by Calculated Risk on 9/21/2009 04:16:00 PM

Monday, September 21, 2009

Moody’s: CRE Prices Off 39 Percent from Peak, Off 5% in July

From Bloomberg: Moody’s Property Index Resumes ‘Steep’ Fall in July (ht James)

The Moody’s/REAL Commercial Property Price Indices fell 5.1 percent in July from the month before, Moody’s said today in a statement. The index is down almost 39 percent from its October 2007 peak.Here is a comparison of the Moodys/REAL Commercial Property Price Index (CPPI) and the Case-Shiller composite 20 index.

...

Commercial property sales this year may fall to an 18-year low. This latest set of numbers suggests no letup in that trend, said Neal Elkin, president of Real Estate Analytics LLC, a New York firm that partners with Moody’s in producing the report.

“We are still vulnerable to moves on the downside,” Elkin said in a telephone interview. “As time passes, the distress and the stress among those who need to sell is growing.”

...

Florida apartment values tumbled 40 percent in a year, the report said.

“That’s eye-popping,” Elkin said. The decline is being caused in part by “a ripple effect” from the overbuilding of condominiums in those markets, many of which are now competing as rentals, he said.

Notes: Beware of the "Real" in the title - this index is not inflation adjusted - that is the name of the company (an unfortunate choice for a price index). Moody's CRE price index is a repeat sales index like Case-Shiller.

Click on graph for larger image in new window.

Click on graph for larger image in new window.CRE prices only go back to December 2000.

The Case-Shiller Composite 20 residential index is in blue (with Dec 2000 set to 1.0 to line up the indexes).

This shows residential leading CRE (although we usually talk about residential investment leading CRE investment, but in this case also for prices), and this also shows that prices tend to fall faster for CRE than for residential.

Also note the comment from Neal Elkin about condos being converted to rental units. There has been a surge in rental units, and rents are falling in most areas - and this is also impacting Apartment building prices.

GAO Report: AIG Stabilized, Repayment "Unclear"

by Calculated Risk on 9/21/2009 03:00:00 PM

| First a repeat of Eric's great AIG cartoon! Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis |

A report on AIG from the General Accounting Office (GAO):

While federal assistance has helped stabilize AIG’s financial condition, GAO-developed indicators suggest that AIG’s ability to restructure its business and repay the government is unclear at this time. Indicators of AIG’s financial risk suggest that since AIG reported significant losses in late 2008, AIG’s operations, with federal assistance, have begun to show signs of stabilizing in mid 2009. Similarly, after a declining trend through 2008 and early 2009, indicators of AIG insurance companies’ financial risk suggest improved financial conditions that were largely results of federal assistance. Indicators of AIG’s repayment of federal assistance show some progress in AIG’s ability to repay the federal assistance; however, improvement in the stability of AIG’s business depends on the long-term health of the company, market conditions, and continued government support. Therefore, the ultimate success of AIG’s restructuring and repayment efforts remains uncertain. GAO plans to continue to review the Federal Reserve’s and Treasury’s monitoring efforts and report on these indicators to determine the likelihood of AIG repaying the government’s assistance in full and the government recouping its investment.

emphasis added

AIA: Architectural Billings Index Declines in August

by Calculated Risk on 9/21/2009 12:14:00 PM

From Baltimore Business Journal: Architects report drop in future projects in August

... The American Institute of Architects said August’s Architectural Billings Index, an economic indicator of future construction activity, fell to 41.7 during the month, which is down from 43.1 in July.

...

“While there have been occasional signs of optimism over the last few months, the overwhelming majority of architects are reporting that banks are extremely reluctant to provide financing for projects and that new equity requirements and conservative appraisals are making it even more difficult for developers to get loans,” said Kermit Baker, AIA chief economist. “Until the anxiety within the financial community eases, these conditions are likely to continue.”

Click on graph for larger image in new window.

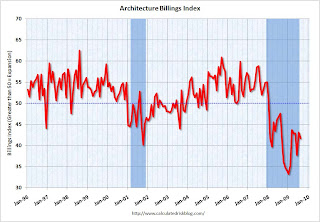

Click on graph for larger image in new window.This graph shows the Architecture Billings Index since 1996. The index has remained below 50, indicating falling demand, since January 2008.

Note: Nonresidential construction includes commercial and industrial facilities like hotels and office buildings, as well as schools, hospitals and other institutions.

Historically there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on commercial real estate (CRE). This suggests further dramatic declines in CRE investment through most of next year - at least.

