by Calculated Risk on 6/20/2008 10:24:00 AM

Friday, June 20, 2008

Chris Thornberg: Possible 50% House Price Declines in SoCal

From Jon Lansner at the O.C. Register: SoCal home woes could mean 50% price drop

[Economist Chris] Thornberg, founding partner at Beacon Economics and former UCLA economics professor, said home prices would have to fall about 40% from peak to trough to return to the historical norm. But add in the impact of rising gasoline prices, the subprime mortgage meltdown and rising foreclosures, and it’s likely prices will fall 50% peak to trough.I think Dr. Thornberg is optimistic on the timing (he sees the price bottom in mid-to-late 2009). This might be true for low end areas, but I expect prices in the mid-to-higher end areas to be a little more sticky - so the price declines might take a few more years.

The S&P/Case-Shiller index shows that prices for the L.A./O.C. area are down 24% from the peak, so the region is about halfway to the bottom, Thornberg said.

In Orange County, price declines will be more severe at the bottom of the price spectrum than the top end, but “the top end is going to get hit, (too),” he said.

That will be a rude awakening for many homeowners suffering from what he called “homallucinations,” or the ability to convince oneself that while the price of everyone else’s home will fall, your neighborhood is clearly different.

BofA and Countrywide: July 1st Target Date

by Calculated Risk on 6/20/2008 09:16:00 AM

From the LA Times: The final days: BofA may swallow Countrywide by July 1

A Bank of America Corp. spokesman in Charlotte confirmed today that the company could complete its takeover of the loss-ridden mortgage giant by July 1.This is one of those deals that seemed destined to be renegotiated - and that never happened.

Countrywide shareholders are to meet on Wednesday at the firm’s Calabasas headquarters to vote on the deal. (Not that they have any real choice.)

Once it gets that approval, BofA could complete its stock swap by July 1.

...

Under terms of the deal, announced in January, BofA will exchange 0.1822 of its shares for each Countrywide share. When the takeover was announced on Jan. 11, BofA shares were at $38.50. That put a value of $7.01 a share on Countrywide.

Today, BofA’s stock fell 23 cents to $28.14, its lowest since 2001. That values Country- wide at $5.13 a share ...

Thursday, June 19, 2008

Night Music: Wall Street Meltdown

by Calculated Risk on 6/19/2008 10:35:00 PM

Wall Street Meltdown:

Inspired by the Richter Scales classic ("Here Comes Another Bubble):

Monthly GDP

by Calculated Risk on 6/19/2008 08:10:00 PM

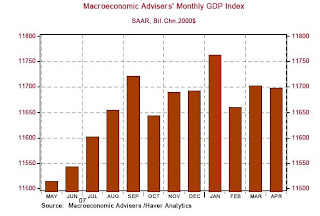

Here is a chart of monthly GDP from Northern Trust: Click on graph for larger image in new window.

Click on graph for larger image in new window.

Even though the average GDP in Q1 2008 was slightly higher than Q4 2007, on a monthly basis it appears GDP peaked in January - and for six of the last seven months (except January), GDP was lower than Sept '07.

Other measures of an economic recession, such as employment and industrial production, suggest the recession started in December '07 or January '08.

The question now is how long and deep the economic slump will be.

Moody's Downgrades MBIA and Ambac

by Calculated Risk on 6/19/2008 06:11:00 PM

Headlines and short story only now from MarketWatch:

Moody's downgrades MBIA to 'A2' from 'Aaa'Here come some more write downs for the banks associated with counterparties being downgraded.

Moody's downgrades Ambac to 'Aa3' from 'Aaa'

Recession: A "Wild Card" for Housing

by Calculated Risk on 6/19/2008 03:24:00 PM

From John Spence at MarketWatch: Builder execs nervous about jobs and the economy

Home-builder executives said at an industry conference Thursday that they're making progress clearing out excess inventory, but warned that a recession and spiking unemployment could stop that advance in its tracks.Yes, the homebuilders are finally building fewer homes than they are selling - so new home inventory is declining. But the huge overhang of existing homes on the market - especially distressed inventory - will keep housing under pressure for some time.

