by Calculated Risk on 4/05/2010 03:15:00 PM

Monday, April 05, 2010

Rising Mortgage Rates: The End of the Refi mini-Boom?

The Ten Year treasury yield hit 4.0% this morning for the first time since Oct 2008. Mortgage rates are moving up too and that probably means that refinance activity will decline sharply. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Refinance activity picks up when mortgage rates fall (for obvious reasons), and this graph shows the monthly refinance activity (MBA refinance index) and the 30 year fixed mortgage rate and one year adjustable mortgage rate (both from the Freddie Mac Primary Mortgage Market Survey) - and the Fed Funds target rate since Jan 1990.

Notice that following the '90/'91 and '01 recessions, the Fed kept lowering the Fed Funds rate because of high unemployment rates. This spurred refinance activity. The Fed can't lower the Fed Funds rate now - and could only spur refinance activity if they restarted the MBS purchase program.  The second graph shows the weekly MBA refinance activity, and the Ten Year Treasury yield.

The second graph shows the weekly MBA refinance activity, and the Ten Year Treasury yield.

When the ten year yield drops sharply, usually refinance activity picks up. And when the yield increases, refinance activity declines.

With the yield on the Ten Year Treasury increasing to 4%, and the end of the Fed MBS purchase program last week, mortgage rates will probably rise and refinance activity will fall sharply.

Greece Emergency Loan: Disagreement on Interest Rate

by Calculated Risk on 4/05/2010 12:26:00 PM

The Financial Times reports that if (when) Greece needs to call on the emergency loan package from the IMF-Eurozone, Germany officials argue Greece should pay 6.0% to 6.5% on the Eurozone loans - the same as they are currently paying on 10 year bonds. Others are arguing for borrowing rates in the 4 to 4.5% range - similar to rates paid by Ireland and Portugal.

See the Financial Times: German stand on loan rates to Greece

Eurozone leaders agreed at the end of March to offer Greece an emergency loan package from the International Monetary Fund and the eurozone if it was unable to raise debt in the market, but they insisted the interest rate on the European portion of a bail would be unsubsidised.I guess it depends on the definition of "unsubsidised".

Apparently the Asian central banks are not interested in Greek Bond issues, from the WSJ: Greek Bond May Get Cool Asian Response

"We wouldn't want to be involved" in the bond issue, one fund manager in Hong Kong said. "The fiscal situation in Greece remains very fragile, so we want to wait for a more concrete plan on how to resolve their debt problem."

ISM Non-Manufacturing Index Shows Expansion in March

by Calculated Risk on 4/05/2010 10:00:00 AM

March ISM Non-Manufacturing index 55.4% vs 53.0 in February

This shows further growth in the service sector, although employment contracted for the 27th consecutive month.

From the Institute for Supply Management: March 2010 Non-Manufacturing ISM Report On Business®

Economic activity in the non-manufacturing sector grew in March for the third consecutive month, say the nation's purchasing and supply executives in the latest Non-Manufacturing ISM Report On Business®.

The report was issued today by Anthony Nieves, C.P.M., CFPM, chair of the Institute for Supply Management™ Non-Manufacturing Business Survey Committee; and senior vice president – supply management for Hilton Worldwide. "The NMI (Non-Manufacturing Index) registered 55.4 percent in March, 2.4 percentage points higher than the seasonally adjusted 53 percent registered in February, and indicating growth in the non-manufacturing sector. The Non-Manufacturing Business Activity Index increased 5.2 percentage points to 60 percent, reflecting growth for the fourth consecutive month. The New Orders Index increased 7.3 percentage points to 62.3 percent, and the Employment Index increased 1.2 percentage points to 49.8 percent.

...

Employment activity in the non-manufacturing sector contracted in March for the 27th consecutive month. ISM's Non-Manufacturing Employment Index for March registered 49.8 percent. This reflects an increase of 1.2 percentage points when compared to the seasonally adjusted 48.6 percent registered in February.

emphasis added

Sunday, April 04, 2010

Reis: U.S. Office Vacancy Rate Highest Since early '90s

by Calculated Risk on 4/04/2010 11:59:00 PM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the office vacancy rate starting 1991.

Reis is reporting the vacancy rate rose to 17.2% in Q1 2010, up from 17.0% in Q4, and up from 15.2% in Q1 2009. The peak following the previous recession was 16.9%.

