by Calculated Risk on 8/31/2008 11:00:00 PM

Sunday, August 31, 2008

Cartoon of the Day

Don't Worry, There's a PLAN

by PJ on 8/31/2008 03:20:00 PM

I've seen CR refer to some of the woes/speculation regarding the future for Lehman Bros; news today from the WSJ says that CEO Richard Fuld is a man with a plan. Er, or at least, we think so:

There's more in the Journal story, including the admission that Lehman's big plan involves it financing "at least some" of its own spinoffs, a la Merrill Lynch's $30bn CDO sale. Lehman's got about $65 billion in commercial and residential RE "assets" that would be part of the "sale." And with financing tough to come by, the cynic in me thinks that Lehman will end up self-financing more than "some" of whatever is eventually spun off.The Wall Street firm run by Chief Executive Officer Richard Fuld is still hammering out the final details and it isn't clear when a plan will be unveiled. One sticking point: finding financing in this cash-strapped environment for a spinoff or sale of these assets.

In addition to offloading the real-estate assets, Lehman is trying to sell its Neuberger Berman investment-management unit. Ideally, Lehman management would like to announce both transactions at the same time so it can assure investors that it has a bold plan to navigate its way out of the current credit crisis.

For the real-estate assets, Lehman has set up a so-called good bank/bad bank structure. Such a deal is likely to involve a spinoff of the holdings to shareholders as well as an investment by outside investors.

Details of the plan weren't clear. One option may be a "sponsored spin." That would involve bundling some of the troubled assets into a new entity, which would then be spun off to Lehman holders on a tax-free basis. Also, a new investor or group of investors could take a big minority stake in the new company, thus "sponsoring" it.

And until more details emerge, I'm calling it a "sale," in quotes. Because financing the sale of your own assets to a company you have majority interest in is sort of like letting your brother date an annoying ex: you think you've cut ties, but she keeps showing up at the dinner table anyway.

Alabama County Faces Bankruptcy

by PJ on 8/31/2008 10:12:00 AM

Talk about being in the sewer. I lived in Orange County,CA in 1994 when the county went bankrupt; now that BK's standing as the largest municipal bankruptcy in U.S. history is being threatened by Jefferson County, Alabama. Over sewer bonds. $3.2 billion of them, to be exact:

Another unforseen effect of the credit crunch.Alabama's largest county offered a plan Friday to restructure its $3.2 billion sewer debt and, at least for now, put off filing the largest municipal bankruptcy in U.S. history.

Gov. Bob Riley said an attorney for Jefferson County proposed restructuring the bond debt at a lower, fixed rate over a longer term, and Wall Street creditors allowed the county to delay any further interest payments at no cost until Sept. 30 ...

The county had the cash to make a $2 million interest payment that was due Friday, but Commissioner Jim Carns said officials must decide whether to continue making payments indefinitely or file for bankruptcy because its obligations far outstrip revenues from the sewer system.

Carns, who did not attend the meeting, said the county must stop the bleeding.

"It's a matter of whether we can get an agreement to stop it or whether we have to get court protection to stop it," he said.

Jefferson is Alabama's most populous county with about 658,000 residents and includes the state's biggest city, Birmingham....

Acting at the suggestion of outside advisers, the county borrowed money for the project on the bond market in a complex and risky series of transactions. When the mortgage crisis hit and banks began tightening up on their lending, the interest rates on the debt ballooned.

Saturday, August 30, 2008

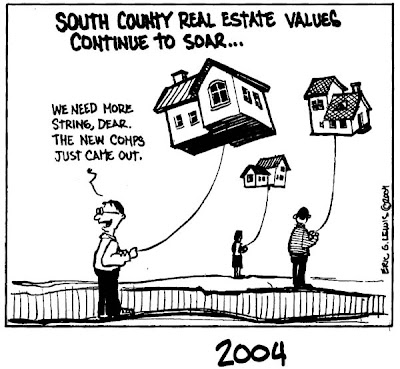

Cartoon of the Day

by Calculated Risk on 8/30/2008 11:00:00 PM

Gustav takes aim at N'awlins, oil prices

by PJ on 8/30/2008 09:23:00 PM

(Note: CR is off hiking, and asked me to help with guest posts. For those who don't know, I run HousingWire when I'm not helping out friends. Anything you want discussed, feel free to shoot an email to pjackson@housingwire.com.....)

Hurricane Gustav is shaping up to be a real problem for the Gulf Coast. Per weather.com, it's now very dangerous Cat 4, and will likely become a Cat 5 hurricane before tonight is up. While CR is West Coast, yours truly is in the DFW metroplex, and we're already seeing an influx of the tens of thousands fleeing the Gulf Coast.....

We're already seeing gas prices get hit. Shell Oil said it will pull all workers off platforms, along with nearly every other producer. More importantly, the Louisiana Offshore Oil Port will halt taking crude this weekend; it's the only deepwater oil port in the nation.

My best to anyone out there running from what appears to be another major U.S. hurricane, but the oil effects appear as if they'll be felt by all of us, too.

