by Calculated Risk on 12/20/2009 06:31:00 PM

Sunday, December 20, 2009

The Lost Decade

We've discussed this several times, and I expect to see a number of articles about the lost decade for the stock market and employment over the next few weeks.

From the WSJ: Stocks' 'Nightmare' Decade

In nearly 200 years of recorded stock-market history, no calendar decade has seen such a dismal performance as the 2000s.This is definitely a "quirk of the calendar", but is has been a difficult 10 years.

Investors would have been better off investing in pretty much anything else, from bonds to gold or even just stuffing money under a mattress.

...

It edges out the 0.2% decline stocks suffered during the Depression years of the 1930s, which up until now held the title of worst decade.

...

To some degree these statistics are a quirk of the calendar, based on when the 10-year period starts and finishes. The 10-year periods ending in 1937 and 1938 were worse ...

On employment, there were 130,532,000 payroll jobs in December 1999, and 130,996,000 payroll jobs in November 2009; an increase of 464 thousand jobs. However the preliminary estimate of the annual benchmark revision "indicates a downward adjustment to March 2009 total nonfarm employment of 824,000". So it appear there will be fewer payroll jobs at the end of the aughts than at the beginning.

Of course another argument is the decade actually started on Jan 1, 2001 (not 2000) and that is similar to the debate over when the millennium started and ended - but I think most people partied like it was 1999!

Weekly Summary and a Look Ahead

by Calculated Risk on 12/20/2009 02:02:00 PM

Existing home sales will be released on Tuesday (probably around 6.3 SAAR, the highest level since the end of the bubble). New Home sales will be released on Wednesday (probably around 430 thousand SAAR). Of course the number that matters for the economy is new home sales ...

In other economic news, the BEA will release the final Q3 GDP on Tuesday, and Personal Income and Outlays for November on Wednesday (this will give a good estimate for Q4 PCE growth). Durable goods will be released Thursday.

Also the Chicago Fed National Activity Index will be released Monday, and Moody’s/REAL Commercial Property Price Indices will probably be released early in the week.

A busy holiday week! Note: I'll be in town this year between Christmas and New Year's day, and there will be some interesting data that week too.

And a summary of last week ...

Click on graph for larger image in new window.

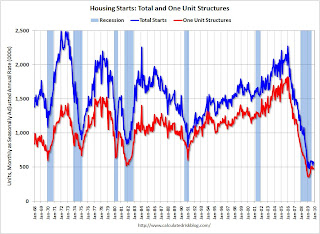

Click on graph for larger image in new window.Total housing starts were at 574 thousand (SAAR) in November, up 8.9% from the revised October rate, and up from the all time record low in April of 479 thousand (the lowest level since the Census Bureau began tracking housing starts in 1959). Starts had rebounded to 590 thousand in June, and have moved mostly sideways for six months.

Single-family starts were at 482 thousand (SAAR) in November, up 2.1% from the revised October rate, and 35 percent above the record low in January and February (357 thousand). Just like for total starts, single-family starts have been at this level for six months.

Here is the Census Bureau report on housing Permits, Starts and Completions.

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).

This graph shows the builder confidence index from the National Association of Home Builders (NAHB).The housing market index (HMI) was at 16 in December. This is a decline from 17 in November. The record low was 8 set in January.

This is very low - and this is what I've expected - a long period of builder depression.

Note: any number under 50 indicates that more builders view sales conditions as poor than good.

The American Institute of Architects’ Architecture Billings Index declined to 42.8 in November from 46.1 in October. Any reading below 50 indicates contraction.

"There continues to be a lot of uncertainty in the construction industry that likely will delay new projects in the near future," said Kermit Baker, chief economist at the American Institute of Architects.

This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.

This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This suggests further significant declines in CRE investment through 2010, and probably longer.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

From the Fed: Industrial production and Capacity Utilization: "Industrial production increased 0.8 percent in November after having been unchanged in October. Manufacturing production advanced 1.1 percent, with broad-based gains among both durables and nondurables. ... At 99.4 percent of its 2002 average, total industrial production was 5.1 percent below its level of a year earlier. Capacity utilization for total industry moved up 0.7 percentage point to 71.3 percent, a rate 9.6 percentage points below its average for the period from 1972 through 2008."

