by Calculated Risk on 1/29/2010 03:21:00 PM

Friday, January 29, 2010

Real GDP: Declines from Prior Peak

This is an update to a graph I posted in early 2009 ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the real GDP declines from the prior peak for post WWII recessions.

The recent recession was the worst since WWII (the peak decline was 3.83% in Q2 2009).

Even after the strong GDP growth in Q4 (due to inventory changes), current GDP is still 1.9% below the prior peak in real terms. If the recovery is sluggish - as I expect - it will take several more quarters to return to the pre-recession peak in real GDP.

Restaurant Index Improves in December

by Calculated Risk on 1/29/2010 01:24:00 PM

Note: This index is based on year-over-year performance, and the headline index might be slow to recognize a pickup in business.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

Unfortunately the data for this index only goes back to 2002.

Note: Any reading below 100 shows contraction for this index.

This is the highest level in almost two years, but the current situation index still suggests contraction in the restaurant industry.

From the National Restaurant Association (NRA): December Restaurant Performance Index Rose to Highest Level in Nearly Two Years

[T]he Association’s Restaurant Performance Index (RPI) ... stood at 98.7 in December, up 0.9 percent from November and its strongest level in nearly two years.

“The RPI’s strong gain in December was the result of broad-based improvements among several index components,” said Hudson Riehle, senior vice president of the Research and Knowledge Group for the National Restaurant Association. “Although restaurant operators continued to report a net decline in same-store sales and customer traffic, both registered their strongest performances since the summer of 2008.”

“Along with a solid improvement among the current situation indicators, restaurant operators are increasingly optimistic about industry growth in the months ahead,” Riehle added. “More than a third of restaurant operators expect to their sales to improve in six months, the highest level in more than two years.”

... The full report is available online. ...

... Index values above 100 indicate that key industry indicators are in a period of expansion, and index values below 100 represent a period of contraction for key industry indicators. Despite the solid improvement in December, the RPI remained below 100 for the 26th consecutive month.

The Current Situation Index, which measures current trends in four industry indicators (same-store sales, traffic, labor and capital expenditures), stood at 97.3 in December – up a strong 1.4 percent from November and its highest level since August 2008. However, December still represented the 28th consecutive month below 100, which signifies contraction in the current situation indicators.

...

Restaurant operators also reported an improving customer traffic performance in December. Thirty percent of restaurant operators reported an increase in customer traffic between December 2008 and December 2009, up from just 21 percent who reported higher customer traffic in November. Forty-seven percent of operators reported a traffic decline in December, down from 62 percent who reported lower traffic in November.

Although restaurant operators reported stronger sales and traffic results in December, capital spending activity continued to drop off. ...

emphasis added

A Few Comments on Q4 GDP Report

by Calculated Risk on 1/29/2010 10:57:00 AM

Any analysis of the Q4 GDP report has to start with the change in private inventories. This change contributed a majority of the increase in GDP, and annualized Q4 GDP growth would have been 2.3% without the transitory increase from inventory changes.

Unfortunately - although expected - the two leading sectors, residential investment (RI) and personal consumption expenditures (PCE), both slowed in Q4.

Note: for more on leading and lagging sectors, see Business Cycle: Temporal Order and Q1 GDP Report: The Good News.

It is not a surprise that both key leading sectors are struggling. The personal saving rate increased slightly to 4.6% in Q4, and I expect the saving rate to increase over the next year or two to around 8% - as households repair their balance sheets - and that will be a constant drag on PCE.

And there is no reason to expect a sustained increase in RI until the excess housing inventory is absorbed. In fact, based on recent reports of housing starts and new home sales, there is a good chance that residential investment will be a slight drag on GDP in Q1 2010.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graphs shows Residential investment (RI) as a percent of GDP since 1947.

RI had declined for 14 consecutive quarters before the increase in Q3 2009. The Q4 report puts RI as a percent of GDP at just over 2.5%, barely above the record low - since WWII - set in Q2 2009.

Notice that RI usually recovers very quickly coming out of a recession. This time RI is moving sideways - not a good sign for a robust recovery in 2010.

The second graph shows non-residential investment as a percent of GDP.

The second graph shows non-residential investment as a percent of GDP.Business investment in equipment and software increased 13.3% (annualized). This is a good sign, but continued investment probably depends on increases in underlying demand.

Investment in non-residential structures was only off 15.4% (annualized) and will probably be revised down (this has happened for the last few quarters). I expect non-residential investment in structures to continue to decline sharply over the next several quarters. In previous downturns the economy recovered long before nonresidential investment in structures recovered - and that will probably be true again this time.

When the supplemental data is released, I'll post graphs of investment in retail, offices, and hotels, and a breakdown of residential investment.

