by Calculated Risk on 1/26/2009 02:48:00 PM

Monday, January 26, 2009

New Mortgage Data Requirements from FHFA

This was from about 10 days ago, but I missed it. Starting Jan 1, 2010, all loans purchased by Freddie and Fannie are required to have loan-level identifiers so that performance can be tracked by orginators and appraisers.

FHFA Announces New Mortgage Data Requirements

Washington, DC – James B. Lockhart, Director of the Federal Housing Finance Agency, announced today that, effective with mortgage applications taken on or after Jan. 1, 2010, Freddie Mac and Fannie Mae are required to obtain loan-level identifiers for the loan originator, loan origination company, field appraiser and supervisory appraiser. ...

FHFA’s requirement is consistent with Title V of the Housing and Economic Recovery Act of 2008, the S.A.F.E. Mortgage Licensing Act, enacted July 30. With that Act, Congress required the creation of a Nationwide Mortgage Licensing System and Registry. In prior years, both Enterprises worked with the Mortgage Bankers Association of America (MBAA) and the National Association of Mortgage Brokers (NAMB) on a similar initiative. However, that effort was thwarted due to the absence of a national registration and identification system. With enactment of the S.A.F.E. Mortgage Licensing Act, identifiers will now be available for each individual loan originator.

“This represents a major industry change. Requiring identifiers allows the Enterprises to identify loan originators and appraisers at the loan-level, and to monitor performance and trends of their loans,” said Lockhart. “If originators or appraisers have contributed to the incidences of mortgage fraud, these identifiers allow the Enterprises to get to the root of the problem and address the issues.”

The purpose of FHFA’s requirement is to prevent fraud and predatory lending, to ensure mortgages owned and guaranteed by the Enterprises are originated by individuals who have complied with applicable licensing and education requirements under the S.A.F.E. Mortgage Licensing Act, and to restore confidence and transparency in the credit markets. In addition, the Enterprises will use the data collected to identify, measure, monitor and control risks associated with originators’ and appraisers’ performance, negligence and fraud.

...

To implement the requirement, FHFA has been working with the Conference of State Bank Supervisors (CSBS) and the FFIEC Appraisal Subcommittee. Within the next 30 days, both Fannie Mae and Freddie Mac will be issuing guidance related to implementation of the requirement.

TARP: Free Ice Cream!

by Calculated Risk on 1/26/2009 12:53:00 PM

Click on photo for larger image in new window.

Click on photo for larger image in new window.

Photo Credit: Otishertz

Otishertz spotted this Ice Cream truck in Portland yesterday. Thanks for sharing!

Umpqua Bank received $214 million from TARP in mid-November.

They cut their dividend recently according to the Portland Business Journal:

Umpqua Bank parent Umpqua Holdings Inc., based in Portland, cut its quarterly dividend in December to 5 cents from prior payments of 19 cents per share.At least we know what they are using the TARP money for: Free ice cream!

Existing Home Sales (NSA)

by Calculated Risk on 1/26/2009 11:26:00 AM

Here is another way to look at existing homes sales - monthly, Not Seasonally Adjusted (NSA): This graph shows NSA monthly existing home sales for 2005 through 2008. Sales (NSA) were slightly higher in December 2008 than in December 2007.

This graph shows NSA monthly existing home sales for 2005 through 2008. Sales (NSA) were slightly higher in December 2008 than in December 2007.

For three of the last four months, sales in 2008 were close to, or slightly higher, than the level of 2007.

However a much larger percentage of the sales in 2008, compared to 2007, were foreclosure resales, and although these are real sales, I think existing home sales will fall further when foreclosure resales start to decline. The second graph shows inventory by month starting in 2002.

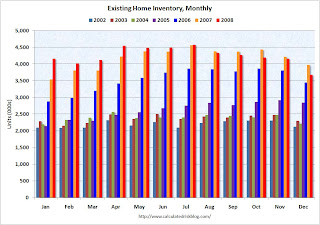

The second graph shows inventory by month starting in 2002.

Inventory levels were flat for years (during the bubble), but started increasing at the end of 2005.

Inventory levels increased sharply in 2006 and 2007, but have been close to 2007 levels for most of 2008. In fact inventory for the last five months was below the levels of last year. This might indicate that inventory levels are close to the peak for this cycle. Note: there is probably a substantial shadow inventory – homeowners wanting to sell, but waiting for a better market - so existing home inventory levels will probably stay elevated for some time. There is also the possibility of some ghost inventory (REOs being held off the market).

