by Calculated Risk on 5/21/2008 01:08:00 PM

Wednesday, May 21, 2008

Architecture Billings Index Remains Weak

From the American Institute of Architects: Architecture Billings Index Remains Weak Click on graph for larger image.

Click on graph for larger image.

After sinking to its lowest level ever in March, indicating a rapid slowdown in billings at U.S. architecture firms, the Architecture Billings Index (ABI) rose slightly in April. As a leading economic indicator of construction activity, the ABI shows an approximate nine to twelve month lag time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the April ABI rating was 45.5, up from the historic low mark of 39.7 in March (any score above 50 indicates an increase in billings). The inquiries for new projects score was 53.9.The key here is that the index fell off a cliff in early 2008, and that there is "an approximate nine to twelve month lag time between architecture billings and construction spending". We should expect weaker non-residential structure investment throughout 2008.

House Price Mosaic

by Calculated Risk on 5/21/2008 11:57:00 AM

Last night I posted a video from Jim the Realtor showing an area of Oceanside, CA with numerous REOs. Jim has an REO listing in the area and he sent me the details.

260 Securidad, Oceanside, California

2 Bedroom 1 Bath, 820 sq ft

The house sold for $318,000 in July 2004, and the owner refinanced a year later for a total of $375,000 in loans.

The house is now listed (REO) at $127,900, and there are several bidders (investors and owner-occupant buyers) and Jim believes the property will sell for between $140,000 and $150,000. Note: the house is in good condition (for what it is) and appears to be move-in ready.

This is about 55% off the previous sales price and even more off the apparent appraised value when the homeowner refinanced.

This brings up a key point: house price changes vary widely by area, not just by state, but even within cities.

*********** Click on graph for larger image.

Click on graph for larger image.

This graph shows the Case-Shiller Home Price Index for San Diego. Prices are off by about 24% from the peak in 2005 according to the Case-Shiller index, but the Oceanside REO is off by about 55%.

Obviously areas with numerous foreclosures have seen larger price declines than areas with fewer foreclosures.

The following map of Denver, from an article by Luke Mullins at U.S. News and World Report, illustrates this point. Some areas of Denver are being devastated by foreclosures, others are mostly untouched. From the USA Today: Mortgage defaults force Denver exodus

From the USA Today: Mortgage defaults force Denver exodus Foreclosures are ripping through the rows of new homes in the flatlands where Denver turns to prairie. Every week, 10 more families here need to find someplace else to live.

But prices in the areas untouched by foreclosures are actually flat, or in some cases have even increased slightly.

...

On some blocks, as many as one-third of the residents have lost their homes, making this one of the worst hotspots in a city that was among the first to feel the pinch of the foreclosure crisis. Many houses here remain empty, bank lockboxes on the front doors.

What does this mean for future prices? First, some areas are probably close to a price bottom. Looking back at the REO in Oceanside, we can see that this property is now attractive to investors. According to Jim, this property will rent for between $1000 to $1200 per month. Here is a simple cap rate calculation:

Cost: $140,000

Rent: $12,000 to $14,400 per year

Expenses:

Taxes (1% in California): $1,400 (note: no Mello Roos or HOA fees)

Vacancy: 5% or $600 to $720 depending on rent.

Maintenance and Insurance: $1,400 per year.

This yields a cap rate of between 6.1% and 7.8% depending on the rent. Investors provide a floor for house prices, and these are attractive cap rates for some small investors.

But what about prices for areas with fewer foreclosures? These prices are still sticky, but will continue to decline. From Peter Hong at the LA Times yesterday: At the luxury end, home prices are falling "You can't have one market hugely cheaper than another forever," said UC Berkeley professor Thomas Davidoff, who specializes in real estate.

Davidoff and others say the time lag stems from the fact that affluent homeowners generally don't have to sell under duress, unlike struggling borrowers facing escalating mortgage payments. But wealthy homeowners are increasingly finding out that if they want to sell their homes, they will need to discount the prices. In the end, the housing market is linked as shown by this graphic.

