by Calculated Risk on 2/12/2010 02:37:00 PM

Friday, February 12, 2010

China Stimulus: High Speed Rail

The rapid expansion of high speed rail in China is pretty astounding ...

From the NY Times: China’s Project to Build Fast Trains Is Spurring Growth

The Chinese bullet train, which has the world’s fastest average speed, connects Guangzhou, the southern coastal manufacturing center, to Wuhan, deep in the interior. In a little more than three hours, it travels 664 miles ... Even more impressive, the Guangzhou to Wuhan train is just one of 42 high-speed lines recently opened or set to open by 2012 in China.This is part of the stimulus package:

Faced with mass layoffs at export factories [due to the global financial crisis], China ordered that the new rail system be completed by 2012 instead of 2020, throwing more than $100 billion in stimulus at the projects.It sounds like they are building the pyramids!

Administrators mobilized armies of laborers — 110,000 just for the 820-mile route from Beijing to Shanghai, which will cut travel time there to 5 hours from 12 when it opens next year.

Inventory Cycle and GDP

by Calculated Risk on 2/12/2010 11:51:00 AM

In Q4 2009 a majority of the increase in GDP was due to changes in private inventories. That can be a little confusing ...

First, GDP is Gross Domestic Production. What is being estimated is "domestic production", but what is being measured is mostly domestic consumption.

Right away we can see that if something is produced domestically and then exported, it will not show up in domestic sales. So exports are added to the equation, and imports subtracted. Investment and Government spending are also added to measures of consumption, and we frequently see an equation like this for GDP:

Y: GDP

C: Consumption

I: Investment

G: Government spending

NX: Exports - imports.

But what about changes in inventories? The same ideas apply. What is measured are sales and changes in inventory, and then production is calculated:

The following simple table shows how this works, and how it impacts GDP.

| Sales | Production | Inventory | I/S | GDP | |

|---|---|---|---|---|---|

| Q1 | 100 | 100 | 100 | 1.00 | -- |

| Q2 | 101 | 101 | 100 | 0.99 | 4.1% |

| Q3 | 102 | 102 | 100 | 0.98 | 4.0% |

| Q4 | 103 | 103 | 100 | 0.97 | 4.0% |

| Q5 | 100 | 104 | 104 | 1.04 | 3.9% |

| Q6 | 97 | 100 | 107 | 1.10 | -14.5% |

| Q7 | 97 | 96 | 106 | 1.09 | -15.1% |

| Q8 | 98 | 93 | 101 | 1.03 | -11.9% |

| Q9 | 99 | 98 | 100 | 1.01 | 23.3% |

| Q10 | 100 | 100 | 100 | 1.00 | 8.4% |

The first four quarters just show normal growth. Sales increase by one unit each quarter, and since inventory is steady, production increases with sales. This gives annualized GDP growth of 4%, and a slightly declining inventory-to-sales ratio (assuming inventory stay at the same level).

Now look at Q5. Sales suddenly drop, but production still increases since the decline in sales was a surprise. This pushes up inventories. Production is measured from sales (100) plus increase in inventory (+4) and GDP still increases.

Now in Q6 sales fall further to 97. The company reacts to the decline in sales and only produces 100 widgets. Inventory still increases (+3), but the combination of sales and inventory changes in Q6 is less than in Q5, so GDP declines sharply (marked in red).

In Q7 sales have bottomed, but the company is still cutting back on producton because they have too much inventory. For Q7, Production = Sales (97) plus changes in inventory (-1) giving production of 96 widgets. That is sharply below the 100 widget production of the prior quarter, so even though sales have bottomed, GDP declines sharply.

In Q8 sales increase slightly, but the company still has too much inventory, and they cut production further - resulting in a decline in GDP.

Finally in Q9, sales increase again by one unit, and the company can now increase production almost to the level of sales. Inventory is still declining (production is less than sales), but production has increased sharply compared to Q8. This shows up as a surge in GDP of 23% in this example.

Remember production in Q9 was calculated from sales and changes in inventory. Production of 98 widgets = Sales of 99 widgets, minus 1 unit for decline in inventory. The increase in production from 93 units in Q8 to 98 unites in Q9 is what shows up in the GDP report.