It is important to watch inventory levels very carefully. If you look at the 2005 inventory data, instead of staying flat for most of the year (like the previous bubble years), inventory continued to increase all year. That was one of the key signs that led me to call the top in the housing market!

If the trend of declining year-over-year inventory levels continues in 2009 that will be a positive for the housing market. Prices will probably continue to fall until the months of supply reaches more normal levels (in the 6 to 8 month range), and that might take some time - especially if sales continue to fall in 2009 as I expect.

Existing Home Sales Increase in December

by Calculated Risk on 1/26/2009 10:00:00 AM

From the NAR: Existing-Home Sales Show Strong Gain In December

ExistingExisting-home sales rose unexpectedly while inventory declined, led by a surge of sales in the West, according to the National Association of Realtors®.

Existing-home sales – including single-family, townhomes, condominiums and co-ops – jumped 6.5 percent to a seasonally adjusted annual rate1 of 4.74 million units in December from a downwardly revised pace of 4.45 million units in November, but are 3.5 percent below the 4.91 million-unit pace in December 2007.

For all of 2008 there were 4,912,000 existing-home sales, which was 13.1 percent below the 5,652,000 transactions recorded in 2007. This is the lowest volume since 1997 when there were 4,371,000 sales.

...

Total housing inventory at the end of December fell 11.7 percent to 3.68 million existing homes available for sale, which represents a 9.3-month supply2 at the current sales pace, down from a 11.2-month supply in November.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in December 2008 (4.74 million SAAR) were 6.5% higher than last month, and were 3.5% lower than December 2007 (4.91 million SAAR).

Not exactly a "strong gain" looking at a long term graph!

It's important to note that a large percentage of these sales were foreclosure resales (banks selling foreclosed properties). NAR economist Yun suggested said a couple of months ago that "distressed sales are currently 35 to 40 percent of transactions". Distressed sales include foreclosure resales and short sales. Although these are real transactions, this means activity (ex-foreclosures) is running around 3 million units SAAR.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 3.67 million in December, from an all time record of 4.57 million homes for sale in July 2008. Usually inventory peaks in mid-Summer, and then declines slowly through November - and then declines sharply in December as families take their homes of the market for the holidays. This decrease was especially large, but this is the usual pattern.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 3.67 million in December, from an all time record of 4.57 million homes for sale in July 2008. Usually inventory peaks in mid-Summer, and then declines slowly through November - and then declines sharply in December as families take their homes of the market for the holidays. This decrease was especially large, but this is the usual pattern. Most REOs (bank owned properties) are included in the inventory because they are listed - but not all. Some houses in the foreclosure process are listed as short sales - so those would be counted too.

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.UPDATE: Important note: The NAR uses Seasonally Adjusted sales, and Not Seasonally adjusted inventory to calculate the Months of Supply. Since inventory always declines in December, the Months of Supply always declines too.

Months of supply decreased to 9.3 months.

I still expect sales to fall further in 2009. It will be interesting in 2009 to see if existing home inventory has peaked for this cycle. I'll have more on existing home sales ...

Job Cuts: Caterpillar 20,000, Sprint 8,000, Home Depot 7,000

by Calculated Risk on 1/26/2009 08:21:00 AM

Update: Home Depot to cut 7,000 jobs. Press Release: The Home Depot Exits EXPO Business

The Home Depot®, the world's largest home improvement retailer, today announced it will exit its EXPO business. The Company is also taking steps to streamline its support functions. These decisions will impact 7,000 associates, or approximately two percent of the Company's total workforce.From MarketWatch Caterpillar profit falls 32% in fourth quarter

Caterpillar Inc. on Monday posted a 32% drop in fourth-quarter profit ...From MarketWatch: Sprint to eliminate 8,000 jobs

More dismal was the bellwether company's 2009 outlook, which predicted a 25% decline in sales due to tighter credit markets and the recession. In response, Caterpillar said it would cut costs, including the elimination of some 20,000 jobs -- nearly 18% of its workforce.

"We expect 2009 will be the weakest year for economic growth in the postwar period," the company said in a statement.