In the end, the housing market is linked as shown by this graphic.

Not all chain reactions start with a first time buyer using a subprime loan, but the loss of a large number of first time buyers will eventually impact the entire chain.

Over time the equilibrium between different price ranges will return, but the price dynamics will be different. Areas with a large number of REOs have seen much faster price declines - and are probably closer to the price bottom. Areas with fewer REOs will exhibit "sticky prices" and the prices will probably decline for some time.

World Savings Option ARM Training Video

by Tanta on 5/21/2008 11:56:00 AM

Channel 5 in San Francisco got its hands on some "training videos" used by World Savings--now owned by Wachovia--to teach brokers and loan officers how to originate their "Pick-A-Payment" negative amortization ARM. It's pretty disgusting:

But what concerns [housing advocate Maeve Elise] Brown even more was the way World Savings employees were instructed to answer questions about the minimum payment on those option ARM's.Unfortunately, I don't think very many borrowers probably asked that minimum-payment question. To think that those few who did would be fobbed off with the comment "it's optional" is nausea-inducing. It also strongly suggests, of course, that borrowers who didn't ask that question didn't find the brokers volunteering the information that making the minimum payment would increase the balance.

"So if I'm paying that minimum payment, I'm not actually putting a dent in my principal though right? My principal and interest they're just going to keep climbing up right?" the borrower asks in the video tape. "It's optional," the broker in the video replied.

"What kind of answer is that?" said Brown after watching the video. "The answer would really be 'Yes.' That's the right answer, that to me would be the true clear straightforward truthful simple answer."

And in still another scenario, the video instructs brokers to explain those loans. "Why would I offer a loan that has a negative amortization?" the broker asked. The World Savings representative replied: "Most brokers refer to them as negative amortization, but we try to use the words a little more user friendly, 'deferred interest.'"

(Hat tip to checker!)

Crackdown on Foreclosed Kids?

by Tanta on 5/21/2008 10:14:00 AM

Periodically I wonder how my life would have been different if, instead of becoming a heartless banker whose only concern is the bottom line, not human lives, I had devoted my career to something socially redeeming, like education of the young. Then I read the WSJ:

Some school districts, hoping to control costs and prevent overcrowding, are intensifying efforts to make sure students actually live where they are registered.I take it those parents who are spurring the school districts to hire PIs and open up

Districts from Florida to California are hiring private investigators, creating anonymous tip lines and imposing penalties when they believe people have registered at false addresses. The measures often are spurred by parents who feel they pay a premium in property taxes to get their children into good schools.

One reason for the crackdown is the rise in home foreclosures, which may prod parents into faking addresses to keep their children at their current schools, some in the field say.

"Foreclosure rates are up. Displacement is up. People are becoming homeless," says William Beitler, a private investigator specializing in address verification for school districts in the Chicago area. Mr. Beitler says he has contracts with 32 districts, up from 23 last year, and his caseload has increased to 7,000 from 3,000. He claims he will save districts a total of $12.2 million next year through removing students.

Which Ratings Model is Broken?

by Tanta on 5/21/2008 08:10:00 AM

Via naked capitalism, there is this ugly report in the Financial Times:

Moody’s awarded incorrect triple-A ratings to billions of dollars worth of a type of complex debt product due to a bug in its computer models, a Financial Times investigation has discovered.That's bad. That's really bad. But then there are these two paragraphs at the end of the article:

Internal Moody’s documents seen by the FT show that some senior staff within the credit agency knew early in 2007 that products rated the previous year had received top-notch triple A ratings and that, after a computer coding error was corrected, their ratings should have been up to four notches lower.

The world’s other major credit agency, Standard and Poor’s, was the first to award triple A status to CPDOs but many investors require ratings from two agencies before they invest so the Moody’s involvement supplied that crucial second rating.The implication here, that Moody's jiggered its model to arrive at the same ratings S&P had already arrived at--presumably to keep the "second opinion" business--is ugly. However, the implication that Moody's had to fudge the numbers in order to come up with AAA on these deals but S&P came up with AAA with a "correct" model is something I for one am having a hard time with.

