by Calculated Risk on 8/25/2009 12:43:00 AM

Tuesday, August 25, 2009

Banks to Raise more Tier 1 Capital

Some people knew this was coming ...

From Reuters: Deutsche Bank plans Tier 1 issue, reopens market

Deutsche Bank AG plans to raise new Tier 1 debt ... as banks seek to rebuild balance sheets in the wake of the financial crisis.And SunTrust hints at raising new capital, from Bloomberg: U.S. Banks Face More Loan Losses, SunTrust Chief Says

The German bank confirmed it planned to issue euro fixed-rate perpetual notes, with annual call dates beginning from March 2015, and said it was managing the issue. ... the first of an expected series of new Tier 1 notes to hit the market in coming months from banks ... The deal would be smaller than 1 billion euros as the bank was seeking to test the market's appetite ...

“The industry is a long way from declaring any sort of victory, especially regarding credit issues,” Chief Executive Officer James Wells III said today in a speech to the Rotary Club of Atlanta. “This credit cycle has yet to play itself out. We do not expect things to improve for the banking industry in the very near future.”Ahhh ... just prudent balance sheet management!

...

“The industry has moved from a potentially cataclysmic scenario to one that is merely very difficult,” Wells said. “The industry is back from the brink of a potential global financial-system meltdown.” ... “Even if the economy begins to improve modestly, commercial real estate conditions will probably deteriorate until 2010.”

...

Wells said SunTrust may repurchase $4.9 billion in preferred shares sold through the U.S. Troubled Asset Relief Program “as soon as possible,” without being more specific.

Monday, August 24, 2009

Obama to Reappoint Bernanke

by Calculated Risk on 8/24/2009 10:13:00 PM

From CNBC: Obama to Reappoint Bernanke as Fed Chief

U.S. President Barack Obama will reappoint Ben Bernanke for a second term as chairman of the Federal Reserve on Tuesday, a senior administration official said on Monday.As Fed Governor Bernanke supported the flawed policies of Alan Greenspan - he never recognized the housing bubble or the lack of oversight - and there is no question, as Fed Chairman, Bernanke was slow to understand the credit and housing problems. And I'd prefer someone with better forecasting skills.

...

"The man next to me, Ben Bernanke, has led the Fed through one of the worst financial crises that this nation and this world have ever faced," Obama will say in a statement to the media at 9 am New York time.

However once Bernanke started to understand the problem, he was very effective at providing liquidity for the markets. The financial system faced both a liquidity and a solvency crisis, and it is the Fed's role to provide appropriate liquidity. Bernanke met that challenge, and I think he is a solid choice for a 2nd term (not my first choice, but solid).

Hotels: A "Perfect Storm" in San Francisco

by Calculated Risk on 8/24/2009 08:06:00 PM

From the SF Gate: Hotel losses mount, hurting city's coffers (ht Michael)

In June, the average room rate in San Francisco was $134, the lowest it has been since 2005 and well below the $162 peak in June 2008 ... For a while, managers filled rooms by offering lower rates, but the number of visitors also has begun to slide, and in June, occupancy tumbled to 73 percent, down from 85 percent the same time last year.A 17% decline in room rates, and a 14% decline in occupancy rates, suggests about a 30% decline in RevPAR (Revenue Per Available Room).

Add to the troubled mix the fact that many hotel owners, in San Francisco and across the state, financed purchases or refinanced loans between 2005 and 2007 - when the hotel values were at their peak. Since then, hotels statewide have lost 50 to 80 percent of their value, meaning that many owners owe far more than their asset is worth.Actually this is a perfect storm everywhere for hotels. Too much supply - and more coming online every day. Too much debt. And too few guests.

Hospitality industry analyst Alan Reay calls the situation a "perfect storm" that won't improve any time soon ...

NY Fed: US Credit Conditions Map

by Calculated Risk on 8/24/2009 05:49:00 PM

Check out the updates to the NY Fed Credit Conditions map.

A very cool tool from the NY Fed: New York Fed Launches Expanded U.S. Credit Conditions Section of Website (ht Bob, Justin)

The Federal Reserve Bank of New York today launched an expanded section of its website, adding new regional information on consumer credit conditions intended to assist policymakers address mortgage delinquency and foreclosure issues.