From the Fed: Industrial production and Capacity Utilization: "Industrial production increased 0.8 percent in November after having been unchanged in October. Manufacturing production advanced 1.1 percent, with broad-based gains among both durables and nondurables. ... At 99.4 percent of its 2002 average, total industrial production was 5.1 percent below its level of a year earlier. Capacity utilization for total industry moved up 0.7 percentage point to 71.3 percent, a rate 9.6 percentage points below its average for the period from 1972 through 2008." This graph shows Capacity Utilization. This series is up from the record low set in June (the series starts in 1967), and still well below the level of last year.

Note: y-axis doesn't start at zero to better show the change.

[R]ating agencies downgraded the public debt of Greece and warned about the outlook for several others. Greece could become the first developed country since 1948 to default on its debt, thanks to a deficit running at more than 12 percent of GDP and few signs that the government is willing or able to cut it. More seriously, Standard & Poor's last week slapped a negative outlook on Spain, a much larger economy.

Best wishes to all.

Fed's Flow of Funds now using LoanPerformance Index

by Calculated Risk on 12/20/2009 11:48:00 AM

UPDATE: Originally I thought the Fed switcehed to Case-Shiller. In fact they switched to LoanPerformance, see: Flow of Funds: Change in House Price Index

From a newsletter by John Mauldin:

Frank Veneroso noticed something unusual in the latest Federal Reserve Flow of Funds report. They changed their methodology for analyzing housing prices to a model more like the Case-Shiller index, which most believe to be more accurate. That meant they deducted another $2 trillion from household net worth than in the previous quarter. They just caught up with reality, so no big news there. But there is some big news if you look closely.On the first point the Fed is now using the

About one-third of the homes in the US have no mortgages. Typically, these are nicer homes, as the "rich" have paid off their homes. So you can estimate that to be somewhere between 35-40% of the total value of US homes. Writes Frank:

"So now the flow of funds accounts tell us that the total value of residential real estate is $16.53 trillion. The share owned by households with a mortgage is probably $10 trillion to $11 trillion. Total mortgage household debt now stands at $10.3 trillion. In effect, for all households with a mortgage taken in the aggregate, their loan-to-value ratio is now close to 100% and perhaps close to half of them have a zero to negative equity."

The second point is probably a little inaccurate. According to the most recent American Community Survey, approximately 31.7% of homeowners have no mortgage. Although the "rich" frequently have no mortgage, homeowners without mortgages tend to own less expensive homes than homeowners with mortgages.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph is based on the American Community Survey data for homeowners without a mortgage, and for homeowners with mortgages.

The median value (not average) of homes without a mortgage is $148,100, and the median for homes with a mortgage is $214,400.

My estimate is that homeowners without mortgages own about 26% of all household real estate (by value), and this suggests homeowners with mortgages have about 85% loan-to-value in the aggregate. This includes homeowners with 90% equity (almost paid off), and homeowners with substantial negative equity.

Negative equity is a serious problem, but according to First American Core Logic, about 23% of homeowners with mortgages have negative equity - and that is probably closer to the actual number.

Note: here is much more on negative equity with several graphs.

It is interesting the the Fed has switched to

Snowstorm Forces Store Closures

by Calculated Risk on 12/20/2009 09:05:00 AM

From the WaPo: Storm forces many stores to close, shoppers to stay home

Across the region, shopping centers began closing at midmorning and, by late afternoon, almost every major mall in the region had closed.And more on the storm from the NY Times: Winter Arrives Early, Blanketing Washington and East Coast

...

Retailers say they hope to make up for the lost day of sales Sunday. But the record-setting storm and its timing were a depressing blow for businesses struggling to survive a tough economy.

A snowstorm on the Saturday before Christmas is one of the worst things that can happen in a recession, said Marshal Cohen, senior analyst for NPD Group, a consumer research firm. "It is the busiest day of the year now gone awry."

With winter officially starting on Monday, one to two feet of snow were expected to fall by Sunday morning from Virginia to New England, where blizzard warnings were posted for coastal areas.Best to all!

“This is one of the bigger ones,” said Kevin Witt, a meteorologist for the National Weather Service in the Baltimore-Washington forecast office in Sterling, Va.

Mr. Witt said that when the gusty snow ended late Saturday night into Sunday morning it could rank among the top 10 winter snowstorms.