S&P stood by its ratings, saying: “Our model for rating CPDOs was developed independently and, like our other ratings models, was made widely available to the market. We continue to closely monitor the performance of these securities in light of the extreme volatility in CDS prices and may make further adjustments to our assumptions and rating opinions if we think that is appropriate.”

Tuesday, May 20, 2008

Investors in Discussions to Buy GM Building

by Calculated Risk on 5/20/2008 10:36:00 PM

This is another followup to CRE: Bought at the top?. Basically NY developer Harry Macklowe bought seven New York office buildings at the price peak, with little down, and a personal guarantee for a portion of the loan. He was unable to refinance the short term debt, and he is now in default. Macklowe is trying to sell his other holdings - including the GM building - to satisfy the personal debt.

From the WSJ: Goldman, Boston Properties, Others In Talks to Buy Macklowe's GM Building

An investment group that includes Boston Properties Inc., Goldman Sachs Group Inc. and two Middle Eastern investors are in negotiations to buy the General Motors building along with up to three other properties from New York developer Harry Macklowe for $3.6 billion to $3.9 billion ...

... The deal would value the GM building at about $2.8 billion, $200 million less than what had been his minimum price.

The deal is designed to rescue Mr. Macklowe from financial ruin, but it isn't clear that this transaction would resolve his debts.

On the REO Trail

by Calculated Risk on 5/20/2008 06:29:00 PM

Here are a couple of recent videos from Realtor Jim in San Diego. The first video is in a run down area of Oceanside with REO after REO (2 min 19 sec).

The second video is in Valley Center (near Escondido). (2 min 21 sec) Jim mentions the Cash for Keys program (he is offering the previous owners $2500 for their keys). This house sold for $927,500 in 2005.

MMI: Fractured Fairy Tales

by Tanta on 5/20/2008 04:00:00 PM

Caroline Baum is exercised over Fannie Mae's recent announcement that it was dropping its "declining markets" policy. Yeah, so, a lot of us didn't like that.

But the rest of us did not write a column that is titled "Mary Had a Little Lamb and a Jumbo Mortgage" and then have this thing about kings and taxes and then Fannie turns out to be the fairy godmother, which is Cinderella, not Mary and the lambs, and then admits to perfect ignorance of what "DU" is and then makes claims about what DU is and then ends up predicting that Fannie will self-insure mortgages which would be like totally surprising since it would require the king to change Fannie Mae's charter which forbids such things, and dammit if you don't get all the way to the end and there aren't any jumbos in it. Boy howdy.

Cliff Diving: CIFG Guaranty's Bond Insurer Ratings

by Calculated Risk on 5/20/2008 03:27:00 PM

From Bloomberg: CIFG Guaranty's Bond Insurer Ratings Cut to Junk (hat tip DD49)

CIFG Guaranty, the bond insurer that lost its AAA ratings in March, was downgraded to below investment grade by Moody's Investors Service, which said the company may become insolvent.From AAA to Junk in two months! Yeah, I'd call that Cliff Diving.

The ratings were cut seven levels to Ba2, two steps below investment grade, from A1 to reflect ``the high likelihood that, absent material developments, the firm will fail minimum regulatory capital requirements,'' Moody's said in a statement.

...

``CIFG demonstrates the cliff-like nature of these events,'' said Thomas Priore, chief executive officer of hedge fund Institutional Credit Partners LLC in New York. ``Depending on the language in the credit-default swap, it can set off a chain of events that creates a complete unwind of the company.''

DataQuick: California Bay Area Home Sales Up from March

by Calculated Risk on 5/20/2008 02:11:00 PM

From DataQuick: Bay Area home sales edge up in April

Bay Area home sales edged up from a seven-month run of record lows last month, indicating that mortgage availability is improving and that an increasing number of fence sitters have decided they like today's lower prices, a real estate information service reported.