From the Financial Times: Signs that worst is over for commercial property

New figures from Reis ... showed that the vacancy rate in the US office sector climbed to 17.2 per cent during the first three months of the year..Even though vacancy rates will probably rise further and rents continue to decline, it does appear the rate of deterioration has slowed.

...

"We expect less of a bloodbath in fundamentals in 2010 versus 2009, but rents will still decline and vacancies will still continue to rise," said Victor Calanog, director of research at Reis. ... During the first quarter, asking rents and effective rents, which include special offers and concessions, both fell by just 0.8 per cent.

excerpts with permission

Reis should release the Mall and Apartment vacancy rates over the next few days, and those will probably be at record levels.

Percent Job Losses During Recessions, aligned at Bottom

by Calculated Risk on 4/04/2010 08:50:00 PM

By request ... Click on graph for larger image.

Click on graph for larger image.

This graph shows the job losses from the start of the employment recession, in percentage terms - but this time aligned at the bottom of the recession (ht Tom). This assumes that the 2007 recession has reached bottom.

The current recession has been bouncing along the bottom for a few months - so the choice of bottom is a little arbitrary (plus or minus a month or two).

Notice that the 1990 and 2001 recessions were followed by jobless recoveries - and the eventual job recovery was gradual. In earlier recessions the recovery was somewhat similar and a little faster than the decline (somewhat symmetrical).

If the current recovery was similar to the earlier recessions, the economy would recovery the 8+ million lost payroll jobs over the next 2 years. I think that is very unlikely ...

Earthquake!

by Calculated Risk on 4/04/2010 06:42:00 PM

In Socal ...

6.9 in Guadalupe Victoria, Mexico. We felt it pretty good in Orange County.

Weekly Summary and a Look Ahead

by Calculated Risk on 4/04/2010 12:25:00 PM

The economic news will be a little lighter in the up coming week, although there will be a number of Fed speeches.

Early in the week, I expect REIS to release the Q1 vacancy data for offices, malls and apartments. This is key data for commercial real estate, and the vacancy rates have been steadily rising and setting new records.

Later in the week, we will probably get the March National Federation of Independent Business (NFIB) small business survey and the rail traffic report for March from the Association of American Railroads (AAR).

On Monday, the ISM non-manufacturing (service) index for March will be released at 10 AM ET, and February pending home sales from the National Association of Realtors (also at 10 AM). The consensus is for an increase in the ISM index to 54.0 from 53.0 in February, and a slight decline in pending home sales.

On Tuesday the Job Openings and Labor Turnover Survey (JOLTS) for February will be released at 10 AM by the BLS. This report has been showing very little hiring and turnover in the labor market. Also on Tuesday the FOMC minutes for the March meeting will be released at 2 PM. Minnesota Fed President Narayana Kocherlakota speaks at 1 PM.

On Wednesday consumer credit will be released by the Federal Reserve at 2 PM. Fed Chairman Ben Bernanke is speaking at a luncheon, and also on Wednesday Kansas City Fed President (and inflation hawk) Tom Hoenig speaks at 2PM.

On Thursday the closely watched initial weekly unemployment claims will be released. The consensus is for some slight improvement from the 439K last week. Fed Vice Chairman Donald Kohn speaks on the U.S. economic outlook at 4 PM, and Chairman Bernanke speaks on economic policy at 8:30 PM.

And on Friday, Wholesale inventories for February will be released at 10 AM. Also on Friday the FDIC will probably close several more banks. Puerto Rico is still on the clock ...

And a (long) summary of last week:

Click on graph for larger image.

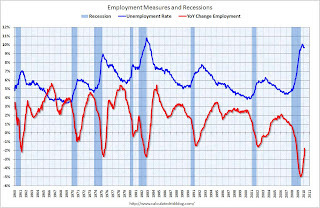

Click on graph for larger image.This graph shows the unemployment rate and the year over year change in employment vs. recessions.

Nonfarm payrolls increased by 162,000 in March. The economy has lost 2.3 million jobs over the last year, and 8.2 million jobs since the beginning of the current employment recession.

The unemployment rate was steady at 9.7 percent.

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

The second graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).For the current recession, employment peaked in December 2007, and this recession is by far the worst recession since WWII in percentage terms, and 2nd worst in terms of the unemployment rate (only early '80s recession with a peak of 10.8 percent was worse).

Census 2010 hiring was 48,000 (NSA) in March. So payrolls increased 114,000 ex-Census.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.The Employment-Population ratio ticked up slightly to 58.6% in March, after plunging since the start of the recession. This is about the same level as in 1983.

