by Calculated Risk on 10/29/2009 10:55:00 PM

Thursday, October 29, 2009

Mark Zandi on the Great Recession

Testimony from Mark Zandi of Economy.com: The Impact of the Recovery Act on Economic Growth (ht Professor Brad DeLong). A few excerpts:

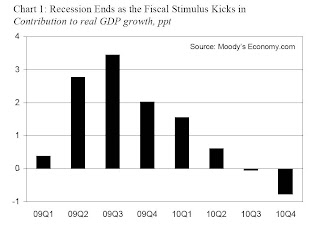

The Great Recession has finally given way to recovery. This downturn will go into the record books as the longest, broadest and most severe since the Great Depression (see Table 1). The recession was twice the length of the average economic contraction, and it dragged down nearly every industry and region in the country. Its final toll in terms of increased unemployment and falling real GDP will be greater than that seen during any other recession on record.The following graph shows Mark Zandi's estimate of the impact of the stimulus package:

...

The housing market crash that was at the recession's center is also moderating. House prices are probably not done falling, but home sales have come off the bottom, and the free fall in housing construction is over. After reducing housing starts to levels last seen during World War II, builders have finally begun to put up a few more homes. There is still a surfeit of vacant existing homes for sale and rent, but inventories of new homes are increasingly lean in a number of markets.

Retailers and manufacturers have also worked hard to reduce bloated inventories. The plunge in inventories in the second quarter was the largest on record and came after a year of steady destocking. Inventories are now so thin that manufacturing production is picking up quickly, as otherwise stores will not have enough on their shelves and in warehouses to meet demand even at currently depressed levels.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This suggests that all the growth in Q3 was due to the stimulus package, and the impact will now wane - only 2% in Q4, and 1.5% in Q1 2010 - and then the package will be a drag on the economy in the 2nd half of 2010.

And on the job loss recovery:

Although the recession is over, the economy is struggling. Job losses have slowed significantly since the beginning of the year, but payrolls are still shrinking, and unemployment is still rising. The nation's jobless rate will top 10% in coming months ...Clearly Zandi is still very worried.

Whether the recovery becomes self-sustaining or recedes back into recession depends first on how businesses respond to recent improvements in sales and profitability. As the benefit of the stimulus fades, businesses must fill the void by hiring and investing more actively. To date, there is not much evidence that they are doing this. At most, firms are curtailing layoffs and no longer cutting back on orders for equipment and software.

... Unless hiring revives, job growth will not resume and unemployment will continue to rise, depressing wages and ultimately short-circuiting consumer spending and the recovery itself.

It is possible that firms will resume hiring soon. There is historically a lag between a pickup in production and increased hiring. In the past, however, during the gap between increased production and increased full-time hiring, businesses boosted working hours and brought on more temporary employees. None of this has happened so far; hours worked remain stuck at a record low, and temporary jobs continue to decline.

A more worrisome possibility is that firms are too shell-shocked to resume hiring. Smaller businesses are struggling to obtain credit; their principal lenders, small banks, face intense pressure, while another key source, credit card lenders, has aggressively tightened its underwriting standards. ...

... Businesses may also wonder if demand for their products will soon fade, given that the recent improvement is supported by the monetary and fiscal stimulus and an inventory swing, all of which are temporary.

Whatever the reason, unless hiring resumes soon, the severe stress in the job market will not abate. With nearly 26 million workers—17% of the workforce—unemployed or underemployed, and those with jobs working a record-low number of hours, workers' nominal compensation threatens to decline. It is not unusual for real compensation—nominal compensation adjusted for inflation—to turn down in a recession, but it would be unprecedented, save during the Great Depression, for nominal compensation to decline.

Falling nominal compensation will further corrode already-fragile consumer spending. Lower- and middle-income households, who are saving little and cannot borrow, will be forced to rein in spending. The transition from recovery to expansion will be anything but graceful and could even be short-circuited.

