by Calculated Risk on 3/22/2011 05:12:00 PM

Tuesday, March 22, 2011

Lawler: On Census Housing Stock/Household Data

CR Note: I'm trying to use the Census 2010 housing stock and vacancy data to estimate the excess vacant housing supply. Here are few "data nerdy" words of caution from economist Tom Lawler for anyone trying to use this data (including me):

CalculatedRisk is one of the few entities (people?) besides me who is tracking the release of Census 2010 housing stock data (total, occupied, and vacant) that have been released so far, and yesterday it put up a spreadsheet showing state data from Census 2010, Census 2000, and Census 1990. It is available here. As of this morning Census had released data for 42 states for 2010.

A word of caution (as I’ve noted before): the “official” Census data from both 2000 and 1990 appear to “undercount overall housing units, with the “undercount” being larger for vacant homes than for occupied homes. As a result, overall (or gross) vacancy rates are understated in the “official” Census data – though by how much is a subject of debate among analysts.

For both Census 1990 and Census 2000, Census analysts conducted a “Housing Units Coverage Study,” which uses data from the “Accuracy and Coverage Evaluation” (A.C.E.) to estimate the “accuracy” of the Census housing counts. The 2000 HUCS was released in February, 2003, and is available here (PDF). As with estimated population over/under counts, Census has not used these “post-Census” studies to change the “official” Census figures.

Here are some different data for occupied and vacant homes as of April 1, 2000. Note that the ACS data are based on a sample, and ACS assumes that the “official” housing unit estimate is “correct.”

| Official Census 2000 | Including Reinstated Units | Dual System Estimate | ACS | |

|---|---|---|---|---|

| Total Housing Units | 115,904,641 | 115,877,639 | 116,586,458 | 115,904,641 |

| Occupied | 105,480,101 | 105,463,423 | 105,808,904 | 104,819,002 |

| Vacant | 10,424,540 | 10,414,216 | 10,777,553 | 11,085,639 |

| Gross Vacancy Rate | 8.99% | 8.99% | 9.24% | 9.56% |

The HUCS notes that the occupied plus vacant housing unit dual system estimates do not quite add up to total housing units because of “rounding.”

As I’ve noted before, the higher vacancy rate from the ACS C2SS was surprising to some given its “2-month” vs. “usual” residence rule. Some believe that since the main purpose of the decennial Census is to count people and not necessarily housing units, there may not have been enough “emphasis” placed on “finding” all vacant housing units – though not everyone agrees with that view.

The Census 1990 HUCS also estimated that the official Census 1990 housing unit counts missed more vacant than occupied units, and also “undercounted” total housing units by about 0.96%. The official “gross” vacancy rate for 1990 was 10.09%, while the HUCS suggested that a more “accurate” GVR was 10.46%. (There are other significant problems with the Census 1990 housing stock data by “type of structure,”)

Neither the 2000 nor the 1990 HUCS provided estimates of housing unit count “misses” by state, though they did provide some data on misses by broad Census region. In 1990 the housing unit undercounts were greatest in the South and the West, as were the gross vacancy rates. The Census 2000 HUCS “showed” less variability in estimated “misses” and vacancy rates across regions, though the gross vacancy rates were estimated to have been understated the most in the Northeast and the West.

The other “source” of housing vacancy data from the Census Bureau, of course, is the quarterly Housing Vacancy Survey, which compiles quarterly averages of monthly data based on a much smaller sample than either the ACS or (of course) the decennial Census. As I’ve noted many times, the HVS is NOT designed to estimate the housing stock; rather, the HVS uses “official” Census estimates of the housing stock (including the decennial Census, as well as subsequent estimates which “build up” off the decennial Census data, building permits, and “crude” estimates of the annual loss in the housing stock based on suspect data from the AHS). The HVS then assumes that its vacancy RATES by type are correct, and based on these rates and the “exogenous” (to the HVS) housing stock estimates, the HVS derives occupied and vacant housing units. If in fact the decennial Census focused on counting “people” and not on counting vacant housing units, however, then it actually doesn’t make “sense” for the HVS to assume that Census’ housing unit estimates are correct.

Instead, IF the HVS vacancy rates were correct, then in all likelihood that would imply the Census estimates of the housing stock were too low. If the Census housing stock estimates were correct, that would imply the HVS vacancy rates were too high. Truth may lie in between, but based on some of the HVS’ state and MSA vacancy rate data, it appears extremely likely that the HVS vacancy rates are way too high – mainly in the “rental” and the “other” category.