The transitory boost from inventory changes is frequently a great kick start to the economy at the beginning of a recovery - as long as the leading sectors (PCE and RI) are also picking up. This report has to be viewed as concerning ... and is reminiscent of Q1 1981 and Q1 2002 ... both examples of inventory changes making large contributions to GDP, but underlying growth remained weak.

BEA: GDP Increases at 5.7% Annual Rate in Q4

by Calculated Risk on 1/29/2010 08:30:00 AM

As expected, GDP growth in Q4 was driven by changes in private inventories, adding 3.39% to GDP.

From the BEA:

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 5.7 percent in the fourth quarter of 2009, (that is, from the third quarter to the fourth quarter), according to the "advance" estimate released by the Bureau of Economic Analysis.This is very close to my expectations and shows a fairly weak economy (real PCE increase 2.0%). The question is: what happens in 2010?

...

The increase in real GDP in the fourth quarter primarily reflected positive contributions from private inventory investment, exports, and personal consumption expenditures (PCE). Imports, which are a subtraction in the calculation of GDP, increased.

The acceleration in real GDP in the fourth quarter primarily reflected an acceleration in private inventory investment, a deceleration in imports, and an upturn in nonresidential fixed investment that were partly offset by decelerations in federal government spending and in PCE.

...

Real personal consumption expenditures increased 2.0 percent in the fourth quarter, compared with an increase of 2.8 percent in the third.

...

Real nonresidential fixed investment increased 2.9 percent in the fourth quarter, in contrast to a decrease of 5.9 percent in the third. Nonresidential structures decreased 15.4 percent, compared with a decrease of 18.4 percent. Equipment and software increased 13.3 percent, compared with an increase of 1.5 percent. Real residential fixed investment increased 5.7 percent, compared with an increase of 18.9 percent.

I'll have some more on GDP and investment later ...

Thursday, January 28, 2010

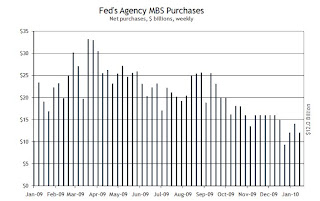

Fed MBS Purchases by Week

by Calculated Risk on 1/28/2010 10:41:00 PM

This graph from the Atlanta Fed weekly Financial Highlights shows the Fed MBS purchases by week:  Click on graph for larger image.

Click on graph for larger image.

From the Atlanta Fed:

The Fed purchased an additional $12 billion net in MBS over the last week, bringing the total to $1.164 trillion or just over 93% complete.The Fed purchased a net total of $12 billion of agency-backed MBS through the week of January 20. This purchase brings its total purchases up to $1.152 trillion, and by the end of the first quarter 2010 the Fed will have purchased $1.25 trillion (thus, it is 92% complete).

This shows that the Fed has slowed down purchases significantly from earlier this year, but so has the issuance of Fannie and Freddie MBS - so I don't think the slowdown has impacted mortgage rates yet.

The second graph shows the weekly MBA refinance index. Refinance activity was very strong in the first half of 2009 (when the Fed was purchasing more agency MBS), but has since fallen off along with agency issuance.

The second graph shows the weekly MBA refinance index. Refinance activity was very strong in the first half of 2009 (when the Fed was purchasing more agency MBS), but has since fallen off along with agency issuance.It sounds like the refinance boom is ending, from the MBA this week:

“Refinance activity fell substantially last week,” said Michael Fratantoni, MBA’s Vice President of Research and Economics. “Although rates remain low, there appears to be a smaller pool of borrowers who are willing and able to refinance at today’s rates.”With 9 weeks to go, the Fed needs to average just under $10 billion in net purchases per week.

Recourse: One of the Dangers of "Walking Away"

by Calculated Risk on 1/28/2010 07:31:00 PM

From Bloomberg: Lenders Pursue Mortgage Payoffs Long After Homeowners Default

[L]enders are exercising their rights to pursue unpaid mortgage balances. To get their money, they can seize wages, tap bank accounts and put liens on other assets held by debtors.As we've discussed before, the recourse laws vary by state. As an example Florida is a recourse state, however in California purchase money is non-recourse. If the borrower walks away in California, the lender is stuck with the collateral. However, if the borrower in California refinanced their home, then the lender usually has recourse, and can pursue a judicial foreclosure (as opposed to a trustee's sale), and seek a deficiency judgment. Usually 2nd liens have recourse too.

...

While there are no statistics on the number of deficiency judgments approved by courts, the Federal Deposit Insurance Corp. tracks the amount banks collect after defaulted loans were written off.