The U.S. Credit Conditions section offers new interactive maps and data on auto and student loan delinquencies, and mortgage “roll” rates. These features complement existing maps and spreadsheets on mortgage foreclosures and delinquencies, measures of subprime and alt-A mortgages and bank credit card delinquencies. The data are available at the state and county level.

Misc: Long Hours at the FDIC, Foreclosures Movin' on Up!

by Calculated Risk on 8/24/2009 04:00:00 PM

Here is an email sent out by George Mason University today (thanks to KurtyBoy):

Beginning August 30, after hours parking in the FDIC parking garage, from 5:30 pm to 11:00 pm with a valid Mason Arlington permit, is no longer available.

Click on email for larger image in new window.

Click on email for larger image in new window.KurtyBoy adds: "Notice how the bullet about the parking has been added in a different font? Like a change that just got made.... "

Looks like long hours for Sheila Bair and crew.

And from Jim the Realtor:

Here is the market graph from Doug Short, Doug Short is matching up the market bottoms for four crashes (with an interim bottom for the Great Depression).

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Comment on First-time Homebuyer Tax Credit

by Calculated Risk on 8/24/2009 01:52:00 PM

A few comments on the first-time homebuyer tax credit:

The tax credit is up to 10% of the purchase price, or $8 thousand maximum. "First-time" homebuyers are defined as anyone who hasn't owned a primarily residence for the last 3 years (not really "first-time").

Fitch: "Dramatic" Decrease in Cure Rates for Delinquent Mortgage Loans

by Calculated Risk on 8/24/2009 12:04:00 PM

These are very important numbers ...

Press Release from Fitch: Fitch: Delinquency Cure Rates Worsening for U.S. Prime RMBS (ht BURN, Ron Wallstreetpit)

While the number of U.S. prime RMBS loans rolling into a delinquency status has recently slowed, this improvement is being overwhelmed by the dramatic decrease in delinquency cure rates that has occurred since 2006, according to Fitch Ratings. An increasing number of borrowers who are 'underwater' on their mortgages appear to be driving this trend, as Fitch has also observed.This really puts the recent rise in delinquencies in perspective. Look at this graph from MBA Forecasts Foreclosures to Peak at End of 2010

Delinquency cure rates refer to the percentage of delinquent loans returning to a current payment status each month. Cure rates have declined from an average of 45% during 2000-2006 to the currently level of 6.6%. ...

'Recent stability of loans becoming delinquent do not take into account the drastic decrease in delinquency cure rates experienced in the prime sector since the peak of the housing market,' said [Managing Director Roelof Slump]. 'While prime has shown the most precipitous decline, rates have dropped in other sectors as well.'

In addition to prime cure rates dropping to 6.6%, Alt-A cure rates have dropped to 4.3%, from an average of 30.2%, and subprime is down to 5.3% from an average of 19.4%. 'Whereas prime had previously been distinct for its relatively high level of delinquency recoveries, by this measure prime is no longer significantly outperforming other sectors,' said Slump.

... Furthermore, up to 25% of loans counted as cures are modified loans, which have been shown to have an increased propensity to re-default.

... 'As income and employment stress has spread, weaker prime borrowers become more likely to become delinquent in their loan payments and are less likely to become current again,' said Slump.

Regardless of aggregate roll-to-delinquent behavior, it will be difficult to argue that the market has stabilized or that performance has improved, until there is a concurrent increase in cure rates. This is especially true in the prime sector, which remains performing many times worse than historic averages. Prime 60+ delinquencies have more than tripled in the past year, from $9.5 billion to $28 billion total, or roughly $1.6 billion a month.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the delinquency and in foreclosure rates for all prime loans.

Prime loans account for all 78% of all loans.

Back in the 2000 to 2006 period, 45% of those delinquencies cured. Now, according to Fitch, only 6.6% cure - and a large percentage of those "cures" are modifications - and there is a large redefault rate on those loans.