Note: NBER will not call the end of the recession until some time after real GDP is above the pre-recession levels (and other indicators too). That would take at least four more quarters of growth at 3%, so the end of the official recession will not be announced until late in 2010 at the earliest. If GDP slips next year that will probably be considered part of the "Great Recession" ...

For more on recession dating, see: Is the Recession Over?

Random Thoughts on the Q3 GDP Report

by Calculated Risk on 10/29/2009 07:29:00 PM

After the Q1 GDP report was released, I wrote: GDP Report: The Good News. The headline number in Q1 was ugly, but there was a clear shift in the negative GDP contributions from leading sectors to lagging sectors.

Here is a repeat of the table from that earlier post showing a simplified typical temporal order for emerging from a recession:

| During Recession | Lags End of Recession | Significantly Lags End of Recession | |

| Residential Investment | Investment, Equipment & Software | Investment, non-residential Structures | |

| PCE | Unemployment(1) | ||

(1) In recent recessions, unemployment significantly lagged the end of the recession. That is very likely this time too.

Now look at the Q3 GDP report from leading to lagging sectors:

This is exactly what I'd expect a recovery to look like.

Unfortunately ... the two leading sectors, residential investment (RI) and personal consumption expenditures (PCE), will both be under pressure for some time. The Census Bureau report this morning showed that there are still far too many excess housing units (homes and rental units) available. There cannot be a sustained recovery in RI without a boom in new home sales and housing starts, and it is difficult to imagine a boom in new home sales with the large overhang of housing units.

It takes household formation to reduce the excess inventory, and household formation requires job creation so that individuals and families will feel more confident and move out of their parent's basements. Some day there will be a boom in household formation, once job creation returns, but usually the first jobs in a recovery are from RI and PCE - so the economy is in sort of a circular trap.

That is why we need policies aimed at job creation and household formation. As housing economist Tom Lawler wrote today in a note to clients: "policies that move renter households into owned homes but that don't stimulate household formations MAKE MATTERS WORSE!"

And the other leading sector, PCE, is also under pressure. The personal saving rate declined in Q3 to 3.3%, but the decline was probably temporary. I expect the saving rate to increase over the next year or two to around 8% - as households repair their balance sheets - and that will be a constant drag on PCE.

I expect Q4 GDP to be similar to Q3, however I think growth in 2010 will be sluggish - with downside risks. I think RI and PCE will be sluggish in 2010, and the stimulus will fade (and become a drag in the 2nd half of 2010).

Here is a look at investment:

Click on graph for larger image in new window.

Click on graph for larger image in new window.Residential investment (RI) had declined for 14 consecutive quarters, and the increase in Q3 2009 was the first since 2005.

This puts RI as a percent of GDP at 2.5%, just barely above the record low - since WWII - set last quarter.

The second graph shows non-residential investment as a percent of GDP.

The second graph shows non-residential investment as a percent of GDP.Business investment in equipment and software increased 1.1% (annualized), breaking a streak of 6 consecutive quarterly declines.

Investment in non-residential structures was only off 9.0% (annualized) and will probably be revised down (this happened last quarter). I expect non-residential investment in structures to decline sharply over the next several quarters. In previous downturns the economy recovered long before nonresidential investment in structures recovered - and that will probably be true again this time.

When the supplemental data is released, I'll post graphs of investment in retail, offices, and hotels, and a breakdown of residential investment.

Some possibly interesting notes:

Moody's Projects Further House Price Declines, Market and More

by Calculated Risk on 10/29/2009 04:00:00 PM

I'm working on a GDP post for later ... Click on graph for larger image in new window.

From Doug Short of dshort.com (financial planner).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

The S&P was up 2.24% today ...

From Bloomberg: Moody’s May Downgrade Mortgage Bonds With New Outlook (ht Brian)

Moody’s Investors Service said it’s planning a review of U.S. home-loan securities that will likely lead to another round of rating changes based on a new view that property prices won’t bottom until next year’s third quarter.And the Fed has finished its $300 billion Treasury purchase program - from Bloomberg: Fed Ends Treasury Buys That Capped Rates

The firm will boost its loss projections by “significant” amounts for prime-jumbo, Alt-A, option adjustable-rate and subprime mortgages backing bonds issued between 2005 and 2008, also after seeing higher losses per foreclosure than expected ... Recent data showing rising home prices doesn’t prove the slump is over, the company said.