"No one who's unemployed ever bought a house," said Lawrence Angelilli, senior vice president of finance at Centex Corp. "That's the wild card that everybody is waiting to see is if we get a true economic recession."

Also, I think a few unemployed people did buy homes during the boom. NINJA loans were one of the big jokes: No Income, No Job, No Assets.

DOT: Americans Drove Fewer Highway Miles in April

by Calculated Risk on 6/19/2008 12:50:00 PM

From the Department of Transportation: Americans Drove 1.4 Billion Fewer Highway Miles in April of 2008 than in April 2007 While Fuel Prices and Transit Ridership Are Both on the Rise

[U.S. Transportation Secretary Mary E. Peters] said that Americans drove 1.4 billion fewer highway miles in April 2008 than at the same time a year earlier and 400 million miles less than in March of this year. She added that vehicle miles traveled (VMT) on all public roads for April 2008 fell 1.8 percent as compared with April 2007 travel. This marks a decline of nearly 20 billion miles traveled this year, and nearly 30 billion miles traveled since November.This is the fewest miles driven in April since 2003.

Bear Stearns Indictment

by Calculated Risk on 6/19/2008 12:25:00 PM

The WSJ has the indictment here.

According to the indictment, the managers knew material information about the condition of the funds, and then provided false information to other investors. As an example, the indictment alleges the managers knew of a major investor withdrawing their entire investment, but in answering direct questions about redemptions, falsely stated that fund redemptions would be minor.

Citigroup Expects Substantial Additional CDO Write Downs

by Calculated Risk on 6/19/2008 11:57:00 AM

Here are few headlines from the Citi conference call.

Impact of CDOs in quarter will be "substantial"

CDO Marks will not be as big as last quarter.

Consumer Credit remains a challenge.

Story to follow ...

Philly Fed: Manufacturing "Continued weakening", "Cost pressures widespread"

by Calculated Risk on 6/19/2008 11:35:00 AM

Here is the Philadelphia Fed Index for June activity released today: Business Outlook Survey.

Note the special question at the bottom on prices. The average expected price change this year is 5.4%!  Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph shows the Philly index vs. recessions for the last 40 years. There are a number of times the index was below zero without a recession - so the reading today doesn't mean the economy is in recession. However it is very likely that the economy is already in recession.

From the release, weaker conditions and higher prices :

Indicators Reflect Continued Weakening

The survey’s broadest measure of manufacturing conditions, the diffusion index of current activity, decreased slightly, from -15.6 in May to -17.1 this month. The index has now been negative for seven consecutive months.

More Manufacturers Report Higher Input Prices

A larger share of firms — 72 percent, up from 61 percent in May— reported higher input prices this month. The prices paid index jumped 16 points, to 69.3, its highest reading since November 1980. (see chart)

Outlook Is Less Optimistic

Following significant improvement in expectations over the last two months, the future general activity index retreated in June, falling from a May reading of 28.2 to 21.3. Forty percent of the firms expect growth in activity over the next six months; 18 percent expect a decline.

1. What impact are these recent cost increases having, or expected to have, on the prices of your finished products over the next three months? | |||

| We expect price decreases | 14.6% | ||

| We expect steady prices | 20.2% | ||

| We expect price increases | 65.2% | ||

| Less than 2.5% | 4.5% | ||

| Between 2.5-5% | 28.1% | ||

| Between 5-7.5% | 13.5% | ||

| Between 7.5-10% | 11.2% | ||

| Between 10-15% | 3.3% | ||

| Greater than 15% | 2.3% | ||

| No response | 2.3% | ||

| Total | 100.0% | ||

| Average expected price change | 5.4% | ||

| Average reported price increase* since the beginning of the year: | 3.8% | ||

*Firms were asked what increases in prices have already occurred since January.

| |||