by Calculated Risk on 6/21/2008 12:35:00 AM

Saturday, June 21, 2008

Steve & Barry's: The Mall Vacancy Answer? Probably Not.

The WSJ has an article about fast growing retailer Steve & Barry's facing possible bankruptcy. This story has an interesting twist: Steve & Barry's Faces Cash Crunch

[S]ome of the forces pushing Steve & Barry's growth were not tied to end-consumer demand, but the needs of mall owners in a softening commercial-real-estate market. Much of the company's earnings came in the form of one-time, up-front payments from mall owners. Those payments were designed to lure the retailer to take over vacated sites, say several people familiar with the company.So the mall owner pays the tenant to take retail space that the the tenant can barely afford unless other mall owners pay the tenant to take additional space. And on and on.

Without these payments, the stores are barely profitable, if at all ...

This shows just how tough the mall leasing environment currently is.

Friday, June 20, 2008

MBIA: $2.9 Billion Required for Contract Terminations

by Calculated Risk on 6/20/2008 05:30:00 PM

UPDATE: from Yves Smith at Naked Capitalism: MBIA Downgrade Increases Collateral Requirements; Clarification on CDS Acceleration in Insolvency/Custodianship

MBIA Comments on the Impact of the Moody's Downgrade

As a result of the downgrade to A2, MBIA expects that it will require $2.9 billion to satisfy potential termination payments under Guaranteed Investment Contracts (GICs). In addition, MBIA expects to be required to post approximately $4.5 billion in eligible collateral to satisfy potential collateral posting requirements under GIC's as a result of the downgrade. MBIA Inc. has total assets of $25 billion related to its ALM business, of which $15.2 billion is available to satisfy these requirements including approximately $4.0 billion in cash and liquid short-term investments; $1.0 billion of unpledged eligible collateral on hand; and approximately $10.2 billion of other unpledged diversified securities with an average rating of Double-A. In addition, MBIA Inc. also has available another $1.4 billion in cash, including the proceeds of its recent equity offering.

S&P Research Downgrades BofA

by Calculated Risk on 6/20/2008 02:17:00 PM

From MarketWatch: S&P cuts Bank of America to sell from hold

"We take unfavorable note of the large Countrywide option-adjustable rate mortgage portfolio that Bank of America will inherit, since we believe this portfolio has yet to be stress tested," S&P said in its action.Not stress tested ... yet. The losses are coming for these Option ARM (and HELOC) portfolios.

More on Bear Stearns Indictment

by Calculated Risk on 6/20/2008 01:16:00 PM

Bloomberg has an overview: Bear Stearns Fund Prosecutors Reveal `Lot of Evidence' of Fraud

As I noted yesterday, the indictment contains several allegations that the managers knew specific material information about the condition of the funds, and then provided false information to investors. Bloomberg noted the same example I gave yesterday:

``It's very hard to say you weren't shading the truth in an important way when you say you had a couple of million dollars of redemptions when in fact you had $47 million,'' [Christopher Clark, a former federal prosecutor in New York] said.If the prosecutors can prove the managers knew certain material facts on a certain date, and then prove the managers told investors materially different facts on a subsequent date - IMO that is powerful evidence of securities fraud.

The WSJ has the indictment here. I think the actual indictment is much stronger than the flimsy evidence provided in the advance news stories.

Ford Warns on Sales

by Calculated Risk on 6/20/2008 11:04:00 AM

From MarketWatch: Ford delays new F-150 pickup, cuts truck production

[Ford] pared its 2008 U.S. industry sales forecast to a range of 14.7 million to 15.2 million cars and trucks, down from its previous projection of 15 million to 15.4 million vehicles. Ford cut its third-quarter production plans to 475,000 vehicles, 50,000 units lower than prior targets ...Apparently June auto sales are looking really weak according to this article in the Detriot Free Press:

[I]n November ... executives were assuming Americans would buy ... only about 15.5 million [vehicles in 2008]. ... [S]o far in June ... J.D. Power and Associates and Citigroup are seeing a sales pace that is almost 20% lower -- only 12.5 million vehicles per year.

Chris Thornberg: Possible 50% House Price Declines in SoCal

by Calculated Risk on 6/20/2008 10:24:00 AM

From Jon Lansner at the O.C. Register: SoCal home woes could mean 50% price drop

[Economist Chris] Thornberg, founding partner at Beacon Economics and former UCLA economics professor, said home prices would have to fall about 40% from peak to trough to return to the historical norm. But add in the impact of rising gasoline prices, the subprime mortgage meltdown and rising foreclosures, and it’s likely prices will fall 50% peak to trough.I think Dr. Thornberg is optimistic on the timing (he sees the price bottom in mid-to-late 2009). This might be true for low end areas, but I expect prices in the mid-to-higher end areas to be a little more sticky - so the price declines might take a few more years.

The S&P/Case-Shiller index shows that prices for the L.A./O.C. area are down 24% from the peak, so the region is about halfway to the bottom, Thornberg said.

In Orange County, price declines will be more severe at the bottom of the price spectrum than the top end, but “the top end is going to get hit, (too),” he said.

That will be a rude awakening for many homeowners suffering from what he called “homallucinations,” or the ability to convince oneself that while the price of everyone else’s home will fall, your neighborhood is clearly different.

BofA and Countrywide: July 1st Target Date

by Calculated Risk on 6/20/2008 09:16:00 AM

From the LA Times: The final days: BofA may swallow Countrywide by July 1

A Bank of America Corp. spokesman in Charlotte confirmed today that the company could complete its takeover of the loss-ridden mortgage giant by July 1.This is one of those deals that seemed destined to be renegotiated - and that never happened.

Countrywide shareholders are to meet on Wednesday at the firm’s Calabasas headquarters to vote on the deal. (Not that they have any real choice.)

Once it gets that approval, BofA could complete its stock swap by July 1.

...

Under terms of the deal, announced in January, BofA will exchange 0.1822 of its shares for each Countrywide share. When the takeover was announced on Jan. 11, BofA shares were at $38.50. That put a value of $7.01 a share on Countrywide.

Today, BofA’s stock fell 23 cents to $28.14, its lowest since 2001. That values Country- wide at $5.13 a share ...

Thursday, June 19, 2008

Night Music: Wall Street Meltdown

by Calculated Risk on 6/19/2008 10:35:00 PM

Wall Street Meltdown:

Inspired by the Richter Scales classic ("Here Comes Another Bubble):

Monthly GDP

by Calculated Risk on 6/19/2008 08:10:00 PM

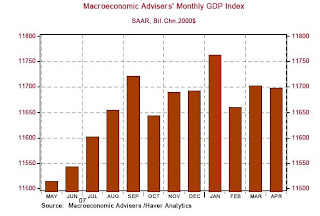

Here is a chart of monthly GDP from Northern Trust: Click on graph for larger image in new window.

Click on graph for larger image in new window.

Even though the average GDP in Q1 2008 was slightly higher than Q4 2007, on a monthly basis it appears GDP peaked in January - and for six of the last seven months (except January), GDP was lower than Sept '07.

Other measures of an economic recession, such as employment and industrial production, suggest the recession started in December '07 or January '08.

The question now is how long and deep the economic slump will be.

Moody's Downgrades MBIA and Ambac

by Calculated Risk on 6/19/2008 06:11:00 PM

Headlines and short story only now from MarketWatch:

Moody's downgrades MBIA to 'A2' from 'Aaa'Here come some more write downs for the banks associated with counterparties being downgraded.

Moody's downgrades Ambac to 'Aa3' from 'Aaa'