“The overhang of impending foreclosures and the continued rise in unemployment rates will impact home prices negatively in the coming months,” New York-based Moody’s said.

emphasis added

NMHC Quarterly Apartment Survey: Occupancy Continues to Decline, but Pace Slows

by Calculated Risk on 10/29/2009 01:48:00 PM

Note from NMHC: "Market Tightness Index reading above 50 indicates that, on balance, apartment markets around the country are getting tighter; a reading below 50 indicates that market conditions are getting looser; and a reading of 50 indicates that market conditions are unchanged."

So the increase in the index to 31 implies lower occupancy rates and lower rents - "looser" apartment conditions - but at a slower pace of contraction than the previous quarter.

From the National Multi Housing Council (NMHC): Apartment Market Conditions Improving, Bid-Ask Spread Narrowing

Only one index—the one measuring market tightness (vacancies and rent levels)—remained below 50 (index numbers below 50 indicate worsening conditions), but it also showed improvement over the prior quarter, rising from 20 to 31.

“The broad improvements in sales volume and debt and equity financing suggest the transactions market may finally be thawing,” noted NMHC Chief Economist Mark Obrinsky. “Nearly half (45 percent) of respondents indicated that the gap between what sellers are asking for and what buyers are offering—the bid-ask spread—has narrowed.”

“But the economic headwinds remain strong,” Obrinsky added, “as the employment market continues to sag, demand for apartment residences continues to slip. Though this quarter’s Market Tightness Index is improved compared to last quarter, it still indicates higher vacancies and lower rents.”

...

The Market Tightness Index rose from 20 to 31. Nearly half (49 percent) said markets were looser (with higher vacancies and lower rents), while 11 percent said markets were tighter. This was the ninth straight quarter in which the index remained below 50, but the fourth consecutive quarter in which the index measure has risen. For the year, the Market Tightness Index averaged 20, the lowest on record (since 1999).

emphasis added

Click on graph for larger image in new window.

This graph shows the quarterly Apartment Tightness Index.

A reading below 50 suggests vacancies are rising. Based on limited historical data, I think this index will lead reported apartment rents by 6 months to 1 year. Or stated another way, rents will probably fall for 6 months to 1 year after this index reaches 50. Right now I expect rents to continue to decline through most of 2010.

This data is for apartment buildings. The data released earlier today from the Census Bureau - showing a record rental vacancy rate - includes all rental units.

Hotel RevPAR Off 14 Percent

by Calculated Risk on 10/29/2009 11:47:00 AM

From HotelNewsNow.com: New Orleans ADR, RevPAR increase in STR weekly numbers

For the industry, in year-over-year measurements, occupancy fell 6.3 percent to end the week at 59.0 percent, ADR dropped 8.3 percent to US$100.04, and RevPAR decreased 14.1 percent to US$59.03.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the occupancy rate by week for each of the last four years (2006 through 2009 labeled by start of month).

Notes: the scale doesn't start at zero to better show the change. Thanksgiving was late in 2008, so the dip doesn't line up with the previous years.

Data Source: Smith Travel Research, Courtesy of HotelNewsNow.com

The above graph shows two key points:

The HotelNewsNow press release has two graphs on room rates (ADR: Average Daily Rate) and RevPAR variance comprared to 2008.

The HotelNewsNow press release has two graphs on room rates (ADR: Average Daily Rate) and RevPAR variance comprared to 2008.This graph shows the RevPAR variance by day, and indicates that business travel (weekdays) is still off more than leisure travel (weekends).

This has been an ongoing story ...

