by Calculated Risk on 6/26/2008 02:53:00 PM

Thursday, June 26, 2008

Oil hits $140, Dow Off 300

From MarketWatch: Oil prices tops $140

TED spread rising sharply. Is this the 4th wave of the credit crisis?

Alt-A Defaults Rise Sharply

by Calculated Risk on 6/26/2008 12:47:00 PM

Paul Jackson at Housing Wire reports: Alt-A Performance Gets Much Worse in May

A new report released by Clayton Fixed Income Services, Inc. on Wednesday afternoon found that 60+ day delinquency percentages and roll rates increased in every vintage during May among Alt-A loans ... Add in soaring borrower defaults, and the picture doesn’t get much better. Clayton reported that the 2006 vintage saw 60+ day borrower deliquencies among Alt-A first liens reach 21.22 percent in May, up 10.5 percent in a single month; 2007 fared even worse, with 60+ day delinquencies ratcheting up 22 percent to 18.55 percent.Paul notes that the rating agencies will be probably have to increase their loss assumptions:

Those numbers make Standard & Poor’s Ratings Services latest assumption of 35 percent loss severity on Alt-A loans, only one month old, already start to look a little too conservative. ... given the data now available, a ratings cut for any AAA classes deemed at risk one month ago would seem to be a foregone conclusion for most investors.Housing Wire has more details.

Existing Home Sales: Not Seasonally Adjusted

by Calculated Risk on 6/26/2008 11:52:00 AM

Click on graph for larger image in new window.

Click on graph for larger image in new window.

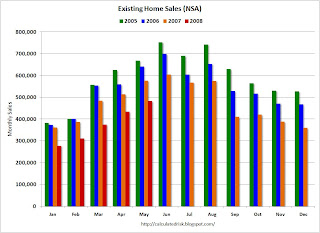

This graph shows Not Seasonally Adjusted (NSA) existing home sales for 2005 through 2008. Sales are sharply lower in May 2008 compared to the previous three years.

May is an important month for existing home sales, and marks the beginning of the Summer selling season.

Let's compare the NSA pattern for existing home sales to the pattern for new home sales. The second graph shows monthly NSA new home sales.

The second graph shows monthly NSA new home sales.

The first difference is that new home sales peak in the Spring, and existing home sales peak in the Summer. This is because new home sales are reported when the contract is signed, and existing home sales are reported at the close of escrow.

The second obvious difference is there was no Spring selling season for New Home sales, but there has been a pickup (although muted) in Existing Home sales.

The difference in sales activity could partly be because new homes tend to be in more remote locations, and with rising fuel prices, home buyers are buying existing homes closer to their places of work. Another explanation is that existing home sales are being boosted by REO (bank Real Estate Owned) sales. Dataquick reported that in California in May, 38.3 percent of all sales were foreclosure resales!  The third graph compares New Home sales vs. Existing Home sales since January 1994.

The third graph compares New Home sales vs. Existing Home sales since January 1994.

Clearly new home sales have fallen faster than existing home sales.

I suspect REO resales explain some of the difference (as does location).

May Existing Home Sales Graphs

by Calculated Risk on 6/26/2008 11:00:00 AM

Note: for the 2nd month in a row, the NAR didn't release the Existing Home sales data online in a timely manner.

The NAR reports: May Existing-Home Sales Show Modest Gain

Existing-home sales – including single-family, townhomes, condominiums and co-ops – increased 2.0 percent to a seasonally adjusted annual rate 1 of 4.99 million units in May from a level of 4.89 million in April, but are 15.9 percent below the 5.93 million-unit pace in May 2007.

Click on graph for larger image in new window.

Click on graph for larger image in new window.The first graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in May 2008 (4.99 million SAAR) were the weakest May since 1998 (4.77 million SAAR).

It's important to note that a large percentage of these sales are for homes that were foreclosed during the previous year. Dataquick reported that in California in May, 38.3 percent of all sales were foreclosure resales!

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 4.49 million homes for sale in May.

The second graph shows nationwide inventory for existing homes. According to NAR, inventory decreased to 4.49 million homes for sale in May. Total housing inventory at the end of May fell 1.4 percent to 4.49 million existing homes available for sale, which represents a 10.8-month supply at the current sales pace, down from a 11.2-month supply in April.The typical pattern is for inventory to decline in December, and then to slowly rebound in January and February, and really start to increase from March through mid-Summer.

The third graph shows the 'months of supply' metric for the last six years.

The third graph shows the 'months of supply' metric for the last six years.Months of supply decreased to 10.8 months.

This follows the highest year end months of supply since 1982 (the all time record of 11.5 months of supply). Even if inventory levels stabilize, the months of supply could continue to rise - and possibly rise significantly - if sales decline later this year. More later when the raw data is available ...

May Existing Home Sales Increase Slightly

by Calculated Risk on 6/26/2008 10:03:00 AM

From MarketWatch: U.S. May existing-home sales rise 2% as expected

The U.S. home and condo resales inched higher in May as prices continued to fall, the National Association of Realtors reported Thursday. Resales of U.S. houses and condos rose 2% to a seasonally adjusted annualized rate of 4.99 million in May from 4.89 million in April.Graphs soon ... (NAR is slow to release the data online again) Update MarketWatch on inventory:

Inventories of unsold homes on the market fell 1.4% to 4.49 million, a 10.8-month supply at the May sales pace. The inventory figures are not seasonally adjusted. Inventories are up 2.4% in the past year.NAR still hasn't released the data online.

