by Calculated Risk on 12/17/2008 08:53:00 AM

Wednesday, December 17, 2008

CRE in the News

A few stories on Commercial Real Estate ...

From the NY Times: A List a Landlord Doesn’t Want to Be On (hat tip Michael)

[A] New York research company, Real Capital Analytics, has compiled data showing that at least $107 billion worth of income-producing property — including hotels, offices, apartment complexes and warehouses — is already in distress or is headed in that direction.And over in the UK, from the Finanical Times: Commercial property fears deepen

The distress is occurring all across the country, but New York tops the list ...

With more than £76bn of debt needing to be refinanced before the end of 2010 and increasing numbers of loans slipping into default, the findings of an influential survey of property lending, to be published on Wednesday, will add to warnings that commercial property could be a timebomb for banks that supported the real estate boom.And from the AP (hat tip Thomas): Fitch: Commercial property loan delinquencies down The AP reports this small decline was due to more loan extensions in November.

... the value of loans in breach of financial covenant was about 3.3 per cent of the total loan book by the end of June ... more than treble that reported at the end of 2007.

...

A decline in cash flow caused by failure of tenants and the subsequent vacant units with no prospect of re-letting was the most commonly cited reason for loans to default. Bankers expect defaults to rise rapidly next year as the recession bites into retailers and office occupiers after early casualties such as Woolworths and MFI.

As the economy deteriorates, Fitch expects delinquencies to rise with the riskiest loans backed by hotel and retail properties.Next year will be grim for CRE.

Tuesday, December 16, 2008

Time to Buy!

by Calculated Risk on 12/16/2008 11:55:00 PM

US Bank a Payday lender? And it's always time to buy in Florida! Enjoy.

| Click on Ad for larger image in new window. A fee of $2 for every $20 borrowed? An APR of 120%. Is US Bank a payday lender? (hat tip Bill) |

| Now is the time to buy in Punta Gorda, Florida (hat tip Lisa) At least you get a free golf club membership. No mention if that gets you access to Bernie Madoff. |  |

Negative Yields on Money Market Funds

by Calculated Risk on 12/16/2008 08:44:00 PM

Just checked some money market funds, and for a few of them the expenses are now greater than the yield - so you'd do better with a mattress.

MarketWatch: Fed to consumers: Hold tight quotes Dean Baker co-director of the Center for Economic and Policy Research:

"I'm a little surprised [the Fed] decided to take it all the way down, it isn't really going to have any substantial impact. The other reason I was surprised is that it could create an awkward situation for money market funds where they will have to give people negative returns."I wonder if the funds will lower their expenses?

Newsweek: Transitions 2008

by Calculated Risk on 12/16/2008 05:27:00 PM

Remembering the remarkable lives of some who passed this year ... see #7

For more pictures, and, well, more ... see Tanta: In Memoriam in the menu bar above.

DataQuick: Socal 55% of Home Sales are previous Foreclosures

by Calculated Risk on 12/16/2008 03:59:00 PM

From DataQuick: Southland home sales ease but still beat '07; median falls below $300K

Southern California home sales outpaced last year for the fifth consecutive month in November, when 55 percent of buyers in the resale market chose repossessed homes. The abundance of discounted foreclosures helped push the median sale price down a record 35 percent from a year ago, a real estate information service reported.The median is dropping fast because the mix has changed to lower priced homes. This mix change is because of all the foreclosures at the low end, and also because jumbo loans are very expensive - limiting home buying at the mid and high end in SoCal. As I've noted before, the Case-Shiller repeat sales index is a better measure of price movement because it isn't distorted by changes in the mix.

"Bargains and bargain hunters have kept this market alive through some of the bleakest financial news in memory. There's this renewed sense that you can score a 'deal' - something that had been missing for many years. Last month's Southland sales weren't great, given they were the second-lowest for any November in 16 years. But they could have been a lot worse," said John Walsh, DataQuick president.That is a key point - the chain is broken - there is no move-up buyer.

"Many first-time homebuyers are, understandably, cheering as foreclosures dominate sales, tugging down prices and raising affordability," he continued. "For home sellers and the industry, though, one concern over foreclosures representing half of all sales is that those transactions simply repay lenders. They don't trigger a move-up purchase."

Fed Funds Rate Target from ZERO to 0.25%

by Calculated Risk on 12/16/2008 02:15:00 PM

This is quite a statement ... Fed will hold rates low for an extended period.

Fed Statement:

The Federal Open Market Committee decided today to establish a target range for the federal funds rate of 0 to 1/4 percent.

Since the Committee's last meeting, labor market conditions have deteriorated, and the available data indicate that consumer spending, business investment, and industrial production have declined. Financial markets remain quite strained and credit conditions tight. Overall, the outlook for economic activity has weakened further.

Meanwhile, inflationary pressures have diminished appreciably. In light of the declines in the prices of energy and other commodities and the weaker prospects for economic activity, the Committee expects inflation to moderate further in coming quarters.

The Federal Reserve will employ all available tools to promote the resumption of sustainable economic growth and to preserve price stability. In particular, the Committee anticipates that weak economic conditions are likely to warrant exceptionally low levels of the federal funds rate for some time.

