by Calculated Risk on 12/22/2008 04:24:00 PM

Monday, December 22, 2008

White House: No one could have known

Never mind that many people saw this coming - obviously the White House wasn't listening.

From the White House: Statement by the Press Secretary on Irresponsible Reporting by New York Times

Most people can accept that a news story recounting recent events will be reliant on '20-20 hindsight'. Today's front-page New York Times story relies on hindsight with blinders on and one eye closed.The "most significant factor" was "cheap money flowing into the U.S."? Uh, no.

The Times' 'reporting' in this story amounted to finding selected quotes to support a story the reporters fully intended to write from the onset, while disregarding anything that didn't fit their point of view. To prove the point, when they filed their story, NYT reporters were completely unfamiliar with the President's prime time address to the nation where he laid out in detail all of the causes of the housing and financial crises. For example, the President highlighted a factor that economists agree on: that the most significant factor leading to the housing crisis was cheap money flowing into the U.S. from the rest of the world, so that there was no natural restraint on flush lenders to push loans on Americans in risky ways. This flow of funds into the U.S. was unprecedented. And because it was unprecedented, the conditions it created presented unprecedented questions for policymakers.

In his address the President also explained in detail the failure of financial institutions to perform normal and necessary due diligence in creating, buying and selling new financial products -- a problem that almost no one saw as it was happening.

The most significant causes of the credit crisis were innovation in mortgage securitization coupled with almost no regulatory oversight (because of ideologues who opposed oversight and regulation). This led to lax lending standards (liar loans, DAPs, widespread use of Option ARMs as affordability products, etc.) and excessive speculation.

Oh well ... I agree the White House missed the story, but the idea that "no one saw" the problem coming is nonsense.

Credit Crisis Indicators

by Calculated Risk on 12/22/2008 02:29:00 PM

The sharp decline in treasury yields had continued across the board. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The 10-year yield is at 2.11% today, slightly above the record low of 2.07% set last Thursday.

This graph shows the 10 year yield since 1962. The smaller graph shows the ten year yield for this year - talk about cliff diving!

The yield on 3 month treasuries is 0.00% (bad). Right at ZERO when I checked!

Here are a few other indicators of credit stress:

| The TED spread was stuck above 2.0 for some time. The peak was 4.63 on Oct 10th. I'd like to see the spread move back down to 1.0 or lower. A normal spread is around 0.5. |

This is the spread between high and low quality 30 day nonfinancial commercial paper. Right now quality 30 day nonfinancial paper is yielding close to zero. If the credit crisis eases, I'd expect a significant decline in this spread - and the graph makes it clear this indicator is still in crisis.

|

It appears the Fed is finally getting some rates down - but clearly the 3-month treasury yield at zero is not a sign of a healthy economy.

REIS: Commercial Real Estate Loan Defaults May Triple

by Calculated Risk on 12/22/2008 11:43:00 AM

From Bloomberg: Commercial Loan Defaults May Triple as Rental Income Declines

U.S. commercial properties at risk of default could triple if rental income from office, retail and apartment buildings drops by even 5 percent, a likely possibility given the recession, according to research by New York-based real estate analysts at Reis Inc.At the end of Q3, REIS reported office vacancy rates hit 13.6% (see WSJ: Office Space Is Emptying Out). Clearly REIS expects a significant increase in the vacancy rate in Q4 2008 (to 14.6%), and then a further increase in 2009 to 15.6%. Although that 2009 projection might be low ...

Lenders that used optimistic rent estimates to grant mortgages beginning in 2005 stand to lose as much as $23.1 billion, or 7.02 percent, of total unpaid balances if landlords lose 5 percent of net operating income, according to Reis. ...

[O]ffice vacancies are forecast to rise to 15.6 percent next year from an estimated 14.6 percent at the end of 2008. ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the office vacancy rate vs. the quarterly unemployment rate and recessions (hat tip Will)

Changes in the unemployment rate and the office vacancy rate are highly correlated. As the unemployment rate continues to rise over the next year or more, I'd expect the office vacancy rate to rise sharply - possible to 17% or more by the end of 2009 (significantly higher than the REIS forecast).