Report: Mortgage Delinquencies increase in August

by Calculated Risk on 9/21/2009 11:09:00 AM

From Reuters: Mortgage Delinquencies Rise Alongside Unemployment (ht Ron Wallstreetpit)

Reuters reports that a record 7.58% of U.S. homeowners with mortgages were 30+ days delinquent in August, up from 7.32% in July ... and up from 4.89% in August 2008.

Reuters also notes that delinquencies are rising at "an accelerating pace".

This is one part of the coming "triple whammy" at the end of this year that Tom Lawler mentioned this morning: rising foreclosures, end of the Fed buying MBS, and the end of the housing tax credit.

We have to be a little careful with the delinquency numbers because they include homeowners in the trial period for modifications.

Note: This uses a different approach than the MBA. The MBA reported 9.24% of all loans outstanding were delinquent at the end of the 2nd quarter. Another 4.3% of loans were in the foreclosure process.

Housing: "Facing a triple whammy" at end of Year

by Calculated Risk on 9/21/2009 08:43:00 AM

"We could be facing a triple whammy at the end of the year: the expiration of the tax credit, the end of the Fed mortgage-buying program and rising foreclosures.”From Bloomberg: Housing Suffering Relapse Confronts Bernanke Credit Conundrum (ht Mike in Long Island) A few excerpts:

Thomas Lawler, housing economist

The Fed’s purchases of mortgage-backed debt so far this year have dwarfed net issues of such securities by Fannie Mae, Freddie Mac and government-run mortgage-bond insurer Ginnie Mae, which totaled about $440 billion through the end of August, said Walt Schmidt, a mortgage-bond strategist in Chicago at FTN Financial.These excerpts make three key points:

Once the Fed exits the market, the spread between yields on mortgage-backed debt and Treasury securities will have to rise, perhaps by a half percentage point, in order to attract other buyers, he said.

...

The impact of terminating the tax credit will show up first in the new-home market, said David Crowe, chief economist of the home-builders’ association.

“It takes at least four months to build a house, and you need to buy it before Dec. 1 to qualify,” he said. “If you haven’t started building it by now, it’s too late.”

...

Residential construction and home sales led the way out of the previous seven recessions going back to 1960, according to David Berson, chief economist of PMI Group, a mortgage insurer in Walnut Creek, California.

Sunday, September 20, 2009

Sunday Night Miscellaneous

by Calculated Risk on 9/20/2009 11:46:00 PM

From Paul Krugman on financial reform: Reform or Bust

I was startled last week when Mr. Obama, in an interview with Bloomberg News, questioned the case for limiting financial-sector pay: “Why is it,” he asked, “that we’re going to cap executive compensation for Wall Street bankers but not Silicon Valley entrepreneurs or N.F.L. football players?”Inferior goods in Japan! From the NY Times: Once Slave to Luxury, Japan Catches Thrift Bug

That’s an astonishing remark — and not just because the National Football League does, in fact, have pay caps. Tech firms don’t crash the whole world’s operating system when they go bankrupt; quarterbacks who make too many risky passes don’t have to be rescued with hundred-billion-dollar bailouts. Banking is a special case ...

Across the board, discount retailers are reporting increases in revenue — while just about everyone else is experiencing declines, in some cases, by double digits.Futures are off slightly ...

As a result, the luxury boutiques, once almighty here, are reeling.

...

In the 1970s and ’80s, and even as the economy limped through the ’90s, a wide group of consumers spent generously on Louis Vuitton bags and Hermès scarves — even at the expense of holidays, travel and, sometimes, meals and rent.

Now, the Japanese luxury market, worth $15 billion to $20 billion, has been among the hardest hit by the global economic crisis, according to a report by the consulting firm McKinsey & Company.

Futures from barchart.com

Bloomberg Futures.

CBOT mini-sized Dow

CME Globex Flash Quotes

And the Asian markets are mixed.

Best to all.

Capital Spending and Consumer Spending

by Calculated Risk on 9/20/2009 08:41:00 PM

Earlier today I posted a couple of bullish views and I disagreed with the projections of an "Immaculate Recovery". Former IMF chief economist Michael Mussa suggested that consumer spending wouldn't lead this recovery, but that business investment would be strong.

This graph shows the general relationship between capital spending and consumer spending (ht Jan Hatzius, Capital Spending: The Caboose of a Slow Train). Note: Consumer spending lagged two quarters for best fit. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This suggests that consumer spending needs to pickup to above 1.5% year-over-year growth rate for business investment in equipment and software to be positive. If businesses expects consumer spending to pick up sharply, maybe they'd invest more - but few business owners expect a sharp pickup.

There might be a boost in capital spending because of a replacement cycle, but with all the slack in the economy (capacity utilization is near record lows and almost double digit unemployment), I definitely don't expect business spending to lead the recovery (as Mussa suggested).

