by Calculated Risk on 5/05/2010 02:25:00 PM

Wednesday, May 05, 2010

Whitney: Banks Under-reserved for 'Double-dip' in House Prices

From Nikolaj Gammeltoft and Peter Eichenbaum at Bloomberg: Whitney Says Banks Face ‘Tough’ Quarter, Housing Dip (ht jb)

Banks continue to suffer from losses on non-performing loans, and U.S. home prices will fall again amid increasing supply and sluggish demand, according to [banking analyst Meredith Whitney].I also think the repeat national house price indexes (Case-Shiller, LoanPerformance) will show further price declines later this year. But, we have to recognize that a majority of the national price declines are behind us, and any 'double-dip' in prices will be much smaller than the previous declines.

“I’m steadfast in my belief there’s going to be a double- dip in housing,” she said. “You will see clearly that the banks are under-reserved when housing dips again.”

My guess is some mid-to-high end bubble areas will see the largest future price declines - so the impact on the banks will depend on their exposure to the those areas.

I think BofA with the Countrywide loans, Wells Fargo with Wachovia / Golden West, and JPMorgan with WaMu are all exposed to the mid-to-high end bubble areas. But all the acquiring banks took large write-downs for these loans earlier, so I'm not sure Whitney is correct about them being under-reserved (it is hard to tell). Of course there are the 2nd lien issues too.

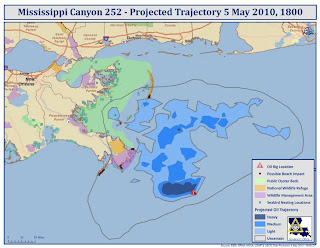

Web Resources for tracking the Oil Spill

by Calculated Risk on 5/05/2010 12:19:00 PM

From NOAA: Deepwater Horizon Incident, Gulf of Mexico

From the Office of the Governor, Louisiana: Gulf Oil Spill 2010 Trajectory

Click on map for larger image in new window.

Update: from Google: Gulf of Mexico Oil Spill (ht Jan)

ISM Non-Manufacturing Index Shows Expansion

by Calculated Risk on 5/05/2010 10:02:00 AM

April ISM Non-Manufacturing index 55.4%, unchanged from March.

This shows further growth in the service sector, although employment contracted for the 28th consecutive month.

From the Institute for Supply Management: April 2010 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in April for the fourth consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee; and senior vice president — supply management for Hilton Worldwide. "The NMI (Non-Manufacturing Index) registered 55.4 percent in April, the same percentage as registered in March, and indicating growth in the non-manufacturing sector. The Non-Manufacturing Business Activity Index increased 0.3 percentage point to 60.3 percent, reflecting growth for the fifth consecutive month. The New Orders Index decreased 4.1 percentage points to 58.2 percent, and the Employment Index decreased 0.3 percentage point to 49.5 percent."

...

Employment activity in the non-manufacturing sector contracted in April for the 28th consecutive month. ISM's Non-Manufacturing Employment Index for April registered 49.5 percent. This reflects a decrease of 0.3 percentage point when compared to the 49.8 percent registered in March.

emphasis added

ADP: Private Employment increased in April

by Calculated Risk on 5/05/2010 08:15:00 AM

ADP reports:

Nonfarm private employment increased 32,000 from March to April 2010 on a seasonally adjusted basis, according to the ADP National Employment Report. The estimated change in employment from February to March 2010 was revised up, from a decline of 23,000 to an increase of 19,000.Note: ADP is private nonfarm employment only (no government jobs).

In addition, the revised estimate of the monthly change in employment from January to February 2010 shows a modest increase of 3,000. Thus, employment has increased for three straight months, albeit only modestly. The slow pace of improvement from February through April is consistent with the pause in the decline of initial unemployment claims that occurred during the winter months.

...

April’s ADP Report estimates nonfarm private employment in the service-providing sector rose by 50,000, the third consecutive monthly increase. Employment in the goods-producing sector declined 18,000 during April. However, while construction employment dropped 49,000, manufacturing employment, in an encouraging sign, rose 29,000, the third consecutive monthly increase.

This is close to the consensus forecast of an increase of 28,000 private sector jobs in April.

The BLS reports on Friday, and the consensus is for an increase of 200,000 payroll jobs in April, on a seasonally adjusted (SA) basis, with about 100,000 temporary Census 2010 jobs.

MBA: Mortgage Purchase Applications Highest Since October

by Calculated Risk on 5/05/2010 07:00:00 AM

The MBA reports: Purchase Applications Continue to Increase, Refinance Activity Declines in Latest MBA Weekly Survey

The Market Composite Index, a measure of mortgage loan application volume, increased 4.0 percent on a seasonally adjusted basis from one week earlier. ...

The Refinance Index decreased 2.1 percent from the previous week and the seasonally adjusted Purchase Index increased 13.0 percent from one week earlier. This is the third consecutive weekly increase in purchase applications and the highest Purchase Index recorded in the survey since the week ending October 2, 2009. ...

"Purchase application activity continued to increase in the last week of the homebuyer tax credit program," said Michael Fratantoni, MBA's Vice President of Research and Economics. "Purchase applications were up 13 percent over the previous week and almost 24 percent over the last month, driven by significant increases in both conventional and government purchase applications. We also saw the Government share of applications for purchasing a home increase to over 50 percent of all purchase applications last week, which is the highest in two decades."

... The average contract interest rate for 30-year fixed-rate mortgages decreased to 5.02 percent from 5.08 percent, with points increasing to 0.92 from 0.91 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the MBA Purchase Index and four week moving average since 1990.

This is the highest level for the purchase index since last October. The index will probably turn down in the next week or two since the tax credit expired last Friday (buyers need to close by June 30th).