by Calculated Risk on 7/01/2008 04:57:00 PM

Tuesday, July 01, 2008

Starbucks Closing 600 Stores

Press Release: Starbucks Increases Number of U.S. Company-Operated Store Closures as Part of Transformation Strategy

Starbucks has announced ... a decision to close approximately 600 underperforming company-operated stores in the U.S. market.In April Starbucks had announced plans to expand by about 400 net stores per year through 2011. This is a substantial cut from that plan.

...

Starbucks now expects to open fewer than 200 new U.S. company-operated stores in fiscal 2009.

This is more bad news for strip mall owners ...

UPDATE: more details from Reuters: Starbucks to cut up to 12,000 jobs, close 600 stores and Bloomberg (hat tip Argento, Cooking ramen in my percolator)

Chrysler Sales Fall 36%

by Calculated Risk on 7/01/2008 03:50:00 PM

From the WSJ: Auto Makers Report Slump in June U.S. Sales

36% [Sales] plunge at Chrysler ...Honda outsold Chrysler by far:

Chrysler's sales slumped to 117,457 from 183,347, with car sales tumbling 49% to 29,858 and truck sales decreasing 30% to 87,599.

Honda Motor ... was the lone bright spot last month with sales up 1.1% to 142,539, a record June for the auto maker.

Manhattan Office Vacancy Rates Hit 2 Year High

by Calculated Risk on 7/01/2008 02:29:00 PM

From Bloomberg: Manhattan Office Vacancy Rates Climb to Two-Year High

Manhattan's office vacancy rate rose to its highest level since 2006 in the second quarter as financial firms, beset by losses, fired workers and reduced their office space, real estate brokerage Cushman & Wakefield Inc. said.Layoffs do matter. During the last downturn, many companies started subleasing space - and that really hit the office market hard in Manhattan. From what I've heard that isn't happening yet this time.

Vacancies in the most expensive U.S. office market rose to 7.1 percent from 5.3 percent a year earlier ...

GM June U.S. sales fall 18.2%

by Calculated Risk on 7/01/2008 02:08:00 PM

From MarketWatch: GM June U.S. sales fall 18.2% to 262,329 vehicles

Ford, Toyota and GM sales were all bad, but I suspect Chrysler's numbers will be really really ugly.

Toyota Sales Off 21.4% in June

by Calculated Risk on 7/01/2008 01:26:00 PM

From MarketWatch: Toyota June U.S. sales down 21.4% to 193,234 vehicles

A little worse than the 12% expected decline.

Ford Sales Off 28% in June

by Calculated Risk on 7/01/2008 12:16:00 PM

From CNNMoney: Ford sales plunge

Ford Motor reported that its U.S. sales tumbled 28% in June, kicking off what could turn out to be the weakest month for auto sales in 16 years.

Ford ... saw sales of its SUVs plunge by more than half and pickups and other trucks fell more than a third.

When In Doubt, Blame the Accountants

by Tanta on 7/01/2008 10:02:00 AM

New-Old meme: FAS 157 is ruining the financial industry. Barry Ritholtz knocks this point of view around, as reported in the New York Times:

Some blame the rapacious lenders. Others point to the deadbeat borrowers. But Stephen A. Schwarzman sees another set of culprits behind all the pain in the financial industry: the accountants.You see, the magic of securitization during the boom was that it created obscure instruments like CDOs that were "worth" more than the underlying collateral (absurd mortgage loans). Now that the magic of securitization during the bust is that it has left behind obscure instruments--those pesky CDOs--that may well be "worth" less than the underlying collateral, if you can imagine that, foul is cried:

Of course, the purpose of FAS 157 was to make the market more transparent and efficient, which Mr. Schwarzman doesn’t take issue with.In other words, mark-to-market is great on the way up, but it's not fair to have to mark on the way down.

“The concept of fair value accounting is correct and useful, but the application during periods of crisis is problematic,” he said. “It’s another one of those unintended consequences of making a rule that’s supposed to be good that turns out the other way.”

Construction Spending in May

by Calculated Risk on 7/01/2008 10:00:00 AM

Construction spending declined in May for residential, but increased slightly for non-residential private construction.

From the Census Bureau: May 2008 Construction at $1,085.2 Billion Annual Rate

Spending on private construction was at a seasonally adjusted annual rate of $784.2 billion, 0.7 percent below the revised April estimate of $789.4 billion.

Residential construction was at a seasonally adjusted annual rate of $378.9 billion in May, 1.6 percent below the revised April estimate of $385.1 billion.

Nonresidential construction was at a seasonally adjusted annual rate of $405.3 billion in May, 0.2 percent above the revised April estimate of $404.3 billion.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The graph shows private residential and nonresidential construction spending since 1993. With revisions, private non-residential construction spending has now passed residential construction spending for the first time (since the Census Bureau started tracking spending).

Nonresidential spending has been strong as builders complete projects, but there is substantial evidence of a looming slowdown - less lending for new projects, less work for architects - and the expected slowdown in non-residential spending will happen in the 2nd half of 2008.

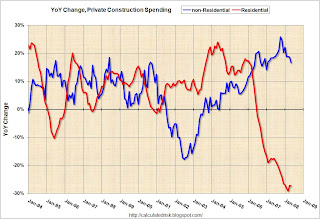

The second graph shows the year-over-year change for private residential and non-residential construction spending.

The YoY change in non-residential spending is starting to slow down and will probably turn negative later this year.

Eli Broad: Economy "Worst Period" in his Life

by Calculated Risk on 7/01/2008 09:04:00 AM

From Bloomberg: Broad Says Economy in Worst Slump Since World War II

Billionaire investor Eli Broad [the founder of homebuilder KB Home] said the U.S. economy is in the ``worst period'' of his adult life as a housing market recovery remains ``several years'' away.For anyone associated with home building, the current period has to feel like an economic depression.

UK: Mortgage Approvals Collapse

by Calculated Risk on 7/01/2008 01:23:00 AM

From the Telegraph: UK house prices in grip of slump that experts expect to deepen

Britain is in the grip of a housing slump as bad as at any stage since the 1970s, property experts warned, as data suggested that first time buyers had all but disappeared from the market.We've sure seen a lot of records recently. Record foreclosures. Record inventory. Record house price declines. Record low mortgage approvals in the UK.

...

Just 42,000 loans were handed out in May – down from 58,000 in April and a massive slump of 64pc compared to this time a year ago, when 116,000 mortgages were given to home buyers. This is the lowest level recorded in any month since the Bank of England started collecting data in 1993.

Another day, another record ...