by Calculated Risk on 10/03/2009 08:56:00 AM

Saturday, October 03, 2009

Comparing Employment Recessions including Revision

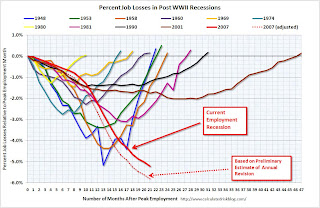

Here is a graph with an estimate of the impact of the preliminary estimate of the annual benchmark revision. (ht John) Click on graph for larger image.

Click on graph for larger image.

The dashed line is an estimate of the impact of the large benchmark revision (824 thousand more jobs lost).

The graph compares the job losses from the start of the employment recession in percentage terms (as opposed to the number of jobs lost).

Instead of 7.2 million net jobs lost since December 2007, the preliminary benchmark estimate suggests the U.S. has lost over 8.0 million net jobs during that period.

Even before the annual revision, the current employment recession was already the worst recession since WWII in terms of percent of job losses. The benchmark revision shows this recession was even deeper. The revision will be reported in February ... just something to remember over the next few months.

Friday, October 02, 2009

Problem Bank List (Unofficial) Oct 2, 2009

by Calculated Risk on 10/02/2009 09:15:00 PM

This is an unofficial list of Problem Banks. All three banks failures today were on this list (Warren Bank, Warren, Michigan; Jennings State Bank, Spring Grove, Minnesota; Southern Colorado National Bank, Pueblo, Colorado)

Changes and comments from surferdude808:

The Unofficial Problem Bank List increased by a net four institutions during the week to 463. Aggregate assets increased by $1.5 billion to $298.6 billion.The list is compiled from regulator press releases or from public news sources (see Enforcement Action Type link for source). The FDIC data is released monthly with a delay, and the Fed and OTC data is more timely. The OCC data is a little lagged. Credit: surferdude808.

Additions include three Illinois-based institutions -- Valley Bank, Moline ($691m); Highland Community Bank, Chicago ($120m); and Freedom Bank, Sterling ($86m) - and First Utah Bank, Salt Lake City ($358m) and Coastal Community Bank, Everett, WA ($262m).

The state banking department of Illinois may be the only state department that publicly releases its enforcement actions. We wish other state banking departments would follow Illinois’ lead by providing transparency around their actions.

There is one deletion from last week’s list -- Waterford Village Bank, Williamsville, NY, which we inadvertently missed removing from the list when it failed on July 24th. We greatly appreciate all feedback received in making this list as accurate as possible.

The only other notable change to the list is the addition of a Prompt Corrective Action order against Partners Bank, Naples, FL issued on September 18th. The OTS had previously placed Partners Bank under a Cease & Desist Order on August 21st.

See description below table for Class and Cert (and a link to FDIC ID system).

For a full screen version of the table click here.

The table is wide - use scroll bars to see all information!

NOTE: Columns are sortable - click on column header (Assets, State, Bank Name, Date, etc.)

Class: from FDIC

The FDIC assigns classification codes indicating an institution's charter type (commercial bank, savings bank, or savings association), its chartering agent (state or federal government), its Federal Reserve membership status (member or nonmember), and its primary federal regulator (state-chartered institutions are subject to both federal and state supervision). These codes are:Cert: This is the certificate number assigned by the FDIC used to identify institutions and for the issuance of insurance certificates. Click on the number and the Institution Directory (ID) system "will provide the last demographic and financial data filed by the selected institution".N National chartered commercial bank supervised by the Office of the Comptroller of the Currency SM State charter Fed member commercial bank supervised by the Federal Reserve NM State charter Fed nonmember commercial bank supervised by the FDIC SA State or federal charter savings association supervised by the Office of Thrift Supervision SB State charter savings bank supervised by the FDIC

Bank Failure #98: Southern Colorado National Bank, Pueblo, Colorado

by Calculated Risk on 10/02/2009 08:20:00 PM

Rarified Air, Rarer cash.

