by Calculated Risk on 3/05/2010 06:12:00 PM

Friday, March 05, 2010

Bank Failure #24 & #25: Illinois and Maryland

Bankers sneer at citizens:

Our loss,... your burden.

February rain.

March green shoots did not flower

These banks push daisies.

by Soylent Green is People

From the FDIC: Heartland Bank and Trust Company, Bloomington, Illinois, Assumes All of the Deposits of Bank of Illinois, Normal, Illinois

Bank of Illinois, Normal, Illinois, was closed today by the Illinois Department of Financial Professional Regulation – Division of Banking, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...From the FDIC: FDIC Creates a New Depository Institution to Assume the Operations of Waterfield Bank, Germantown, Maryland

As of December 31, 2009, Bank of Illinois had approximately $211.7 million in total assets and $198.5 million in total deposits....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $53.7 million. ... Bank of Illinois is the 24th FDIC-insured institution to fail in the nation this year, and the third in Illinois. The last FDIC-insured institution closed in the state was George Washington Savings Bank, Orland Park, on February 19, 2010.

Waterfield Bank, Germantown, Maryland, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...No one wanted Waterfield ...

As of December 31, 2009, Waterfield Bank had $155.6 million in assets and $156.4 million in deposits. At the time of closing, the amount of deposits exceeding the insurance limits totaled about $407,000. ...

The FDIC estimates that the cost to its Deposit Insurance Fund will be $51.0 million. Waterfield Bank is the 25th bank to fail in the nation this year and the first in Maryland. The last FDIC-insured institution to fail in the state was Bradford Bank, Baltimore, on August 28, 2009.

Bank Failure #23: Sun American Bank, Boca Raton, Florida

by Calculated Risk on 3/05/2010 05:36:00 PM

Huddled masses cry "Relief!"

Cash burn warms bankers.

by Soylent Green is People

From the FDIC: First-Citizens Bank & Trust Company, Raleigh, North Carolina Assumes All of the Deposits of Sun American Bank, Boca Raton, Florida

Sun American Bank, Boca Raton, Florida, was closed today by the Florida Office of Financial Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...It is Friday!

As of December 31, 2009, Sun American Bank had approximately $535.7 million in total assets and $443.5 million in total deposits. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $103.8 million. ... Sun American Bank is the 23rd FDIC-insured institution to fail in the nation this year, and the fourth in Florida. The last FDIC-insured institution closed in the state was Marco Community Bank, Marco Island, on February 19, 2010.

Update on Post Bubble Real Estate Swindle in San Diego

by Calculated Risk on 3/05/2010 03:36:00 PM

This is an update on a great series by Kelly Bennett of Voice of San Diego.

First a little background: According to Kelly, in 2008 - after the bubble burst - James McConville bought distressed condos from developers in bulk, and then sold them to straw buyers at inflated prices (individuals with solid credit records who agreed to sign for the loans for a fee). McConville pocketed the difference between the straw buyer price and the bulk price - approximately $12.5 million.

McConville promised to rent the properties, and pay the mortgages from the rental income. Good luck!

This was happening in 2008.

And the update from Kelly Bennett at Voice of San Diego: A Year Later, Losses Pile Up in Complexes Ravaged by Swindle

All of the 81 condos from the Sommerset Villas, Sommerset Woods and Westlake Ranch complexes involved in the scam have been repossessed. Twenty-four have yet to find new buyers. But the other 57 have resold for prices drastically lower than the mortgages were worth, let alone the initial purchase prices.There is much more in the article, but this ties into another article today from Bloomberg: Fannie, Freddie Ask Banks to Eat Soured Mortgages

The U.S. taxpayer is paying for the mounting losses. Across the complexes, the cost to taxpayers is at least $7.8 million.

When the units were just in the beginning stages of foreclosure, it was too soon to tell whether the government-sponsored mortgage companies, Freddie Mac and Fannie Mae, had definitely purchased the shaky loans.

Fannie Mae and Freddie Mac may force lenders including Bank of America Corp., JPMorgan Chase & Co., Wells Fargo & Co. and Citigroup Inc. to buy back $21 billion of home loans this year as part of a crackdown on faulty mortgages.

That’s the estimate of Oppenheimer & Co. analyst Chris Kotowski, who says U.S. banks could suffer losses of $7 billion this year when those loans are returned and get marked down to their true value.

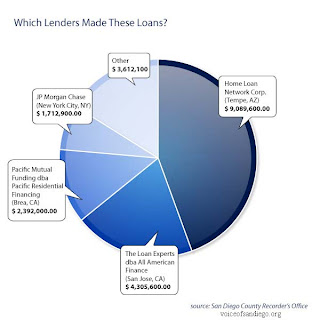

Click on graph for larger image.

