasonally adjusted, and at a new post-bubble low not seasonally adjusted (NSA).

The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.The Composite 10 SA is down 2.8% compared to March 2010.

The Composite 20 SA is down 3.5% compared to March 2010.

The third graph shows the price declines from the peak for each city included in S&P/Case-Shiller indices.

Prices increased (SA) in 7 of the 20 Case-Shiller cities in March seasonally adjusted. Prices in Las Vegas are off 58.3% from the peak, and prices in Dallas only off 7.7% from the peak.

Prices increased (SA) in 7 of the 20 Case-Shiller cities in March seasonally adjusted. Prices in Las Vegas are off 58.3% from the peak, and prices in Dallas only off 7.7% from the peak.From S&P (NSA):

“This month’s report is marked by the confirmation of a double-dip in home prices across much of the nation. The National Index, the 20-City Composite and 12 MSAs all hit new lows with data reported through March 2011. ... Home prices continue on their downward spiral with no relief in sight.” says David M. Blitzer, Chairman of the Index Committee at S&P Indices. “Since December 2010, we have found an increasing number of markets posting new lows. In March 2011, 12 cities - Atlanta, Charlotte, Chicago, Cleveland, Detroit, Las Vegas, Miami, Minneapolis, New York, Phoenix, Portland (OR) and Tampa - fell to their lowest levels as measured by the current housing cycle. Washington D.C. was the only MSA displaying positive trends with an annual growth rate of +4.3% and a 1.1% increase from its February level.There could be some confusion between the SA and NSA numbers. The National index and Composite 20 (NSA) are both at new post-bubble lows.

I'll have more soon ...

Monday, May 30, 2011

The Excess Vacant Housing Supply

by Calculated Risk on 5/30/2011 09:45:00 PM

Last week economist Tom Lawler looked at the national excess vacant housing supply by using the Census 2010 data and comparing to the 2000 and 1990 census data.

I've been looking at the same data, but on a state by state basis. As Tom noted, trying to determine the excess supply as of April 1, 2010 requires an estimate of the normal vacancy rates. Some states always have high vacancy rates on April 1st because of the large number of second homes - like Maine - so what we need to do is compare the 2010 state vacancy rates to the previous census vacancy rates.

But we also have to remember what was happening in 1990 and 2000. There was a regional housing bubble in California, Arizona and several other states in the late '80s, and the 2000 Census happened at the end of stock bubble when the demand for housing was strong (so the excess vacant inventory was probably below normal).

So calculating excess inventory by comparing to the 2000 Census probably gives a number that is too high - and comparing to the 1990 Census gives a number that is too low. So, like Lawler, I also calculated an excess supply based on a combination of the 1990 and 2000 data.

A few notes:

• For those interested, here is the spreadsheet (with the 1990, 2000, and 2010 data and some calculations).

• Just because a state appears to have no vacant excess inventory doesn't mean there isn't any inventory - this calculation is based on an estimate of a normal level of inventory.

• Remember that this is for April 1, 2010. The builders have a completed a record low number of housing units over the last 14 months, and the excess supply is probably lower now.

• House prices depend on local supply and demand - and also on the number of distressed homes on the market (forced sellers). But the excess vacant inventory is important for forecasting when new construction will increase - assuming the builders can compete with all the distressed homes on the market (that story yesterday on San Diego was interesting).

The columns are sortable in the following table. My guess is the excess inventory was above 1.8 million on April 1, 2010, and that the excess is probably several hundred thousand units lower now. Tom Lawler thought the excess was in the 1.6 to 1.7 million range on April 1, 2010, and is probably in the 1.2 to 1.4 million range now.

It is no surprise that Florida has the largest number of excess vacant units and that Nevada has the largest percentage of excess vacant units. What might be a surprise to some is that California is below the U.S. average.

Weekend ...

• Summary for Week Ending May 27th

• Schedule for Week of May 29th

Even more Negative Sentiment for Homeownership

by Calculated Risk on 5/30/2011 05:05:00 PM

As I've noted before, I've been looking for a change in sentiment for homeowership. A shift in sentiment doesn't mean housing prices have bottomed - it just means the market is getting closer. In previous busts it seemed like negative sentiment lasted for a few years. Earlier posts on this with anecdotal evidence: Housing: Feeling the Hate, More "Hate" for Housing, More "Hate" for Homeownership and More Negative Sentiment for Homeownership.

A few excerpts from David Streitfeld's article at the NY Times: Index Expected to Show New Low in House Prices

“The emotional scars left by the collapse are changing the American psyche,” said Pete Flint, chief executive of the housing Web site Trulia. “There was a time when owning a home was a symbol you had made it. Now it’s O.K. not to own.”Weekend ...

Trulia, a real estate search engine for buyers and renters ... is a hive of renters, including Mr. Flint. “I’m in no rush at all to buy,” he said.

...