Where did it all go?

by Soylent Green is People

Form the FDIC: Legacy Bank, Wiley, Colorado, Assumes All of the Deposits of Southern Colorado National Bank, Pueblo, Colorado

Southern Colorado National Bank, Pueblo, Colorado, was closed today by the Office of the Comptroller of the Currency, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Three down. Closing in on 100.

As of September 4, 2009, Southern Colorado National Bank had total assets of $39.5 million and total deposits of approximately $31.9 million. ....

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $6.6 million.... Southern Colorado National Bank is the 98th FDIC-insured institution to fail in the nation this year, and the third in Colorado. The last FDIC-insured institution closed in the state was New Frontier Bank, Greeley, on April 10, 2009.

Bank Failure #97: Jennings State Bank, Spring Grove, Minnesota

by Calculated Risk on 10/02/2009 07:08:00 PM

Recovery is forestalled

More bankers jobless

by Soylent Green is People

From the FDIC: Central Bank, Stillwater, Minnesota, Assumes All of the Deposits of Jennings State Bank, Spring Grove, Minnesota

Jennings State Bank, Spring Grove, Minnesota, was closed today by the Minnesota Department of Commerce, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...Hey, less than $12 million! Still counts ...

As of July 31, 2009, Jennings State Bank had total assets of $56.3 million and total deposits of approximately $52.4 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $11.7 million. ... Jennings State Bank is the 97th FDIC-insured institution to fail in the nation this year, and the fourth in Minnesota. The last FDIC-insured institution closed in the state was Brickwell Community Bank, Woodbury, on September 11, 2009.

Bank Failure #96: Warren Bank, Warren, Michigan

by Calculated Risk on 10/02/2009 06:11:00 PM

Bank: GL GBTW

Bair: BCNU

by Soylent Green is People

From the FDIC: The Huntington National Bank, Columbus, Ohio, Assumes All of the Deposits of Warren Bank, Warren, Michigan

Warren Bank, Warren, Michigan, was closed today by the Michigan Office of Financial and Insurance Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. ...It is Friday!

As of July 31, 2009, Warren Bank had total assets of $538 million and total deposits of approximately $501 million. ...

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $275 million. ... Warren Bank is the 96th FDIC-insured institution to fail in the nation this year, and the second in Michigan. The last FDIC-insured institution closed in the state was Michigan Heritage Bank, Farmington Hills, on April 24, 2009.

Report: Starwood "Winner" of Corus "Assets", and more Walking Away from Hotels

by Calculated Risk on 10/02/2009 03:56:00 PM

Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

From the WSJ: Starwood-Led Group Likely Winner of Corus Assets

... a group of investors led by ... Starwood Capital Group is emerging as the likely winner ... of the failed Corus Bank's condominium loans and other property ...And more hotels going down ... from a Lodgian press release: (ht Zach)

The assets have a face value of about $5 billion but the winning bid is expected to be far less than that ... To minimize the losses to taxpayers from the failure of Corus, the FDIC will take a 60% equity stake in the partnership that ends up owning the Corus assets ...The FDIC also will provide financing to the partnership.

The Merrill Lynch Fixed Rate Pool 3, secured by six hotels, is in default. The loan matured on October 1, 2009. The company has engaged in negotiations with the lender regarding extension and modification of the loan, with no resolution to date. Unless some agreement is reached in the near-term, the company intends to return the hotels to the lender in full satisfaction of the debt; The company has stopped servicing the debt secured by the Crowne Plaza in Worcester, Mass., and intends to return the hotel to the lender in full satisfaction of the debt;

Bloomberg: Banks With 20% Unpaid Loans

by Calculated Risk on 10/02/2009 03:09:00 PM

Since it is Friday ...