NY Times: Financial Crisis Inquiry Commission

by Calculated Risk on 9/20/2009 04:11:00 PM

From a NY Times Editorial: Facts and the Financial Crisis

The Financial Crisis Inquiry Commission, created by Congress to examine the causes of the crisis, held its first public meeting last week. ... the meeting was a long time coming, and thin on substance.The NY Times asks some good questions:

In the run-up to the crisis, what did regulators, particularly the Federal Reserve, know and do in response to unconstrained lending? What were their thoughts about the way banks and investors worldwide increasingly disregarded risk?It will be interesting to read the 2004 FOMC transcripts to see if there was any discussion of lending standards, house prices and a credit bubble. It makes no sense that we have to wait 5+ years for the transcripts ...

Publicly, they did not act to curb the excesses. But internally, was there contrary analysis or dissent? Were there chances to take another course that we may learn from now in hindsight?

Answers to these questions are in files that are not public and in the heads of the people in positions of responsibility at the time. The commission must be aggressive in its pursuit of documents and unflinching in taking testimony at even the highest levels of government and business.

I suspect we will find some concerns expressed in 2004 - perhaps something similar to what Fed Economist Michael Prell said at the Dec 21, 1999 FOMC (about the stock market):

To illustrate the speculative character of the market, let me cite an excerpt from a recent IPO prospectus: ... “We do not expect to generate sufficient revenues to achieve profitability and, therefore, we expect to continue to incur net losses for at least the foreseeable future. If we do achieve profitability, we may not be able to sustain it.” Based on these prospects, the VA Linux IPO recorded a first-day price gain of about 700 percent and has a market cap of roughly $9 billion. Not bad for a company that some analysts say has no hold on any significant technology.I wouldn't be surprised to see something similar in the 2004 transcripts, but about housing and the credit markets.

The warning language I’ve just read is at least an improvement in disclosure compared to the classic prospectus of the South Sea Bubble era, in which someone offered shares in “A company for carrying on an undertaking of great advantage, but nobody to know what it is.” But, I wonder whether the spirit of the times isn’t becoming similar to that of the earlier period. ... At this point, those same people are abandoning all efforts at fundamental analysis and talking about momentum as the only thing that matters.

If this speculation were occurring on a scale that wasn’t lifting the overall market, it might be of concern only for the distortions in resource allocation it might be causing. But it has in fact been giving rise to significant gains in household wealth and thereby contributing to the rapid growth of consumer demand--something reflected in the internal and external saving imbalances that are much discussed in some circles.

emphasis added

A couple of Bullish Views

by Calculated Risk on 9/20/2009 01:07:00 PM

From James Grant in the WSJ: From Bear to Bull

Knocked for a loop, we forget a truism. With regard to the recession that precedes the recovery, worse is subsequently better. The deeper the slump, the zippier the recovery. To quote a dissenter from the forecasting consensus, Michael T. Darda, chief economist of MKM Partners, Greenwich, Conn.: "[T]he most important determinant of the strength of an economy recovery is the depth of the downturn that preceded it. There are no exceptions to this rule, including the 1929-1939 period."And from McClatchy Newspapers: Ex-IMF chief economist has rosy recovery view

Growth snapped back following the depressions of 1893-94, 1907-08, 1920-21 and 1929-33. If ugly downturns made for torpid recoveries, as today's economists suggest, the economic history of this country would have to be rewritten.

...

"At the business trough in 1933," Mr. Darda points out, "the unemployment rate stood at 25% (if there had been a 'U6' version of labor underutilization then, it likely would have been about 44% vs. 16.8% today. . . ). At the same time, the consumption share of GDP was above 80% in 1933 and the household savings rate was negative. Yet, in the four years that followed, the economy expanded at a 9.5% annual average rate while the unemployment rate dropped 10.6 percentage points."

...

Our recession, though a mere inconvenience compared to some of the cyclical snows of yesteryear, does bear comparison with the slump of 1981-82. In the worst quarter of that contraction, the first three months of 1982, real GDP shrank at an annual rate of 6.4%, matching the steepest drop of the current recession, which was registered in the first quarter of 2009. Yet the Reagan recovery, starting in the first quarter of 1983, rushed along at quarterly growth rates (expressed as annual rates of change) over the next six quarters of 5.1%, 9.3%, 8.1%, 8.5%, 8.0% and 7.1%. Not until the third quarter of 1984 did real quarterly GDP growth drop below 5%.

[Michael] Mussa, the former chief economist of the International Monetary Fund, presented a decidedly upbeat economic forecast last week that turned heads in the nation's capital. ...I disagree with these views.