The focus of the Committee's policy going forward will be to support the functioning of financial markets and stimulate the economy through open market operations and other measures that sustain the size of the Federal Reserve's balance sheet at a high level. As previously announced, over the next few quarters the Federal Reserve will purchase large quantities of agency debt and mortgage-backed securities to provide support to the mortgage and housing markets, and it stands ready to expand its purchases of agency debt and mortgage-backed securities as conditions warrant. The Committee is also evaluating the potential benefits of purchasing longer-term Treasury securities. Early next year, the Federal Reserve will also implement the Term Asset-Backed Securities Loan Facility to facilitate the extension of credit to households and small businesses. The Federal Reserve will continue to consider ways of using its balance sheet to further support credit markets and economic activity.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Christine M. Cumming; Elizabeth A. Duke; Richard W. Fisher; Donald L. Kohn; Randall S. Kroszner; Sandra Pianalto; Charles I. Plosser; Gary H. Stern; and Kevin M. Warsh.

In a related action, the Board of Governors unanimously approved a 75-basis-point decrease in the discount rate to 1/2 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of New York, Cleveland, Richmond, Atlanta, Minneapolis, and San Francisco. The Board also established interest rates on required and excess reserve balances of 1/4 percent.

FDIC Increases Insurance Rates

by Calculated Risk on 12/16/2008 12:11:00 PM

From the FDIC: FDIC Adopts Assessments for Insured Institutions for 2009

The Board of Directors of the Federal Deposit Insurance Corporation (FDIC) today voted to adopt a final rule increasing risk-based assessment rates uniformly by 7 basis points (7 cents for every $100 of deposits), on an annual basis, for the first quarter of 2009.This doubles (or more) the insurance rate for most insitutions.

"With higher levels of bank failures, the FDIC's resolution costs have increased significantly. ..." said FDIC Chairman Sheila C. Bair. ...

Currently, banks pay between 5 and 43 basis points of their domestic deposits for FDIC insurance. Under the final rule, risk-based rates would range between 12 and 50 basis points (annualized) for the first quarter 2009 assessment. Most institutions would be charged between 12 and 14 basis points.

In October, the FDIC also proposed changes to take effect beginning in the second quarter of 2009 that would make deposit insurance assessments fairer by requiring riskier institutions to pay a larger share.

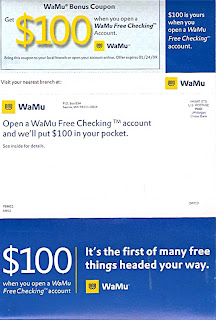

Get your own piece of the TARP!

by Calculated Risk on 12/16/2008 11:31:00 AM

Best Buy Cites "Historic Slowdown", cuts Capital Spending Plans in Half

by Calculated Risk on 12/16/2008 09:00:00 AM

Press Release:

“The historic slowdown in the economy and its effect on our business over the past 90 days have been the most challenging consumer environment our company has ever faced,” said Brad Anderson, vice chairman and CEO of Best Buy. “We believe that there has been a dramatic and potentially long-lasting change in consumer behavior as people adjust to the new realities of the marketplace."Company after company is announcing reduced capital spending plans, and this means non-residential investment will decline sharply next year.

...

"[B]ased on the recent changes we’ve seen in consumer behavior and the potential for worsening consumer spending, we need to prepare our organization to operate in a wide range of potential macro economic scenarios in the coming year. Additional prudent actions will be taken to prepare the business, such as reducing our capital spending by approximately 50 percent next year, including a substantial reduction in new store openings in the United States, Canada and China."

emphasis added

Housing Starts Decline to Record Low

by Calculated Risk on 12/16/2008 08:32:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

Total housing starts were at 625 thousand (SAAR) in November, by far the lowest level since the Census Bureau began tracking housing starts in 1959.

Single-family starts were at 441 thousand in November; also the lowest level ever recorded (since 1959). Single-family permits were at 412 thousand in November, suggesting single family starts may fall even further next month.

Here is the Census Bureau report on housing Permits, Starts and Completions.

Building permits decreased:

Privately-owned housing units authorized by building permits in November were at a seasonally adjusted annual rate of 616,000.On housing starts:

This is 15.6 percent below the revised October rate of 730,000 and is 48.1 percent below the revised November 2007 estimate of 1,187,000.

Single-family authorizations in November were at a rate of 412,000; this is 12.3 percent below the October figure of 470,000..

Privately-owned housing starts in November were at a seasonally adjusted annual rate of 625,000. This is 18.9 percent below the revised October estimate of 771,000 and is 47.0 percent below the revised November 2007 rate of 1,179,000.And on completions:

Single-family housing starts in November were at a rate of 441,000; this is 16.9 percent (±8.5%) below the October figure of 531,000.

Privately-owned housing completions in November were at a seasonally adjusted annual rate of 1,084,000. This is 3.3 percent above the revised October estimate of 1,049,000, but is 22.8 percent below the revised November 2007 rate of 1,404,000.Notice that single-family completions are significantly higher than single-family starts. This is important because residential construction employment tends to follow completions, and completions will probably continue to decline.

Single-family housing completions in November were at a rate of 760,000; this is 0.9 percent above the October figure of 753,000.

A VERY weak report ...