REIS believes the rise in defaults will primarily because of the overly optimistic projections used when properties were purchased in recent years:

“A large decline in net operating income isn’t necessary to shift a lot of properties underlying CMBS loans into debt- service coverage ratios that would be worrisome,” [Victor Calanog, REIS director of research] said in an interview.As I've noted several times, many existing properties were recently purchased at prices that were based on overly optimistic pro forma income projections. These loans typically included reserves to pay interest until rents increased (like a negatively amortizing option ARM), and it is likely that many of these deals will blow up when the interest reserve is depleted - probably in the 2009-2010 period.

...

Over the last three years, lenders raised income projections for commercial properties by as much as 15 percent more than those properties’ historical performance, he said.

“That optimism might not be warranted,” Calanog said. “There’s a big pool of loans underwritten in 2005 and 2006 coming due in 2010 and 2011 that I believe will experience a rise in delinquencies and defaults.”

Loans from those years assumed strong growth in rents, a scenario that seems unlikely as the recession deepens, Calanog said.

WSJ: Commercial Property Investors Seek Bailout

by Calculated Risk on 12/22/2008 10:43:00 AM

From the WSJ: Developers Ask U.S. for Bailout as Massive Debt Looms

With a record amount of commercial real-estate debt coming due, some of the country's biggest property developers have become the latest to go hat-in-hand to the government for assistance.Although the headline says "developers" this is really about property investors who bought commercial buildings at the price peak and are now underwater. But say the owners default and the properties are transferred to the bondholders - what is the risk to the economy? None.

They're warning policymakers that thousands of office complexes, hotels, shopping centers and other commercial buildings are headed into defaults, foreclosures and bankruptcies. The reason: according to research firm Foresight Analytics LCC, $530 billion of commercial mortgages will be coming due for refinancing in the next three years -- with about $160 billion maturing in the next year.

With the automakers there was a concern that a large number of jobs would be lost without a bailout. How many jobs will be lost if the ownership of an office building or mall changes? Very few.

The article suggests there is a concern that some owners will not be able to refinance because of the credit crisis, even though their properties have strong positive cash flow. But that seems like a liquidity issue for the Fed and the banks, and doesn't seem to require a bailout from the Treasury.

I don't see the argument for a bailout.

Sunday, December 21, 2008

NY Times: More Part Time Workers

by Calculated Risk on 12/21/2008 11:20:00 PM

From the NY Times: More Firms Cut Labor Costs Without Layoffs

A growing number of employers, hoping to avoid or limit layoffs, are introducing four-day workweeks, unpaid vacations and voluntary or enforced furloughs, along with wage freezes, pension cuts and flexible work schedules. These employers are still cutting labor costs, but hanging onto the labor.

...

Several employees at Hot Studio said they did not mind the policy, particularly as they have heard of layoffs elsewhere in the economy. “People feel they’d much rather have a job in six months than get a bonus right now,” said Jon Littell, a Web designer.

The magnanimous feeling will probably pass, said Truman Bewley, an economics professor at Yale University who has studied what happens to wages during a recession. If the sacrifices look as though they are going to continue for many months, he said, some workers will grow frustrated, want their full compensation back and may well prefer a layoff that creates a new permanence.

“These are feel-good, temporary measures,” he said.

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the number of employees working part time for economic reasons for the last 50 years. IMPORTANT: The BLS made a change in Jan 1994, and prior to that change more workers fell into this category.

From the BLS:

Reasons for working part time. Persons who work part time do so either for noneconomic reasons (that is, because of personal constraints or preferences) or for economic reasons (that is, because of business-related constraints such as slack work or the lack of full-time opportunities). Because respondents typically are not familiar with this distinction, the question was reworded to provide examples of the two types of reasons. More importantly, the measurement of working part time involuntarily (or for economic reasons) was modified to better reflect the concept. Starting in 1994, workers who usually work part time and are working part time involuntarily must want and be available for full-time work.Although the chart is not population adjusted, this suggests that there is a larger move to part time employment in the current downturn than in previous downturns. I tend to focus on the unemployment rate, but employees working part time (for economic reasons) is an important part of the weak employment picture.

