by Calculated Risk on 3/06/2008 12:27:00 PM

Thursday, March 06, 2008

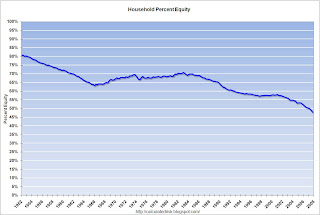

Fed: Household Percent Equity Plummets in Q4

The Fed released the Q4 Flow of Funds report today: Flow of Funds.

The Fed report shows that household real estate assets decreased from $20.325 Trillion in Q3 to $20.155 Trillion in Q4. That is a decline of $170.2 billion.

When we subtract out new single family structure investment and residential improvement, the value of existing household real estate assets declined by $282 Billion.

The simple math: Decrease in household assets: $20,154.7 billion minus $20,324.9 billion equals minus $170.2 billion. Now subtract investment in new single family structures ($259.7 Billion Seasonally Adjusted Annual Rate) and improvements ($187.2 Billion SAAR). Note: to make it simple, divide the SAAR by 4.

Finally negative $170.2B minus $259.7/4 minus $187.2B/4 equals a decline in existing assets of $282 Billion.

Household percent equity was at an all time low of 47.8%. Click on graph for larger image.

Click on graph for larger image.

This graph shows homeowner percent equity since 1952. Even though prices have risen dramatically in recent years, the percent homeowner equity has fallen significantly (because of mortgage equity extraction 'MEW'). With prices now falling - and expected to continue to fall - the percent homeowner equity will probably decline rapidly in the coming quarters.

Note: approximately 31% of household have no mortgage. So the 50+ milllion households with mortgage have far less equity than 47.8%. The second graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP is now declining, although mortgage debt as a percent of GDP still increased slightly in Q4.

The second graph shows household real estate assets and mortgage debt as a percent of GDP. Household assets as a percent of GDP is now declining, although mortgage debt as a percent of GDP still increased slightly in Q4.

This is just the beginning. If house prices fall 20%, households will lose $4 trillion in equity. If they fall 30%, households will lose $6 trillion in equity.

S&P: "Recessionary pressures" to Impact Housing

by Calculated Risk on 3/06/2008 11:17:00 AM

There are some negative comments on housing and the economy in a Standard & Poor's press release today downgrading Washington Mutual (no link yet): S&P Cuts Rtgs On WAMU; Put On Watch Neg

"These rating actions reflect our expectations for a more severe residential mortgage credit cycle than we had anticipated at the start of 2008," said Standard & Poor's credit analyst Victoria Wagner. "We now believe that the severity of losses on all residential mortgages will be higher that we had thought and that the weak housing market will now be a longer cycle. This adds to the time frame to resolve foreclosed properties and the cost to carry these nonperforming assets."And on recessionary pressures:

emphasis added

Our overall view of the recessionary pressures in the economy is also now more negative. We expect that this change in the external environment will push loan losses and loan delinquencies much higher than we previously factored into the WAMU ratings ...

More on Record Foreclosures

by Calculated Risk on 3/06/2008 10:34:00 AM

Here are a few quotes:

From CNNMoney: Foreclosures hit all-time high

"Declining home prices are clearly the driving factor behind foreclosures, but the reasons and magnitude of the declines differ from state to state," said Doug Duncan, MBA's Chief Economist said in a prepared statement.From AP: Home Foreclosures Hit Record High

From Bloomberg: U.S. Mortgage Foreclosures Rise as Owners `Give Up'

``U.S. mortgage foreclosures rose to an all-time high at the end of 2007 as borrowers with adjustable-rate loans walked away from properties before their payments rose, the Mortgage Bankers Association said today.These quotes hit on several key points: Declining prices is the driving force behind foreclosures, foreclosures are at record levels and the foreclosure rate is expected to continue to increase, and people are giving up "before they get the reset". All points we've discussed before.

``We're seeing people give up even before they get to the reset because they couldn't afford the home in the first place,'' said Jay Brinkmann, vice president of research and economics for the Washington-based trade group.

Fire Sales and Margin Calls

by Calculated Risk on 3/06/2008 10:13:00 AM

From Housing Wire: UBS Rumored to Have Dumped $24 Billion in Alt-A RMBS

From the WSJ: Carlyle Capital Adds to Fears Of Forced Sales

Carlyle Capital Corp., a listed investment company managed by a unit of private-equity firm the Carlyle Group, added to worries about forced liquidations of residential mortgage-backed securities after failing to meet margin calls on its $21.7 billion portfolio Wednesday.Talk about leverage.

...

The company leverages its $670 million equity 32 times to finance a $21.7 billion portfolio of residential mortgage-backed securities issued by U.S. housing agencies Freddie Mac and Fannie Mae. All of the securities are rated Triple-A and are considered to be implicitly guaranteed by the U.S. government.