As is clear from various Census publications, not just counting all housing units but also determining whether a given housing unit is vacant or not can actually be tricky, and getting an accurate tally often involves having to do multiple “calls,” trips, or follow-ups. Many analysts believe that the HVS, which is a voluntary survey, doesn’t produce very accurate vacancy rates in any given quarter – in any words, there is high degree of “non-sampling” error, with a bias toward a vacancy rate that is too high (and, by the way, a homeownership rate that is too high.) In addition, the HVS’ sample size for some areas is extremely small, and since housing markets across the country are not even remotely close to homogenous, there is a pretty high (and not as easy to calculate as one thinks) sampling error as well.

I’m only putting all this in because it’s a lot trickier than it should be to look at available government information/data, including time series that for the most part are not consistently derived over time, to estimate the current (much less last year’s) “excess” supply of housing.

Moody's: Commercial Real Estate Prices declined 1.2% in January

by Calculated Risk on 3/22/2011 02:08:00 PM

Moody's reported today that the Moody’s/REAL All Property Type Aggregate Index declined 1.2% in January. Note: Moody's CRE price index is a repeat sales index like Case-Shiller - but there are far fewer commercial sales and there are a large percentage of distressed sales - and that can impact prices and make the index very volatile.

Below is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index. Beware of the "Real" in the title - this index is not inflation adjusted.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

CRE prices only go back to December 2000. The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

According to Moody's, CRE prices are down 4.3% from a year ago and down about 43% from the peak in 2007.

ATA Truck Tonnage Index declined in February

by Calculated Risk on 3/22/2011 12:06:00 PM

This is one of several transportation indexes I follow ...

From the American Trucking Association: ATA Truck Tonnage Index Fell 2.9% in February

The American Trucking Associations’ advance seasonally adjusted (SA) For-Hire Truck Tonnage Index decreased 2.9% in February after increasing a revised 3.5% in January 2011. ... In January, the SA index equaled 116.6. During December 2010 and January 2011, the SA tonnage index jumped a total of 6.1%.

...

ATA Chief Economist Bob Costello said that the winter storms in February probably played a role in the latest reduction and that he wasn’t concerned about the decrease. “Tonnage is not going to increase every month and in general I’m very pleased with freight volumes early this year.” Costello also stated that the anecdotal reports from motor carriers are very encouraging. “I’m hearing a significant amount of positive news from fleets and that the largest concern continues to be the price of diesel fuel, not freight levels.”

...

Trucking serves as a barometer of the U.S. economy, representing 68% of tonnage carried by all modes of domestic freight transportation, including manufactured and retail goods.

Click on map for graph gallery.

Click on map for graph gallery.This graph from the ATA shows the Truck Tonnage Index since Jan 2007.

This decline followed two sharp increases, so it isn't that concerning. The largest concern for truckers is oil prices, not freight levels - and high oil prices are a key risk for the economy, especially with gasoline prices hitting $4 per gallon in some areas.

Richmond Fed Manufacturing Survey shows Expansion in March

by Calculated Risk on 3/22/2011 10:08:00 AM

From the Richmond Fed: Manufacturing Activity Continues to Advance in March; Expectations Remain Upbeat

In March, the seasonally adjusted composite index of manufacturing activity — our broadest measure of manufacturing — fell five points to 20 from February's reading of 25. Among the index's components, shipments decreased six points to 23, new orders dropped seven points to finish at 20, while the jobs index held firm at 16. [above indicates expansion]This was slightly below the consensus forecast of 24, but still shows solid expansion. Prices remain a concern.

...

Hiring conditions continued to firm at Fifth District plants in March. The manufacturing employment index held steady at 16, while the average workweek measure moved down seven points to 10. In contrast, wage growth edged up one point to 19.

• Also, the FHFA reported U.S. Monthly House Price Index Declined 0.3 Percent from December to January. This is for GSE loans and is not as closely followed as Case-Shiller or CoreLogic. According to the FHFA, house prices are at a new post-bubble low and the "January 2011 index is roughly the same as the May 2004 index level."

Europe Update

by Calculated Risk on 3/22/2011 09:16:00 AM

As Letterman said last night "What are we supposed to pay attention to, Libya or Japan?” (ht Brian)

We could add Yemen, Bahrain, Saudi Arabia and more to Letterman's list (maybe he should do a top ten world problems - but unfortunately it would be serious).

