by Calculated Risk on 2/02/2009 02:38:00 PM

Monday, February 02, 2009

Q4: Office, Mall and Lodging Investment

Let's start with a stunning graph ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows investment in lodging (based on data from the BEA) as a percent of GDP. The recent boom in lodging investment has been stunning. Lodging investment is now at 0.34% of GDP - an all time high - but all evidence suggests this investment is about to decline sharply.

Note: prior to 1997, the BEA included Lodging in a category with a few other buildings. This earlier data was normalized using 1997 data, and is an approximation. Investment in multimerchandise shopping structures (malls) increased slightly in Q4 2008, after peaking in Q4 2007.

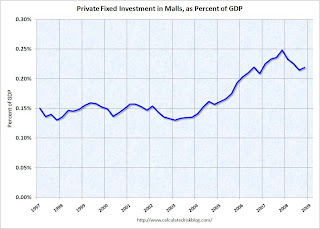

Investment in multimerchandise shopping structures (malls) increased slightly in Q4 2008, after peaking in Q4 2007.

This is probably due to builders finishing projects or perhaps the numbers will be revised downwards. But it does appear new mall construction is about to stop.

As David Simon, Chief Executive Officer or Simon Property Group, the largest U.S. shopping mall owner said last week:

"The new development business is dead for a decade. Maybe it’s eight years. Maybe it’s not completely dead. Maybe I’m over-dramatizing it for effect."

The third graph shows office investment as a percent of GDP since 1972. Office investment increased slightly in Q4 2008. With the office vacancy rate rising sharply, office investment will probably decline all this year.

The third graph shows office investment as a percent of GDP since 1972. Office investment increased slightly in Q4 2008. With the office vacancy rate rising sharply, office investment will probably decline all this year.Note: In 1997, the Bureau of Economic Analysis changed the office category. In the earlier years, offices included medical offices. After '97, medical offices were not included (The BEA presented the data both ways in '97).

I expect investment in all three categories - malls, lodging and offices - to decline sharply in 2009.

Macy's Cut 7,000 Jobs, Reduces Capital Spending Plans Again

by Calculated Risk on 2/02/2009 01:30:00 PM

From MarketWatch: Macy's cutting 4% of workforce, quarterly dividend

Macy's ... said Monday ... it will slash 7,000 jobs [and] reduced its 2009 capital expenditures budget to about $450 million ...It was just last November that Macy's cut their 2009 capital spending plans from $1 billion to $550 to $600 million. From an 8-K SEC filing in November 2008:

"In recognition of the weak economy, we reduced our budget for 2009 capital expenditures from approximately $1 billion to a range of $550 million to $600 million, compared with approximately $950 million in 2008."

Terry J. Lundgren, Macy's, Nov 12, 2008

UK: CRE Values Off 26% in 2008

by Calculated Risk on 2/02/2009 12:17:00 PM

From the BBC: Commercial property values plunge (hat tip Adam)

UK commercial property values fell by a record amount in 2008, according to Investment Property Databank (IPD).The good news for CRE is prices aren't sticky like for residential real estate. The bad news is this leaves many recent purchases far underwater, and probably means the owners will walk away once any interest reserve runs dry. Just more losses for the banks ...

Its UK Quarterly Property Index showed commercial properties lost 26.4% of their value last year - the most since records began in 1987.

The values of office buildings, shops and warehouses are now broadly in line with December 2001 levels.

Residential Investment Components

by Calculated Risk on 2/02/2009 11:09:00 AM

This is a first ... investment in home improvements exceeded investment in new single family structures for the first time ever in Q4 2008 (it was close in Q3).

Residential investment, according to the Bureau of Economic Analysis (BEA), includes new single family structures, multifamily structures, home improvement, broker's commissions, and a few minor categories. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the various components of RI as a percent of GDP for the last 50 years. The most important components are investment in single family structures followed by home improvement.

Investment in home improvement was at a $170.8 billion Seasonally Adjusted Annual Rate (SAAR) in Q4, above investment in single family structures of $150.2 billion (SAAR) for the first time ever.

Let's take a closer look at these two key components of RI: As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales.

As everyone knows, investment in single family structures has fallen off a cliff. This is the component of RI that gets all the media attention - although usually from stories about single family starts and new home sales.

Currently investment in single family structures is at 1.05% of GDP, significantly below the average of the last 50 years of 2.35% - and also below the previous record low in 1982 of 1.20%.

But what about home improvement? The third graph shows home improvement investment as a percent of GDP.

The third graph shows home improvement investment as a percent of GDP.

Home improvement is at 1.20% of GDP, off the high of 1.30% in Q4 2005 - but still well above the average of the last 50 years of 1.07%.

This would seem to suggest there remains significant downside risk to home improvement spending over the next couple of years.