MBA: Foreclosures Hit Another Record

by Calculated Risk on 3/06/2008 10:03:00 AM

From MarketWatch: U.S. foreclosures hit another record high, MBA says

The percentage of mortgages that were in foreclosure hit a record high in the fourth quarter, while mortgage delinquencies rose to a 23-year high, the Mortgage Bankers Association said Thursday. A record 2.04% of U.S. mortgages were somewhere in the foreclosure process at the end of the year, while a record-high 0.83% of loans entered foreclosure in the fourth quarter ...

Wednesday, March 05, 2008

Thornburg Mortgage: "Material" Default

by Calculated Risk on 3/05/2008 06:30:00 PM

Thornburg Mortgage filed a form 8-K with the SEC today warning of a material event: (hat tip RW)

Thornburg Mortgage, Inc. (the “Company”) has entered into reverse repurchase agreements, a form of collateralized short-term borrowing, with various counterparties.

The Company received a letter from JPMorgan Chase Bank, N.A. (“JPMorgan”), dated February 28, 2008, after failing to meet a margin call of approximately $28 million. The letter states that an Event of Default as defined under that certain Master Repurchase Agreement, dated as of August 3, 2006, as amended on February 7, 2007 by and between the Company and JPMorgan (the “Agreement”) exists. The letter also notified the Company that JPMorgan will exercise its rights under the Agreement. The aggregate amount of proceeds lent to the Company under the Agreement was approximately $320 million.

The Company’s receipt of the notice of an event of default has triggered cross-defaults under all of the Company’s other reverse repurchase agreements and its secured loan agreements. The Company’s obligations under those agreements are material.

Merrill Lynch Discontinues First Franklin Mortgage Origination

by Calculated Risk on 3/05/2008 05:52:00 PM

Press Release: Merrill Lynch Discontinues First Franklin Mortgage Origination (hat tip jkinthewoods)

Merrill Lynch (MER) said today that it is discontinuing mortgage origination at its First Franklin subsidiary in the United States and will explore the sale of Home Loan Services, a mortgage loan servicing unit for First Franklin.Merrill Lynch bought First Franklin in late 2006 for $1.3 Billion. This included both the mortgage origination business and the Home Loan Services servicing business.

...

About 650 people will be affected by the discontinuation of mortgage origination at First Franklin and First Franklin's NationPoint division. The firm estimates total charges, primarily severance and real estate costs related to this matter, for 2008 of approximately $60 million, of which approximately half will be recorded in the first quarter.

Fed's Beige Book: "Generally downbeat"

by Calculated Risk on 3/05/2008 02:08:00 PM

A few excerpts from the Fed's Beige book:

Consumer Spending:

Reports on retail spending were generally downbeat, although Boston, St. Louis, and Dallas described sales as mixed and Kansas City reported that consumer spending was "largely unchanged" since the previous survey period. The majority of Districts characterized sales as below plan, downbeat, weak, or having softened.Manufacturing:

Reports on the manufacturing sector were mixed but, on the whole, subdued. New York, Philadelphia, Richmond, Kansas City, and Dallas indicated that production or shipments were sluggish or falling. Atlanta, Minneapolis, and San Francisco characterized activity as varying across industries. Boston, Cleveland, and Chicago indicated stable levels or trends. Only St. Louis noted a strengthening relative to prior reports.Residential Real Estate:

Residential real estate markets were generally weak over the last couple of months. Sales were low in every District with very few local exceptions ... Districts that reported home prices all saw overall declinesAnd on CRE:

The markets for office and retail space showed signs of a slowdown in several Districts. Office vacancies were reported up, and leasing volumes down, in Manhattan, Baltimore, Washington, D.C., Memphis, portions of Maine and Rhode Island, and Las Vegas. Districts indicated that office vacancies held steady in Boston and the Carolinas, and were down in Philadelphia and in the Minneapolis and St. Louis Districts; however, contacts in the Boston and Philadelphia Districts and see some emerging slack.Overall a downbeat report.

...

Retail vacancy was reported up in the Minneapolis District and retail space demand was described as slow in the Chicago District. Demand for industrial space was described as either "firm" or "flat" in the Districts commenting on that sector.

Here is the December 1990 Beige Book (to compare to a previous recession).

Ambac to Sell Common Stock and Equity Units

by Calculated Risk on 3/05/2008 01:34:00 PM

Ambac has filed with the SEC to sell common stock and equity units.

Here is the press release: Ambac Financial Group, Inc. Announces Commencement of Simultaneous Common Stock and Equity Unit Offerings

Ambac Financial Group, Inc. (NYSE:ABK - News) (Ambac) today announced that it has commenced a public offering for at least $1 billion worth of shares of its common stock, par value $0.01 per share ("Common Stock"). Ambac has also granted the underwriters in that public offering a 30-day option to purchase from Ambac additional shares of Common Stock to cover over-allotments, if any.

In addition, Ambac announced that it has concurrently commenced a public offering of Equity Units, with a stated amount of $50 per unit for a total stated amount of $500 million. Ambac has also granted the underwriters a 30-day option to purchase additional Equity Units to cover over-allotments, if any.

Ambac Deal May Be Imminent, Stock Halted Ahead of News

by Calculated Risk on 3/05/2008 12:24:00 PM

Shares of bond insurer Ambac Financial(ABK) were halted pending news.