A total of 6,310 new and resale houses and condos sold in the nine- county Bay Area in April. That was up 28.8 percent from 4,898 in March, and down 15.3 percent from 7,447 for April 2007, DataQuick Information Systems reported.

The month-to-month jump was the strongest for any March/April in DataQuick's statistics, which go back to 1988. Starting last September and through March, each calendar month was the slowest on record. Last month was the slowest April since 1995 when 5,636 homes were sold.

"The big issue here is that mortgages are becoming obtainable, which will reduce the pile of stacked up pending escrows. It's unclear if the financing is because of policy changes or because mortgage investors are getting more interested in securities. Probably both," said Marshall Prentice, DataQuick president.

The median price paid for a Bay Area home was $518,000 last month, down 3.4 percent from $536,000 in March, and down 21.4 percent from $659,000 in April last year. Last month's median was 22.1 percent lower than the peak median of $665,000 reached in June and July last year.

...

Foreclosure property resales accounted for 25.7 percent of last month's Bay Area market. The percentage is higher in outlying areas that absorbed spillover activity during the frenzy. While foreclosure properties were 5.9 percent of San Francisco's resale market and 8.9 percent of Marin's resale market last month, they were 44.7 percent in Contra Costa and 54.2 percent in Solano.

...

Foreclosure activity is at record levels ...

Philly Fed State Coincident Indicators for April

by Calculated Risk on 5/20/2008 12:00:00 PM

From the Philadelphia Fed:

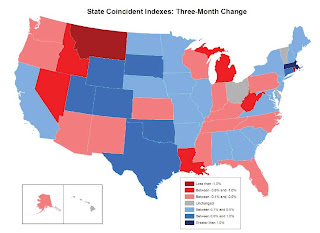

The Federal Reserve Bank of Philadelphia produces a monthly coincident index for each of the 50 states. The indexes are released a few days after the Bureau of Labor Statistics (BLS) releases the employment data for the states.Here is the release for April:

The indexes increased in 26 states for the month, decreased in 16, and were unchanged in the remaining eight (a one month diffusion index of 20). For the past three months, the indexes increased in 25 states, decreased in 21, and were unchanged in the other four (a three month diffusion index of eight).

Click on graph for larger image.

Click on graph for larger image.This is a graph of the monthly Philly Fed data of the number of states with increasing activity.

I've added the current probable recession. About half of the U.S. was in recession in April based on this indicator.

Note: the Philly Fed calls some states unchanged with minor changes. The press release says there were 26 states with increasing activity, but including small changes, there were 28 (as graphed).

This map is from the Philly Fed report for April, and shows the Three Month change for all 50 states. If the economy is in recession, this map should turn very red over the next few months.

California is definitely in recession by most measures, but the Philly Fed Three Month change shows the state economy is still growing slightly. This is probably true for other states too, and I expect the map to turn more and more red in the coming months.

For comparison to April, here is the December 2007 map (bottom).

For comparison to April, here is the December 2007 map (bottom).Clearly there is more red in the April (top) map as the recession spreads.

Oppenheimer: Credit Crisis Will Extend Into 2009

by Calculated Risk on 5/20/2008 10:08:00 AM

From Bloomberg: Credit Crisis Will Extend Into 2009, Oppenheimer Says

The U.S. credit crisis will extend into and even beyond 2009 as banks will write off more than $170 billion of additional reserves by the end of next year, according to Oppenheimer & Co. estimates.From the report titled: Far From Over: We Believe The Credit Crisis Will Extend Well Into 2009

``The real harrowing days of the credit crisis are still in front of us and will prove more widespread in effect than anything yet seen,'' analysts led by Meredith Whitney wrote in a research note today. ``Just as strained liquidity pushed so many small and mid-sized specialty finance companies to beyond the brink, we believe it will do the same with the U.S. consumer.''