Q3: Record Rental Vacancy Rate, Homeownership Rate Increases Slightly

by Calculated Risk on 10/29/2009 10:00:00 AM

This morning the Census Bureau reported the homeownership and vacancy rates for Q3 2009. Here are a few graphs ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

The homeownership rate increased slightly to 67.6% and is now at the levels of Q2 2000.

Note: graph starts at 60% to better show the change.

The homeownership rate increased in the '90s and early '00s because of changes in demographics and "innovations" in mortgage lending. The increase due to demographics (older population) will probably stick, so I expect the rate to decline to the 66% to 67% range - and not all the way back to 64% to 65%.

The small increase in the homeownership rate in Q3 might by related to the first-time home buyer tax credit, but I expect the rate to decline further.

The homeowner vacancy rate was 2.6% in Q3 2009. A normal rate for recent years appears to be about 1.7%.

A normal rate for recent years appears to be about 1.7%.

This leaves the homeowner vacancy rate about 0.9% above normal, and with approximately 75.3 million homeowner occupied homes; this suggests there are close to 675 thousand excess vacant homes.

And as expected, as a result of the first-time homebuyer tax credit ...

The rental vacancy rate increased to a record 11.1% in Q3 2009.  It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 11.1% to 8%, there would be 3.1% X 40 million units or about 1.25 million units absorbed.

It's hard to define a "normal" rental vacancy rate based on the historical series, but we can probably expect the rate to trend back towards 8%. According to the Census Bureau there are close to 40 million rental units in the U.S. If the rental vacancy rate declined from 11.1% to 8%, there would be 3.1% X 40 million units or about 1.25 million units absorbed.

These excess units will keep pressure on rents and house prices for some time.

Weekly Initial Unemployment Claims: 530 Thousand

by Calculated Risk on 10/29/2009 08:48:00 AM

The DOL reports weekly unemployment insurance claims decreased slightly to 530,000:

In the week ending Oct. 24, the advance figure for seasonally adjusted initial claims was 530,000, a decrease of 1,000 from the previous week's unrevised figure of 531,000. The 4-week moving average was 526,250, a decrease of 6,000 from the previous week's unrevised average of 532,250.

...

The advance number for seasonally adjusted insured unemployment during the week ending Oct. 17 was 5,797,000, a decrease of 148,000 from the preceding week's revised level of 5,945,000.

Click on graph for larger image in new window.

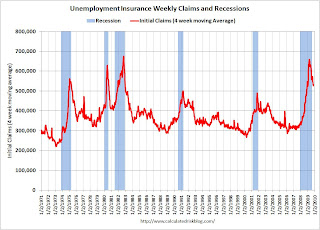

Click on graph for larger image in new window.This graph shows the 4-week moving average of weekly claims since 1971.

The four-week average of weekly unemployment claims decreased this week by 6,000 to 526,250, and is now 132,500 below the peak in April. The significant decline from the peak strongly suggests that initial weekly claims have peaked for this cycle.

However, the key question is: Will claims continue to decline sharply, like following the recessions in the '70s and '80s, or will claims plateau for some time at an elevated level, as happened during the jobless recoveries in the early '90s and '00s?

The level is still very high suggesting continuing job losses ...

BEA: GDP Increases at 3.5% Annual Rate in Q3

by Calculated Risk on 10/29/2009 08:30:00 AM

From the BEA:

Real gross domestic product -- the output of goods and services produced by labor and property located in the United States -- increased at an annual rate of 3.5 percent in the third quarter of 2009, (that is, from the second quarter to the third quarter), according to the "advance" estimate released by the Bureau of Economic Analysis.This is close to expectations, and GDP in Q4 will probably be in the same range with more inventory restocking and stimulus spending. But the question is: what happens in 2010?

...

The upturn in real GDP in the third quarter primarily reflected upturns in PCE, in private inventory investment, in exports, and in residential fixed investment and a smaller decrease in nonresidential fixed investment that were partly offset by an upturn in imports, a downturn in state and local government spending, and a deceleration in federal government spending.

...

Real personal consumption expenditures increased 3.4 percent in the third quarter, in contrast to a decrease of 0.9 percent in the second.