From Bloomberg: Banks With 20% Unpaid Loans at 18-Year High Amid Recovery Doubt

The number of U.S. lenders that can’t collect on at least 20 percent of their loans hit an 18-year high, signaling that more bank failures and losses could slow an economic recovery.And here is a classic quote:

[There are] 26 firms with more than one-fifth of their loans 90 days overdue or not accruing interest as of June 30 -- a level of distress almost five times the national average ...

For banks with 20 percent of loans overdue, “either they’ve got a massive amount of capital, or the FDIC just hasn’t gotten around to them,” said Jeff Davis, an analyst with FTN Equity Capital Markets in Nashville.

“Everything was so positive for so long in this area, it came as a surprise when it stopped,” said John Medernach, Benchmark’s CEO ...Hey, Hoocoodanode? (Who could have known?)

“I stop and think of all the rich farmland that has been developed into subdivisions during the boom years,” Medernach said. “It makes you wonder what we’ve been doing.”

The article includes a table with all 62 banks. Here are the "leaders" according to Bloomberg:

| Company | Location | Nonaccrual Loans as % of Total |

|---|---|---|

| Community Bank of Lemont | Lemont, IL | 49.45 |

| Eastern Savings Bank FSB | Hunt Valley, MD | 48.01 |

| City Bank | Lynnwood, WA | 43.95 |

ABI: Personal Bankruptcy Filings up 41 Percent Compared to Sept 2008

by Calculated Risk on 10/02/2009 12:41:00 PM

From the American Bankruptcy Institute: Consumer Bankruptcy Filings Surge Past One Million During First Nine Months of 2009

Consumer bankruptcies totaled 1,046,449 filings through the first nine months of 2009 (Jan. 1-Sept. 30), the first time since the 2005 bankruptcy overhaul that filings have surged past the 1 million mark during the first three calendar quarters of a year, according to the American Bankruptcy Institute (ABI), relying on data from the National Bankruptcy Research Center (NBKRC). The filings for the first three-quarters of 2009 were the highest total since the 1,350,360 consumer filings through the first nine months of 2005.

"Bankruptcy filings continue to climb as consumers look to shelter themselves from the effects of rising unemployment rates and housing debt," said ABI Executive Director Samuel J. Gerdano. "The consumer filing total through the first nine months is consistent with our expectation that consumer bankruptcies will top 1.4 million in 2009."

The September 2009 consumer filing total reached 124,790, a 41 percent increase from the 88,663 consumer filings in September 2008.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, Q3 2009 based on monthly data from the American Bankruptcy Institute.

The quarterly rate is close to the levels prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

There have been 1.05 million personal bankruptcy filings through Sept 2009, and the American Bankruptcy Institute is predicting over 1.4 million new bankruptcies by year end - I'll take the over!

Employment-Population Ratio, 10% Unemployment, Part Time Workers

by Calculated Risk on 10/02/2009 11:26:00 AM

A few more graphs based on the (un)employment report ...

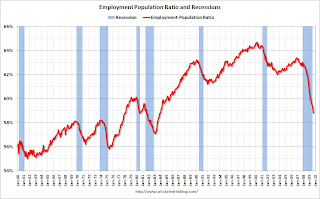

Employment-Population Ratio Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the employment-population ratio; this is the ratio of employed Americans to the adult population.

Note: the graph doesn't start at zero to better show the change.

The general upward trend from the early '60s was mostly due to women entering the workforce.

This measure fell in September to 58.8%, the lowest level since the early '80s.

The Labor Force Participation Rate fell to 65.2% (the percentage of the working age population in the labor force). This is also the lowest since the mid-80s.

When the job market starts to recover, many of these people will reenter the workforce and look for employment - and that will keep the unemployment rate elevated for some time.

This second graph shows the quarterly change in net jobs (on the x-axis) as a percentage of the civilian workforce, and the change in the unemployment rate on the y-axis. Although this data is from two different surveys, there is a clear relationship between the data. For a discussion of the two surveys, see Jobs and the Unemployment Rate.