Saturday, December 19, 2009

OpEd on AIG: Show Us the E-Mail

by Calculated Risk on 12/19/2009 09:06:00 PM

Eliot Spitzer, Frank Partnoy and William Black write in the NY Times: Show Us the E-Mail

A.I.G. was at the center of the web of bad business judgments, opaque financial derivatives, failed economics and questionable political relationships that set off the economic cataclysm of the past two years. When A.I.G.’s financial products division collapsed — ultimately requiring a federal bailout of $180 billion — those who had been prospering from A.I.G.’s schemes scurried for taxpayer cover. Yet, more than a year after the rescue began, crucial questions remain unanswered. Who knew what, and when? Who benefited, and by exactly how much? Would A.I.G.’s counterparties have failed without taxpayer support?It is amazing that we still don't have these answers - especially about the regulators, with an explanation of how the new process would have caught the AIG problems.

The three of us, as experienced investigators and prosecutors of financial fraud, cannot answer these questions now. But we know where the answers are. They are in the trove of e-mail messages still backed up on A.I.G. servers, as well as in the key internal accounting documents and financial models generated by A.I.G. during the past decade. Before releasing its regulatory clutches, the government should insist that the company immediately make these materials public. By putting the evidence online, the government could establish a new form of “open source” investigation.

...

We would like to understand whether the leaders of A.I.G. understood that they were approaching a financial Armageddon ... We would like to see how A.I.G. was able to pay huge bonuses to its officers based on the short-term income ... We would also like to know what regulators knew, and what they did with the information they had obtained.

| But this does give me an excuse to repeat Eric's great AIG cartoon! Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis |

FDIC Bank Failure Update

by Calculated Risk on 12/19/2009 06:22:00 PM

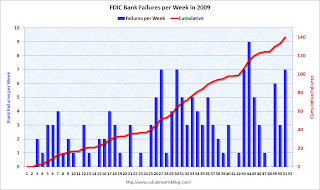

A few graphs and some predictions ... the first graph shows bank failures by week in 2009: Click on graph for larger image in new window.

Click on graph for larger image in new window.

Note: Week 1 on graph ended Jan 2nd.

There have been 140 bank failures this year, and there are only a few days left to close banks in 2009.

Based on history, I think the FDIC is done for the year.

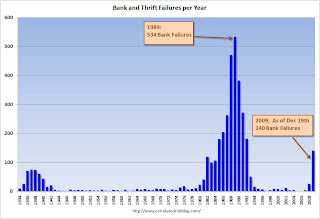

This sets the over-under line for 2010 at 140 (assuming no more failures). Will there be more bank failures in 2010 than in 2009? I'll definitely take the over (more failures in 2010 than in 2009). The second graph shows bank failures by year since the FDIC was started.

The second graph shows bank failures by year since the FDIC was started.

The 140 bank failures this year was the highest total since 1992 (181 bank failures). Next year will probably be much higher ... although I doubt we will see as many failures as in 1988 or 1989 (470 and 534 failures respectively).

The third graph is of bank failures by number of institutions and assets, from the December Congressional Oversight Panel’s Troubled Asset Relief Program report. (ht Catherine Rampell):  Note: This is through Nov 30th for 2009.

Note: This is through Nov 30th for 2009.

From the report (page 45):

Figure 11 shows numbers of failed banks, and total assets of failed banks since 1970. It shows that, although the number of failed banks was significantly higher in the late 1980s than it is now, the aggregate assets of failed banks during the current crisis far outweighs those from the 1980s. At the high point in 1988 and 1989, 763 banks failed, with total assets of $309 billion.167 Compare this to 149 banks failing in 2008 and 2009, with total assets of $473 billion.168Note: This is in 2005 dollars and this includes the failure of WaMu in 2008 with $307 billion in assets that didn't impact the DIF.

So my (easy) predictions: 1) The FDIC is done for 2009 (140 bank failures is the final count), 2) There will be more bank failures in 2010, and 3) there will be less failure in 2010 than the peak of the S&L crisis.

Bernanke ARM OK, Head "Explodes"?

by Calculated Risk on 12/19/2009 12:49:00 PM

Bernanke misspoke in the recent TIME magazine interview:

TIME: Do you have a mortgage?Bernanke did have an adjustable rate mortgage, but it did not "explode".

Bernanke: Oh, yes, we refinanced.

