by Calculated Risk on 11/03/2008 02:34:00 PM

Monday, November 03, 2008

Fed: Lending Standards Tighten, Loan Demand Weakens in October

Note: some readers are being swamped with political ads - especially in California. I'm trying to block the ads ... please accept my apology.

From the Fed: The October 2008 Senior Loan Officer Opinion Survey on Bank Lending Practices

In the current survey, large net fractions of domestic institutions reported having continued to tighten their lending standards and terms on all major loan categories over the previous three months. The net percentages of respondents that reported tightening standards increased relative to the July survey for both C&I and commercial real estate loans, as did the fractions reporting tightening for all price and nonprice terms on C&I loans. Considerable net fractions of foreign institutions also tightened credit standards and terms on loans to businesses over the past three months. Large fractions of domestic banks reported tightening standards on loans to households over the same period. Demand for loans from both businesses and households at domestic institutions continued to weaken, on net, over the past three months.

Click on graph for larger image in new window.

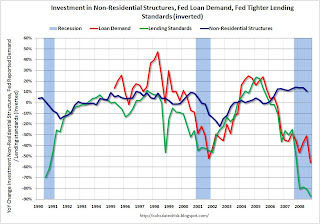

Click on graph for larger image in new window.Of particular interest is the increase in tighter lending standards for Commercial Real Estate (CRE) loans. This graph compares investment in non-residential structure with the Fed's loan survey results for lending standards (inverted) and CRE loan demand.

Note that any reading below zero for loan demand means less demand than the previous quarter. This is strong evidence of an imminent slump in CRE investment.

More charts here for residential mortgage, consumer loans and C&I.

GM: "probably worst industry sales month in the post-WWII era."

by Calculated Risk on 11/03/2008 01:51:00 PM

From MarketWatch: GM U.S. October light vehicle sales fall 45.1%

General Motors said Monday that October U.S. light vehicle sales fell 45.1% to 168,719 units from 307,408 a year ago.The WSJ in a headline quoted GM executive Mark LaNeve as saying October was "probably worst industry sales month in the post-WWII era."

Ford: Auto Sales Decline 30% in October

by Calculated Risk on 11/03/2008 12:26:00 PM

From Bloomberg: Ford Motor Says October U.S. Auto Sales Declined 30 Percent (hat tip Justin)

Ford Motor Co. ... said its U.S. sales fell 30 percent in October, the 23rd decline in the past 24 months.Meanwhile, also from Bloomberg: GM, Ford, Chrysler Shut Out of Auto-Bond Market for Fifth Month

The total dropped to 132,838 cars and trucks, from 190,195 a year earlier ...

Ford Motor Co., GMAC LLC and Chrysler LLC were shut out of the market for bonds backed by auto loans for the fifth straight month ... Sales of auto bonds slumped to $500 million last month, compared with $9 billion in October 2007, according to Merrill Lynch & Co. data. ...And Ford is probably in the best shape of the U.S. automakers.

The credit market seizure is forcing automakers to cut back on loans to dealers and customers, contributing to a slowdown that may shrink U.S. auto sales this year to the lowest level since 1993.

Credit Crisis Indicators: Some More Progress

by Calculated Risk on 11/03/2008 11:12:00 AM

The London interbank offered rate, or Libor, that banks charge one another for three-month loans in U.S. currency slid 17 basis points to 2.86 percent today, a 16th day of declines, data from the British Bankers' Association showed. It hasn't been as low since the failure of Lehman Brothers Holdings Inc. on Sept. 15.The rate peaked at 4.81875% on Oct. 10.

Usually the 3 month trades below the target Fed Funds rate by around 25 bps, so this is too low with the Fed funds rate at 1.0%. However, the effective Fed Funds rate is even lower (0.30% yesterday), so a 3 month yield of 0.44% is in the right range. I'd like to see the effective funds rate closer to the target rate.

I'd like to see the spread move back down to 1.0 or lower - at least below 2.0.

Here is a list of SFP sales. The Treasury announced another $30 billion for the Fed today ... no progress.

The Fed is buying higher quality commercial paper (CP) and this is pushing down the yield on this paper (0.97% on Friday!) - and increasing the spread between AA and A2/P2 CP. So this indicator is a little misleading right now. Still, if the credit crisis eases, I'd expect a significant decline in this spread.

The LIBOR is down and the TED spread is off again, so there is a little more progress.

ISM Factory Index Lowest Since 1982

by Calculated Risk on 11/03/2008 10:16:00 AM

From MarketWatch: U.S. ISM factory index plunges again in October

The Institute for Supply Management reported Monday [that the] ISM index fell to 38.9% in October from 43.5% in September. This is the lowest level since September 1982.Ouch.