These mortgage recoveries rose 48 percent to a record $1.01 billion in the first nine months of last year compared with the year-earlier period, according to the Washington-based regulator. Recoveries on defaulted home-equity loans almost doubled to $392 million, the FDIC data shows.

Historically lenders rarely pursued a deficiency judgment in California because the trustee's sale was much cheaper and quicker than a judicial foreclosure - and the borrowers rarely had any resources anyway. However in Florida, all foreclosures are judicial, so the lender might as well obtain a deficiency judgment too.

This is important for short sales too. All sellers should obtain the advice of a lawyer and make sure the lender waives their rights for a deficiency judgment if possible.

Update: For a few examples in California, see Greg Weston's blog on jingle mail.

Fannie Mae: Delinquencies Increase Sharply in November

by Calculated Risk on 1/28/2010 04:41:00 PM

Earlier I posted the Freddie Mac delinquency graph.

And here is the monthly Fannie Mae hockey stick graph ... (note that Fannie releases delinquency data with a one month lag to Freddie). Click on graph for larger image in new window.

Click on graph for larger image in new window.

Fannie Mae reported today that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 5.29% in November, up from 4.98% in October - and up from 2.13% in November 2008.

"Includes seriously delinquent conventional single-family loans as a percent of the total number of conventional single-family loans."

Once again it is important to note these stats do include Home Affordable Modification Program (HAMP) loans in trial modifications.

Treasury Releases new Guidance for HAMP

by Calculated Risk on 1/28/2010 02:11:00 PM

There are two key components:

1) New Requirements that Documentation be Provided Before Trial Modification Begins.

2) and guidance on Converting Borrowers in the Temporary Review Period to Permanent Modifications

From Treasury: Administration Updates Documentation Collection Process and Releases Guidance to Expedite Permanent Modifications. And the Special Directive.

1) On beginning trial modifications: The original plan allowed servicer discretion on when to place borrowers in HAMP trial modification programs. Some servicers required documentation and a first payment before putting the borrower in a trial program, others just accepted a verbal agreement over the phone. The new rules include:

Effective for all trial period plans with effective dates on or after June 1, 2010, a servicer may evaluate a borrower for HAMP only after the servicer receives the following documents, subsequently referred to as the “Initial Package”. The Initial Package includes:The trial period will start after the initial documents are received, a trial plan is sent to the borrower, and the borrower makes the initial payment.Request for Modification and Affidavit (RMA) Form, IRS Form 4506-T or 4506T-EZ, and Evidence of Income

The Treasury was initially trumpeting the number of trial modifications, but that was a poor metric of success since some servicers were just putting anyone who answered the phone in a trial modification.

2) The second key component of the directive is how to handle all the current trial modifications. For the borrowers who have not made all of their payments, the directive requires the HAMP trial program to be canceled. For borrowers who have made payments, but are missing documentation, Treasury provides some additional guidelines.

This suggests a surge of trial cancellations in February.

Hotel RevPAR off 10.3%

by Calculated Risk on 1/28/2010 01:16:00 PM

The good news for hotels is it appears the occupancy rate might be near the bottom. This week Smith Travel Research reported the occupancy rate was "virtually flat with an 0.9-percent decrease" compared to the same week in 2009.

The bad news for hotels is the average daily rate (ADR) is still falling because the occupancy rate is so low. Therefore RevPAR (revenue per available room) is still falling.

From HotelNewsNow.com: Boston leads occ., RevPAR increases in STR weekly numbers

Overall, in year-over-year measurements, the industry’s occupancy ended the week virtually flat with an 0.9-percent decrease to 46.8 percent, average daily rate dropped 9.4 percent to US$93.87, and RevPAR for the week fell 10.3 percent to finish at US$43.89.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the occupancy rate by week since 2000, and the rolling 52 week average occupancy rate.

Notes: the scale doesn't start at zero to better show the change.

The graph shows the distinct seasonal pattern for the occupancy rate; higher in the summer because of leisure/vacation travel, and lower on certain holidays. Business travel is the key over the next few months.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

Freddie Mac: Delinquencies Increase Sharply in December

by Calculated Risk on 1/28/2010 11:04:00 AM

Here is the monthly Freddie Mac hockey stick graph ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

Freddie Mac reported that the rate of serious delinquencies - at least 90 days behind - for conventional loans in its single-family guarantee business increased to 3.87% in December 2009, up from 3.72% in November - and up from 1.72% in December 2008.

"Single-family delinquencies are based on the number of mortgages 90 days or more delinquent or in foreclosure as of period end ..."

Just more evidence of the growing delinquency problem, although some of these loans may be in the trial modification programs and are still included as delinquent until they become permanent.

Fannie Mae should report soon ...