by Calculated Risk on 3/10/2011 11:04:00 AM

Thursday, March 10, 2011

CoreLogic: House Prices declined 2.5% in January, Prices at New Post-bubble low

Notes: CoreLogic reports the year-over-year change. The headline for this post is for the change from December to January 2011. The CoreLogic HPI is a three month weighted average of November, December and January and is not seasonally adjusted (NSA).

From CoreLogic: CoreLogic® Home Price Index Shows Year-Over-Year Decline for Sixth Straight Month

CoreLogic ... January Home Price Index (HPI) which shows that home prices in the U.S. declined for the sixth month in a row. According to the CoreLogic HPI, national home prices, including distressed sales, declined by 5.7 percent in January 2011 compared to January 2010 after declining by 4.7 percent in December 2010 compared to December 2009. Excluding distressed sales, year-over-year prices declined by 1.6 percent in January 2011 compared to January 2010 and by 3.2 percent in December 2010 compared to December 2009. Distressed sales include short sales and real estate owned (REO) transactions.

The January data shows home prices continuing to slide. Mark Fleming, chief economist with CoreLogic, said, “A number of factors continue to dampen any recovery in the housing market. Negative equity, which limits the mobility of homeowners, weak demand and the overhang of shadow inventory all continue to exert downward pressure on housing prices. We are looking out for renewed demand in the coming months as the spring buying season gets underway to hopefully reduce the downward pressure.”

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. This graph shows the national CoreLogic HPI data since 1976. January 2000 = 100.

The index is down 5.7% over the last year, and off 32.8% from the peak.

This is the sixth straight month of year-over-year declines, and the seventh straight month of month-to-month declines. The index is now 1.6% below the previous post-bubble low set in March 2009, and I expect to see further new post-bubble lows for this index over the next few months.

Trade Deficit increased in January to $46.3 billion

by Calculated Risk on 3/10/2011 09:12:00 AM

The Department of Commerce reports:

[T]otal exports of $167.7 billion and imports of $214.1 billion resulted in a goods and services deficit of $46.3 billion, up from $40.3 billion in December, revised. January exports were $4.4 billion more than December exports of $163.3 billion. January imports were $10.5 billion more than December imports of $203.6 billion.

Click on graph for larger image.

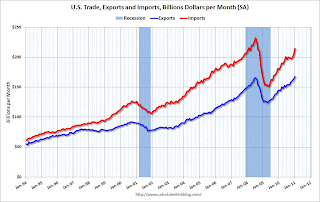

Click on graph for larger image.The first graph shows the monthly U.S. exports and imports in dollars through January 2011.

Exports are up sharply and are now above the pre-recession peak. Imports have surged over the last two months, largely due to the increase in oil prices.

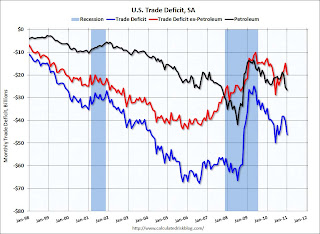

The second graph shows the U.S. trade deficit, with and without petroleum, through January.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.

The blue line is the total deficit, and the black line is the petroleum deficit, and the red line is the trade deficit ex-petroleum products.The petroleum deficit increased in January as both quantity and import prices continued to rise - averaging $84.34 in January, up from $79.78 in December. Prices will be even higher in February and March. The trade deficit with China was $23.3 billion (NSA) in January. Once again the oil and China deficits are essentially the entire trade deficit (or even more).

Weekly Initial Unemployment Claims increase to 397,000

by Calculated Risk on 3/10/2011 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending March 5, the advance figure for seasonally adjusted initial claims was 397,000, an increase of 26,000 from the previous week's revised figure of 371,000. The 4-week moving average was 392,250, an increase of 3,000 from the previous week's revised average of 389,250.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery.This graph shows the 4-week moving average of weekly claims for the last 40 years. The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week by 3,000 to 392,250.

The 4-week average is still below the 400,000 level, and although there is nothing magical about 400,000 - staying below that level is a good sign for the labor market.

Wednesday, March 09, 2011

California Realtors: Only three out of five short sale transactions close

by Calculated Risk on 3/09/2011 11:35:00 PM

The previous post was about the problems with principal reductions. One effective way to reduce principal is a short sale ... but it is a very difficult process.

The president of the California Association of Realtors, Beth Peerce, sent out an "open letter" tonight. Here is an excerpt on short sales:

Short sales can play an important role in our state’s economic recovery by accelerating the pace of home sales and reducing the inventory of bank-owned homes on the market. There are other benefits as well. ...

