by Calculated Risk on 12/29/2010 08:41:00 PM

Wednesday, December 29, 2010

Case Shiller House Prices: Which cities will hit post bubble lows next?

In the S&P/Case-Shiller report for October, S&P noted:

[S]ix markets – Atlanta, Charlotte, Miami, Portland (OR), Seattle and Tampa – hit their lowest levels since home prices started to fall in 2006 and 2007S&P reports the data Not Seasonally Adjusted (NSA) because of concerns about foreclosures impacting the seasonal factor.

Using the Seasonally Adjusted (SA) series, eleven cities were at post bubble lows; the six cities listed above plus Phoenix, Chicago, Detroit, New York and Las Vegas.

The following graph shows the percent above the post bubble lows for the 20 Case-Shiller cities and the two composite indexes using both SA and NSA data.

Click on graph for larger image in graph gallery.

Click on graph for larger image in graph gallery. Las Vegas was slightly above the post bubble low NSA (it isn't apparent on the graph).

We can probably guess the cities that will set new post bubble lows in November. Using the NSA data, Las Vegas, New York and Detroit will all probably join the list above setting new lows.

Using the SA data, Dallas, Cleveland, Denver, and maybe the Composite 20 index will be at new lows.

Note: Earlier I posted A few for Graphs for 2010. Enjoy!

Lawler Forecast for 2011: Housing Starts and New Home Sales

by Calculated Risk on 12/29/2010 04:25:00 PM

Earlier I posted A few for Graphs for 2010. Enjoy!

A 2011 forecast from economist Tom Lawler:

| 2010 (estimate) | 2011 (forecast) | |

|---|---|---|

| Total Starts | 588 | 665 |

| .... Single Family | 473 | 520 |

| .... Multi Family | 115 | 145 |

| New Home Sales | 320 | 365 |

Note: Tom already forecast completions would be at a record low next year, but he thinks starts will increase "with most of the increase coming in the second half of the year".

A special thanks to Tom Lawler for sharing his insights with me this year - and allowing me to share some of them!

BLS Change on Unemployment Duration

by Calculated Risk on 12/29/2010 02:47:00 PM

To make this clear (since I mentioned this change earlier): This change will have no impact on the number of unemployed or the unemployment rate. This will only impact the average duration of unemployment.

From the BLS: Changes to data collected on unemployment duration

Effective with data for January 2011, the Current Population Survey (CPS) will be modified to allow respondents to report longer durations of unemployment. Presently, the CPS accepts unemployment durations of up to 2 years; any response of unemployment duration greater than this is entered as 2 years. Starting with data for January 2011, respondents will be able to report unemployment durations of up to 5 years. This change will likely affect estimates of average (mean) duration of unemployment. The change will not affect the estimate of the number of unemployed persons and will not affect other data series on the duration of unemployment.Currently if someone says they have been unemployed longer than 2 years, they are listed at 2 years (the current maximum). This new change will allow for responses up to 5 years and will probably have a small impact on the average (mean) duration of unemployment, but will have no impact on the median duration - or on the number unemployed or the unemployment rate.

A few Graphs for 2010

by Calculated Risk on 12/29/2010 11:36:00 AM

Click on graphs for a larger image in graph gallery.

Click on graphs for a larger image in graph gallery.

The first graph shows the job losses from the start of the employment recession, in percentage terms aligned at maximum job losses.

As of November there were 7.4 million fewer payroll jobs in the U.S. compared to the peak of employment in 2007. If the U.S. economy adds 200,000 jobs per month, it will take 3 years to get back to the previous peak (2 years at 300,000 per month). And that doesn't include jobs needed to offset population growth (about 125,000 jobs per month).

The second graph shows the employment population ratio, the participation rate, and the unemployment rate.

The second graph shows the employment population ratio, the participation rate, and the unemployment rate.

Two of the key stories in 2010 were the unemployment rate (red line) stayed near 10% (at 9.8% in November), and the Labor Force Participation Rate declined to 64.5% in November (blue line). This is the percentage of the working age population in the labor force - and the decline suggests that a large number of people have just given up looking for work.

And now to housing ...

This graph shows existing home sales (left axis) and new home sales (right axis) through November.

This graph shows existing home sales (left axis) and new home sales (right axis) through November.

A key story in 2010 was the collapse in home sales following the expiration of the homebuyer tax credit (Note: the tax credit is widely viewed as a failure).

Existing home sales are back to the levels of 1997 / 1998 and new home sales fell to record lows in the 2nd half of 2010.

As existing home sales declined, existing home inventory and months-of-supply increased.

As existing home sales declined, existing home inventory and months-of-supply increased.

This graph shows the year-over-year change in inventory and the months-of-supply. Inventory is not seasonally adjusted, so it really helps to look at the YoY change.

Inventory increased 5.4% YoY in November and the months-of-supply (9.5 months in November) is well above normal.

And the high level of inventory has pushed down house prices. This graph shows existing home months-of-supply (left axis), and the annualized change in the Case-Shiller composite 20 house price index (right axis, inverted).

And the high level of inventory has pushed down house prices. This graph shows existing home months-of-supply (left axis), and the annualized change in the Case-Shiller composite 20 house price index (right axis, inverted).

With the increase in inventory (and months-of-supply), it was no surprise that house prices started declining again in the 2nd half of 2010.

The good news is housing starts stayed near record low levels. This is helping to reduce the excess inventory of housing units.

The good news is housing starts stayed near record low levels. This is helping to reduce the excess inventory of housing units.

This graph shows the huge collapse following the housing bubble, and that housing starts have mostly been moving sideways for two years - with a slight up and down over the last six months due to the home buyer tax credit.