Construction Spending: Private Nonresidential has Peaked

by Calculated Risk on 2/02/2009 10:00:00 AM

From the Census Bureau: December 2008 Construction at $1,053.7 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $737.1 billion, 1.7 percent (±1.1%) below the revised November estimate of $749.6 billion. Residential construction was at a seasonally adjusted annual rate of $319.2 billion in December, 3.2 percent (±1.3%) below the revised November estimate of $329.9 billion. Nonresidential construction was at a seasonally adjusted annual rate of $417.9 billion in December, 0.4 percent (±1.1%)* below the revised November estimate of $419.7 billion.

The value of private construction in 2008 was $770.4 billion, 9.4 percent (±1.8%)below the $850.0 billion spent in 2007. Residential construction in 2008 was $358.4 billion, 27.2 percent (±2.2%) below the 2007 figure of $492.5 billion and nonresidential construction was $412.0 billion, 15.3 percent (±1.8%) above the $357.5 billion in 2007..

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows private residential and nonresidential construction spending since 1993. Note: nominal dollars, not inflation adjusted.

Residential construction spending is still declining, and now nonresidential spending has peaked and will probably decline sharply over the next 18 months.

The second graph shows the year-over-year change for private residential and nonresidential construction spending.

The YoY change in nonresidential spending is slowing down and will probably turn negative in the first half of 2009. Residential construction spending is still declining, but the rate of decline has slowed.

This shows hints of two key stories for 2009: 1) a collapse in private nonresidential construction spending, and 2) and the possibility of a bottom in private residential construction spending (It might not happen in '09, but we can finally start looking).

Less Spending, More Savings in December

by Calculated Risk on 2/02/2009 08:51:00 AM

From the WSJ: Consumers Spend Less, Boost Savings

U.S. consumers cut their spending during December and they increased savings ... Personal consumption fell 1.0% compared to the month before. ...The higher savings rate is a step towards repairing household balance sheets.

Personal income fell at a seasonally adjusted rate of 0.2% compared to the month before, the Commerce Department said Monday....

Personal saving as a percentage of disposable personal income was 3.6% in December, the highest since 4.8% in May 2008. It was 2.8% in November.

Sunday, February 01, 2009

NY Times Example of a Toxic Asset

by Calculated Risk on 2/01/2009 10:32:00 PM

“To date, the banks have stuck their heads in the sand and demanded that they be paid the price of good apples for bad apples.”Vikas Bajaj and Stephen Labaton provide us with an example of the different values for a toxic assets in the NY Times: Risks Are Vast in Revaluing Tainted Assets

Lynn E. Turner, a former SEC chief accountant

The wild variations on the value of many bad bank assets can be seen by looking at one mortgage-backed bond recently analyzed by a division of Standard & Poor’s, the credit rating agency.To be worth even 38 cents on the dollar, this must be a senior tranche. The lower tranches have absorbed most of the losses so far, and that is why S&P is currently valuing the bond at 87 cents on the dollar, but any higher default assumptions, and the value of this bond will plummet. I'm amazed, given that these are no money down 2nds that the loss severity is only 40 percent.

The financial institution that owns the bond calculates the value at 97 cents on the dollar, or a mere 3 percent loss. But S.& P. estimates it is worth 87 cents, based on the current loan-default rate, and could be worth 53 cents under a bleaker situation that contemplates a doubling of defaults. But even that might be optimistic, because the bond traded recently for just 38 cents on the dollar, reflecting the even gloomier outlook of investors.

...

The bond is backed by 9,000 second mortgages used by borrowers who put down little or no money to buy homes. Nearly a quarter of the loans are delinquent, and losses on defaulted mortgages are averaging 40 percent. The security once had a top rating, triple-A.

But this illustrates the problem. If the bank marks the bond to market (38 cents), they will have to take huge losses. But if the government even pays the current S&P estimated value, the bank will have to write the bond down further, and the taxpayers will probably take huge losses too. Unless a bank has been very aggressive with their write downs, buying the toxic assets doesn't help - or is a gift from taxpayers to shareholders.

The article is excellent and covers several other related topics.

Falling Retail Rents in New York

by Calculated Risk on 2/01/2009 05:19:00 PM

From the NY Times: Recession Has Landlords of Retail Tenants Extending Discounts of Their Own

“There are an awful lot of empty stores, but what is more damaging for the landlords is that most of the other stores are empty — not empty physically, but people aren’t shopping,” [Mayor] Bloomberg said.The problems are just beginning for New York.

...

[M]any landlords find themselves in a bind because they paid stiff prices for property in recent years and need to cover hefty mortgage payments. On average, Manhattan landlords paid $3,348 per square foot for retail properties in 2008, compared with $538 per square foot in 2004, according to the brokerage Cushman & Wakefield.