"... in our opinion the "next shoe to drop," is what became an over-reliance on the securitization market for consumer liquidity. Herein, we draw a direct correlation between a shutdown in securitization volumes and accelerating losses on bank balance sheets. As we see no near or medium term come back in securitization volumes, we believe losses will only accelerate further and far worse than even the most draconian estimates."And the opposite view: TED Spread at Nine-Month Low, Signals Credit Easing

Lending confidence at banks rose to the highest level in more than nine months, according to a key indicator, signaling the global credit crunch may be easing.

The so-called TED spread, the difference between what the U.S. government and banks pay to borrow in dollars for three months, dropped below 78 basis points for the first time since August.

...

``The worst of the fears about the liquidity crisis appear to be alleviating,'' said Peter Jolly, head of markets research in Sydney at NabCapital, the investment-banking arm of National Australia Bank Ltd. ``Liquidity is becoming more available ever since the bold moves by the Fed.''

Home Depot: "Home-improvement conditions worsened"

by Calculated Risk on 5/20/2008 09:04:00 AM

From the WSJ: Home Depot's Net Falls 66% As Homeowners Cut Projects

Home Depot Inc. reported a 66% drop in fiscal first-quarter net income, thanks in part to restructuring charges, as it continues to suffer amid economic conditions that have been discouraging homeowners from spending on home-improvement projects.This is not a surprise. And it could get much worse.

...

"The housing and home-improvement markets remained difficult in the first quarter. In fact, conditions worsened in many areas of the country," Chairman and Chief Executive Frank Blake said.

Freddie Mac's Balance Sheet

by Tanta on 5/20/2008 08:53:00 AM

Last week--I think it was last week--CR asked me at one point if I were going to write anything about Freddie's financials and the FAS 157 Uproar and I remember saying that our blog colleague Accrued Interest had just that day remarked that he might well write about the subject. I therefore fervently hoped he would do so, and I could just link to it, which would save me the trouble of having to have my own opinion.

So he finally got around to it. Go read it. It's well worth your time.

Trash Outs and Cash For Keys

by Tanta on 5/20/2008 08:19:00 AM

Here's a wee bit of cognitive dissonance with your coffee, courtesy of TheStreet.com:

Neighborhoods across the U.S. are being ransacked.I have been wanting some real numbers--not just a few splashy anecdotes--about the "trash out" thing. This is because it's exactly the sort of car-crash story the press loves, so it's the sort of thing always in danger of getting overstated (like the "burn outs").

In fact, about 50% of homes have substantial damage following foreclosure, according to a survey of 1,500 real estate agents by Campbell Communications in Washington, D.C. (This is not just due to homeowners looting their foreclosing properties; some do not have the financial capabilities for the home's upkeep, and other times vandals are responsible.)

To keep real estate agents from being left to sell homes with floor and carpet damages, holes in the wall, and removed appliances, a preventive measure is being offered to homeowners facing foreclosure known as "cash for keys."

The thing is, "trash outs" have as far as I know existed ever since the invention of foreclosure; they were simply rather rare. Not that most foreclosed homes were ever in pristine condition. But that's the thing: for most of my experience in this business the vast majority of REO damage was in fact due to the mortgagor's inability to afford repairs (indeed, the exploding water heater that damaged several hundred square feet of carpet might well have been the financial catastrophe that sent a struggling household into foreclosure in the first place). The rest was a function of vacancy: either vandalism or simply weather damage like frozen pipes, green pools, brown lawns, etc.

So I'm a touch skeptical about the claim that 50% of REO has "substantial damage" and most of that is willful trashing of the property. It would have been nice for the reporter to supply the details here. I became even more skeptical when I read this:

Lenders see cash for keys as a small price to pay when compared with the cost of repairs. Indeed, the price impact when people damage their houses can be up to 25% of what the home is worth, according to Campbell Communications. (That means a $400,000 home's repairs might cost around $100,000.)I freely admit it has been a while since my wrinkled reptilian snout has had to read a lot of detailed repair estimates. However, I think I need someone to explain to me how anyone can do $100,000 worth of damage to a three-bedroom two-and-a-half bathroom home with doors that are not wide enough to admit a backhoe. I suppose it's possible, but can the average repair bill be even close to that?