Unfortunately, many homeowners are unable to successfully negotiate a short sale. According to a recent survey of 2,150 California REALTORS® who have assisted clients with a short sale, only three out of five transactions closed – even when there was an interested and qualified buyer.

What’s the problem? For one, no two mortgage agreements are the same, so it can be difficult to standardize short sale processes and procedures. Many homeowners have second mortgages, which further complicate matters. Then there’s the challenge of convincing multiple parties to take a financial loss or, in the case of loan servicers, to forego fees they otherwise might earn during the course of the foreclosure process. Poor and slow service by many banks and servicers has only exacerbated the problem. Horror stories abound from potential homebuyers and REALTORS® forced to wait 90 or more days for a response to a purchase offer or being required to fax short sale applications or other paperwork as many as 50 times. These delays discourage potential homebuyers from considering a short sale purchase ...

Increasing the number of closed short sales by speeding up and streamlining the short sale process is one important way we can help California families avoid foreclosure and move our economy closer to recovery. ... We’re meeting with major banks, U.S. Treasury officials, government-sponsored entities (including Fannie Mae and Freddie Mac), and others to urge them to standardize processes, comply with federal guidelines, improve communication with other stakeholders and increase staffing with the goal of eliminating service issues. ...

But we can’t do it alone. That’s why we’re focusing the spotlight on short sales and calling on regulators, elected officials, nonprofits, business organizations, companies, and individuals with a stake in California’s economic future to resolve this issue and others that get in the way of a recovery.

Research: "The flawed logic of principal reduction"

by Calculated Risk on 3/09/2011 07:10:00 PM

From Chris Foote, Kris Gerardi and Paul Willen at the Atlanta Fed: The seductive but flawed logic of principal reduction (ht Dean).

The researchers point out that principal reduction seems to make sense if a borrower is going to default and the lender foreclose, but that it is hard to predict exactly who is going to default (and not cure). If lenders aggressively offered principal reductions to underwater homeowners who are delinquent, then borrowers who are current would have an incentive to stop paying their mortgages.

I noted this a couple of years ago:

If it became widely known that lenders routinely reduce the principal balance for delinquent borrowers with negative equity, this would be an incentive for a large number of additional homeowners to stop paying their mortgages.And from another old post:

Some people point to Lewis Ranieri's apparent success with principal reductions, from Fortune: Lewis Ranieri wants to fix the mortgage messHere are some excerpts from the new research:

Now Ranieri is championing an inventive solution for fixing the mess he's accused of enabling in the first place. Ranieri has raised $825 million from 31 foundations and corporate and public pension funds, including the South Carolina Retirement Systems, to form the Selene Residential Mortgage Opportunity Fund.This only works because Ranieri bought the distressed mortgages at a deep discount, and his company has no reputation risk. Ranieri wants his borrowers to know that he will reduce their principal.

Selene's mission is simple: to buy delinquent mortgages at a deep discount, work with homeowners to get them paying again, and resell the now stable loans for profit. To get homeowners to do their part, Ranieri is taking the radical step of substantially lowering their mortgage balances.

Imagine what would happen to Wells Fargo or Bank of America if their borrowers found out that the banks would substantially reduce their principal if they were 1) underwater (negative equity), and 2) stopped making their payments. The delinquency rate and losses would skyrocket

The idea of principal reduction starts with a correct premise: borrowers with positive equity—that is, houses worth more than the unpaid principal balance on their mortgages—rarely ever lose their homes to foreclosure.I think that is the key reason lenders have been reluctant to offer principal reductions.

...

With this idea in mind, it then follows that if we could somehow get everyone back into positive-equity territory, then we could end the foreclosure crisis. To do that, we either need to inflate house prices, which is difficult to do and probably a bad idea anyway, or reduce the principal mortgage balances for negative-equity borrowers. So we have a cure for the foreclosure crisis: if we can get lenders to write down principal to give all Americans positive equity in their homes, the housing crisis would be over.

...

The logic that principal reduction can prevent foreclosures at no cost is compelling and seductive, and proposals to encourage principal reduction were common early in the foreclosure crisis.

...

Ultimately the reason principal reduction doesn't work is what economists call asymmetric information: only the borrowers have all the information about whether they really can or want to repay their mortgages, information that lenders don’t have access to. If lenders weren't faced with this asymmetric information problem—if they really knew exactly who was going to default and who wasn't—all foreclosures could be profitably prevented using principal reduction.