Note: the graph doesn't start at zero to better show the change.

The Labor Force Participation Rate increased slightly to 64.9% (the percentage of the working age population in the labor force). This is at the level of the early 80s. Many of these people will return to the labor force when the employment picture improves - and that will keep the unemployment rate elevated unless net hiring picks up dramatically.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased sharply to 9.1 million.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) increased sharply to 9.1 million. The all time record of 9.2 million was set in October. This suggests the increase last month was not weather related - and is not a good sign.

The next graph shows long term unemployment.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.According to the BLS, there are a record 6.55 million workers who have been unemployed for more than 26 weeks (and still want a job). This is a record 4.3% of the civilian workforce. (note: records started in 1948)

Although the headline number of 162,000 payroll jobs was a positive (this is 114,000 after adjusting for Census 2010 hires), the underlying details were mixed. The positives: the unemployment rate was steady, the employment-population ratio ticked up slightly (after plunging sharply), the diffusion index showed more industries hiring, and average hours increased (might have been impacted by the snow in February).

But a near record number of part time workers (for economic reasons), a record number of unemployed for more than 26 weeks, and a decline in average hourly wages are all negatives.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

This graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.Private residential construction spending is now 62.9% below the peak of early 2006.

Private non-residential construction spending is 29.0% below the peak of late 2008.

Residential spending will probably exceed non-residential spending later this year - mostly because of continued declines in non-residential spending as major projects are completed.

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for March (red, light vehicle sales of 11.78 million SAAR from AutoData Corp).

This graph shows the historical light vehicle sales (seasonally adjusted annual rate) from the BEA (blue) and an estimate for March (red, light vehicle sales of 11.78 million SAAR from AutoData Corp).This is a 13.9% increase from the February sales rate.

Excluding August '09 (Cash-for-clunkers), this is the highest level since September 2008. The current level of sales are very low, and are at about the low point for the '90/'91 recession (even with a larger population now).

Fannie Mae reported that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 5.52% in January, up from 5.38% in December - and up from 2.77% in January 2009.

Fannie Mae reported that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 5.52% in January, up from 5.38% in December - and up from 2.77% in January 2009."Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans."

IMPORTANT: These graphs are Not Seasonally Adjusted (NSA).

IMPORTANT: These graphs are Not Seasonally Adjusted (NSA).This graph shows the nominal not seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 30.2% from the peak, and down about 0.2% in January NSA (up 0.4% SA, but the data wasn't available when the charts were created).

The Composite 20 index is off 29.6% from the peak, and down about 0.4% in January (NSA) (up 0.3% SA)

Prices decreased (NSA) in 18 of the 20 Case-Shiller cities in January NSA.

Prices decreased (NSA) in 18 of the 20 Case-Shiller cities in January NSA. On a SA basis from the NY Times: U.S. Home Prices Prices Inch Up, but Troubles Remain

Twelve of the cities in the index went up in January from December. Los Angeles was the biggest gainer, up 1.7 percent. Chicago was the biggest loser, dropping 0.8 percent.

Here is a map of the three month change in the Philly Fed state coincident indicators. Twenty five states are showing declining three month activity. The index increased in 18 states, and was unchanged in 7.

Here is a map of the three month change in the Philly Fed state coincident indicators. Twenty five states are showing declining three month activity. The index increased in 18 states, and was unchanged in 7.Here is the Philadelphia Fed state coincident index release for February.

In the past month, the indexes increased in 21 states, decreased in 22, and remained unchanged in seven for a one-month diffusion index of -2. Over the past three months, the indexes increased in 18 states, decreased in 25, and remained unchanged in seven for a three-month diffusion index of -14.

Best wishes to all.

Texas and the Housing Bubble

by Calculated Risk on 4/04/2010 09:02:00 AM

From Alyssa Katz at the WaPo: How Texas escaped the real estate crisis

Only a dozen states have lower mortgage foreclosure and default rates [than Texas], and all of them are rural places such as Montana and South Dakota, where they couldn't have a real estate boom if they tried.Here is a graph based on the Q4 2009 MBA delinquency survey:

Texas's 3.1 million mortgage borrowers are a breed of their own among big states with big cities. Fewer than 6 percent of them are in or near foreclosure, according to the Mortgage Bankers Association; the national average is nearly 10 percent.

...