Then there's this:

How many people are biting?Having been assured by all kinds of people that homeowners are just ruthlessly walking away, I'm struggling with the idea that they're too pissed to collect an extra couple grand for the keys. They'd rather "mail them in" and get nothing? Because this might have something to do with their credit ratings? They really think they can make more than $3,000 net ripping out the furnace and selling it on eBay? That's easier than taking a check from the servicer?

It depends. Cash for keys is not always considered a bargain by homeowners. Losing their home and credit is a heavy burden.

"Most people don't want cash for keys," says the researcher Popik. "They want their credit ratings to stay intact."

My theory is that whenever the emerging popular narratives are this contradictory--homeowners are cold and calculating enough to just walk away from an upside-down investment, but they are also emotional and irrational enough to prefer the revenge of knocking holes in the drywall to getting a check to cover moving expenses; they can afford their mortgages but choose not to pay them, but they also can't afford basic maintenance before the foreclosure; they care about their credit ratings except they don't care about their credit ratings; they are the victims of servicers who won't answer the phone, but they are also bitter people who thumb their noses at a generous check the servicer is offering--we have an excellent opportunity to recognize that:

1. The category "homeowner" is extremely diverse.

2. All kinds of people do all kinds of things for all kinds of reasons, not all of which are obvious to anyone including the people who do these things.

3. Any discussion of "psychology" that assumes a universal, perfectly consistent and easily-predictable human response to falling home values or foreclosures is not a very sophisticated understanding of human psychology (Hi, Dr. Shiller!).

4. Any argument about "bailouts" that seems to depend on characterizing all homeowners in the same way, and imputing to them all the same experiences and motives and the same responses to incentives or disincentives, is not worth listening to.

5. I wouldn't hang a dog on the basis of a survey of real estate agents at this point.

Monday, May 19, 2008

The Boat Repo Man

by Calculated Risk on 5/19/2008 11:19:00 PM

“I used to take the weak ones. Now I’m taking the whole herd.”From David Streitfeld at the NY Times: Economic Tide Is Rising for Repo Man

Boat Repo Man Jeff Henderson

Some people lose their house or their boat to abrupt setbacks: illness, job loss, divorce. [49-year-old Robert] Dahmen, who works as a technology manager for a car manufacturer, belongs to a second, probably larger group: he simply spent beyond his means. He is one of the millions of reasons the consumer-powered American economy did so well for most of this decade, and one of the reasons its prospects look so bleak now.There is much more in the article about the boat repo business.

...

He originally bought a smaller, more affordable boat, but a salesman talked him into an upgrade. “Oh yeah, I said, that would be cool.”

...

The merriment came at a price, though. Toy Box cost $175,000.

... Meanwhile, he lost his condominium when his mortgage readjusted and those payments went up. His 401(k) is down to $9,000.

“I oversaturated myself with long-term debt,” he said. “It was a risk, a calculated risk. I obviously lost.” He is declaring bankruptcy.

...

From now on, Mr. Dahmen said, the consumer economy would have to get by without him. “I have no intention of ever buying anything, ever,” he said. “I don’t think I could if I wanted to.”

Class Action Salad

by Tanta on 5/19/2008 05:30:00 PM

I fear that if the complaint in this case is written with anything like the care and clarity of this press release, Downey probably has little to worry about.

The Complaint charges that Downey and certain of its officers and directors violated federal securities laws by issuing materially false statements regarding the Company's financial results. Specifically, the Complaint alleges that defendants concealed the following: (i) Downey's portfolio of Option ARMs contained millions of dollars worth of impaired and risky securities, many of which were backed by subprime mortgage loans; (ii) prior to the Class Period, Downey had seen Countrywide's growth and had started to get more aggressive in acquiring loans from brokers such that the loans were extremely risky; (iii) defendants failed to properly account for highly leveraged loans; (iv) Downey had very little real underwriting, which led to large numbers of bad loans; and (v) Downey had not adequately reserved for Option ARM loans, which provided that during the initial term of the loan borrowers could pay only as much as they desired with any underpayment being added to the loan balance.I can't wait to find out what the evidentiary standard is for (ii).