...

Real nonresidential fixed investment decreased 2.5 percent in the third quarter, compared with a decrease of 9.6 percent in the second. Nonresidential structures decreased 9.0 percent, compared with a decrease of 17.3 percent. Equipment and software increased 1.1 percent, in contrast to a decrease of 4.9 percent. Real residential fixed investment increased 23.4 percent, in contrast to a decrease of 23.3 percent.

I'll have some more on investment later ...

Wednesday, October 28, 2009

In re Olga: of Bankruptcy and Foreclosure

by Calculated Risk on 10/28/2009 09:23:00 PM

CR Note: This is a guest post from albrt.

In re Olga: of Bankruptcy and Foreclosure.

An article by a person named Morgenson appeared in the New York Times last weekend, calling to our collective attention a New York bankruptcy case that adds to our collective knowledge of our collective foreclosure problem. Driven by a suspicion that the article would have helped us understand more if it had been written by someone other than the aforesaid Morgenson, your intrepid foreclosure correspondent dug into the record and filed the following report.

Picking on Poor Gretchen

First, for recent arrivals, there is a long and honored history at this site of Picking on Poor Gretchen. In this case I want to congratulate Morgenson, as it appears she did break this story herself rather than picking it up, unattributed, from bloggers. Let me also say I am not necessarily the best person to carry on the tradition of Picking on Poor Gretchen. I experimented with journalism in my youth, and I know how difficult it can be to get enough actual facts in a short time to fill up the number of column inches your editor is expecting from you.

But the more I thought about the Times article, the harder it was to escape the conclusion that Brad Delong is right – the print dinosaurs are doomed, and they have done it to themselves. The first few paragraphs of Morgenson’s purported article are appallingly fact-free and hyperbolic, or as Tanta put it, “Morgenson’s valid points are drowning in a sea of sensational swill.”

The article begins:

FOR decades, when troubled homeowners and banks battled over delinquent mortgages, it wasn’t a contest. Homes went into foreclosure, and lenders took control of the property.Morgenson deserves credit for finding this story, but it is hardly the first foreclosure-gone-wrong story of the decade, or even of the “recent foreclosure wave.” Morgenson has apparently forgotten the redoubtable Judge Boyko, who dismissed some Ohio foreclosure complaints in 2007 based on somewhat similar facts. We know Morgenson covered that story, so it is not clear to me whether the “decades” of judicial neglect and rubber stamping occurred before 2007 or after. But, well, whatever.

On top of that, courts rubber-stamped the array of foreclosure charges that lenders heaped onto borrowers and took banks at their word when the lenders said they owned the mortgage notes underlying troubled properties.

* * *

But some judges are starting to scrutinize the rules-don’t-matter methods used by lenders and their lawyers in the recent foreclosure wave.

So What Happened In This Case?

Most of the sensational swill is in the first few paragraphs of this Times story. Once you get past the first third, Morgenson’s facts are basically correct. Unfortunately, much of the context is missing. For example, one of the things you would never guess from reading the Times article is that it matters whether you’re talking about a bankruptcy case or a foreclosure case. That is Takeaway Lesson Number One from this case: Bankruptcy is different from foreclosure.

The purpose of a foreclosure case is usually to allow a lender to take back collateral after the borrower stops paying on a loan. It should not be a surprise that lenders often win such cases, frequently by default. By contrast, the purpose of a bankruptcy case is to allow the debtor to restructure debt, distribute the available assets fairly among creditors, and extinguish debt that can’t realistically be paid. It should not be surprising that debtors “win” bankruptcy cases more often than foreclosure cases, especially if the debtor can show the lender has not followed the rules.

I will call the debtor in this case “Olga.” Her last name is redacted because she doesn’t seem to be seeking publicity. Olga filed bankruptcy under Chapter 13, which is a section of the bankruptcy code allowing individuals with regular income to develop a three or five year plan to pay their debts under supervision of a trustee. The debtor is protected from bill collectors, and most debts that can’t reasonably be paid are discharged. Chapter 13 theoretically allows the debtor to keep a mortgaged home if the debtor can catch up on payments within the plan period. The bankruptcy judge does not have the power to change the loan contract much, though, so many people can’t keep their homes using Chapter 13 unless the lender can somehow be “persuaded” to modify the loan.

