by Calculated Risk on 4/24/2009 08:07:00 PM

Friday, April 24, 2009

Bank Failure 29: First Bank of Idaho, Fsb, Ketchum, Idaho

"First Bank..." souring everywhere

Outbreak in spud land.

by Soylent Green is People

From the FDIC: U.S. Bank, Minneapolis, Minnesota, Assumes All of the Deposits of First Bank of Idaho, Fsb, Ketchum, Idaho

First Bank of Idaho, FSB, Ketchum, Idaho, was closed today by the Office of Thrift Supervision, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with U.S. Bank, Minneapolis, Minnesota, to assume all of the deposits, excluding those from brokers, of First Bank of Idaho.That makes four ...

...

As of December 31, 2008, First Bank of Idaho had total assets of approximately $488.9 million and total deposits of $374.0 million. U.S. Bank paid a premium of 0.55 percent to acquire the deposits of First Bank of Idaho.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $191.2 million. U.S. Bank's acquisition of the deposits of First Bank of Idaho was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives. First Bank of Idaho is the 29th bank to fail in the nation this year and the first in the state. The last FDIC-insured institution to fail in Idaho was Northwestern Federal Savings and Loan Association, Boise, on August 26, 1988.

Bank Failure 28: First Bank of Beverly Hills, Calabasas, California

by Calculated Risk on 4/24/2009 08:03:00 PM

Irresponsibility =

Assimilation :(

by Soylent Green is People

From the FDIC: FDIC Approves the Payout of the Insured Deposits of First Bank of Beverly Hills, Calabasas, California

The Federal Deposit Insurance Corporation (FDIC) approved the payout of the insured deposits of First Bank of Beverly Hills, Calabasas, California. The bank was closed today by the California Department of Financial Institutions, which appointed the FDIC as receiver.That is three. No one wanted this one ...

For insured deposits placed directly with the bank and not through a broker, the FDIC will mail these customers checks for their insured funds on Monday. ...

First Bank of Beverly Hills, as of December 31, 2008, had total assets of $1.5 billion and total deposits of $1 billion. It is estimated that the bank has $179,000 of uninsured deposits.

....

First Bank of Beverly Hills is the 28th FDIC-insured institution to fail this year and the fourth in California. The last bank to be closed in the state was County Bank, Merced, on February 6, 2009. The FDIC estimates the cost of the failure to its Deposit Insurance Fund to be approximately $394 million.

Bank Failure 27: Michigan Heritage Bank, Farmington Hills

by Calculated Risk on 4/24/2009 06:38:00 PM

A legacy for our kids.

Debt slaves forever.

by Soylent Green is People

From the FDIC: Level One Bank, Farmington Hills, Michigan, Assumes All of the Deposits of Michigan Heritage Bank, Farmington Hills

Michigan Heritage Bank, Farmington Hills, Michigan, was closed today by the Michigan Office of Financial and Insurance Regulation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Level One Bank, Farmington Hills, Michigan, to assume all of the deposits, excluding those from brokers, of Michigan Heritage.Two down today.

...

As of December 31, 2008, Michigan Heritage had total assets of approximately $184.6 million and total deposits of $151.7 million. Level One paid a premium of 1.16 percent to acquire the deposits of Michigan Heritage.

...

The FDIC estimates that the cost to the Deposit Insurance Fund will be $71.3 million. Level One's acquisition of all the deposits of Michigan Heritage was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives. Michigan Heritage is the 27th bank to fail in the nation this year and the first in the state. The last bank to fail in Michigan was Main Street Bank, Northville, on October 10, 2008.

Geithner Press Conference

by Calculated Risk on 4/24/2009 04:50:00 PM

Update: Summary of posts today:

Here is the CNBC feed.

And a live feed from C-SPAN.