Senate Reaches Deal on Housing Bill

by Calculated Risk on 5/19/2008 05:01:00 PM

From Reuters: U.S. senators say have deal on housing rescue bill

The two top members of the U.S. Senate Banking Committee announced on Monday that they have a deal that will create a multi-billion dollar mortgage rescue fund and a new regulator for Fannie Mae and Freddie Mac.No specifics yet.

And from the WSJ: New Housing Deal Reached

The committee didn't immediately release details of the agreement and what changes had been made to the bill. The legislation combines the regulatory reforms for government-sponsored enterprises Fannie Mae and Freddie Mac with a proposal to use the Federal Housing Administration to offer up to $300 billion in federal guarantees to help refinance struggling borrowers into new mortgage loans.

DataQuick on SoCal: Sales "Surge" in March, Off 19% from last year

by Calculated Risk on 5/19/2008 01:19:00 PM

From DataQuick: Southland home sales highest in eight months

Southern California home sales surged last month to the highest level since August as bargain shoppers took advantage of price slashing. Although some higher-end costal markets also posted gains, the swell in transactions mainly reflects more sales of homes under $500,000 in inland areas where depreciation and foreclosures have been greatest, a real estate information service reported.This is interesting. The pickup in sales is mostly in the areas with steep price declines and severe foreclosure activity (like the Inland Empire).

A total of 15,615 new and resale houses and condos sold in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties in April. That was up 21.9 percent from 12,808 the previous month but down 19 percent from 19,269 in April last year, according to DataQuick Information Systems.

Sales from March to April have risen on average 1.2 percent since 1988, when DataQuick's statistics begin. Although last month's sales total was the highest for any month since August 2007, when 17,755 homes sold, it was still the weakest April since April 1995, when 15,303 homes sold, and the second-lowest April on record. Last month was 38 percent below of the April average of 25,311 sales.

Post-foreclosure homes continued to play a major role in the Southland market. Of all the homes that resold in April, 37.5 percent had been foreclosed on at some point in the prior 12 months, compared with a revised 35.8 percent in March and 4.6 percent a year ago. Across the six-county area, "foreclosure resales" ranged from 26.9 percent of resale activity in Orange County to 52.7 percent in Riverside County.

Last month's upswing in sales was most pronounced for homes priced under $500,000, which accounted for two-thirds of the Southland's sales gain over March. Riverside County, the epicenter of Southland foreclosure activity and price declines, posted the region's only year-over-year sales increase -– that county's first in two years.

...

"Quite a few more buyers stepped off the sidelines last month to snap up homes at substantial discounts relative to the market's short-lived peak," said Marshall Prentice, DataQuick president. "It's no surprise, given the magnitude of the price declines in inland areas and the fact sales have been so amazingly low for so long. We continue to look for evidence of a sales bounce in the mid-priced and higher-end markets along the coast. If the higher conforming loan limits are making a difference in those areas, it's certainly not a large one, at least not as of the end of April."

The median price paid for a Southland home was $385,000 last month, unchanged from March but down 23.8 percent from the peak median of $505,000 in April 2007.

...

Foreclosure activity is at record levels ...

emphasis added

Moody's: CRE Prices Fall 2.3% in March

by Calculated Risk on 5/19/2008 12:16:00 PM

From Reuters: US Commercial property price fall most since 2000 -Moody's

Moody's said prices of retail properties have dropped 5.7 percent from their peak in 2007, compared with declines of 3.4 percent for apartment buildings and 2.3 percent for industrial real estate, respectively. Office property prices are down 2 percent from their peak, according to quarterly data.The CRE bust is here.

On a monthly basis, commercial property prices fell 2.3 percent in March, the most since Moody's began collecting the data in 2000.