Another piece of "good news" is it appears that mortgage delinquencies might have peaked.

This graph based on quarterly data from the MBA shows the percent of loans delinquent by days past due.

This graph based on quarterly data from the MBA shows the percent of loans delinquent by days past due.

Although delinquencies might have peaked, the level is still very high and there are many more foreclosures in the pipeline.

Note: With declining house prices, the number of homeowners with negative equity will increase - and the delinquency rate might start increasing again.

Some "bad news" for housing is that REO (Real Estate Owned) inventories at Fannie, Freddie and the FHA are at record levels.

This graph shows the REO inventory for Fannie, Freddie and FHA through Q3 2010.

This graph shows the REO inventory for Fannie, Freddie and FHA through Q3 2010.

The REO inventory for the "Fs" has increased sharply over the last year, from 153,007 at the end of Q3 2009 to a record 293,171 at the end of Q3 2010.

Remember this is just a portion of the total REO inventory. Private label securities and banks and thrifts also hold a substantial number of REOs, and the overall REO inventory is below the peak in 2008.

On manufacturing, there was a pickup in capacity utilization and industrial production, but there is still a large amount of excess capacity.

On manufacturing, there was a pickup in capacity utilization and industrial production, but there is still a large amount of excess capacity.

This graph shows Capacity Utilization. This series is up 10.3% from the record low set in June 2009 (the series starts in 1967).

Capacity utilization at 75.2% is still far below normal - and well below the pre-recession levels of 81.2% in November 2007.

Another key story in 2010 is that the consumer has started spending again.

Another key story in 2010 is that the consumer has started spending again.

This graph shows real Personal Consumption Expenditures (PCE) through November (2005 dollars).

The two-month method of estimating real PCE growth for Q4 (a fairly accurate method), suggests real PCE growth of 4.3% in Q4! So this looks like a pretty strong quarter for growth in personal consumption. The last time real PCE grew at more than 4% was in 2006.

And the final graph is a little bit of good news for commercial real estate.

And the final graph is a little bit of good news for commercial real estate.

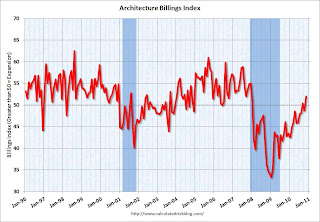

In 2010, investment in non-residential structures was a drag on GDP growth. However, this graph of the Architecture Billings Index shows expansion in billings for the first time in almost 3 years. (above 50 is expansion).

This index usually leads investment in non-residential structures by about 6 to 9 months.

Best to all

Leonhardt on 2010: A Year That Fizzled

by Calculated Risk on 12/29/2010 07:57:00 AM

Note: There will be no release this week of mortgage applications from the Mortgage Bankers Association.

From David Leonhardt at the NY Times: In the Rearview, a Year That Fizzled

When 2010 began, hiring and consumer spending were finally picking up. ... By the summer, the unemployment rate was rising again, and Americans’ attitudes about the future were again souring.This graphic has two charts - the second one shows the "long road back" to full employment (below 6% unemployment rate). According to Moody's, if the economy adds 200,000 jobs per months, it will take until 2020. At a 250,000 per month pace, it will take until 2016. A long long time ...

...

To look back at 2010 and to look ahead, we have put together a series of charts. If there is an overall message, it’s that the economy still needs a whole lot of work.

No wonder the Census Bureau is adding another long term unemployed category. From the USA Today (ht Nanette)

Citing what it calls "an unprecedented rise" in long-term unemployment, the federal Bureau of Labor Statistics (BLS), beginning Saturday, will raise from two years to five years the upper limit on how long someone can be listed as having been joblessAnd here are some more graphs from Leonhardt Snapshots of the Economy

Tuesday, December 28, 2010

Misc: Households 'Doubling Up', Bank Failures, Vegas Convention business looking up

by Calculated Risk on 12/28/2010 09:45:00 PM

A few interesting unrelated stories:

• From Michael Luo in the NY Times: ‘Doubling Up’ in Recession-Strained Quarters

Census Bureau data released in September showed that the number of multifamily households jumped 11.7 percent from 2008 to 2010, reaching 15.5 million, or 13.2 percent of all households. It is the highest proportion since at least 1968, accounting for 54 million people.The article discusses the difficulties of 'doubling up', and the strains it puts on families and friends.

Even that figure, however, is undoubtedly an undercount of the phenomenon social service providers call “doubling up,” which has ballooned in the recession and anemic recovery. The census’ multifamily household figures, for example, do not include such situations as when a single brother and a single sister move in together, or when a childless adult goes to live with his or her parents.

• From the WSJ: Hard Call for FDIC: When to Shut Bank. The FDIC disputes that it is dragging its feet closing banks due to a lack of manpower.

• And some upbeat news from Richard Velotta at the Las Vegas Sun: Signs of a surge in Las Vegas conventions

After more than a year of lethargic convention attendance in Las Vegas ... next year’s visitor numbers are expected to reach levels on par with late 2005 or early 2006 ... After stellar 2007, convention traffic tanked.Looking at the Las Vegas visitors data, convention attendance declined in 2008, but really collapsed (off 24%) in 2009. Attendance was about the same this year as in 2009, so this would be quite an increase.

The recession hit Las Vegas in August 2008 when convention traffic fell 22.3 percent from the same month a year earlier. ... In 2009, convention traffic was off 23.9 percent for the year and August 2009 was down a stunning 58.9 percent from that ugly August 2008 number.

Earlier:

• Case-Shiller: Home Prices Weaken Further in October

• House Prices and Months-of-Supply, and Real House Prices