Construction Spending in September

by Calculated Risk on 11/03/2008 10:00:00 AM

The Census Bureau reported this morning that private non-residential construction increased slightly in September from August, but spending is still below the peak in June 2008. I expect that non-residential investment will decline sharply over the next year or two.

From the Census Bureau: September 2008 Construction at $1,060.1 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $751.7 billion, 0.1 percent above the revised August estimate of $751.1 billion. Residential construction was at a seasonally adjusted annual rate of $336.5 billion in September, 1.3 percent below the revised August estimate of $340.8 billion.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The graph shows private residential and nonresidential construction spending since 1993.

Nonresidential spending had been strong as builders completed projects, but there is substantial evidence of a looming slowdown - less lending for new projects, less work for architects - and it appears the expected slowdown in non-residential spending has arrived.

The second graph shows the year-over-year change for private residential and non-residential construction spending.

The YoY change in non-residential spending is starting to slow down and will probably turn negative later this year or early in 2009.

It now looks like investment in non-residential structures will negatively impact GDP in Q4. This had been one of the few bright spots for the economy.

Circuit City Announces Closure of 155 Stores

by Calculated Risk on 11/03/2008 08:56:00 AM

We discussed this yesterday, and here is the announcement from Circuit City: Circuit City Stores, Inc. Provides Update on Liquidity and Announces Store Closing Plan

Due in part to its deteriorating liquidity position and the continued weak macroeconomic environment, the company has decided to take certain restructuring actions immediately, including closing 155 domestic segment stores, reducing future store openings and aggressively renegotiating certain leases.This is another blow to mall owners and will impact new commercial real estate construction. The vacancy rate at malls is already soaring as announced last month:

For strip centers and other open-air shopping venues, the vacancy rate climbed to 8.4% in the third quarter from 8.1% in the second quarter.Here is a list of the stores being closed. The store closings are concentrated in states with serious housing and economic issues: Arizona, California, Georgia, Florida, and more.

...

The vacancy rate at malls in the top 76 U.S. markets rose to 6.6% in the third quarter, up from 6.3% in the previous quarter, to its highest level since late 2001, according to Reis.

China: Owners Deserting Factories

by Calculated Risk on 11/03/2008 08:30:00 AM

Don Lee at the LA Times reports on a growing trend in China: Some owners deserting factories in China

First, Tao Shoulong burned his company's financial books. He then sold his private golf club memberships and disposed of his Mercedes S-600 sedan.Back in March, I spoke with an executive of a U.S. company, and he told me his company was scaling back their Chinese operations because their manufacturing costs in China had increased by 30%. This was due to a combination of the new Chinese labor laws, higher currency exchange, higher material costs and other factors.

And then he was gone.

And just like that, China's biggest textile dye operation -- with four factories, a campus the size of 31 football fields, 4,000 workers and debts of at least $200 million -- was history.

...

Toy makers are among the hardest hit. More than 3,600 such factories have closed -- about half the industry's total, government figures show. Most were small operations, but last month Smart Union Group's three huge factories stopped production, leaving more than 8,700 workers jobless.

Now a global slowdown and the credit crisis has led to a contraction in the Chinese manufacturing sector. China will probably be forced to stimulate their economy - and, as I speculated this weekend, this could lead to higher intermediate and long term interest rates in the U.S.

At least 'decoupling' is officially dead.

Long Line Forms at Bailout Window

by Calculated Risk on 11/03/2008 01:25:00 AM

From the WSJ: Rescue Cash Lures Thousands of Banks

Treasury and banking regulators say as many as 1,800 publicly held institutions could apply for government investments in coming weeks ... thousands more private banks could apply for government capital as well, a Treasury spokeswoman said Sunday.What a surprise ...

Sunday, November 02, 2008

Report: GM Turned down by Government

by Calculated Risk on 11/02/2008 09:20:00 PM

From the NY Times: U.S. Rejects G.M.’s Call for Help in a Merger

The Treasury Department has turned down a request by General Motors for up to $10 billion to help finance the automaker’s possible merger with Chrysler ... the Bush administration will now shift its focus to speeding up the $25 billion loan program for fuel-efficient vehicles approved by Congress in September and administered by the Energy Department.A possible GM-Chrysler merger probably only makes sense to GM with government help - and with tens of thousands of projected layoffs (some estimates are 200 thousand job losses including suppliers and other service providers), this deal probably isn't very appealing to lawmakers.

...

While G.M. and Chrysler continue to talk, no deal is expected until the government clarifies its role, if any.

Without this deal, Chrysler will probably go bankrupt - and the jobs will be lost anyway - and some lenders will be stuck with Chrysler pier loans (more write downs for some banks).