The 27 EU leaders meet on Thursday and Friday. In advance of that meeting, the Finance Ministers have reached agreement on the permanent bailout fund, from Reuters: EU finance ministers agree on capital, ESM loan pricing

The euro zone's permanent bailout fund, the European Stability Mechanism ... which will have an effective lending capacity of 500 billion euros, will be backed by 80 billion euros of paid-in capital and 620 billion euros of callable capital ... It will offer loans at funding costs plus 200 basis points for loans up to three years and plus another 100 basis points for loans longer than three years.The temporary EFSF has a 300 basis points margin and a 50bp fee.

Here are the 2 year bond yields from Bloomberg for Ireland (over 10%!), Portugal, and Greece. And here are the ten year yields for Greece, Ireland, Spain, and Belgium. The focus will be on Ireland and Portugal at the meetings this week.

Monday, March 21, 2011

Here comes $4 Gasoline

by Calculated Risk on 3/21/2011 11:14:00 PM

From Eric Wolff at the North County Times: Analysts see gas headed back to $4 a gallon

The average gas price may reach $4 a gallon by Thursday in San Diego County, and Riverside-San Bernardino counties won't be far behind, gasoline analysts said.California has higher gasoline prices than most of the U.S. - and San Diego is usually near the top in California - but prices are moving higher for everyone (although still below $4 per gallon for most).

The average price Monday for a gallon of regular unleaded was $3.955 in Riverside and San Bernardino counties and $3.977 in San Diego County, according to AAA. Both prices exceeded the price of gas at this point in 2008, when gas prices peaked in June at $4.63.

Last week, Jim Hamilton had a post on consumer sentiment and gasoline prices, including a graph on prices across the country. Note: The final March Reuter's/University of Michigan's Consumer sentiment index will be released on Friday.

Earlier:

• February Existing Home Sales: 4.88 million SAAR, 8.6 months of supply

• Existing Home Inventory decreases 1.2% Year over Year

• Existing Home Sales and Inventory Graphs

Two Stories: Treasury to Begin Selling MBS Portfolio, Federal Reserve to Release Discount Window Borrowing

by Calculated Risk on 3/21/2011 06:08:00 PM

A couple of stories ...

• From Treasury: Treasury to Begin Orderly Wind Down of Its $142 Billion Mortgage-Backed Securities Portfolio

Today, the U.S. Department of the Treasury announced that it will begin the orderly wind down of its remaining portfolio of $142 billion in agency-guaranteed mortgage-backed securities (MBS). Starting this month, Treasury plans to sell up to $10 billion in agency-guaranteed MBS per month, subject to market conditions.I don't think this will have much impact on mortgage rates.

“We’re continuing to wind down the emergency programs that were put in place in 2008 and 2009 to help restore market stability, and the sale of these securities is consistent with that effort,” said Mary J. Miller, Assistant Secretary for Financial Markets.

• From Bloomberg: Fed Must Release Data on Emergency Bank Loans as High Court Rejects Appeal

The Federal Reserve will disclose details of emergency loans it made to banks in 2008, after the U.S. Supreme Court rejected an industry appeal that aimed to shield the records from public view.There was probably heavy borrowing by - shock - Citi, BofA and most other big banks. This ruling is for discount window lending, and the Dodd-Frank bill required the Fed to disclose this information with a two year lag - so I'm not sure why the Fed objected. The Fed has already released data on the emergency Credit and Liquidity Facilities. There were no surprises. I support transparency, but I doubt there will be any surprises with the discount window data either.

The justices today left intact a court order that gives the Fed five days to release the records, sought by Bloomberg News’s parent company, Bloomberg LP

Census 2010 Housing Occupancy and Vacancy Data

by Calculated Risk on 3/21/2011 02:50:00 PM

Earlier:

• February Existing Home Sales: 4.88 million SAAR, 8.6 months of supply

• Existing Home Inventory decreases 1.2% Year over Year

• Existing Home Sales and Inventory Graphs

The Census Bureau has released data for 42 states so far. These states account for about 83% of the U.S. housing stock based on the 2000 and 1990 Census data. Here is a table of the data released so far - total housing units, Occupied and Vacant - for each state, plus the vacancy rate for 2010, 2000 and 1990. The data is sortable by column.

Here is a spreadsheet of the 2010, 2000 and 1990 for those who want to look at the data.

