by Calculated Risk on 5/26/2009 09:08:00 AM

Tuesday, May 26, 2009

Case-Shiller: Prices Fall Sharply in March

S&P/Case-Shiller released their monthly Home Price Indices for March this morning and also the quarterly national house price index.

The monthly data includes prices for 20 individual cities, and two composite indices (10 cities and 20 cities). Note: This is not the quarterly national index soon. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the nominal seasonally adjusted Composite 10 and Composite 20 indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 32.4% from the peak, and off 2.0% in March.

The Composite 20 index is off 31.4% from the peak, and off 2.2% in March.

Prices are still falling and will probably decline for some time. The second graph shows the Year over year change in both indices.

The second graph shows the Year over year change in both indices.

The Composite 10 is off 18.6% over the last year.

The Composite 20 is off 18.7% over the last year.

This is near the worst year-over-year price declines for the Composite indices since the housing bubble burst started.

I'll have much more soon (on individual cities, comparing to the stress test scenarios, price-to-rent, price-to-income).

Monday Night Futures

by Calculated Risk on 5/26/2009 12:11:00 AM

Big week for housing data: Case-Shiller house prices will be released Tuesday, existing home sales on Wednesday, and new home sales on Thursday.

The U.S. futures are flat tonight:

CBOT mini-sized Dow

Futures from barchart.com

CME Globex Flash Quotes

And the Asian markets are mixed.

Best to all.

Monday, May 25, 2009

Housing: More problems ahead for the low end?

by Calculated Risk on 5/25/2009 08:06:00 PM

Bob_in_MA points out some interesting comments on low price areas in the WaPo article: Housing Bust Leaves Most Sellers at a Loss

In the Virginia and Maryland suburbs, prices for single-family homes are down to where they were five years ago. In Prince William and Loudoun counties, a flood of foreclosures has pushed prices so low that bargain hunters have flocked there in recent months, helping to boost sales.It will be interesting to see if sales in the low end areas start to decline after the recent reports of booming sales to another round of investors and first time buyers ...

But while in past slumps a surge in sales has signaled the start of a rebound, this downturn is unlike any in recent times and it's premature to call a recovery, said Barry Merchant, senior housing policy analyst at the Virginia Housing Development Authority.

The encouraging signs have been offset by more troublesome ones, he said. After tapering off for a few months, foreclosures in Northern Virginia are starting to creep up again and may keep climbing now that several lenders have lifted foreclosure moratoriums.

Meanwhile, the year-over-year sales increases of the past few months are petering out in some Virginia suburbs, suggesting that interest in the fire-sale prices may have peaked, Merchant said. In April, Loudoun sales declined 12.5 percent from a year earlier.

"If sales are not increasing and foreclosures are on the uptick, then the question is: 'Is there another shoe to fall?' " Merchant said. "Maybe what we were hoping was the bottom was just a bump on the way down."

The low end of the real estate market [in Phoenix] — and in some equally hard-hit places like inland California and coastal Florida — is becoming as wild as anything during the boom.and

... record or near-record-high sales this spring in many of the [California] Bay Area’s most affordable, foreclosure-heavy communities.and

... the number of single-family houses that resold last month was at record or near-record-high levels for an April in many of the more affordable, foreclosure-heavy [Southern California] inland markets.

GM Bondholders watching Chrysler Bankruptcy

by Calculated Risk on 5/25/2009 05:22:00 PM

An update on a key court ruling tomorrow - not just for Chrysler, but probably for GM too.

From the Financial Times: GM creditors watch Chrysler lawsuit (ht jb)

General Motors bondholders ... will be watching a New York court on Tuesday as a group of Chrysler creditors tries to block the imminent emergence of GM’s smaller rival from bankruptcy protection.So Chrysler will probably emerge from bankruptcy this week - and GM will likely file for bankruptcy by next Monday, June 1st.

GM’s offer to the bondholders of a 10 per cent equity stake in the restructured company expires at midnight. The bondholders, with $27bn in unsecured claims, are widely expected to reject the proposal, setting the stage for GM to file for bankruptcy protection by June 1.

...

The bankruptcy court is expected to approve the deal tomorrow, paving the way for the new company to emerge from Chapter 11.

Krugman: World economy stabilising

by Calculated Risk on 5/25/2009 02:09:00 PM

From Reuters: World economy stabilising says Krugman

"I will not be surprised to see world trade stabilise, world industrial production stabilise and start to grow two months from now," Krugman told a seminar [in the UAE].And Krugman also suggested the GCC countries might consider abandoning the dollar peg, from BI-ME and Bloomberg: Gulf countries should drop dollar peg, says Paul Krugman

"I would not be surprised to see flat to positive GDP growth in the United States, and maybe even in Europe, in the second half of the year."

...

"In some sense we may be past the worst but there is a big difference between stabilising and actually making up the lost ground," he said.

"We have averted utter catastrophe, but how do we get real recovery?

"We can't all export our way to recovery. There's no other planet to trade with."

emphasis added

“You have a region that does as much trade with the eurozone as the United States,” Krugman, an economics professor at Princeton University in New Jersey, told reporters in Dubai. “If you feel that you must have a peg, the economics suggest that it ought to be a basket that reflects trade weights.”I hope Krugman posts on his impressions of Dubai.

Foreclosures and Mosquito Hunters

by Calculated Risk on 5/25/2009 11:41:00 AM

From Carolyn Said at the SF Chronicle: Aerial hunter sniffs out mosquito-ridden pools

Last year, mosquito districts hired [Aerial Services of Livermore] to fly over almost every county in California. It covered 3,500 square miles - about one-third of the state's urban area - and "harvested" 27,000 algae-ridden pools, providing the districts with photographs, maps, street addresses, latitude/longitude and parcel data, including ownership.This story isn't new - but it is interesting:

"We find lots of mosquito sources at foreclosed homes," said John Rusmisel, district manager for Alameda County's Mosquito Abatement District. "It's an ongoing and big problem."