...

While New York City’s retail vacancy rate has remained relatively low at 4.7 percent, it grew faster than in any other major city between the third quarter of 2007 and the third quarter of 2008, according to Marcus & Millichap Research Services.

And rents have started to drop even on busier shopping districts like Madison Avenue, where a Grubb & Ellis report issued last month predicted that rents could fall by as much as 30 percent this year.

Unemployment Forecast

by Calculated Risk on 2/01/2009 03:01:00 PM

Here is a preview of the January employment report (due Friday) from Rex Nutting at MarketWatch: Fifth straight month of heavy layoffs should push jobless rate to 7.5%

The axe fell on an expected half million jobs last month, economists say, and the only reason the job losses weren't larger is that weak hiring for temporary jobs in November and December meant fewer people were laid off in January.Over a year ago, I put together a forecast showing the effects of the recession would linger for some time, but that the headline unemployment rate (U-3) wouldn't exceed 8%. Still many more workers would be underemployed (as counted in U-6).

...

The unemployment rate is expected to rise to 7.5% in January from 7.2% in December. It would be the highest unemployment rate since 1992. Economists expect the jobless rate to hit nearly 9% by early next year.

The logic was related to the structure of the economy; historically layoffs in manufacturing drive the unemployment rate, and since a much smaller percentage of U.S. workers are now employed in manufacturing - and manufacturing never really recovered from the 2001 recession - I felt manufacturing layoffs like in the '50s or '70s would have less of an impact on overall employment. Also many more employees are moved to part time work these days (as opposed to lost jobs), and these employees aren't included in the headline unemployment rate (but are included in U-6).

For most of 2008 I tracked job losses in construction and retail, however the employment picture changed rapidly in September.

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the cumulative changes in employment starting in August 2007 (red line is total nonfarm employment). Total employment peaked in December 2007, but the graph starts earlier to show the three key areas - construction, retail and manufacturing - that all saw earlier job losses.

For some time the total job losses were far less than the combined losses in construction, retail and manufacturing, suggesting other areas of the economy were doing OK.

However starting in September 2008, job losses in other areas of the economy started increasing rapidly.

The employment diffusion index from the BLS tells the same story.

A diffusion index is a measure of the dispersion of change. This gives a feel for how widespread job gains and losses are across industries. The closer to 50, the more narrow the changes in employment.

A diffusion index is a measure of the dispersion of change. This gives a feel for how widespread job gains and losses are across industries. The closer to 50, the more narrow the changes in employment.Until September, the employment diffusion index was above 40, suggesting the job losses were limited to a few industries. However since then, especially in November and December, the diffusion index plummeted, suggesting job losses are now widespread.

With widespread job losses, the unemployment rate could move much higher. I've seen a number of forecasts for double digit unemployment in 2010 (even 12% or more). The U.S. economy hasn't seen double digit unemployment since the early '80s.

This graph shows the unemployment rate and the year over year change in employment vs. recessions.

This graph shows the unemployment rate and the year over year change in employment vs. recessions.The unemployment rate rose to 7.2 percent in December; the highest level since January 1993.

And year over year employment is now strongly negative (there were 2.6 million fewer Americans employed in Dec 2008 than in Dec 2007).

And not only has the unemployment rate risen sharply, but the number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is now over 8 million for the first time ever (although the U.S. population has increased significantly since the early '80s).

And not only has the unemployment rate risen sharply, but the number of workers only able to find part time jobs (or have had their hours cut for economic reasons) is now over 8 million for the first time ever (although the U.S. population has increased significantly since the early '80s).So, even with less of an impact on unemployment from manufacturing job losses (as compared to the '50s or '70s) and more workers finding part time work, the unemployment rate will probably still move higher than 8% - and could well move much higher.

It is difficult to gage the impact of the Obama stimulus package on employment. As an example, with commercial real estate construction coming to a screeching halt, many more construction workers will lose their jobs in 2009. However this might be somewhat offset by more public construction projects.

I think double digit unemployment is now very possible, although I'll take the under 10% (at least for now).

Best to all. Football fans: Enjoy the game!

San Diego House "Deal of the Week"

by Calculated Risk on 2/01/2009 11:02:00 AM

The North County Times has a feature called "Deal of the Week".

House sells at 69 percent discount

This week the featured home is in Escondido (inland north county San Diego). The house is a 1000 Sq Ft, 2 BR, 1 BA, older home built in 1955. The house sold for $146 thousand in 1999.

During the bubble, the house for $420 thousand in 2006 (with 100% financing from subprime lender Argent Mortgage).

After foreclosure last year, the house sold to cash flow investors in November 2008 for $130 thousand (less than the 1999 price) and is currently being offered for rent.

This really shows the round trip in prices for low end properties in California.