Once all of the data is released, I'll post some more analysis. This data is useful in estimating the number of excess vacant units, the absorption rate by state, demolitions and more.

The following table shows the increase in percentage points in the vacancy rate by state. This table compares to the 2000 Census and also an average of the 1990 and 2000 Census. (sorted by highest percentage point increase from 2000). The data for the remaining 8 states and D.C. will be released by April 1st.

The "excess units" uses the change in vacancy rate times the total number of housing units.

Some states like Vermont always have a high vacancy rate because of the number of summer homes (the Census is an estimate as of April 1, 2010), so it is important to compare to previous Census vacancy rates.

We can also calculate an absorption rate (not included) by using the increase in occupied units between 2000 and 2010 - as an example, even though Nevada saw the largest increase in vacancy rate, it is a faster growing state than say Ohio - so the excess housing units may be absorbed quicker (of course Nevada also has the highest percentage of borrowers with negative equity - another problem!)

| Change from: | 2000 Census | Average 2000 and 1990 | ||

|---|---|---|---|---|

| Change Vacancy Rate in Percentage Points | Excess Units | Change in Percentage Points | Excess Units | |

| Nevada | 5.1% | 59,338 | 4.6% | 53,996 |

| Florida | 4.2% | 380,887 | 2.9% | 263,512 |

| Georgia | 3.9% | 160,129 | 3.0% | 121,064 |

| Ohio | 3.2% | 162,506 | 3.4% | 176,515 |

| Arizona | 3.1% | 89,502 | 1.0% | 27,463 |

| Wisconsin | 2.9% | 77,083 | 2.4% | 61,696 |

| Tennessee | 2.9% | 80,489 | 2.8% | 79,932 |

| Minnesota | 2.8% | 65,900 | 1.5% | 35,579 |

| Indiana | 2.8% | 76,999 | 2.6% | 72,745 |

| Delaware | 2.7% | 11,135 | 1.9% | 7,666 |

| Illinois | 2.7% | 141,182 | 2.3% | 121,780 |

| Colorado | 2.6% | 56,688 | 0.1% | 2,420 |

| Mississippi | 2.5% | 32,221 | 2.6% | 33,107 |

| North Carolina | 2.3% | 101,068 | 2.6% | 110,489 |

| Missouri | 2.3% | 62,267 | 2.0% | 52,948 |

| Vermont | 2.2% | 7,208 | 0.2% | 640 |

| California | 2.2% | 305,515 | 1.6% | 213,702 |

| Idaho | 2.2% | 14,781 | 1.4% | 9,089 |

| New Jersey | 2.1% | 75,520 | 1.3% | 45,243 |

| Virginia | 2.1% | 71,336 | 1.6% | 52,278 |

| Montana | 2.1% | 10,072 | 1.0% | 4,886 |

| Washington | 1.9% | 54,065 | 1.6% | 46,283 |

| Iowa | 1.8% | 24,589 | 1.7% | 23,357 |

| Connecticut | 1.8% | 26,300 | 1.4% | 20,652 |

| Arkansas | 1.7% | 22,950 | 1.8% | 24,071 |

| Alabama | 1.7% | 37,409 | 2.6% | 56,385 |

| Louisiana | 1.7% | 33,304 | 0.5% | 10,753 |

| Maryland | 1.7% | 40,080 | 1.7% | 41,387 |

| Nebraska | 1.7% | 13,385 | 1.2% | 9,391 |

| Utah | 1.7% | 16,215 | 0.9% | 9,086 |

| Kentucky | 1.6% | 30,786 | 2.0% | 37,740 |

| Kansas | 1.6% | 19,395 | 0.9% | 11,564 |

| Texas | 1.2% | 119,793 | -0.8% | -80,526 |

| Oregon | 1.2% | 19,385 | 1.5% | 24,654 |

| South Dakota | 1.1% | 4,090 | 0.5% | 1,867 |

| Oklahoma | 0.9% | 14,776 | -0.6% | -9,198 |

| Pennsylvania | 0.8% | 47,067 | 0.9% | 48,483 |

| Alaska | 0.8% | 2,592 | -1.0% | -3,080 |

| North Dakota | 0.2% | 657 | -0.6% | -1,890 |

| Hawaii | -0.1% | -469 | 1.8% | 9,499 |

| Wyoming | -0.2% | -393 | -1.9% | -4,956 |

| New Mexico | -0.9% | -8,495 | -1.4% | -12,962 |

| District of Columbia | NA | NA | NA | NA |

| Maine | NA | NA | NA | NA |

| Massachusetts | NA | NA | NA | NA |

| Michigan | NA | NA | NA | NA |

| New Hampshire | NA | NA | NA | NA |

| New York | NA | NA | NA | NA |

| Rhode Island | NA | NA | NA | NA |

| South Carolina | NA | NA | NA | NA |

| West Virginia | NA | NA | NA | NA |

Existing Home Inventory decreases 1.2% Year over Year

by Calculated Risk on 3/21/2011 11:30:00 AM

Earlier the NAR released the existing home sales data for February; here are a couple more graphs ...

The first graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.

Although inventory increased from January to February (as usual), inventory decreased 1.2% YoY in February. This is a small YoY decrease and follows six consecutive month of year-over-year increases in inventory.