"The recession is over and a global recovery is under way," he began, unveiling a pile of data and historical charts to support his view that forecasters regularly underestimate recoveries – and are doing so again.

Where the IMF foresees just 0.6 percent year-over-year growth in 2010 in the U.S. economy and 2.5 percent globally, Mussa sees 3.3 percent growth in the U.S. economy next year and 4.2 percent growth globally. He projects a U.S. growth rate of 4 percent from the middle of this year through the end of 2010.

"All forecasts tend to underpredict the recovery. … I think that's what we are seeing this time," said Mussa, now a senior fellow at the Peterson Institute for International Economics, a leading research organization in Washington.

...

Mussa pointed to forecasts made at the end of the 1981-1982 recession, the closest approximation to today's deep downturn. ...

The Reagan administration projected a growth rate from December 1982 to December 1983 of 3.1 percent, as did the Federal Reserve. In fact, the real growth rate turned out to be 6.3 percent.

...

Mussa concurs with most mainstream forecasters that consumers won't lead this recovery, and that Americans will sharply boost their savings to a 7 percent annual rate by the end of 2010.

What, then, will drive growth? Business investment, Mussa said ...

First, I expect a decent GDP rebound in Q3 and Q4 because of an inventory correction and exports. However this boost will be temporary.

But what will be the engine of growth in 2010? Usually consumer spending and residential investment lead the economy out of recession. Although I started the year expecting a bottom in new home sales and single family housing starts (and it appears that has happened), there is still too much existing home inventory for much of an increase in the short term.

And even Mussa agrees that consumers will remain under pressure as they repair their household balance sheets - yet he expects growth in business investment?

Goldman Sachs put on a research note on Friday: Capital Spending: The Caboose of a Slow Train (no link). Although the analysts noted a possible equipment replacement cycle, they also noted:

Few businesses will step up capital spending sharply unless they see a meaningful improvement in end demand for their products. Since the most important component of end demand for US companies is the domestic consumer, our cautious view of the outlook for personal consumption also implies a cautious view of capital spending, other things being equal. In essence, capital spending is the caboose of recovery, not the locomotive.There is already to much capacity, and until end demand absorbs some of that unused capacity, there won't be a meaningful increase in capital spending.

And on the comparison to the early '80s recession (both Grant and Mussa made this comparison), Krugman had some comments in early 2008: Postmodern recessions

A lot of what we think we know about recession and recovery comes from the experience of the 70s and 80s. But the recessions of that era were very different from the recessions since. Each of the slumps — 1969-70, 1973-75, and the double-dip slump from 1979 to 1982 — were caused, basically, by high interest rates imposed by the Fed to control inflation. In each case housing tanked, then bounced back when interest rates were allowed to fall again.And that means that the Fed can't just cut interest rates and boost housing. This recession is very different than the early '80s.

... Post-moderation recessions haven’t been deliberately engineered by the Fed, they just happen when credit bubbles or other things get out of hand.

This time housing will remain under pressure until the number of excess housing units (both owner occupied and rentals) decline to more normal levels.

So I think an "Immaculate Recovery" is very unlikely.

San Francisco: $30 Billion Option ARM Time Bomb

by Calculated Risk on 9/20/2009 08:49:00 AM

From Carolyn Said at the San Francisco Chronicle: $30 billion home loan time bomb set for 2010

From 2004 to 2008, "one in five people who took out a mortgage loan (for both purchases and refinancing) in the San Francisco metropolitan region ... got an option ARM," said Bob Visini, senior director of marketing in San Francisco at First American CoreLogic, a mortgage research firm. "That's more than twice the national average.The article has much more.

"People think option ARMs (will be) a national crisis," he said. "That's not really true. It's just in higher-cost areas like California where you see their prevalence."

...

First American shows more than 54,000 option ARMs issued here with a value of about $30.9 billion. Fitch shows more than 47,000 option ARMs here with a value of about $28 billion. Both say their data underestimate the totals.

...

Fitch said 94 percent of borrowers elected to make minimum payments only.

...

Unlike subprime loans, which were more commonly used for entry-level homes, option ARMs started out with high balances. In the five-county San Francisco area, option ARMs average about $584,000 and were used to buy homes averaging $823,000, according to an analysis of First American data.

That means they'll spawn foreclosures among upper-end homes.

...

"The average option ARM borrower is significantly underwater, so much that they don't think they'll get out," Sirotic said. On average nationwide, option ARM borrowers ... owe is 126 percent of their home's value, based on depreciation and not including the effects of negative amortization, Sirotic said.

Option ARMs were used as affordability products in mid-to-high priced areas of bubble states like California. Now most of the borrowers are significantly underwater, and this will lead to more foreclosures, and falling prices, in the mid-to-high end areas.