Japan Exports Decline 27%

by Calculated Risk on 12/21/2008 09:01:00 PM

From Bloomberg: Japan Exports Plunge Record 27% as Recession Deepens

Japan’s exports plunged the most on record in November as global demand for cars and electronics collapsed ... Exports fell 26.7 percent from a year earlier ...And this isn't just because of exports to the U.S. or Europe:

Exports to Asia fell 27 percent, the most since 1986, after the first decline in six years in October. Shipments to China, Japan’s largest trading partner, fell 25 percent, the steepest drop in 13 years.This looks like a worldwide recession including China (see: Forecaster: Negative Q4 GDP in China)

U.S. retail gasoline prices decline to $1.66 per gallon

by Calculated Risk on 12/21/2008 07:20:00 PM

From Bloomberg: U.S. Retail Gasoline Falls to $1.66 a Gallon, Lundberg Says

The average price of regular gasoline at U.S. filling stations fell to $1.66 a gallon as the nation’s recession sapped demand.

Gasoline slipped 9 cents, or 5.1 percent, in the two weeks ended Dec. 19, according to oil analyst Trilby Lundberg’s survey of 7,000 filling stations nationwide.

Click on graph for larger image in new window.

Click on graph for larger image in new window. This graph shows the nominal weekly U.S. gasoline prices since 1993 (source: EIA)

Gasoline prices are close to the 2000 through 2003 price range, when the median prices was just over $1.50 per gallon.

UK: Up to 15 national retail chains expected to go BK in January

by Calculated Risk on 12/21/2008 12:19:00 PM

From The Times: High street braced for Christmas sales carnage

UP to 15 national retail chains are predicted to go bust before the middle of January, forcing thousands more shopworkers onto the dole.The pattern will probably be similar in the U.S. with a number of retailers filing for bankruptcy in January (usually the worst month of the year for retail BKs), with more retail layoffs, and even more empty retail stores (see: Retail Space to be Vacated from some retail numbers from reader wc)

The prediction came from insolvency expert Begbies Traynor as well-known retail chains clamour to sell enough goods to meet their quarterly rent payments on Christmas Day. Nick Hood, partner at Begbies Traynor ... refused to name specific store groups, but this weekend it emerged that The Officers Club, a 150-strong national menswear chain, had been put up for distressed sale through KPMG, while the specialist tea retailer, Whittards, and music store Zavvi remained on the critical list.

...

Rupert Eastell, head of retail at BDO Stoy Hayward, said: “From tomorrow until mid-January, it’s going to be the worst three weeks for retailers in 20 years.”

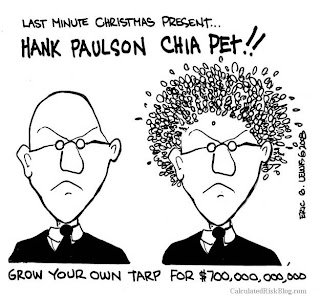

Last Minute Gift Idea

by Calculated Risk on 12/21/2008 05:56:00 AM

| Click on cartoon for larger image in new window. Cartoon from Eric G. Lewis |

This works for mini-me too.

Saturday, December 20, 2008

Real Estate and Tax Advantages

by Calculated Risk on 12/20/2008 11:24:00 PM

How come so many people write about real estate as a tax advantaged investment, and they never mention the tax disadvantage?

Take this article in the NY Times: Tax Break May Have Helped Cause Housing Bubble

Luckily the title contained the word "may" because it is pretty easy to demonstrate that the '97 tax change was a minor factor (at most) in the real estate bubble. But I have a question about this section:

Together with the other housing subsidies that had already been in the tax code — the mortgage-interest deduction chief among them — the law gave people a motive to buy more and more real estate.Yes, there is a mortgage interest deduction, and a capital gains exclusion for a primary residence - but there is also a property tax for real estate. This is a tax disadvantage compared to stocks and bonds.

...

Referring to the special treatment for capital gains on homes, Charles O. Rossotti, the Internal Revenue Service commissioner from 1997 to 2002, said: “Why insist in effect that they put it in housing to get that benefit? Why not let them invest in other things that might be more productive, like stocks and bonds?”

If you own a $500 thousand home, you probably pay $5 to $10 thousand per year in property taxes. If you own $500 thousand in stocks and bonds, how much do you pay per year in property taxes (just for owning them - not selling them)?

I'm not arguing for or against any particular tax treatment here, I just think when comparing the tax treatment of various assets, maybe we should consider all taxes.