Inventory should increase over the next few months (the normal seasonal pattern), and the YoY change is something to watch closely this year. Inventory is already very high, and further YoY increases in inventory would put more downward pressure on house prices.

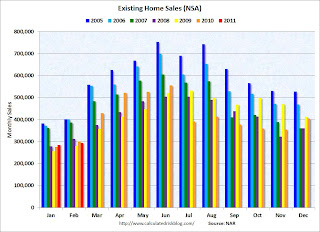

The second graph shows existing home sales Not Seasonally Adjusted (NSA).

The second graph shows existing home sales Not Seasonally Adjusted (NSA).

The red columns in January and February are for 2011.

Sales NSA were about the same level as the last three years. February is usually the second weakest month of the year for existing home sales (close to January). The real key is what happens in the spring and summer - and March sales and inventory will give a clearer picture of existing home sales activity.

The bottom line: Sales decreased in February (using the old method to estimate sales), possibly due to a decrease in investor purchases of distressed properties at the low end and possibly some weather factors. The NAR noted "Investors accounted for 19 percent of sales activity in February, down from 23 percent in January; they were 19 percent in February 2010."

The NAR also mentioned: "Distressed homes – sold at discount – accounted for a 39 percent market share in February, up from 37 percent in January and 35 percent in February 2010." A higher percentage of distressed sales probably means lower prices - and we should expect the repeat sales indexes to show further price declines in February.

Note: The Case-Shiller prices index will be released next Tuesday (March 29th), and will be for January (average of three months) - and the NAR report suggests further price declines in February.

March is the beginning of the selling season for existing homes, so the next report will be much more important.

February Existing Home Sales: 4.88 million SAAR, 8.6 months of supply

by Calculated Risk on 3/21/2011 10:00:00 AM

The NAR reports: February Existing-Home Sales Decline

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, dropped 9.6 percent to a seasonally adjusted annual rate of 4.88 million in February from an upwardly revised 5.40 million in January, and are 2.8 percent below the 5.02 million pace in February 2010.

...

Total housing inventory at the end of February rose 3.5 percent to 3.49 million existing homes available for sale, which represents an 8.6-month supply at the current sales pace, up from a 7.5-month supply in January.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in February 2011 (4.88 million SAAR) were 9.6% lower than last month, and were 2.8% lower than February 2010.

The second graph shows nationwide inventory for existing homes.

The second graph shows nationwide inventory for existing homes.According to the NAR, inventory increased to 3.49 million in February from 3.37 million in January.

Inventory is not seasonally adjusted and there is a clear seasonal pattern with inventory peaking in the summer and declining in the fall and winter. Inventory will probably increase significantly over the next several months.

The last graph shows the 'months of supply' metric.

The last graph shows the 'months of supply' metric.Months of supply increased to 8.6 months in February up from 7.5 months in January. The months of supply will probably increase over the next few months as inventory increases. This is higher than normal.

Special Note: Back in January, I noted that it appeared the NAR had overestimated sales by 5% or so in 2007, and that the errors had increased since then (perhaps 10% or 15% or more in 2009 and 2010). I reported in January that the NAR was working on benchmarking existing home sales for earlier years with other industry data, and I expected "this effort will lead to significant downward revisions to previously reported sales". The numbers reported today were estimated using the old method and will probably be revised down significantly, but they are still useful on a month-to-month basis.

These sales numbers were below the consensus of 5.15 million SAAR, and are slightly below what I expected (Lawler's forecast was 5 million). I'll have more soon.