[T]here is a ... secret to Texas's success ... Across the nation, cash-outs became ubiquitous during the mortgage boom, as skyrocketing house prices made it possible for homeowners, even those with bad credit, to use their home equity like an ATM. But not in Texas. There, cash-outs and home-equity loans cannot total more than 80 percent of a home's appraised value. There's a 12-day cooling-off period after an application, during which the borrower can pull out. And when a borrower refinances a mortgage, it's illegal to get even a dollar back. Texas really means it: All these protections, and more, are in the state constitution. The Texas restrictions on mortgage borrowing date from the first days of statehood in 1845, when the constitution banned home loans.

"Delinquency and foreclosure rates are significantly lower in Texas," says Scott Norman of the Texas Mortgage Bankers Association. "The 80 percent loan-to-value limit -- that's the catalyst for a lot of this."

Click on graph for larger image in new window.

Click on graph for larger image in new window.Sure enough the seriously delinquent rate in Texas is only higher than 12 other states. However the total delinquency rate is right in the middle.

The limits on home equity borrowing might have helped because fewer homeowners could get into situations with negative equity.

This graph is based on the First American CoreLogic Q4 negative equity report.

This graph is based on the First American CoreLogic Q4 negative equity report.This graph shows the negative equity and near negative equity by state.

Once again Texas is in the bottom half, but the negative equity rate doesn't seem extremely low.

I think there are other factors too. Texas is part of Krugman's Flatland, and most areas with abundant land saw smaller price increases during the bubble. And there is a direct correlation between price increase and eventual price decrease - and therefore negative equity (all those people who bought near the top) - and the delinquency rate. I think Texas saw a minimal price increase because it is easy to build there.

Although I think limits on home equity borrowing make sense, and might have helped at the margin, I'm not convinced it is a "secret" to the lower rate in Texas.

Note: Nevada and Arizona have building limitations, and they also saw significant investor buying from Californians - many using their home equity to buy investment property.

Saturday, April 03, 2010

India: 30% Mall Vacancy Rate in Cities, Falling Rents

by Calculated Risk on 4/03/2010 11:14:00 PM

We rarely discuss India ...

From Praveen Singh at the Indian Express: Sprawling Malls, empty spaces

According to reports, the average vacancy across malls in major cities rose to over 30 per cent last year. ...It appears there was a commercial real estate bubble in India too.

Jones Lang LaSalle Meghraj (JLLM), a global property consultant, says that out of 17.3 million sq ft supply of retail space across the country in 2010, only 9.3 million sq ft is expected to be absorbed. ...

[T]here has been a continuous fall in retail rentals. A Cushman & Wakefield (C&W) survey revealed that certain pockets of Delhi, Gurgaon, Chandigarh, Kolkata, Hyderabad, Mumbai, Pune and Bangalore are witnessing severe decline in rentals. The NCR, which received the highest quantum of mall space last year, saw a rental correction of approximately 30 to 60 per cent in locations such as Noida and Gurgaon. Likewise, high streets like Linking Road and Kemps Corner in Mumbai, Cathedral Road and R K Salai in Chennai, and Ganesh Khind Road in Pune witnessed a 13 to 20 per cent drop in rentals.

Housing Starts and the Unemployment Rate

by Calculated Risk on 4/03/2010 07:43:00 PM

Returning to a theme ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows single family housing starts through February and the unemployment rate through March (inverted).

You can see both the correlation and the lag. The lag is usually about 12 to 18 months, with peak correlation at a lag of 16 months for single unit starts. The 2001 recession was a business investment led recession, and the pattern didn't hold.

Usually housing starts and residential construction employment lead the economy out of a recession, but not this time because of the huge overhang of existing housing units. Housing starts (blue) are moving sideways. The second graph shows construction payroll employment. Unfortunately the BLS didn't start breaking out residential specialty trade construction employment until 2001 - so this graph shows total construction.

The second graph shows construction payroll employment. Unfortunately the BLS didn't start breaking out residential specialty trade construction employment until 2001 - so this graph shows total construction.

Usually residential leads both into and out of a recession, and non-residential lags a recession. But we can't see that here.

But this graph does show that there are 2.13 million fewer construction payroll jobs than at the peak. About 1.3 million of these are residential construction. Since non-residential construction is still declining - and residential is flat - this is a key area of employment that will see little recovery this year.

Of course this is only about 14% of the total unemployed and other sectors will probably do better, but this is usually a leading sector for the economy. Since I expect the housing recovery to be sluggish, I also expect unemployment to remain high throughout 2010.