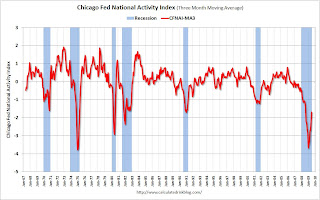

Chicago Fed: July National Activity Index

by Calculated Risk on 8/24/2009 10:33:00 AM

From the Chicago Fed: Index shows economic activity improved in April

The Chicago Fed National Activity Index was –0.74 in July, up from –1.82 in June. All four broad categories of indicators improved in July, while three of the four continued to make negative contributions to the index. Production-related indicators made a positive contribution to the index for the first time since October 2008 and for only the second time since December 2007.

Click on table for larger image in new window.

Click on table for larger image in new window.This graph shows the Chicago Fed National Activity Index (three month moving average) since 1967. According to the Chicago Fed:

"[T]he Chicago Fed National Activity Index (CFNAI), is a weighted average of 85 existing, monthly indicators of national economic activity. The CFNAI provides a single, summary measure of a common factor in these national economic data ...

[T]he CFNAI-MA3 appears to be a useful guide for identifying whether the economy has slipped into and out of a recession. This is useful because the definitive recognition of business cycle turning points usually occurs many months after the event. For example, even though the 1990-91 recession ended in March 1991, the NBER business cycle dating committee did not officially announce the recession’s end until 21 months later in December 1992. ...

When the economy is coming out of a recession, the CFNAI-MA3 moves significantly into positive territory a few months after the official NBER date of the trough. Specifically, after the onset of a recession, when the index first crosses +0.20, the recession has ended according to the NBER business cycle measures."

Note: this is based on only a few recessions, but this is one of the indicators to watch to determine when the recession ends. This suggests the economy was still in recession in July.

Of course this says nothing about economic purgatory ...

Roubini Concerned about Double Dip Recession

by Calculated Risk on 8/24/2009 08:52:00 AM

From Bloomberg: Roubini Sees Increasing Risk of Double-Dip Recession

Nouriel Roubini ... said the chance of a double-dip recession is increasing ... The global economy will bottom out in the second half of 2009, Roubini wrote ...There are still many problems in the economy, including the housing market, commercial real estate, household balance sheets (still too much debt), consumer spending, and more. As Roubini notes, there are significant risks "associated with exit strategies from the massive monetary and fiscal easing".

“There are risks associated with exit strategies from the massive monetary and fiscal easing,” Roubini wrote. “Policy makers are damned if they do and damned if they don’t.”

Government and central bank officials may undermine the recovery and tip their economies back into “stagdeflation” if they raise taxes, cut spending and mop up excess liquidity in their systems to reduce fiscal deficits, Roubini says. He defines “stagdeflation” as recession and deflation.

...

Roubini currently expects a U-shaped recovery, where growth will be “anemic and below trend for at least a couple of years,” he said.

From the WSJ: Policy Makers Seek to Learn From 1937's Stalled Comeback

The Great Depression was W-shaped. The stock-market collapse led to a steep economic decline. But by 1933, the economy had rebounded. Then a series of monetary and fiscal blunders drove the country back into a deep recession at the end of 1937.

That episode is at the heart of the debate over how quickly the government and the U.S. Federal Reserve should unwind the emergency measures they have taken to fend off a Depression-like contraction.

For the administration, the answer is clear: Err on the side of continued expansionary policies. "What you learned from that episode in 1937 is that it's not enough to be recovering," says Christina Romer, chairman of the president's Council of Economic Advisers and an expert on the Great Depression. "You don't want to do anything when you start recovering that nips it off too soon."

Sunday, August 23, 2009

Bove sees 150-200 more bank failures

by Calculated Risk on 8/23/2009 07:31:00 PM

From Reuters: Analyst Bove sees 150-200 more U.S. bank failures (ht Ron at WallStreetPit)

[Dick] Bove said "perhaps another 150 to 200 banks will fail," on top of 81 so far in 2009, adding stress to the FDIC's deposit insurance fund.Meredith Whitney said Friday that she expects around 300 banks to fail this cycle. With 109 failures so far (81 this year), 300 seems low. I'll take the over ...

...

Bove said the FDIC will likely levy special assessments against banks in the fourth quarter of this year and second quarter of 2010.

He said these assessments could total $11 billion in 2010, on top of the same amount of regular assessments. "FDIC premiums could be 25 percent of the industry's pretax income," he wrote.