Tim Hebb, a Los Angeles systems engineer ... sold his bungalow in August 2006, then leased it back for a year. Since then [he] rented a succession of apartments.

“I have flirted with buying again many times over the past few years,” said Mr. Hebb. “Let’s face it, people are not rational creatures.”

...

“We have more of what we call ‘renters by choice’ than I’ve seen in the 40 years I’ve been in the apartment business,” said Jeffrey I. Friedman, chief executive of [Associated Estates Realty Corporation, which owns 13,000 apartments in Georgia, Indiana, Michigan and other Midwest and Southeast states]

...

Susan Lindsey, a San Diego software programmer, was once eagerly waiting for the housing market to crash. She said she would have no guilt about swooping in on some foreclosed owner who had bought a place he could not afford.

With prices now down by a third, however, she is content to stay in her $2,500-a-month rental.

• Summary for Week Ending May 27th

• Schedule for Week of May 29th

Oil and Gasoline Price Update

by Calculated Risk on 5/30/2011 12:23:00 PM

Oil and gasoline prices are probably the biggest downside risk to the economy right now. Oil prices are off slightly today, from the WSJ: Oil Prices Ease

The front-month July Brent contract on London's ICE futures exchange was recently down 35 cents, or 0.3%, at $114.68 a barrel. The front-month July contract on the New York Mercantile Exchange was trading lower 43 or 0.4%, at $100.16 per barrel.Looking at the following graph, it appears that gasoline prices are off about 18 cents nationally from the peak. This graph suggests - with oil prices around $100 per barrel that gasoline prices will fall into the $3.50 - $3.60 per gallon range in the next few weeks.

However that just takes us back to March pricing - and that was already a drag on consumer spending. I'll have more on the overall economy later.

| Orange County Historical Gas Price Charts Provided by GasBuddy.com |

Reports: Next Greek bailout to include external supervision

by Calculated Risk on 5/30/2011 08:50:00 AM

From the Financial Times: Greece set for severe bail-out conditions

European leaders are negotiating a deal that would lead to unprecedented outside intervention in the Greek economy, including international involvement in tax collection and privatisation of state assets ... the package would also include incentives for private holders of Greek debt voluntarily to extend Athens’ repayment schedule, as well as another round of austerity measuresFrom Reuters: EU racing to draft second Greek bailout: sources

excerpts with permission

The European Union is working on a second bailout package for Greece in a race to release vital loans next month and avert the risk of the euro zone country defaulting ... a new 65 billion euro package could involve a mixture of collateralized loans from the EU and IMF, and additional revenue measures, with unprecedented intrusive external supervision of Greece's privatisation program.The bond yields in Europe are fairly stable this morning. Here are the links for bond yields for several countries (source: Bloomberg):

...

The next scheduled meeting of euro zone finance ministers is on June 20 in Luxembourg

| Greece | 2 Year | 5 Year | 10 Year |

| Portugal | 2 Year | 5 Year | 10 Year |

| Ireland | 2 Year | 5 Year | 10 Year |

| Spain | 2 Year | 5 Year | 10 Year |

| Italy | 2 Year | 5 Year | 10 Year |

| Belgium | 2 Year | 5 Year | 10 Year |

| France | 2 Year | 5 Year | 10 Year |

| Germany | 2 Year | 5 Year | 10 Year |

Weekend ...

• Summary for Week Ending May 27th

• Schedule for Week of May 29th

Sunday, May 29, 2011

ECB Official: "Orderly" Greek restructuring is a "fairy tale"

by Calculated Risk on 5/29/2011 11:03:00 PM

Another update on Europe - the IMF, the European Central Bank and the European Commission are trying to decide on the next step for Greece.

Lorenzo Bini Smaghi, an ECB executive board member told the Financial Times in an interview that a Greek "soft" restructuring is a "fairy tale". Here is quote:

LBS: There is no such thing as an “orderly” debt restructuring in the current circumstances. It would be a mess. And I haven’t mentioned contagion – which would come on top.And from the WSJ: Bond Auctions Set to Measure Contagion Fears

If you look at financial markets, every time there is mention of word like restructuring or “soft restructuring,” they go crazy ... “soft restructurings” “re-profilings” do not exist. They are catchwords that politicians have tried to use, but without any content.

excerpt with permission

A team of European and International Monetary Fund officials is scheduled to conclude a closely watched examination of Greek government finances this week as bellwether bond auctions are expected to provide a sign of whether anxiety over Greece's debts is infecting investor appetite for sovereign bonds elsewhere in the euro zone.The crisis in Greece doesn't seem to be impacting Spain or Italy ... yet.

Italy will seek to raise as much as €8.5 billion ($12.1 billion) from bond investors Monday, while Spain is seeking an estimated €3.5 billion ...

Yesterday ...

• Summary for Week Ending May 27th

• Schedule for Week of May 29th