TIME: Oh, perfect. When?

Bernanke: About 5%. A couple of months ago.

TIME: Good time.

Bernanke: Yes. We had to do it because we had an adjustable rate mortgage and it exploded, so we had to.

TIME: So, did you get a fixed rate at 5%? I think this might be the most valuable piece of information. (Laughter.)

Bernanke: Thirty years fixed rate at a little over 5%.

First, Dr. Bernanke is the Fed Chairman and "exploding" ARMs are a very important mortgage issue. So I think this topic is relevant and newsworthy (and Bernanke mentioned it).

Second, "explode" has a very clear meaning when discussing mortgages; it means that the borrower's mortgage payment has increased sharply. An ARM can "explode" for two reasons:

1) The interest rate can reset to a much higher level. This isn't much of a concern right now because the most common indexes like LIBOR are at very low levels and most loans are resetting lower.

2) The loan can recast. From Tanta on resets and recasts:

"Reset" refers to a rate change. "Recast" refers to a payment change. ... "Recast" is really just a shorter word for "reamortize": you take the new interest rate, the current balance, and the remaining term of the loan, and recalculate a new payment that will fully amortize the loan over the remaining term.Neither applied to Bernanke. From the WSJ: Looking a Little Deeper at Bernanke’s Floating Rate Mortgage

The Fed chairman was in an adjustable rate mortgage with a rate that started at 4.125% in 2004 and adjusted after five years to a rate that would be 2.25 percentage points above one-year Libor, which as of the first reset date in June was a little more than one and a half percent. That suggest his costs wouldn’t be exploding now, as the interview suggested. In fact, they’d be going down.So Bernanke refinanced into a loan with a higher interest rate and with a larger mortgage payment for the security of a fixed rate. This suggests he thinks fixed mortgage rates have bottomed (otherwise he could have paid less on his mortgage, at a 3.75% interest rate, and then refinanced next year). He did not "have to do it".

"Snowmaggedon" for Northeast Retailers

by Calculated Risk on 12/19/2009 10:01:00 AM

From the WaPo: For retailers, snow would pile on

Retailers can stop accusing the economy of holding back holiday sales. Now they can blame it on the weather.Blame it on the weather!

The mighty blizzard expected to descend on the Northeast today comes on the last Saturday before Christmas, typically the busiest day of the year for retailers. But with as much as a foot of snow forecast from North Carolina to New Jersey, retailers are worried that their customers will spend the Super Saturday shoveling rather than shopping. One meteorologist predicts that could result in a retail snowmaggedon.

Senate Passes Unemployment Extension

by Calculated Risk on 12/19/2009 08:40:00 AM

The Senate passed another extension of unemployment benefits and Cobra insurance premiums this morning as part of the Defense spending bill. This bill had already passed the House.

In addition to the defense spending, the bill contained an extension of the date for qualification for existing tiers of unemployment benefits to Feb. 28th 2010 (previously only those losing benefits by Dec 31, 2009 qualified). Also the Cobra insurance premium subsidy was extended for two months.

This issue will be revisited early next year for those losing benefits after February.

From the WSJ: Senate Sends Defense Bill to Obama

Mortgage Insurers Loosen Standards Slightly

by Calculated Risk on 12/19/2009 12:11:00 AM

From the WSJ: Down-Payment Standards Eased

Earlier this month, MGIC removed New Orleans, Dover, Del., Akron, Ohio, and four other areas in Ohio from its list of restricted markets. ...The changes are small. As the article notes, this is due to slightly improved markets and an attempt to regain market share from the FHA.

Under the looser requirements, a borrower with a credit score of 680 or higher in New Orleans, for instance, can finance up to 95% of a home's value. Before the change, a borrower who wanted to finance that much of a home's value would have needed a credit score of at least 700.

In September, Genworth Financial Inc. winnowed its list of declining and distressed markets to five states: Arizona, California, Florida, Michigan and Nevada.

I wonder if this is related - just two weeks ago: Wisconsin Regulator Approves MGIC Regulatory Cap Waiver Thru 2011 (ht jb)

Mortgage insurance giant MGIC Investment Corp. (MTG) announced, Thursday, that the Office of the Commissioner of Insurance for the State of Wisconsin approved the company’s revised business plan and agreed to waive minimum regulatory capital requirements until Dec. 31, 2011.