by Calculated Risk on 11/04/2010 11:38:00 AM

Thursday, November 04, 2010

Hotels: RevPAR up 12.5% compared to same week in 2009

Hotel occupancy is one of several industry specific indicators I follow ...

Important: Even though the occupancy rate is close to 2008 levels, 2010 is a more difficult year for the hotel industry than 2008. RevPAR (revenue per available room) is up 12.5% compared to the same week in 2009, but still down 3% compared to the same week in 2008 - and 2008 was a very difficult year for the hotel industry.

From HotelNewsNow.com: STR: Upper-upscale reports softer week

Overall the industry’s occupancy increased 11.7% to 57.9%, ADR was up 0.7% to US$99.84, and RevPAR ended the week up 12.5% to US$57.76.The following graph shows the four week moving average for the occupancy rate by week for 2008, 2009 and 2010 (and a median for 2000 through 2007).

Click on graph for larger image in new window.

Click on graph for larger image in new window.Notes: the scale doesn't start at zero to better show the change. The graph shows the 4-week average, not the weekly occupancy rate.

On a 4-week basis, occupancy is up 8.5% compared to last year (the worst year since the Great Depression) and 5.8% below the median for 2000 through 2007.

The occupancy rate is slightly above the levels of 2008, but RevPAR is still down 3% compared to the same week in 2008.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Weekly Initial Unemployment Claims increase to 457,000

by Calculated Risk on 11/04/2010 08:30:00 AM

The DOL reports on weekly unemployment insurance claims:

In the week ending Oct. 30, the advance figure for seasonally adjusted initial claims was 457,000, an increase of 20,000 from the previous week's revised figure of 437,000. The 4-week moving average was 456,000, an increase of 2,000 from the previous week's revised average of 454,000.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since January 2000.

The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims increased this week by 2,000 to 456,000.

The 4-week moving average has been moving sideways at an elevated level for almost a year - a sign of a weak job market.

Wednesday, November 03, 2010

Bernanke: "What the Fed did and why"

by Calculated Risk on 11/03/2010 11:59:00 PM

Fed Chairman Ben Bernanke explains what the Fed is trying to accomplish in the WaPo: What the Fed did and why: supporting the recovery and sustaining price stability

[W]hen the Fed's monetary policymaking committee - the Federal Open Market Committee (FOMC) - met this week to review the economic situation, we could hardly be satisfied. The Federal Reserve's objectives - its dual mandate, set by Congress - are to promote a high level of employment and low, stable inflation. Unfortunately, the job market remains quite weak; the national unemployment rate is nearly 10 percent ...

Today, most measures of underlying inflation are running somewhat below 2 percent, or a bit lower than the rate most Fed policymakers see as being most consistent with healthy economic growth in the long run. ... [L]ow and falling inflation indicate that the economy has considerable spare capacity, implying that there is scope for monetary policy to support further gains in employment without risking economic overheating. The FOMC decided this week that ... further support to the economy is needed. With short-term interest rates already about as low as they can go, the FOMC agreed to deliver that support by purchasing additional longer-term securities, as it did in 2008 and 2009. ...

This approach eased financial conditions in the past and, so far, looks to be effective again. Stock prices rose and long-term interest rates fell when investors began to anticipate the most recent action. Easier financial conditions will promote economic growth. For example, lower mortgage rates will make housing more affordable and allow more homeowners to refinance. Lower corporate bond rates will encourage investment. And higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.

Misc: Bankruptcy Filings increase, Freddie Mac reports loss, and more

by Calculated Risk on 11/03/2010 09:46:00 PM

Foreclosure activity for non-performing loans also continued to increase during the third quarter as many of those loans transitioned to REO. The timing and volume of the company's future REO activities could be adversely affected by deficiencies in the foreclosure practices of the company's mortgage servicers, as well as related delays in the foreclosure process.And the costs for the REOs are increasing too:

included in non-interest expense for the third quarter of 2010 was REO operations expense of $337 million, compared to REO operations income of $40 million in the second quarter of 2010, reflecting higher property write-downs due to lower estimated REO fair values as well as higher expenses driven by increased REO inventory.Earlier stories today:

Comments on FOMC statement

by Calculated Risk on 11/03/2010 05:40:00 PM

A few comments ...

U.S. Light Vehicle Sales 12.26 million SAAR in October

by Calculated Risk on 11/03/2010 03:29:00 PM

Note: I'll posts some comments on the FOMC statement later today.

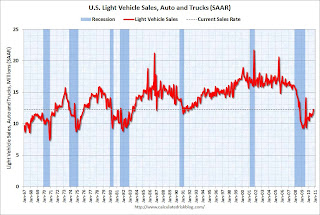

Based on an estimate from Autodata Corp, light vehicle sales were at a 12.26 million SAAR in October. That is up 17.9% from October 2009, and up 4.7% from the September 2010 sales rate.

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for October (red, light vehicle sales of 12.26 million SAAR from Autodata Corp).

This is the highest sales rate since September 2008, excluding Cash-for-clunkers in August 2009.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

The second graph shows light vehicle sales since the BEA started keeping data in 1967.

Note: dashed line is current estimated sales rate. The current sales rate is still near the bottom of the '90/'91 recession - when there were fewer registered drivers and a smaller population.

This was above most forecasts of around 12.0 million SAAR.