[Bob Franklin] bought a Cessna plane with a 30-inch-wide hole in the bottom to mount a downward-facing camera. The hole is a $40,000 option, as it requires rerouting wires and making structural changes. ... He wrote software for flight planning, camera control and specialized image processing.I find it amusing that he got the idea for the business while towing an advertising banner for Circuit City.

Real Estate Agents Giving Up

by Calculated Risk on 5/25/2009 09:11:00 AM

From the LA Times: Realtors are abandoning a listing ship

Already weakened by the sour housing market, the profession faces increasing challenges from Internet-based services that help people save thousands on a home purchase.

The number of agents typically declines in a housing slump and rebounds when the market recovers. But this time, "when we see an upturn in the cycle, any recovery in the ranks of residential real estate brokers will be limited by a reduced need for their services," said Stuart Gabriel, director of UCLA's Ziman Center for Real Estate.

"The real estate brokerage industry is not going away, but the combination of efficiency gains via the Internet and the cyclical downturn will both be significant forces to their rapidly shrinking ranks," Gabriel said.

The National Assn. of Realtors reports a 13% drop in membership since 2006.

Click on graph for larger image in new window.

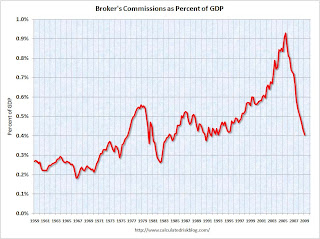

Click on graph for larger image in new window. This graph shows broker's commissions as a percent of GDP.

Not surprisingly - giving the housing bubble - broker's commissions soared in recent years, rising from $56 billion in 2000, to $109 billion in 2005. Commissions have declined to an annual rate of $57 billion in Q1 2009 - the lowest since 2000.

As a percent of GDP (shown on graph), broker's commissions are at the lowest level since 1993. All data from the BEA.

Here is a simple formula: Commissions = transactions X price X commission percent.

Broker's commissions increased because of both soaring prices and soaring activity. A double bubble.

Now a combination of lower prices, less activity, and innovation is putting pressure on commissions, and leading to fewer real estate agents.

Late Night Cranes

by Calculated Risk on 5/25/2009 12:29:00 AM

The U.S. Markets are closed Monday for Memorial Day (enjoy with your friends and family!). This will be a busy week for housing data: Case-Shiller house prices on Tuesday, existing home sales on Wednesday, and new home sales on Thursday. Should be interesting ...

The Asian markets are mixed tonight.

This video fits with an earlier post: Lost Vegas. This video is from about a year and a half ago ... but the Vegas skyline looked similar a few months ago when I was driving through Nevada ... maybe not Dubai (or Beijing) but still crazy!

Sunday, May 24, 2009

NY Times: We're All Subprime Now!

by Calculated Risk on 5/24/2009 09:24:00 PM

From Peter Goodman and Jack Healy at the NY Times: Job Losses Push Safer Mortgages to Foreclosure (ht shaun)

In the latest phase of the nation’s real estate disaster, the locus of trouble has shifted from subprime loans ... to the far more numerous prime loans issued to those with decent financial histories.

...

From November to February, the number of prime mortgages that were delinquent at least 90 days, were in foreclosure or had deteriorated to the point that the lender took possession of the home increased more than 473,000, exceeding 1.5 million, according to a New York Times analysis of data provided by First American CoreLogic, a real estate research group. Those loans totaled more than $224 billion.

During the same period, subprime mortgages in those three categories increased by fewer than 14,000, reaching 1.65 million. The number of similarly troubled Alt-A loans — those given to people with slightly tainted credit — rose 159,000, to 836,000.

Over all, more than four million loans worth $717 billion were in the three distressed categories in February, a jump of more than 60 percent in dollar terms compared with a year earlier.

Geithner Blames Borrowers and more, but not Regulators for Bubble

by Calculated Risk on 5/24/2009 05:38:00 PM

A WaPo interview with Secretary Geithner ...

WaPo's Lois Romano: "You mentioned that Americans borrowed beyond their means. When you look at the collapse of the housing market, who do you think bears the greatest responsibility? Is it the banks for pushing these loans? Is it the consumer for borrowing over their means? The regulators? Where do you see the fault lines there?"

Geithner: "For something this big and damaging to happen it takes a lot of mistakes over time. And it is that combination of things. Interest rate here and around the world were kept too low for too long. Investors made - took a bunch of risks without understanding the risks. They were betting on the expectation that house prices would continue to go up - to go up forever. Rating agencies failed to rate these products adequately. Supervisors failed to underwrite loans with sufficiently conservative standards. So those basic checks and balances failed. And people borrowed too much. It took all those things for it to happen."

CR Note: (short transcript by CR). Although there were many factors in the housing and credit bubble, the two keys were: 1) rapid innovation in the mortgage industry (securitization, automated underwriting, rapidly expanded wholesale lending, etc), and 2) a complete lack of oversight by regulators. As the late William Seidman wrote in his memoir (published in 1993): "Instruct regulators to look for the newest fad in the industry and examine it with great care. The next mistake will be a new way to make a loan that will not be repaid."

Geithner failed to mention the rapid changes in lending and the failure of government oversight as the two critical causes of the bubble. Either Geithner misspoke or he still doesn't understand what happened - and that is deeply troubling.

VIDEO Here (embedding was causing problems)