Sprint Nextel Corp. said Monday it will eliminate 8,000 jobs in the first three months of 2009 as part of an effort to reduce costs in the face of a deepening U.S. recession.

Nationalization

by Calculated Risk on 1/26/2009 01:30:00 AM

From the NY Times: Nationalization Gets a New, Serious Look

[M]ost members of the Obama economic team concede that the rapid deterioration of the country’s biggest banks, notably Bank of America and Citigroup, is bound to require far larger investments of taxpayer money, atop the more than $300 billion of taxpayer money already poured into those two financial institutions and hundreds of others.Does this mean "Nationalization"?

But if hundreds of billions of dollars of new investment is needed ... what do taxpayers get in return?

So far, President Obama’s top aides have steered clear of the word entirely, and they are still actively discussing other alternatives, including creating a “bad bank” that would nationalize the worst nonperforming loans by taking them off the hands of financial institutions without actually taking ownership of the banks. Others talk of de facto nationalization, in which the government owns a sizeable chunk of the banks but not a majority...I say to-may-to, you say to-mah-to.

That has already happened ...

Sunday, January 25, 2009

Slow Day, Busy Week

by Calculated Risk on 1/25/2009 08:02:00 PM

For a few months it seemed Sunday had become the new Monday for news. I'm happy for a slow news day!

But this week will be busy: existing home sales on Monday, Case-Shiller house price index on Tuesday, the FOMC meeting on Wednesday, New Home sales on Thursday, and Q4 GDP (the big news) on Friday ... and much more.

The consensus is for a real GDP decline of 5.5% annualized in Q4. Should be interesting ...

Best to all.

Summers: "Next few months are going to be very, very difficult"

by Calculated Risk on 1/25/2009 03:35:00 PM

From Bloomberg: Summers Says Economy Entering a ‘Difficult’ Time

“The next few months are, no question, going to be very, very difficult and it may be longer than that,” said Summers, appearing on NBC’s “Meet the Press.”"Very different" doesn't tell us much.

...

Summers said Obama plans to overhaul the $700 billion Troubled Asset Relief Program enacted in October. Obama’s bank rescue plan, using the remaining $350 billion in TARP, will be “very different” than it was under George W. Bush’s administration, Summers said.

...

“Secretary-designate Geithner ... will be laying out the plans and principles behind our approach,” said Summers ...

CRE: When the Reserve Runs Dry

by Calculated Risk on 1/25/2009 10:30:00 AM

Bloomberg has an update on Manhattan’s largest apartment complex: Tishman’s Stuyvesant Town Fund May Run Dry This Year (hat tip Brian)

Tishman Speyer Properties LP and BlackRock Realty ... are relying on a reserve fund to pay debt on the property and have only six months of money left before it runs out, Fitch Ratings said in a report. ... The fund for the Stuyvesant Town and Peter Cooper Village apartments has declined to $127.7 million as of Jan. 15, from $400 million when it was established.This property was purchased in 2006 and has obviously not met income projections. When the reserve fund runs dry, the owner will need to put in more cash or possibly default on the loan.

This is a common problem for office, retail and apartment properties that were purchased in 2005 or 2006, at prices that were based on overly optimistic pro forma income projections. A reserve fund was used to pay interest until the rents increased, a scenario that is now unlikely with a recession and declining rents. Many of these deals will blow up when the interest reserve is depleted - probably this year or in 2010.

Saturday, January 24, 2009

Obama to Make Changes to Financial Regulatory System

by Calculated Risk on 1/24/2009 10:07:00 PM

From the NY Times: Obama Plans Fast Action to Tighten Financial Rules

Officials say they will make wide-ranging changes, including stricter federal rules for hedge funds, credit rating agencies and mortgage brokers, and greater oversight of the complex financial instruments that contributed to the economic crisis.It sounds like the Obama administration will propose the stimulus plan, the new bank bailout, and significant regulatory changes for financial system all in short order.

...

Officials said they want rules to eliminate conflicts of interest at credit rating agencies ...

Aides said they would propose new federal standards for mortgage brokers ... They are considering proposals to have the S.E.C. become more involved in supervising the underwriting standards of securities that are backed by mortgages.

...

The administration is also preparing to require that derivatives like credit default swaps ... be traded through a central clearinghouse and possibly on one or more exchanges.