But Olga was willing to try. She gave notice to creditors and filed a plan, among other things, and her mortgage servicer (PHH Mortgage Corp.) filed a proof of claim with a schedule stating how much was allegedly owed on Olga’s house. Olga’s lawyer noticed that PHH’s paperwork was not very complete, so he sent some information requests. He was not satisfied with the response, so he filed a motion to have PHH’s proof of claim expunged.

Olga’s Motion to Expunge

Mortgage servicers have important rights under the various contracts associated with the loan, but the servicer frequently is not, and PHH in this case was not, the actual owner of the note or the mortgage. In addition, the paperwork provided by PHH was woefully incomplete. Woefully incomplete paperwork can mean something different in bankruptcy than it does in foreclosure.

When your paperwork is woefully incomplete in a foreclosure case, you can ask for a delay or you can drop the case or have it dismissed, and you usually get another chance. Bankruptcy, by contrast, is kind of a one-shot deal by nature. The judge will add up all the debts, add up all the money available, approve a plan, and that’s it. Very limited do-overs.

Olga’s motion listed a number of problems:

These items are explained a little bit more in Olga’s Response to the lender’s objection to her motion to expunge the proof of claim, which is a pretty good summary of things borrowers might want to think about when they are considering whether to contest foreclosures. MERS was a nominee at some point, but was not directly involved in the case.

My impression is that Olga’s lawyer did not expect the proof of claim to be expunged, and was primarily interested in getting more information and forcing the lender to negotiate. Bankruptcy Judge Robert Drain had other ideas – he expunged the claim.

The Aftermath

This is probably not the end of the story because, as Olga’s lawyer explained, a title company probably will not insure the title if Olga tries to sell the house without taking any further action. Judge Drain did not explain much in his order, but what seems to have gotten his attention is the likelihood that the note and mortgage really never were properly assigned to the securitization trust.

Takeaway Lesson Number Two from this case is that, if Judge Drain is right, this is not a nothingburger. This could apply to a large number of securitized mortgages based on the language of the securitization documents themselves, not on the quirks of local law. The decision has been appealed to the district court, so we will likely find out more unless the case settles.

Morgenson also noted that this decision was by a “federal judge.” It is probably worth noting that bankruptcy judges are not quite the same as U.S. District Court judges. Bankruptcy judges are not appointed for life, they only have jurisdiction over matters that are related to bankruptcy, and their decisions are appealable to a District Court judge, as happened in this case. But bankruptcy judges have a lot of power over core bankruptcy matters. This particular judge was the one who slashed executive compensation in the Delphi case.

In my opinion, Takeaway Lesson Number Three is this: lenders would probably have been better off with a reasonable cramdown provision in the bankruptcy laws. As Tanta explained in her cramdown post, home mortgages were often modified in bankruptcy proceedings before 1993. Morgenson’s claim that all types of court proceedings have uniformly favored lenders “for decades” is wrong, but the bankruptcy laws got a lot worse for consumers in 1993 and again in 2005. In the absence of reasonable solutions imposed by a bankruptcy judge, lawyers for debtors and home mortgage lenders sometimes act like Reagan and Brezhnev, threatening each other with nuclear options and hoping none of the tactical warheads go off prematurely. Which is what seems to have happened in this case.

CR Note: This is a guest post from albrt.

Home Buyer Tax Credit Revision

by Calculated Risk on 10/28/2009 05:54:00 PM

From Bloomberg: Senate Said to Revise Plan to Extend, Expand Homebuyer Credit (ht Anthony)

The article states the plan might still change .

The details:

The key change from yesterday is the increase in income limits for first-time home buyers (and somewhat minor changes to the size of the tax credit).