Click on graph for larger image.Kelly provided me with this graphic on the San Diego swindle. This shows the lenders that were swindled. Since most of these loans were sold to Fannie and Freddie, there is a good chance the loans will be pushed back on the lenders - if they still exist. We know JPMorgan is still around!

More from Bloomberg:

The banks have to buy back the loans at par, and then take an impairment, because borrowers usually have stopped paying and the price of the underlying home has plunged. JPMorgan said in a presentation last month that it loses about 50 cents on the dollar for every loan it has to buy back.The losses will be much higher than 50 cents on the dollar on these loans.

Frank: Fannie Freddie Investments not Risk Free, Treasury Clarifies

by Calculated Risk on 3/05/2010 01:16:00 PM

UPDATE: From CNBC: Frank Denies Saying No Guarantee on Fannie, Freddie

From Zachary Goldfarb at the WaPo: Rep. Frank questions safety of Fannie Mae, Freddie Mac investments

"People who own Fannie and Freddie debt are not in the same legal position as [those who own] Treasury bonds and I don't want them to be," [Rep. Barney Frank (D-Mass.), chairman of the House Financial Services Committee] said in an interview Thursday.and from Reuters: U.S. Treasury says stands behind Fannie, Freddie

...

In restructuring the companies, Frank said he wants "to preserve the right to give people haircuts." He added, "I don't want to preclude that."

"As we said in December, there should be no uncertainty about Treasury's commitment to support Fannie Mae and Freddie Mac as they continue to play a vital role in the housing market during this current crisis," the statement from the Treasury said.I think Frank was referring to some future structure of Fannie and Freddie, but the market took his comments as suggesting that current bondholders might take a haircut.

Treasury has reiterated their commitment to Fannie and Freddie (although I wish Treasury would put out statements on their press room site).

Diffusion Index and Temporary Help

by Calculated Risk on 3/05/2010 11:24:00 AM

First - David Leonhardt at the NY Times Economix asks: Is the Recovery Losing Steam?

How you view today’s jobs report depends on snow.We won't know which "snow" view is correct for another month - or maybe even months.

...

If the storms indeed had a big effect — if they cut even 100,000 jobs from payrolls — then today’s report counts as very good news.

...

If the snow effect was close to zero ... the recovery is losing steam — as the peak impact of the stimulus is now past and consumers and businesses still aren’t spending aggressively.

Which of these two situations — the optimistic or pessimistic one — is more plausible? You’ll hear a lot of strong arguments today, but no one really knows. The uncertainty about the snow effect is too big, as the Labor Department did a nice job of acknowledging.

My guess is that recovery has indeed lost some steam in the last couple of months.

But here are a couple more graphs based on data in the employment report - and both of these are little more positive ...

Temporary Workers

From the BLS report:

In February, temporary help services added 48,000 jobs. Since reaching a low point in September 2009, temporary help services employment has risen by 284,000.

This graph is a little complicated.

This graph is a little complicated.The red line is the three month average change in temporary help services (left axis). This is shifted four months into the future.

The blue line (right axis) is the three month average change in total employment (excluding temporary help services).

Unfortunately the data on temporary help services only goes back to 1990, but it does appear that temporary help leads employment by about four months. When we discussed this graph last year, temporary help suggested positive job growth in December 2009. But with revisions - the graph has been shifted a few months.

The thinking is that before companies hire permanent employees following a recession, employers will first increase the hours worked of current employees and also hire temporary employees. Since the number of temporary workers increased sharply, some people think this might be signaling the beginning of an employment recovery.

However, there has been some evidence of a shift by employers to more temporary workers, and the saying may become "We are all temporary now!", so use this increase with caution. For more, including some cautionary comments from a BLS economist on using temporary help, see Tom Abate's article in the San Francisco Chronicle.

Also - the temporary hiring for the Census should probably be excluded from this graph in the future (remember the Census will boost payroll jobs by maybe 100 thousand in March, and up to 500 thousand in May - but all those jobs will be lost over the following 6 months).

Diffusion Index

The BLS diffusion index for total private employment increased to 48.0 from 44.2 in January. This is the highest level since March 2008.

The BLS diffusion index for total private employment increased to 48.0 from 44.2 in January. This is the highest level since March 2008.For manufacturing, the diffusion index is at 54.9, the first time above 50 since November 2007.

Think of this as a measure of how widespread job losses are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS. From the BLS:

Figures are the percent of industries with employment increasing plus one-half of the industries with unchanged employment, where 50 percent indicates an equal balance between industries with increasing and decreasing employment.The diffusion index had been trending up, meaning job losses are becoming less widespread.

However a reading of 48.0 is still below the balance level, and I'd expect the diffusion index to be at or above 50 when the economy starts adding net jobs.

Earlier employment posts today: