by Calculated Risk on 2/28/2008 04:25:00 PM

Thursday, February 28, 2008

Wells Fargo: New Tighter Mortgage Guidelines

Blown Mortgage has the details: Wells Fargo Names Most of California Severely Distressed

Wells Fargo has named nearly every California county a “Severely Distressed Market” which requires LTV reductions of 5% for any conforming loan over 75% LTV and also eliminates financing over 75% LTV for any non-conforming loan. The Wells Fargo Mortgage Express product (which is Wells Fargo’s stated income/stated asset program) is also not permitted in “Severely Distressed Market” areas.And from the BizJournals.com: Wells Fargo tightens mortgage guidelines (hat tip Michael)

Look for the rest of the market leaders to quickly follow suit. This immediately puts a huge swath of the state with increasingly limited refinance options. A huge portion of California loans are of the non-conforming variety and well over the 75% LTV mark ...

The tougher lending standards take effect Feb. 29 ...

Twenty counties in California, including Los Angeles County and Orange County, are on the severely distressed markets list. At-risk markets around the country include 33 in Florida, 15 each in Michigan and Virginia, and 13 each in Maryland and Ohio. Many other states, including Arizona, Colorado, Connecticut, Louisiana, Massachusetts, Minnesota, New York, Nevada, New Jersey, Washington and Wisconsin had markets on the list.

Tim Duy's Fed Watch

by Calculated Risk on 2/28/2008 03:12:00 PM

From Dr. Tim Duy at Economist's View: This Train Doesn’t Stop

A choice has to be made in the short run. Focus on inflation, and hold policy relatively tight? Or focus on growth, hoping that soft economic growth will tame inflationary pressures? The Fed continues to choose the latter path.And on inflation:

...

The die is cast. Look for another 50bp in March and then two more 25bp cuts at subsequent meetings to bring the Fed Funds rate to 2%.

Inflationary pressures are building globally (note that China is completing the chain that leads to an inflationary spiral, setting the expectation that high inflation will be matched by higher wages), reflected in surging commodity prices and the freefall of the dollar. The former is weighing heavily on US consumers. Indeed, I am amazed that this story is only starting to capture the attention of the press. So much attention is placed on the housing market as the source of declining consumer confidence, but over the last three months, headline CPI has surged 6.8% annualized. Sure doesn’t look like nominal wages gains are keeping up. No wonder confidence is collapsing.Tim Duy is very good at looking inside the Fed's thinking. Unfortunately, the situation isn't pretty.

And I sense it’s going to get worse ...

Bankrate: Fixed Mortgage Rates at Highest Since October

by Calculated Risk on 2/28/2008 11:48:00 AM

From Bankrate.com: Fixed Mortgage Rates at 4-Month High

Fixed mortgage rates increased for the third week in a row, with the average conforming 30-year fixed mortgage rate now 6.41 percent.

(graphic from Bankrate.com)

Holden Lewis at Bankrate.com writes: Fixed rates up, ARMs decline

ARMs are becoming more compelling each week, and this week is no exception, as the most popular fixed rate went up while adjustable rates went down.From Chairman Bernanke yesterday: Bernanke says 'we have a problem' controlling long-term mortgage rates

The benchmark 30-year fixed-rate mortgage rose 4 basis points, to 6.41 percent, according to the Bankrate.com national survey of large lenders. A basis point is one-hundredth of 1 percentage point. The mortgages in this week's survey had an average total of 0.4 discount and origination points. One year ago, the mortgage index was 6.2 percent; four weeks ago, it was 5.88 percent.

'We have a problem, which is that the spreads between the Treasury rates and lending rates are widening, and our policy is essentially, in some cases just offsetting the widening of the spreads, which are associated with signs of illiquidity,' Bernanke told the House Financial Services Committee.The Bernanke conundrum: In the short term, the more he cuts short rates, the more certain long rates may rise.

'So in that particular area, it's been more difficult to lower long-term mortgage rates through Fed action,' he said.

Freddie Mac: $2.5 billion Loss, CEO "Extremely Cautious"

by Calculated Risk on 2/28/2008 10:43:00 AM

Housing downturn leads to Freddie Mac losses The weakened U.S. housing market took a toll on Freddie Mac's bottom line in the fourth quarter and for 2007 as a whole, the mortgage-finance giant said Thursday as it reported worse-than-expected financial results.The company is "extremely cautious" just as everyone is calling for an expanded role in mortgage lending for Freddie and Fannie. I expect more visits to the confessional.

Richard Syron, Freddie Mac's chief executive, also said the company's "extremely cautious" as 2008 moves forward.

McLean, Va.-based Freddie posted a quarterly net loss of $2.5 billion ...

Fannie Mae New Rules for Appraisals

by Tanta on 2/28/2008 08:17:00 AM

To refresh memories: Last fall, New York AG Andrew Cuomo sued an outfit called eAppraiseIt and its parent company, First American, for conspiring with WaMu to pressure appraisers to produce inflated appraised values. WaMu was not part of the suit, since for legal reasons state AGs can't sue federally-chartered thrifts in state court. Fannie Mae and Freddie Mac were not being sued either, but they were quickly served with subpoenas for documentation involving inflated appraisals on loans they may have purchased. The GSEs quickly agreed to appoint independent examiners to review appraisal practices, with the direct threat that lenders would be forced to buy back loans that failed to meet existing GSE rules.

It appears that Fannie Mae has finished or nearly finished its review, and is about to ruin several very large aggregators' and thousands of pissant brokers' day with a new set of rules regarding how appraisals can be obtained and what affiliations between lender and appraiser are acceptable:

Feb. 27 (Bloomberg) -- Fannie Mae, the biggest source of financing for U.S. home loans, told lenders it will probably ban their use of appraisals by in-house employees or those arranged by brokers.My observations:

Fannie Mae distributed the proposal, a response to New York Attorney General Andrew Cuomo's yearlong mortgage probe, to lenders in a ``talking points'' memo this week, according to a person familiar with the document. The memo was published on American Banker's Web site yesterday.

``It would be a monumental change because it would require a shift in the way that the lending industry does business,'' said Jonathan Miller, chief executive officer of Manhattan-based appraisal company Miller Samuel Inc. and a longtime proponent of creating a firewall between residential appraisers and mortgage originators. ``I think it would be tremendous.'' . . .

``Fannie Mae wishes to cooperate with the New York AG's investigation and, as part of a cooperation agreement, will likely agree to a number of items,'' according to the memo.

The proposed changes include banning Fannie Mae's partners from using appraisers employed by their wholly owned subsidiaries. Mortgage lenders that own appraisal companies include Countrywide Financial Corp., the nation's largest home- loan originator.

The restrictions would apply to loans acquired after Sept. 1, according to the memo. Fannie also told lenders that an independent appraisal clearinghouse likely would be established.

`Laughable' Practice

About three quarters of residential mortgage appraisals are arranged through brokers who only get paid if a loan closes, Miller said today in a phone interview. He called the practice ``laughable'' because it creates a financial incentive for mortgage brokers to push appraisers toward higher valuations. Higher appraisals also mean more homeowners qualify to refinance their homes and take cash out, he said. . . .

Cuomo spokesman Jeffrey Lerner said today in an e-mail that that Cuomo, Fannie Mae and Freddie Mac hadn't reached an agreement.

``We have had ongoing discussions for several months,'' Lerner said. ``At the end of the process, we will either have agreements or we will take other appropriate action.''

Cuomo prefers to pursue cooperative resolutions before litigating, Lerner said.

``We are continuing our discussions and we are making progress,'' said Corinne Russell, spokeswoman for the Office of Federal Housing Enterprise Oversight, which oversees Fannie Mae and Freddie Mac. . . .

Freddie Mac hasn't sent any memo similar to Fannie Mae's, said company spokeswoman Sharon McHale.

``We are cooperating fully with the attorney general's investigation, but at this point it would be premature to speculate as to what the outcome will be,'' McHale said.

Countrywide spokeswoman Ginny Zoraster declined to comment on Fannie Mae's proposals.

``The company does not believe this case has merit and expects to present a vigorous defense,'' Zoraster said in an e- mailed statement.

1. So much for "synergy." I only hope that if this puts a stop to large lenders buying appraisal firms (and destroying appraiser independence), we can next move on to large lenders buying title companies (and destroying escrow officer independence).

2. Insofar as brokering of mortgages is going to survive this bust--and the indications are that any bank with a shred of sense right now is shutting down its wholesale division--they will go back to being application-takers, for which they will earn a modest fee. They will have a hard time maintaining their current pose of a "full-service lender" by also processing loans--including ordering appraisals, selecting a closing agent, etc.--which are a huge source of fees collected from consumers and which tend to give consumers the (false) impression that brokers are actually lenders.

What has been going on for some time now is that the massive failures in the wholesale model have forced the wholesale lenders to, in essence, redundantly process these loans, as everything the broker does has to be checked and rechecked and in some cases simply repeated. (You let brokers order appraisals, and once you get it, you order a second appraisal or field review appraisal or run an AVM in order to reality-check the appraisal you got. The process pretty much ceases to be efficient here.) If the GSEs just come out and force wholesalers to take control of the appraisal process from the very beginning, then the kabuki ends and we stop pretending that brokers are doing anything except bringing in a consumer willing to sign an application. The rest of the loan processing is turned over to the wholesaler.

3. An "independent appraisal clearinghouse" would, presumably, be intended to remove some of the problems I discussed in this post with individual lenders managing approved or excluded appraisal lists. Without details I can't really say what they're doing here, but it sounds like Fannie and Freddie are seriously considering getting into approving or excluding individual appraisers or appraisal firms. FHA has always done that in some fashion or another; the GSEs never have. That's a very substantial change to the way the GSEs do business with lenders.

Inflation is Your (Ben's) Friend

by Calculated Risk on 2/28/2008 12:31:00 AM

Here is partial excerpt from a great Saturday Night Live piece in the late '70s, with Dan Aykroyd impersonating Jimmy Carter:

Inflation is our friend.

For example, consider this: in the year 2000, if current trends continue, the average blue-collar annual wage in this country will be $568,000. Think what this inflated world of the future will mean - most Americans will be millionaires. Everyone will feel like a bigshot. Wouldn't you like to own a $4,000 suit, and smoke a $75 cigar, drive a $600,000 car? I know I would! But what about people on fixed incomes? They have always been the true victims of inflation. That's why I will present to Congress the "Inflation Maintenance Program", whereby the U.S. Treasury will make up any inflation-caused losses to direct tax rebates to the public in cash. Then you may say, "Won't that cost a lot of money? Won't that increase the deficit?" Sure it will! But so what? We'll just print more money! We have the papers, we have the mints.

Click on graph for larger image.

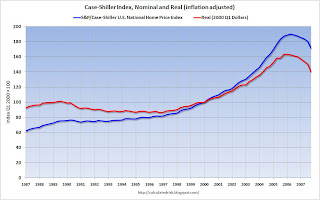

Click on graph for larger image.And here is a graph of the Case-Shiller index in both nominal terms and real terms (adjusted using CPI less shelter).

In nominal terms, the index is off 8.9% over the last year, and 10.2% from the peak.

However, in real terms, the index has declined 12.9% during the last year, and is off 14.6% from the peak.

Inflation is helping significantly in lowering real house prices. If prices will eventually fall 30% in nominal terms, then we are only about 1/3 of the way there. But if the eventual decline is 30% in real terms, then we are about half way there.

Wouldn't you like to own a million dollar home? With 4% inflation per year, many people will.

Wednesday, February 27, 2008

Another Debt Markets Freezes

by Calculated Risk on 2/27/2008 11:48:00 PM

From the WSJ: New Monkey, Same Backs

A new round of higher debt costs confronts some states and cities as another usually humdrum part of the credit markets runs into trouble. This time, the culprits are variable-rate demand notes. And banks that guarantee they will act as buyers of last resort face something they never expected -- having to purchase many of them at once.Another borrow short, lend long (or invest long) strategy. New monkey, same backs. Great title.

Variable-rate demand notes let issuers borrow for long periods -- but at short-term interest rates. Like auction-rate securities, interest payments adjust on a weekly or even daily basis. The difference is that for variable-rate demand notes, securities firms sell the debt at whatever interest rate meets the market's demand.

The problem: Just like many issuers of auction-rate securities whose interest costs soared after auctions for some of their debt failed, an increasing number of municipalities are being hit with sharply higher interest on their variable-rate demand notes because dealers of the debt are having trouble selling it.

Last week, rates on $300 million of California's variable-rate demand notes rose to 8.25% from 2% the previous week.

Vallejo Close to Bankruptcy Filing

by Calculated Risk on 2/27/2008 07:20:00 PM

From Bloomberg: California City Moves Closer to Bankruptcy Filing

Vallejo, a city of 135,000 outside of San Francisco, moved closer to bankruptcy after negotiations with its labor unions collapsed.Many cities in California are struggling with falling revenue and rising pension costs. Vallejo is just the first in line.

Bondholders will likely be asked to sacrifice some of their investment if the city seeks bankruptcy protection, an attorney for the municipality said last night. Vallejo faces ballooning labor costs and declining housing-related sales-tax revenue, leaving budget officials projecting that money will run out within weeks.

The city council is scheduled to consider a resolution tomorrow to file for Chapter 9 bankruptcy protection, after negotiations with labor unions to win salary concessions broke down Monday.

``What happens in Vallejo is going to be the model for what happens across the state. It will have a big impact.''

[Clark Stamper of Stamper Capital & Investments]

New Home Months of Supply

by Calculated Risk on 2/27/2008 05:36:00 PM

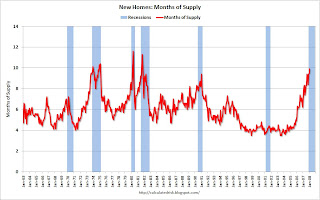

Another long term graph today - this one for New Home Months of Supply. Click on graph for larger image.

Click on graph for larger image.

"Months of supply" is at the highest level since 1981. Note that this doesn't include cancellations, but that was true for the earlier periods too.

The all time high for Months of Supply was 11.6 months in April 1980.

Once again, the current recession is "probable" and hasn't been declared by NBER.

Note: Months of supply is calculated by dividing inventory (seasonally adjusted) by sales (SAAR) and multiplying by 12 (to convert to months). As an example, Sales were reported at a Seasonally Adjusted Annual rate of 588K this morning. Inventory was reported at 483K. So 483K divided by 588K times 12 = 9.9 months.

S&P: Mortgage Delinquency Rates Climb

by Calculated Risk on 2/27/2008 04:00:00 PM

From AP: S&P: Mortgage Bond Credit Worsens (hat tip nades)

The good news is delinquencies for HELOCs issued in 2007 have moderated. That is probably a combination of tighter lending standards, and that the loans are new - the borrowers haven't run out of cash yet!