The following data is for the last 40 years: 1969 through Q3 2009. The Red squares are for 2008, and for the first three quarters of 2009 (the current employment recession).

The Red squares are for 2008, and for the first three quarters of 2009 (the current employment recession).

The U-3 headline unemployment rate for September was reported at 9.8% (this was actually rounded down from 9.83%).

Notice the relationship is not linear. As the job market starts to recover, more people will participate in the labor force - and the Labor Force Participation Rate and the employment-population ratio will increase.

10% Unemployment

It is possible that the unemployment rate will hit 10% in October (the current unemployment rate is 9.83%, an increase of 0.17% from August).

With similar job losses in October as in September, or just more people participating in the work force - perhaps looking for one of the scarce holiday retail jobs - the unemployment rate could easily hit 10% this month. If not in October, then probably in November.

Part Time for Economic Reasons

From the BLS report:

In September, the number of persons working part time for economic reasons (sometimes referred to as involuntary part-time workers) was little changed at 9.2 million. The number of such workers rose sharply throughout most of the fall and winter but has been little changed since March.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is at a record 9.179 million.

The number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is at a record 9.179 million. Note: the U.S. population is significantly larger today (about 305 million) than in the early '80s (about 228 million) when the number of part time workers almost reached 7 million. That is the equivalent of about 9.3 million today, so population adjusted this is not quite a record.

Earlier employment posts today:

Unemployment: Stress Tests, Unemployed over 26 Weeks, Diffusion Index

by Calculated Risk on 10/02/2009 09:30:00 AM

Note: earlier Employment post: Employment Report: 263K Jobs Lost, 9.8% Unemployment Rate. The earlier post includes a graph of percent job losses in a recession - the current recession is the worst post-WWII.

Stress Test Scenarios

The economy is performing better that the stress test baseline scenario for GDP and house prices, but worse than the "more adverse" stress test scenario for unemployment.  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the unemployment rate compared to the stress test economic scenarios on a quarterly basis as provided by the regulators to the banks (no link).

This is a quarterly forecast: the Unemployment Rate for Q3 is 9.63% (rounded to 9.6%), and will move higher in Q4. Once again, the unemployment rate is already higher than the "more adverse" scenario.

Note also that the unemployment rate has already exceeded the peak of the "baseline scenario".

Unemployed over 26 Weeks

The DOL report yesterday showed seasonally adjusted insured unemployment at 6.1 million, down from a peak of about 6.9 million. This raises the question of how many unemployed workers have exhausted their regular unemployment benefits (Note: most are still receiving extended benefits, although many workers are starting to exhaust their extended benefits too).

The monthly BLS report provides data on workers unemployed for 27 or more weeks, and here is a graph ... The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

The blue line is the number of workers unemployed for 27 weeks or more. The red line is the same data as a percent of the civilian workforce.

According to the BLS, there are a record 5.4 million workers who have been unemployed for more than 26 weeks (and still want a job). This is a record 3.5% of the civilian workforce. (note: records started in 1948)

Diffusion Index The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.

The BLS diffusion index is a measure of how widespread changes in employment are. Some people think it measures the percent of industries increasing employment, but that isn't quite correct.

From the BLS handbook:

The diffusion indexes for private nonfarm payroll employment are based on estimates for 278 industries, while the manufacturing indexes are based on estimates for 84 industries. Each component series is assigned a value of 0, 50, or 100 percent, depending on whether its employment showed a decrease, no change, or an increase over a given period. The average (mean) value is then calculated, and this percent is the diffusion index number.Think of this as a measure of how widespread the job losses are across industries. The further from 50 (above or below), the more widespread the job losses or gains reported by the BLS.

Both the "all industries" and "manufacturing" employment diffusion indices had been trending up - meaning job losses were becoming less widespread. However both turned down in September. This series is noisy month-to-month, but it still appears job losses are widespread across industries.

Ugly. Ugly. Ugly.