By Q10 sales and production are pretty much back in equilibrium, but at a lower level than the peak. Now further increases in production depend on increases in sales.

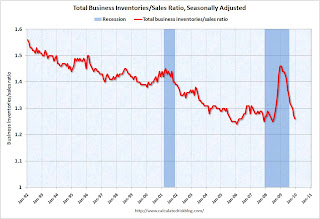

And that brings us to the Manufacturing and Trade Inventories and Sales report from the Census Bureau today that showed inventories declined slightly in December (seasonally adjusted).

Click on graph for larger image in new window.

Click on graph for larger image in new window.The Census Bureau reported:

Inventories. Manufacturers’ and trade inventories, adjusted for seasonal variations but not for price changes, were estimated at an end-of-month level of $1,310.7 billion, down 0.2 percent (±0.1%) from November 2009 and down 9.7 percent (±0.4%) from December 2008.This report suggests that inventories are back in line with sales, and the inventory cycle is mostly over (there will probably still be a positive contribution in Q1 2010 from changes in private inventories). Further increases in production will now depend on increases in consumption (or exports).

Inventories/Sales Ratio. The total business inventories/sales ratio based on seasonally adjusted data at the end of December was 1.26. The December 2008 ratio was 1.46.

China Tightens and Europe Slows

by Calculated Risk on 2/12/2010 09:15:00 AM

From Bloomberg: China Raises Bank Reserve Requirement to Cool Economy

China ordered banks to set aside more deposits as reserves for the second time in a month to cool the fastest-growing economy after loan growth accelerated and property prices surged.And from Eurostat: Euro area and EU27 GDP up by 0.1%

The reserve requirement will increase 50 basis points, or 0.5 percentage point, effective Feb. 25, the People’s Bank of China said on its Web site today. The current level is 16 percent for big banks and 14 percent for smaller ones.

GDP increased by 0.1% in both the euro area1 (EA16) and the EU271 during the fourth quarter of 2009, compared with the previous quarter, according to flash estimates published by Eurostat, the statistical office of the European Union. In the third quarter of 2009, growth rates were +0.4% and +0.3% respectively.Germany's economy stalled (no change), and Latvia saw the biggest decline (-3.2%).

And Greece's economy shrunk by 0.8%, possibly exacerbating the Greek debt crisis.

Note: Europe numbers are quarter-to-quarter. In the U.S. the GDP is annualized.

Retail Sales increase 0.5% in January

by Calculated Risk on 2/12/2010 08:30:00 AM

On a monthly basis, retail sales increased 0.5% from December to January (seasonally adjusted), and sales were up 4.7% from January 2009 (easy comparison).  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows retail sales since 1992. This is monthly retail sales, seasonally adjusted (total and ex-gasoline).

This shows that retail sales fell off a cliff in late 2008, and appear to have bottomed.

The red line shows retail sales ex-gasoline and shows the increase in final demand ex-gasoline has been sluggish. The second graph shows the year-over-year change in retail sales since 1993.

The second graph shows the year-over-year change in retail sales since 1993.

Retail sales increased by 4.7% on a YoY basis. The year-over-year comparisons are easy now since retail sales collapsed in late 2008. Retail sales bottomed in December 2008.

Here is the Census Bureau report:

The U.S. Census Bureau announced today that advance estimates of U.S. retail and food services sales for January, adjusted for seasonal variation and holiday and trading-day differences, but not for price changes, were $355.8 billion, an increase of 0.5 percent (±0.5%)* from the previous month and 4.7 percent (±0.5%) above January 2009.

...

Gasoline stations sales were up 29.0 percent (±1.5%) from January 2009

New Jersey: State of Fiscal Emergency

by Calculated Risk on 2/12/2010 12:52:00 AM

From Reuters: New Jersey governor declares fiscal emergency

New Jersey Governor Chris Christie on Thursday declared a "fiscal emergency," allowing him to reserve or freeze state spending as part of his plan to tackle one of the largest 2011 deficits among U.S. states.Just a late night budget update ...

...

The deficit in the current budget, which ends on June 30, is $2.2 billion, while the gap in the following budget has spiked to $11 billion from a forecast of $8 billion in November ... the largest per-capita budget shortfall of any U.S. state