Bank Failure 26: American Southern Bank, Kennesaw, Georgia

by Calculated Risk on 4/24/2009 04:47:00 PM

A strange word to bankers

Result: ...takeover.

by Soylent Green is People

From the FDIC: Bank of North Georgia, Alpharetta, Georgia, Assumes All of The Deposits of American Southern Bank, Kennesaw, Georgia

American Southern Bank, Kennesaw, Georgia, was closed today by the Georgia Department of Banking and Finance, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect the depositors, the FDIC entered into a purchase and assumption agreement with Bank of North Georgia, Alpharetta, Georgia, to assume all of the deposits, excluding those from brokers, of American Southern Bank.It is Friday!

...

As of March 30, 2009, American Southern Bank had total assets of approximately $112.3 million and total deposits of $104.3 million. Bank of North Georgia paid a premium of 0.003 percent to acquire the deposits of American Southern Bank.

...

In addition to acquiring $55.6 million of the failed bank's deposits, Bank of North Georgia agreed to purchase approximately $31.3 million in assets. The FDIC will retain any remaining assets for later disposition.

The FDIC estimates that the cost to the Deposit Insurance Fund will be $41.9 million. Bank of North Georgia's acquisition of all the deposits of American Southern Bank was the "least costly" resolution for the FDIC's Deposit Insurance Fund compared to alternatives. American Southern Bank is the 26th bank to fail in the nation this year and the fifth in the state. The last bank to fail in Georgia was Omni National Bank, Atlanta, on March 29.

Markets and Chrysler Pier Loans

by Calculated Risk on 4/24/2009 04:00:00 PM

Update: C-SPAN is showing the Geithner press conference at 4:45 PM ET:

Here is the CNBC feed.

And a live feed from C-SPAN.

Here is something to discuss while we wait for Treasury Secretary Geithner's press conference and the FDIC ... (although a significant credit union was already seized today). Click on graph for larger image in new window.

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

These are the four worst S&P 500 / DOW bear market in the U.S.

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

For a comparison to the Nikkei, and NASDAQ crashes, see Doug's: "The Mega-Bear Quartet and L-Shaped Recoveries". And here is another update on the Chrysler first lien negotiations. Note: I have no idea why this is so public.

And here is another update on the Chrysler first lien negotiations. Note: I have no idea why this is so public.

The diagram shows the offers and counteroffers from the banks.

From the WSJ: Chrysler's Lenders to Make New Offer on Debt

The lending group has proposed cutting the $6.9 billion Chrysler owes them down to $3.75 billion, according to a person familiar with the offer.Just 6 days to go ...

...

The lenders decided not to lower the 40% equity stake in Chrysler they are seeking ... The creditors also dropped their request for $1 billion of preferred stock in Chrysler and that Fiat SpA put $1 billion of cash into Chrysler

NCUA Seizes Eastern Financial Florida Credit Union

by Calculated Risk on 4/24/2009 03:17:00 PM

Press Release: Eastern Financial Florida Credit Union Placed In Conservatorship (ht Will)

The National Credit Union Administration (NCUA) today assumed control of the operations of Eastern Financial Florida Credit Union, a state-chartered, federally insured credit union headquartered in Miramar, Florida.An early start to BFF (bank failure friday).

...

Eastern Financial Florida Credit Union was originally chartered in 1937 and today serves Broward, Miami-Dade, Palm Beach, Hillsborough, Pinellas counties and the Jacksonville area. The credit union has approximately $1.6 billion in assets and just over 200,000 members.

The National Credit Union Administration (NCUA) is the independent federal agency that charters and supervises federal credit unions. NCUA, with the backing of the full faith and credit of the U.S. government...

Federal Reserve Releases Stress Test White Paper

by Calculated Risk on 4/24/2009 02:00:00 PM

From the Fed: The Supervisory Capital Assessment Program: Design Summary (287 KB PDF)

Press Release:

A white paper describing the process and methodologies employed by the federal banking supervisory agencies in their forward-looking capital assessment of large U.S. bank holding companies was published on Friday.I'm reading it now.

The white paper is intended to assist analysts and other interested members of the public in understanding the results of the Supervisory Capital Assessment Program, expected to be released in early May. All U.S. bank holding companies with year-end 2008 assets exceeding $100 billion were required to participate in the assessment, which began February 25. These institutions collectively hold two-thirds of the assets and more than half the loans in the U.S. banking system.