Update: some stats on Gustav, after NO mayor Ray Nagin just ordered a mandatory evacuation:

....Gustav, currently a Category 4 Hurricane with winds of up to 150 miles per hour, now has a 900-mile wide footprint. The storm surge it delivers as it powers ashore on Monday could be as high as 24 feet – higher than Hurricane Katrina, Nagin says he was told. [emphasis added]

I worked in the mortgage/default industry after Katrina. Given what servicers are already dealing with, this is just one more straw on the camel's proverbial back, should it come to pass.

Open thread

by lama on 8/30/2008 12:08:00 PM

Great Balance Sheet! Strong Earnings!

by lama on 8/30/2008 10:53:00 AM

A pet peeve of mine is analysts. When is the last time you heard one of them speak about cash flows other than in passing? If you do not address the components of the Statement of Cash Flows, you cannot opine on the strength of the Balance Sheet or Earnings. What’s the problem? The Statement of Cash Flows is conceptually difficult to grasp as it’s traditionally taught. The statement might be called “Statement of all the other assets and activities affected cash.” It’s not that one thing is more important than the other 2, it’s that the stool needs 3 legs.

It’s even more important to know this now. Cash is always nice to have, but even more so in a down market when it’s not so easy to borrow cash. If any of you are buying individual stocks, you have to learn how The Statement of Cash Flows works. It is not possible to assess a company’s condition without understanding it. I surfed around a bit and didn’t find anything that was very good. The Wikipedia entry was as good as any.

http://en.wikipedia.org/wiki/Cash_flow_statement

Between long hours and airports, I did not have adequate time to assemble an adequate post on the topic but thought it worth a rant.

Why are regulators always behind?

by lama on 8/30/2008 09:46:00 AM

Here's an article featuring regulators reacting to 3 to 5 year-old news.

http://www.bloomberg.com/apps/news?pid=20601068&sid=aBDDcYvIKUdE&refer=economy

I have some observations about regulators:

1. They are retstrained by Congressional inaction or mission statements.

2. They are not actively in the marketplace, so they miss the first signs of trouble. More than a year ago, a retail store owner could have told you the economy was sinking. For our small consulting firm, 9 months ago it became easier to find accounting talent. Are regulators in the Ivory Tower?

3. There are more inputs into any economic analysis than there ever were before. In the early 90's recession, Asia meant Japan, Europe was 3 countries, the Middle East was just a gas station and The Americas was the US. Now, there are so many more countries with real economies, what's the benchmark?

What can regulators do? What should they do?

SFAS 157, Fair Value and Other Fairy Tales

by lama on 8/30/2008 07:39:00 AM

There’s been much discussion on various blogs about Fair Value Accounting. Proponents make an excellent point in that, what difference does it make what you paid for something? If you’re telling me, an investor, that you have a certain amount of assets on your books, prove to me what they’re worth. Not exactly a revolutionary thought to have. The fact is, this is what balance sheets have supposed to be reflecting all along. “Lower of Cost or Market” they called it back in school over the sounds of clicking abaci.

What really changed recently with SFAS 157 are the number of assets under fair value rules and the additional required disclosures, mostly footnotes, for Fair Value accounting for various instruments.

What types of assets should be subject to fair value accounting? Should a company revalue its land and equipment each year? Seems like a lot of work and expense. Corporations already keep two sets of books, GAAP and Tax. To be fair, the underlying transactions are the same for both, but the more in-depth analysis is performed by two separate groups of well paid employees, the Reporting Group and Tax Department. Fair value will involve hiring another group of accountants; perhaps not as large, but more expense.

What is the benefit? Fair Value isn’t going to mean much for internal operations. Some of the biggest opponents are US based manufacturers, headed by automakers. Does it matter what your plant’s equipment is worth? Not for internal purposes. It won’t help you analyze your business. In the case of Plant Equipment, not even the investors benefit much from fair value.

What types of assets should be valued at fair value? Most of us agree that securities are at the center. We’re now in the process of sorting out the values of nicely packaged garbage on banks’ books. Basic Economics and Accounting theory posits that assets should be valued at discounted future cash flows. Cash is the exit strategy for all assets. Nowhere is this more evident than valuing securities. With securities, we need to look at the intent of the owner; the exit strategy to convert to cash. So, the exit strategy defines the valuation method. For securities, this brings us to the three categories of investments; Levels 1, 2 and 3. Here are guidelines:

Prior Name; Available for Sale

English Translation; We’re selling if the price is right

Valuation; Market value, preferably on an exchange

Prior Name; Held to Maturity

English Translation; We’re not selling

Valuation; Cost, unless the loss is “other than temporary”.

The levels indicate how obvious or concrete the market comparisons, with L1 the highest. Do you see a trend in valuations? It’s ALL exit value. It’s all based on intent. The reason we don’t time value discount Level 1 and 2 securities is because the cash conversion is projected to happen now (or soon enough).

Side note: Temporary L2 asset losses are found further down on the Income Statement under Other Comprehensive Income (sort of purgatory place) where they do not get factored into P/E ratios.

Friday, August 29, 2008

Cartoon of the Day

by Calculated Risk on 8/29/2008 11:00:00 PM