Claims: The Impact of Unemployment Benefits Extension

by Calculated Risk on 6/26/2008 08:30:00 AM

It now appears like that Congress will extend unemployment insurance benefits from 26 weeks to 39 weeks. How will this impact the Weekly Claims data?

First, weekly claims typically get a short term bounce with an unemployment benefit extension as some workers refile for claims. This will probably add 50K per week to claims for several weeks (pushing claims solidly above 400K).

Extended benefits are not included in continued claims (there is a separate category), however continued claims will probably also get a small boost as some job seekers wait for better opportunities.

Just a couple of points to remember when claims get a boost - probably as soon as next month. Of course weekly claims are already rising, even before the extended benefits become available, indicating a weakening labor market.

Here is the current report from the Department of Labor for the week ending June 21, showing initial unemployment claims increased to 384,000, and the 4-week moving average was 378,250. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the continued claims since 1989.

Continued claims increased this week to 3,139,000, an increase of 82,000 from the preceding week.

Notice that following the previous two recessions, continued claims stayed elevated for a couple of years after the official recession ended - suggesting the weakness in the labor market lingered. The same will probably be true for the current recession (probable). The second graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989. The four week moving average has been trending upwards for the last few months, and the level is now solidly above the possible recession level (approximately 350K).

The second graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989. The four week moving average has been trending upwards for the last few months, and the level is now solidly above the possible recession level (approximately 350K).

Wednesday, June 25, 2008

Credit Crisis: The 4th Wave?

by Calculated Risk on 6/25/2008 11:46:00 PM

The TED spread is starting to rise again and is back above 1.0 for the first time since the beginning of May. Here is the TED Spread from Bloomberg. The spread is still far below the previous three waves, but well above the normal level (below 0.5).

And from the WSJ: European Bank-Lending Anxiety Returns

Tensions in Europe's short-term lending markets are on the rise again, repeating a pattern that central bankers had hoped to end by pumping in hundreds of billions of dollars in recent months.And from the Fed Commercial Paper report, the A2/P2 less AA spread has risen to 82 bps. Note: This is the spread between high and low quality 30 day nonfinancial commercial paper.

The pressure partly reflects an end-of-quarter effect, as banks hoard cash to make sure their finances look healthy when they report second-quarter results.

But it also demonstrates that fears of further write-downs and possible failures aren't going away.

Perhaps it's a little premature to worry about a 4th wave, but these are worrisome signs.

Economic Poll: 75% Blame Bush

by Calculated Risk on 6/25/2008 06:51:00 PM

From the LA Times: Times poll: 75% blame Bush's policies for deteriorating economy

[A]ccording to a Los Angeles Times/Bloomberg poll ... Nine percent of respondents said the country's economic condition has become better off since Bush became president, compared with 75% who said conditions had worsened. Among Republicans, 42% said the country is worse off, while 26% said it is about the same, and only 22% thought economic conditions had improved.This is kind of like blaming the quarterback for a loss; there are many other factors (although I share the view that the Bush administration has done a poor job on economic matters). This is a very high level of pessimism, and is probably related to higher gasoline prices, something that is very visible to every American.

...

All together, 82% of respondents said the economy is doing badly, compared with 71% who felt that way when the question was asked in February. And the pessimism has intensified: 50% of respondents said the economy is doing "very badly," compared to 38% in February.

On energy:

Seventy percent of respondents said the rising cost of fuel had caused hardship for their families and the pain appeared spread across all income groups: 79% of people with incomes of less than $40,000 a year said the higher prices were a hardship, but so did 55% of respondents with incomes above $100,000.In general confidence polls are coincident indicators (they tell you what you already know about spending patterns), so this doesn't suggest anything about future consumer spending. But it's pretty clear that Americans are not happy.

More on Inferior Goods

by Calculated Risk on 6/25/2008 04:25:00 PM

Here is some more evidence of consumers shifting to inferior goods - from Bloomberg via the LA Times: Earnings jump 15% at Kroger, operator of Ralphs.

Consumers bought more store-branded products ...Generic or store-branded products are classic inferior goods. Sales for store-branded products typically increase during tough economic times, and decrease when times are good (as consumers shift back to name brands).

On the same store sales increase of 5.5% - isn't that just related to higher prices for food products?

Fed: No Rate Change

by Calculated Risk on 6/25/2008 02:12:00 PM

From the FOMC:

The Federal Open Market Committee decided today to keep its target for the federal funds rate at 2 percent.

Recent information indicates that overall economic activity continues to expand, partly reflecting some firming in household spending. However, labor markets have softened further and financial markets remain under considerable stress. Tight credit conditions, the ongoing housing contraction, and the rise in energy prices are likely to weigh on economic growth over the next few quarters.

The Committee expects inflation to moderate later this year and next year. However, in light of the continued increases in the prices of energy and some other commodities and the elevated state of some indicators of inflation expectations, uncertainty about the inflation outlook remains high.

The substantial easing of monetary policy to date, combined with ongoing measures to foster market liquidity, should help to promote moderate growth over time. Although downside risks to growth remain, they appear to have diminished somewhat, and the upside risks to inflation and inflation expectations have increased. The Committee will continue to monitor economic and financial developments and will act as needed to promote sustainable economic growth and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; Sandra Pianalto; Charles I. Plosser; Gary H. Stern; and Kevin M. Warsh. Voting against was Richard W. Fisher, who preferred an increase in the target for the federal funds rate at this meeting.