More than 150 examiners, supervisors and economists from the Federal Reserve, Office of the Comptroller of the Currency, and Federal Deposit Insurance Corporation participated in this supervisory process. Starting from two economic scenarios--a consensus estimate of private-sector forecasters and an economic situation more severe than is generally anticipated--they developed a range of loss estimates and conducted an in-depth review of the banks’ lending portfolios, investment portfolios and trading-related exposures, and revenue opportunities. In doing so, they examined bank data and loss projections, compared loss projections across firms, and developed independent benchmarks against which to evaluate the banks’ estimates. From this analysis, supervisors determined the capital buffer needed to ensure that the firms would remain appropriately capitalized at the end of 2010 if the economy proves weaker than expected.

Geithner News Conference at 4:30 PM ET

by Calculated Risk on 4/24/2009 12:24:00 PM

UPDATE: CNBC is reporting that Treasury Stress Test white paper will be released at 2 PM ET.

The Treasury white paper on the stress tests will probably be released prior to Geithner's news conference.

From Eric Dash at the NY Times: Edgy Banks Start to Get Word Today on Stress Tests

After a two-month wait, the nation’s 19 largest banks will start learning on Friday how they fared in important federal examinations — and which among them will need another bailout from the government or private investors.Dash discusses several individual banks in the article. But what does "fate will be decided by regulators" mean? I thought preprivatization was off the table.

...

The Federal Reserve intends to disclose, in general terms, how it conducted the stress tests on Friday afternoon, but the government will not publicly reveal the results until May 4.

...

Analysts are already betting that the stress tests will show that banks need to raise significant amounts of new capital ... the 19 banks subject to stress tests are starting to divide into three groups: the strong that can weather the storm; the weak that will need new, perhaps significant, support; and the ones on the verge, whose fate will be decided by regulators.

Also from Bloomberg: Emanuel Says Stress Tests Will Reveal ‘Gradation’

... Rahm Emanuel said stress tests on the biggest 19 U.S. banks will reveal a “gradation,” with some being “very, very healthy” and others needing assistance.

...

Emanuel said that President Barack Obama has “100 percent” confidence in Federal Reserve Chairman Ben S. Bernanke.

Home Sales: The Distressing Gap

by Calculated Risk on 4/24/2009 11:07:00 AM

Real Time Economics at the WSJ excerpted some analyst comments about the existing home sales report yesterday: Economists React: ‘Plunge Is Over’ in Existing-Home Sales. A few comments from analysts:

"Home sales have stabilized following the post-Lehmans plunge..."As I've noted before, I believe this "stabilization" discussion in existing home sales analysis is all wrong.

"This is a bit disappointing but the big picture is still clear; the plunge in sales following the Lehman blowup is over."

"The weaker-than-expected result does not change the broad trend in sales, however, which continues to point to a tenuous stabilization..."

"Although home resales were down in March, one can make a reasonable argument that resales are bottoming ..."

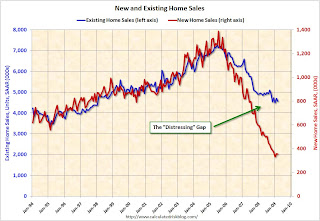

Close to half of existing home sales are distressed sales: REO sales (foreclosure resales) or short sales. This has created a gap between new and existing sales as shown in the following graph that I've jokingly labeled the "Distressing" gap.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows existing home sales (left axis) and new home sales (right axis) through March.

I believe this gap was caused by distressed sales - in many areas home builders cannot compete with REO sales, and this has pushed down new home sales while keeping existing home sales activity elevated.

Over time, as we slowly work through the distressed inventory of existing homes, I expect existing home sales to fall further. See Existing Home Sales: Turnover Rate

So I believe those analysts looking at the existing home sales report for stability are looking in the wrong place. The first "signs of stability" in the housing market will be declining inventory (see 3rd graph here), a bottom in new home sales (see previous post), and the gap between new and existing home sales closing.